France Healthy Snacks Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Low/No Fat & Salt Snacks (Low Fat Snacks, No Fat Snacks, Low Salt Snacks, No Salt Snacks), Low/No Sugar & Caffeine Snacks (Low Sugar Snacks, No Sugar Snacks, No Added Sugar Snacks, No Caffeine Snacks), Allergy / Free-from / Specialized Diet Snacks (Gluten-Free Snacks, Dairy-Free Snacks, Lactose-Free Snacks, Hypoallergenic Snacks, Keto Snacks, Meat-Free Snacks, No Allergens Snacks, Plant-Based Snacks, Vegan Snacks, Vegetarian Snacks, Weight Management Snacks), Fortified / Nutrient-Enhanced Snacks (Good Source of Antioxidants Snacks, Good Source of Minerals Snacks, Good Source of Omega-3s Snacks, Good Source of Vitamins Snacks, High Fibre Snacks, High Protein Snacks, Probiotic Snacks, Superfruit Snacks), Health & Wellness-Oriented Snacks (Bone and Joint Health Snacks, Brain Health and Memory Snacks, Cardiovascular Health Snacks, Digestive Health Snacks, Energy Boosting Snacks, Immune Support Snacks, Skin Health Snacks, Vision Health Snacks), Natural Snacks, Organic Snacks), By Product Type (Meat Snacks, Nuts, Seeds & Trail Mixes, Dried Fruit Snacks, Cereal & Granola Bars, Others), By Packaging (Bag & Pouches, Boxes, Cans, Jars, Others), By Sales Channel (Retail Offline, Retail Online)

- Food & Beverage

- Jan 2026

- VI0754

- 115

-

France Healthy Snacks Market Statistics and Insights, 2026

- Market Size Statistics

- Healthy snacks in France is estimated at USD 5.62 billion in 2025.

- The market size is expected to grow to USD 6.06 billion by 2032.

- Market to register a cagr of around 1.08% during 2026-32.

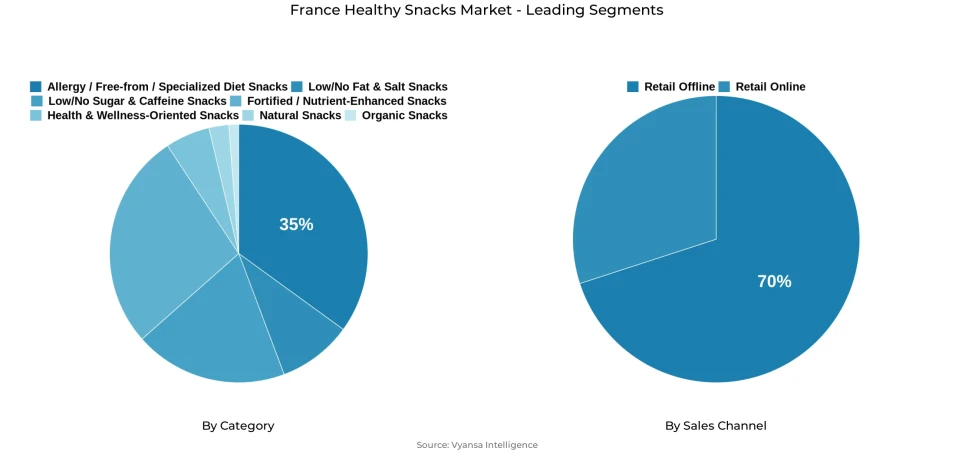

- Category Shares

- Allergy / free-from / specialized diet snacks grabbed market share of 35%.

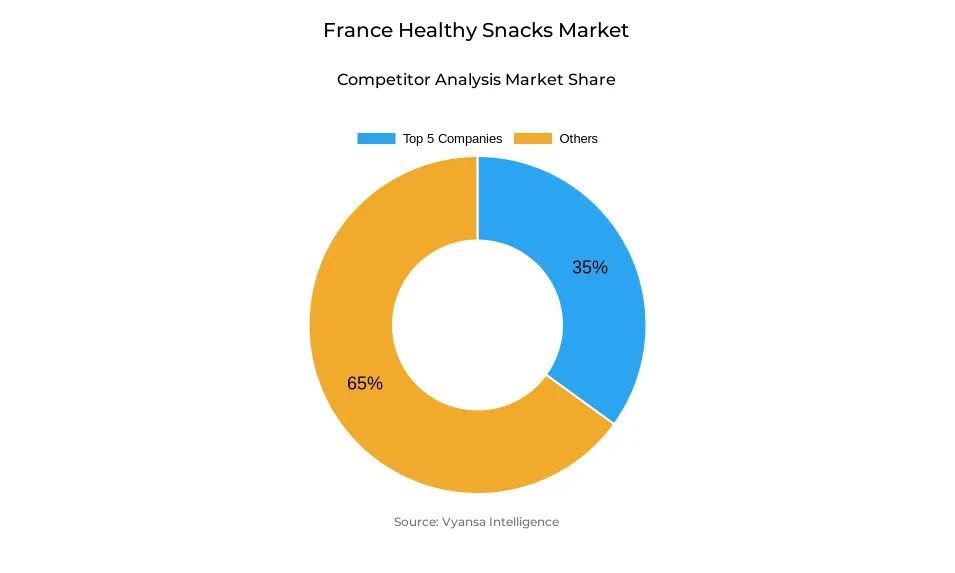

- Competition

- More than 10 companies are actively engaged in producing healthy snacks in France.

- Top 5 companies acquired around 35% of the market share.

- Haribo GmbH & Co KG; Ecotone; Seeberger GmbH; Chocoladefabriken Lindt & Sprüngli AG; Unilever Group etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

France Healthy Snacks Market Outlook

The France Healthy Snacks Market was valued arund USD 5.62 billion in 2025 and is estimated to reach approximately USD 6.06 billion by 2032, at a CAGR of 1.08% in the forcast period. The market will grow due to rising health awareness, increased end users interest in functional and low sugar food, and the rising trend of gluten-free, organic, and vegan snacks. The long-standing concern among end users for sugar will remain an important driver for the market as it will compel manufacturers to come up with no sugar and no added sugar products in the confectionery, biscuits, and gums segment.

Allergy / Free-from/Specialized Diet Snacks have the largest market share, accounting around 35%, fueled by the increasing number of people suffering from gluten intolerance, as well as end users demand for clean label products. Gluten-free snacks, especially confectionery, ice cream, and savory products, specifically chocolate confectionery, ice cream, and savory products, remain prominent drivers of value sales. Key brands such as Lindt, Magnum, and Häagen-Dazs are also increasing their share through the development of vegan and organic ranges that cater to end-end users demands.

The growth opportunity for high-protein and vegetarian snack brands is also promising due to the rising popularity of vegetarian and flexetarian diets. the key emerging categories under this segment are vegetable chips, fortified chocs, and protein-enriched ice cream, which combine indulgence and functionality together. the brands Ferrero and Too Good are innovators in this space due to the launch of protein bars and lower-sugar confectioneries.

Despite that, the retail offline is still the most prominent sales channel, accounting for 70% of sales. However, with the growth of health-focused innovations, Traditional and online retailers are also supposed to play a very important role in defining the future of the French market of healthy snacks, with a view toward evolving demand related to nutritious and low-fat snacks.

France Healthy Snacks Market Growth DriverGrowing Health Awareness and Government Action on Sugar Reduction

The increasing awareness about the ill-effects of high sugar intake on health has led to an increasing demand for health-savory snacking options in the French market. As per Inserm, a French research organization, close to 47.3% of the adult population in France is currently observed to be suffering from obesity, with 17% suffering from obesity 2023, which is pushing the government hard to cut sugar intake, especially from children. This is also complementing the WHO's recommendation to restrict per day sugar intake to below 10% of total energy. Mondelez and Haribo, leading companies, have already started reformulating their products with lower sugar content.

The National Nutrition and Health Programme (PNNS) of the government is further complimenting the goals of reducing sugar, and the increasing convergence of end users behavior and the health strategies of the nation is thus triggering market growth in the no sugar and low sugar snacking ranges, which offer health and indulgence simultaneously.

France Healthy Snacks Market ChallengeBalancing Health, Taste, and Price Amid Economic Pressures

The challenge for France's healthy snack manufacturers lies in maintaining the delicate balance between nutritional quality, taste, and affordability. Inflationary pressures have strained household budgets, with INSEE reporting that food prices rose by 11.1% yearly in August 2023, prompting emd users to prioritize price over premium health claims. While interest in sugar-free and gluten-free options remains strong, higher costs associated with these formulations hinder widespread adoption among middle and lower income groups.

Moreover, skepticism persists regarding claims like gluten free or low fat, which some end users perceive as marketing tactics rather than genuine nutritional benefits. This economic and perceptual gap challenges producers to maintain transparency while keeping innovation cost-effective, especially as France's broader economic recovery remains fragile and discretionary spending remains cautious.

France Healthy Snacks Market TrendExpansion of Plant-Based and Protein-Enriched Snack Innovations

The market is witnessing a notable increase in demand for plant-based and high-protein snacks in France, driven by end users growing adoption of flexitarian and vegan lifestyles. End users research shows that about 31% of end users in France follow a flexitarian diet, choosing to consume less meat to stay healthy and for environmental reasons. This is contributing to a rise in lentil chip, protein bars, and vegan chocolate confectionery.

Enterprises like Ferrero and TooGood are leveraging this by incorporating their plant-based or high-protein offerings in a blend of indulgence with functional benefits. Functional ice creams with high-quality supplements like L-Carnitine and collagen are examples of innovative enterprises straddling wellness and indulgence. There is a shift in calorie-based consumption patterns in healthy snacking.

France Healthy Snacks Market OpportunityRising Traction Towards Organic and Made in France Products

The increasing demand for locally produced and organic snacks is an enormous opportunity for the future expansion of the company. Study results on end users behavior have verified the interest in organic and locally sourced offerings by flexitarian end users and those with an interest in the environment, with considerable purchasing rates for the related market segment. Combining sustainability with Made in France helps boost end users confidence and conform with the government's efforts for the local food production for the nation's economic sustainability.

Further, with the growing availability of organic chocolate and gluten-free biscuits with French wheat, there is further support for both environmental and cultural sustainability. Sustainability will continue to play a significant role in end users choice, and brands that focus on traceability, French ingredients, and recyclable packaging will likely continue to dominate market share in the healthy snacks category.

France Healthy Snacks Market Segmentation Analysis

By Category

- Low/No Fat & Salt Snacks

- Low Fat Snacks

- No Fat Snacks

- Low Salt Snacks

- No Salt Snacks

- Low/No Sugar & Caffeine Snacks

- Low Sugar Snacks

- No Sugar Snacks

- No Added Sugar Snacks

- No Caffeine Snacks

- Allergy / Free-from / Specialized Diet Snacks

- Gluten-Free Snacks

- Dairy-Free Snacks

- Lactose-Free Snacks

- Hypoallergenic Snacks

- Keto Snacks

- Meat-Free Snacks

- No Allergens Snacks

- Plant-Based Snacks

- Vegan Snacks

- Vegetarian Snacks

- Weight Management Snacks

- Fortified / Nutrient-Enhanced Snacks

- Good Source of Antioxidants Snacks

- Good Source of Minerals Snacks

- Good Source of Omega-3s Snacks

- Good Source of Vitamins Snacks

- High Fibre Snacks

- High Protein Snacks

- Probiotic Snacks

- Superfruit Snacks

- Health & Wellness-Oriented Snacks

- Bone and Joint Health Snacks

- Brain Health and Memory Snacks

- Cardiovascular Health Snacks

- Digestive Health Snacks

- Energy Boosting Snacks

- Immune Support Snacks

- Skin Health Snacks

- Vision Health Snacks

- Natural Snacks

- Organic Snacks

The segment with highest market share under category is Allergy/Free-from/Specialized Diet Snacks, with around 35% of the France Healthy Snacks Market. Gluten-free snacks continue to lead as end users become increasingly aware of gluten intolerance and the need to focus on health and wellness. There is also a growing number of end users who have adopted gluten-free due to a personal focus towards a healthy lifestyle, apart from those with gluten intolerance. In light of such facts, gluten-free chocolate confectionery snacks and gluten-free ice creams have been consistently promoted through innovation that is a mix of vegan, organic, and natural.

Moreover, the trend of no sugar and no-added sugar is also increasing. This is because of the rising cases of obesity and diabetes. Players are focusing on reducing the sugar content and looking forward to sustainable sources. This further attracts more end users, making the market the leading market during the forecast period.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales channel is retail offline, whit around 70% of the France Healthy Snacks Market. The major source of re-distribution lies in supermarkets and hypermarkets, which offer healthy snacks in bulk varieties, including gluten-free, sugar-free, and vegetarian snacks. This offline shopping channel provides end users an opportunity to compare brands and read labels regarding transparency, along with various promotions and tastings that are being done in-store.

Additionally, the major retail chains are also expanding the range of private label healthy snacks to attract the price-conscious end user base under the impact of the economy. The retail stores of Carrefour and Monoprix are stressing clean label and organic snack options to showcase strong shelf impact and win end user confidence. Since the end user demand would be satisfied by the ease of access and immediate purchase satisfaction, the retail offline model would dominate the distribution scenario in the forcast period.

List of Companies Covered in France Healthy Snacks Market

The companies listed below are highly influential in the France healthy snacks market, with a significant market share and a strong impact on industry developments.

- Haribo GmbH & Co KG

- Ecotone

- Seeberger GmbH

- Chocoladefabriken Lindt & Sprüngli AG

- Unilever Group

- Intersnack Group GmbH & Co KG

- Ferrero & Related Parties

- Kellanova

- General Mills Inc

Competitive Landscape

The competitive landscape of the France Healthy Snacks Market was shaped by strong innovation around no sugar, no added sugar, and gluten free claims, alongside the emergence of niche functional segments. Major multinational players such as Mondelez and Haribo continued to reformulate core products with reduced sugar and more natural ingredients, reinforcing their positions in sugar confectionery. In chewing gum, Pür (The PUR Co) rose rapidly to lead no added sugar gum, supported by natural ingredients, xylitol sweetening, and wider distribution. Gluten free snacks remained highly competitive, with brands such as Lindt, Magnum, Häagen-Dazs, and Seeberger dominating key categories. At the same time, specialised and smaller players including WTF, Naturgreen, El Granero, and Too Good strengthened their presence by combining health, ethical, and functional claims, intensifying competition across both premium and niche segments.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Healthy Snacks Market Policies, Regulations, and Standards

4. France Healthy Snacks Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Healthy Snacks Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Low/No Fat & Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Low Fat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. No Fat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Low Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. No Salt Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Low/No Sugar & Caffeine Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Low Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. No Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. No Added Sugar Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. No Caffeine Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Allergy / Free-from / Specialized Diet Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Gluten-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Dairy-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lactose-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Hypoallergenic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.5. Keto Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.6. Meat-Free Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.7. No Allergens Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.8. Plant-Based Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.9. Vegan Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.10. Vegetarian Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.11. Weight Management Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Fortified / Nutrient-Enhanced Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Good Source of Antioxidants Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Good Source of Minerals Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Good Source of Omega-3s Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Good Source of Vitamins Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.5. High Fibre Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.6. High Protein Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.7. Probiotic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.8. Superfruit Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Health & Wellness-Oriented Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.1. Bone and Joint Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.2. Brain Health and Memory Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.3. Cardiovascular Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.4. Digestive Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.5. Energy Boosting Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.6. Immune Support Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.7. Skin Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5.8. Vision Health Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Natural Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Organic Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product Type

5.2.2.1. Meat Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Nuts, Seeds & Trail Mixes- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Dried Fruit Snacks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Cereal & Granola Bars- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Packaging

5.2.3.1. Bag & Pouches- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Boxes- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Jars- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. France Low/No Fat & Salt Snacks Healthy Snacks Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. France Low/No Sugar & Caffeine Snacks Healthy Snacks Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. France Allergy / Free-from / Specialized Diet Snacks Healthy Snacks Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. France Fortified / Nutrient-Enhanced Snacks Healthy Snacks Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. France Health & Wellness-Oriented Snacks Healthy Snacks Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. France Natural Snacks Healthy Snacks Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. France Organic Snacks Healthy Snacks Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Product Type- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Packaging- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Chocoladefabriken Lindt & Sprüngli AG

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Unilever Group

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Intersnack Group GmbH & Co KG

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Ferrero & Related Parties

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Kellanova

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Haribo GmbH & Co KG

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Ecotone

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Seeberger GmbH

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. General Mills Inc

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Product Type |

|

| By Packaging |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.