Taiwan Plant-Based Dairy Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Plant-Based Milk (Soy Drinks, Almond, Blends, Coconut, Oat, Rice, Other Plant-Based Milk), Plant-Based Yoghurt, Plant-Based Cheese), By Sales Channel (Offline (Grocery Retailers, Convenience Retailers, Supermarkets, Hypermarkets), Online)

- Food & Beverage

- Jan 2026

- VI0751

- 120

-

Taiwan Plant-Based Dairy Market Statistics and Insights, 2026

- Market Size Statistics

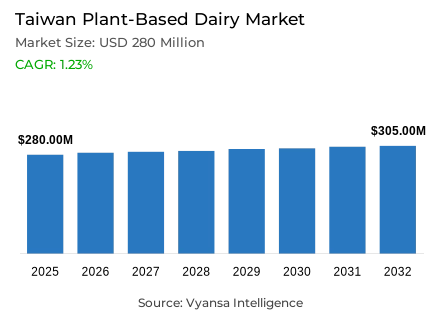

- Plant-based dairy in Taiwan is estimated at USD 280 million in 2025.

- The market size is expected to grow to USD 305 million by 2032.

- Market to register a cagr of around 1.23% during 2026-32.

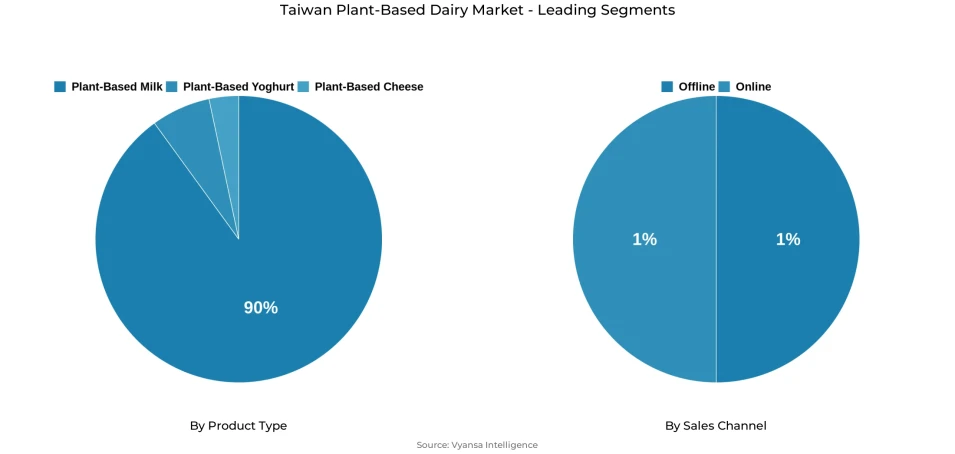

- Product Type Shares

- Plant-based milk grabbed market share of 90%.

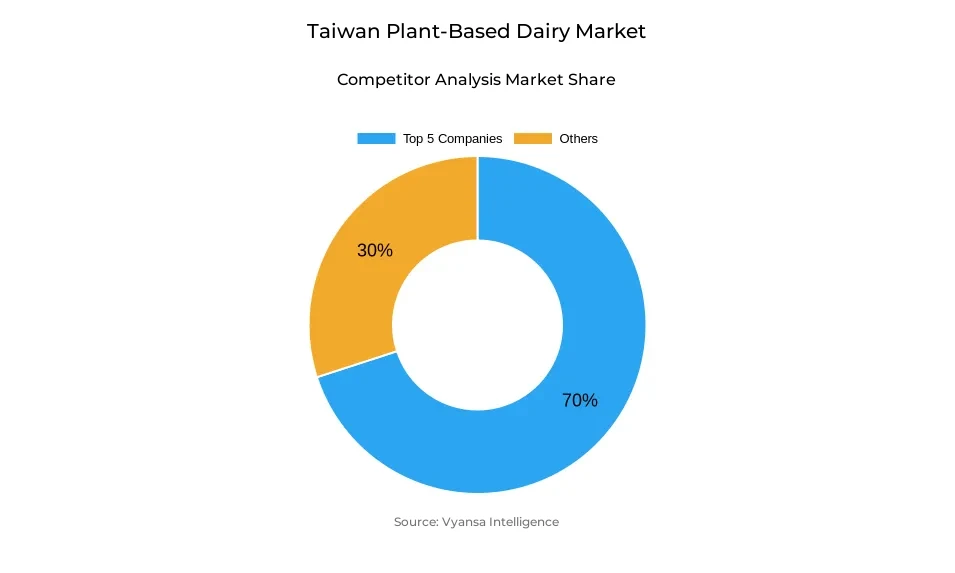

- Competition

- More than 5 companies are actively engaged in producing plant-based dairy in Taiwan.

- Top 5 companies acquired around 70% of the market share.

- Chung Hwa Food Industrial Co Ltd; Tait Market & Distribution Co Ltd; Wei Chuan Foods Corp; Uni-President Enterprises Corp; I-Mei Foods Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Taiwan Plant-Based Dairy Market Outlook

The Taiwan plant-based dairy market is estimated around $280 million in 2025 and will reach around $305 million in 2032, growing at a CAGR of 1.23% from 2026 to 2032. The plant-based milk segment leads the market by a significant margin with a 90% share, with soy milk being the most preferred dairy alternative in Taiwan due to its pricing, health benefits, and strong domestic presence in the market. Although oat milk has led some trends in the previous years due to the entry of imported plant-based dairy, its popularity has diminished owing to high pricing and domestic competition.

Retail offline distribution within the Sales Channel is set to lead the market, comprising around 85% of sales. Supermarkets, hypermarkets, convenience stores, and warehouse retailers like Costco are expected to continue being major distribution points for consumption of plant-based dairy alternatives. Greater distribution and competitive pricing of locally available options are expected to continue drives for modest market expansion. The foodservice market is set for slower sales of oats for use in foodservice applications due to cafes moving away from high-priced oat milk.

Health-conscious individuals and senior citizens are leading the momentum in the popularity of soy milk. The development of functional and premium segments is taking hold new entrants are focussing on manual preparation methods, non-GMO soybeans, and superior ingredients. The emphasis on premium offerings can be expected to create further segmentation in this category budget-conscious end user buying on price and an increasingly larger group going for superior alternatives.

On the whole, the plant-based dairy market in Taiwan is forecast to display moderate growth. This will be driven by the continued popularity of soy milk, expanding coverage through various channels of distribution, and the development of premium products to fulfill end user trends.

Taiwan Plant-Based Dairy Market Growth DriverIncreasing Demand for Functional & Health-Oriented Products

Health consciousness among the Taiwan end user is propelling the market for plant-based dairy products. Kuang Chuan has launched the first functional soy milk in Taiwan, officially recognized and certified by the government for its functionality in relation to enhancing bone and managing blood lipids. This breakthrough has received considerable attention among the health-conscious and older end user, thus creating a positive perception for soy milk as a healthy beverage drink.

The idea that the company uses in marketing soy milk, akin to health supplements, points towards one of the most significant changes taking place in the positioning of plant-based dairy in Taiwan. With end users becoming increasingly conscious about wellness and healthcare, functional soy milk segments are now increasing their presence in the market.

Taiwan Plant-Based Dairy Market TrendPremiumisation and Local Sourcing in Soy Milk

Soy milk in Taiwan is witnessing a growing premiumisation trend as end users shift from viewing it as an everyday drink to appreciating it as a high-quality, artisanal product. Newer brands are focusing on handmade production methods, clean labels, and the use of locally grown non-GMO soybeans, offering a richer taste and a more authentic appeal. These brands have successfully positioned soy milk as a lifestyle beverage rather than just a traditional drink.

This transformation is also being driven by consumers willingness to pay more for quality and local sourcing. Premium soy milk products are now available not only in upscale stores but also in mainstream outlets, indicating strong acceptance and a clear move toward premium and sustainable consumption choices.

Taiwan Plant-Based Dairy Market OpportunityExpansion of Local Brands through Affordable Innovation

Local brands in Taiwan are expected to gain opportunities to enhance their market presence through the development of innovative and cost-effective plant-based dairy beverages. Since the popularity among the imported oat milk brands has already come to a halt, local brands such as AGV would have the opportunity to utilize their knowledge and awareness regarding the local requirements when it comes to flavor and pricing.

Availability in supermarkets, convenience stores, and warehouse retailers will further enhance user availability. Taiwan local manufacturers, through innovation and affordability, are expected to drive the future growth in the plant-based dairy market.

Taiwan Plant-Based Dairy Market Segmentation Analysis

By Product Type

- Plant-Based Milk

- Plant-Based Yoghurt

- Plant-Based Cheese

The segment with highest market share under product type is plant-based milk, which constitutes approximately 90% of the share. Plant-based milk remains at the forefront in this product type due to its utility in different applications. For example, brands such as oats, rice, and almonds, which were offered by local companies with pricing that favored affordability, were also in high uptake. The growing demand for healthier and plant-based drinks has further enhanced the status of this category.

Whereas it was the trend of super-premium oat milk being in demand, but Taiwanese brands have focused on presenting cost-effective and innovative ideas of either plant-based or other types of milks in the market, making this market leading in the Taiwanese plant-based dairy market.

By Sales Channel

- Offline

- Online

The segment with highest market share under sales channel, is retail offline, accounting for around 85% of the Taiwan plant-based dairy market. Physical retail outlets remain the primary purchase point for plant-based milk, as end users prefer to compare prices, formats, and nutritional claims directly at the shelf. Supermarkets, hypermarkets, and convenience stores play a key role in ensuring wide availability of soy milk, rice milk, and oat milk, which are often consumed as part of daily routines rather than occasional purchases.

Retail offline dominance is further supported by price sensitivity among end users, particularly amid inflationary pressures. Affordable plant-based milk options are more visible and accessible in brick-and-mortar stores, encouraging repeat purchases. In addition, chilled storage, promotional pricing, and familiarity with traditional retail formats reinforce consumer confidence. As locally produced plant-based milk continues to expand its presence, retail offline is expected to remain the cornerstone of distribution in Taiwan.

List of Companies Covered in Taiwan Plant-Based Dairy Market

The companies listed below are highly influential in the Taiwan plant-based dairy market, with a significant market share and a strong impact on industry developments.

- Chung Hwa Food Industrial Co Ltd

- Tait Market & Distribution Co Ltd

- Wei Chuan Foods Corp

- Uni-President Enterprises Corp

- I-Mei Foods Co Ltd

- Kuang Chuan Dairy Co Ltd

- AGV Products Corp

- Standard Foods Corp

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Taiwan Plant Based Dairy Market Policies, Regulations, and Standards

4. Taiwan Plant Based Dairy Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Taiwan Plant Based Dairy Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Plant-Based Milk- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Soy Drinks- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Almond- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.3. Blends- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.4. Coconut- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.5. Oat- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.6. Rice- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.7. Other Plant-Based Milk- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Plant-Based Yoghurt- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Plant-Based Cheese- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Sales Channel

5.2.2.1. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.1. Grocery Retailers- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.2. Convenience Retailers- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.3. Supermarkets- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.4. Hypermarkets- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Competitors

5.2.3.1. Competition Characteristics

5.2.3.2. Market Share & Analysis

6. Taiwan Plant-Based Milk Market Outlook, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Taiwan Plant-Based Yoghurt Market Outlook, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Taiwan Plant-Based Cheese Market Outlook, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Uni-President Enterprises

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.I-Mei Foods Co Ltd

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Kuang Chuan Dairy Co Ltd

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.AGV Products Corp

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Standard Foods Corp

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Chung Hwa Food Industrial Co Ltd

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Tait Market & Distribution Co Ltd

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Distribution Co Ltd

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Wei Chuan Foods Corp

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. company 1

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.