Switzerland Beer Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Dark Beer (Ale, Sorghum Beer, Weissbier/Weizen/Wheat Beer), Lager (Flavoured/Mixed Lager, Standard Lager (Premium Lager (Domestic Premium Lager, Imported Premium Lager), Mid-Priced Lager (Domestic Mid-Priced Lager, Imported Mid-Priced Lager), Economy Lager (Domestic Economy Lager, Imported Economy Lager))), Non/Low Alcohol Beer (Low Alcohol Beer, Non Alcoholic Beer), Stout, Others (Porter, Malt etc.)), By Production (Macro Brewery, Micro Brewery, Craft Brewery), By Packaging Type (Bottles, Cans, Others), By Sales Channel (On-Trade, Off-Trade)

- Food & Beverage

- Jan 2026

- VI0748

- 130

-

Switzerland Beer Market Statistics and Insights, 2026

- Market Size Statistics

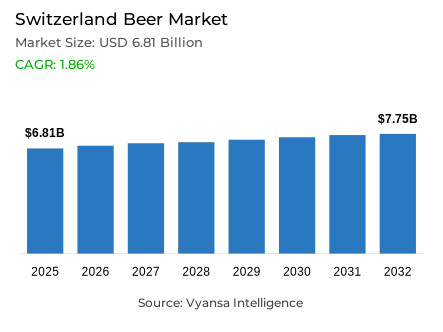

- Beer in Switzerland is estimated at USD 6.81 billion in 2025.

- The market size is expected to grow to USD 7.75 billion by 2032.

- Market to register a cagr of around 1.86% during 2026-32.

- Product Type Shares

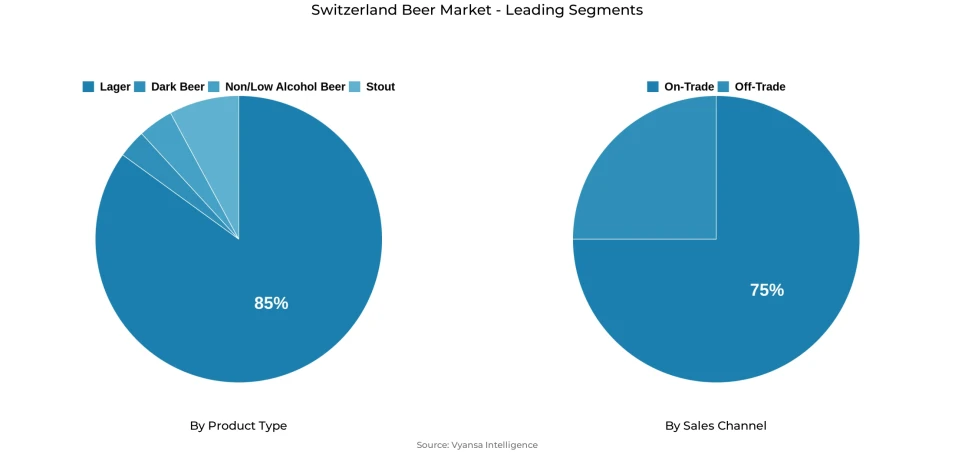

- Lager grabbed market share of 85%.

- Competition

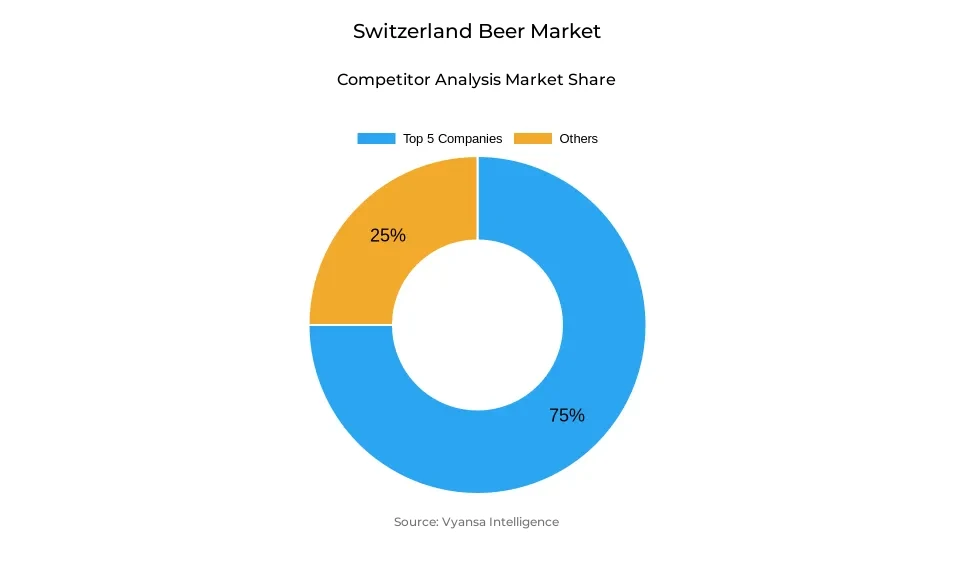

- More than 15 companies are actively engaged in producing beer in Switzerland.

- Top 5 companies acquired around 75% of the market share.

- Denner AG; Aldi Suisse AG; Introdrink GmbH; Feldschlösschen Getränke AG; Heineken Switzerland AG etc., are few of the top companies.

- Sales Channel

- On-trade grabbed 75% of the market.

Switzerland Beer Market Outlook

The Switzerland beer market is projected to value $6.81 billion in 2025 and is likely to reach $7.75 billion by 2032, registering a CAGR of around 1.86% during 2026–2032. The growth in the market will be gradual as end end users increasingly adopt responsible drinking cultures and lower per capita alcohol consumption. Though overall demand for beer is expected to experience only modest growth, growing interest in non-alcoholic and craft versions will mitigate volume erosion in mainstream categories. Weather vagaries and economic constraints might continue to impact consumption patterns, but beer will remain a culturally important drink with wide end users appeal.

Lager, comprising almost 85% of aggregate beer volume sold, will remain the market leader through the forecasting horizon. In this segment, mid-range and standard lagers like Feldschlösschen, Heineken, and Schützengarten will continue their popularity thanks to robust brand names and broad retail distribution. Non-alcoholic beer, however, will be the most dynamic subsegment fueled by increasing health consciousness and enhanced taste and quality. Premium and imported lagers will also continue to have demand, catering to end users who value quality and authenticity over quantity.

The market is still very consolidated, with the top five holding around 75% of share. Major brewers like Feldschlösschen Getränke AG and Heineken Switzerland AG will concentrate on innovation, sustainability, and diversification. But Switzerland has a wide base of small local breweries that will provide diversity in choices, leading to exploration of local ingredients and specialty beers like ale and stout, which are anticipated to grow steadily.

Distribution-wise, the on-trade accounted for around 75% of off-trade beer sales and will continue to grow further with support from the revival of the tourism and hospitality industries. Supermarkets will remain the off-trade retail leaders, while e-commerce will increase gradually as online grocery platforms extend their product range. Environmental concerns, along with debate over a national deposit scheme, are also set to impact future packaging and recycling habits throughout the beer market.

Switzerland Beer Market Growth Driver

Growing Need for Non-Alcoholic Beer Enabling Market Stability

Rising preference for non-alcoholic beer continues to support steady expansion in the country’s beer market. With the change in behavior of more conscious and health-oriented drinking, non-alcoholic beer has increased demand among drinkers who want the flavor of beer without alcohol. This category captures the most rapid growth, evidencing a change in consumption pattern as end-end users trade off wellness needs against social drinking habits. The enhanced image and presence of non-alcoholic beer are assisting the market in maintaining overall stability despite decreased alcohol consumption trends.

Additionally, large brewers are growing their non-beverage portfolios to address changing palates and health-focused inclinations. Such forward-thinking strategic emphasis on innovation across the non-alcoholic space not only diversifies products but also improves interaction with a wider end-user segment, minimizing future demand falloff and maintaining strength throughout the Switzerland Beer Market.

Switzerland Beer Market Trend

Shift Towards Quality and Responsible Drinking Culture

More emphasis on quality and sensible drinking is transforming the Switzerland Beer Market. End users are becoming more discerning, opting for premium and imported beers that provide better taste and genuineness. This behavior is complemented by the general lifestyle transition toward moderation, as the end users emphasize health and moderation of consumption while still enjoying social drinking experiences. Such brands as Heineken are reaping the rewards from this transformation, articulating a move from quantity to quality.

This trend is forcing brewers to reinforce their premium brands and enhance brand reputation via innovation and more sophisticated brewing processes. By responding to this culture of responsible consumption, manufacturers are aligning with shifting end-user values, building loyalty among health-and-wellness-oriented end users, and underpinning the market's gradual shift toward premiumisation and quality-oriented consumption.

Switzerland Beer Market Opportunity

Cranking Up Craft Brewing and Local Innovation to Fuel Expansion

The increasing presence of small breweries throughout Switzerland will provide great chances of market diversification. With the highest concentration of breweries in Europe, Switzerland's domestic producers are launching specialty and craft beers prepared using specific local ingredients like herbs, honey, and fruits. Such an emphasis on artisanal manufacture targets increased demand for authenticity and locally inspired tastes among ultimate end users.

The small breweries in the next few years will influence overall market trends through innovation and experimentation. With craft brewing picking up pace, it is also possible that pioneering companies will follow suit and be regionally and creatively oriented with their product offerings. This shift towards locally produced and innovative beers will provide premium growth opportunities, improve end-user interaction, and reinforce the general diversification of the Switzerland Beer Market.

Switzerland Beer Market Segmentation Analysis

By Product Type

- Dark Beer

- Lager

- Non/Low Alcohol Beer

- Stout

The segment with highest market share under Product Type is Lager, with around 85% share. The leading product is Lager, as it has strong penetration into Switzerland beer culture and is favored for its smooth and balanced taste, which is refreshing and perfect for casual get-togethers or formal dining. Its versatility finds it fit for all occasions and is popular among diverse end users. Additionally, local players as well as international brands specialize intensively in lager brewing, producing quality varieties at premium, mid-range, and economy prices.

This extensive portfolio and consistent taste profile have helped lager maintain its loyalty among Switzerland end users. Its ease of drinking, recognizability, and ready availability at restaurants, bars, and retail outlets further solidifies its dominance, making it the cornerstone of beer consumption among Switzerland end users.

By Sales Channel

- On-Trade

- Off-Trade

The segment with highest market share under Sales Channel is the On-Trade channel, comprising around 75% of the market. On-trade is well-preferred since beer is still a vital component of Switzerland lively social and hospitality culture. Restaurants, pubs, and bars are favorite places to consume freshly served beer, especially lager, which is preferred on tap for its quality and freshness.

The ongoing rebound of the hospitality industry and Switzerland's prosperous tourist economy have added further momentum to this category. Outdoor dining, social events, and local celebrations also fuel powerful on-trade beer consumption, as end end users link beer to shared experiences and fun. This symbolic usage makes on-trade the leading channel for beer sales nationwide.

List of Companies Covered in Switzerland Beer Market

The companies listed below are highly influential in the Switzerland beer market, with a significant market share and a strong impact on industry developments.

- Denner AG

- Aldi Suisse AG

- Introdrink GmbH

- Feldschlösschen Getränke AG

- Heineken Switzerland AG

- Brauerei Locher AG

- Coop Genossenschaft

- Schützengarten AG, Brauerei

- Holsten-Brauerei AG

- Anheuser-Busch InBev NV

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Switzerland Beer Market Policies, Regulations, and Standards

4. Switzerland Beer Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Switzerland Beer Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Quantity Sold in Million Litres

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Dark Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Ale- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Sorghum Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Weissbier/Weizen/Wheat Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Flavoured/Mixed Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Standard Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.1. Premium Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.1.1. Domestic Premium Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.1.2. Imported Premium Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.2. Mid-Priced Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.2.1. Domestic Mid-Priced Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.2.2. Imported Mid-Priced Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.3. Economy Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.3.1. Domestic Economy Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2.3.2. Imported Economy Lager- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Non/Low Alcohol Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Low Alcohol Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Non Alcoholic Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Stout- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Others (Porter, Malt etc.) - Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Production

5.2.2.1. Macro Brewery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Micro Brewery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Craft Brewery- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Packaging Type

5.2.3.1. Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. On-Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Off-Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Switzerland Dark Beer Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Quantity Sold in Million Litres

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Production- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Switzerland Lager Beer Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Quantity Sold in Million Litres

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Production- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Switzerland Non/Low Alcohol Beer Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.1.2.By Quantity Sold in Million Litres

8.2. Market Segmentation & Growth Outlook

8.2.1.By Production- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Switzerland Stout Beer Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.1.2.By Quantity Sold in Million Litres

9.2. Market Segmentation & Growth Outlook

9.2.1.By Production- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Feldschlösschen Getränke AG

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Heineken Switzerland AG

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Brauerei Locher AG

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Coop Genossenschaft

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Schützengarten AG, Brauerei

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Denner AG

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Aldi Suisse AG

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Introdrink GmbH

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Holsten-Brauerei AG

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Anheuser-Busch InBev NV

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Production |

|

| By Packaging Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.