Switzerland Plant-Based Dairy Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Plant-Based Milk (Soy Drinks, Almond, Blends, Coconut, Oat, Rice, Other Plant-Based Milk), Plant-Based Yoghurt, Plant-Based Cheese), By Sales Channel (Offline (Grocery Retailers, Convenience Retailers, Supermarkets, Hypermarkets), Online)

- Food & Beverage

- Jan 2026

- VI0742

- 125

-

Switzerland Plant-Based Dairy Market Statistics and Insights, 2026

- Market Size Statistics

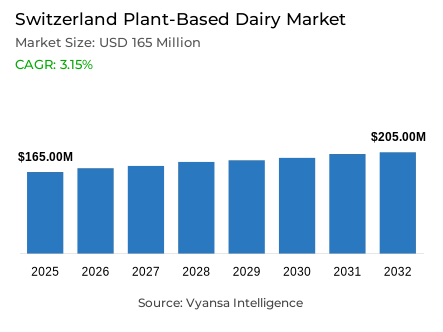

- Plant-based dairy in Switzerland is estimated at USD 165 million in 2025.

- The market size is expected to grow to USD 205 million by 2032.

- Market to register a cagr of around 3.15% during 2026-32.

- Product Type Shares

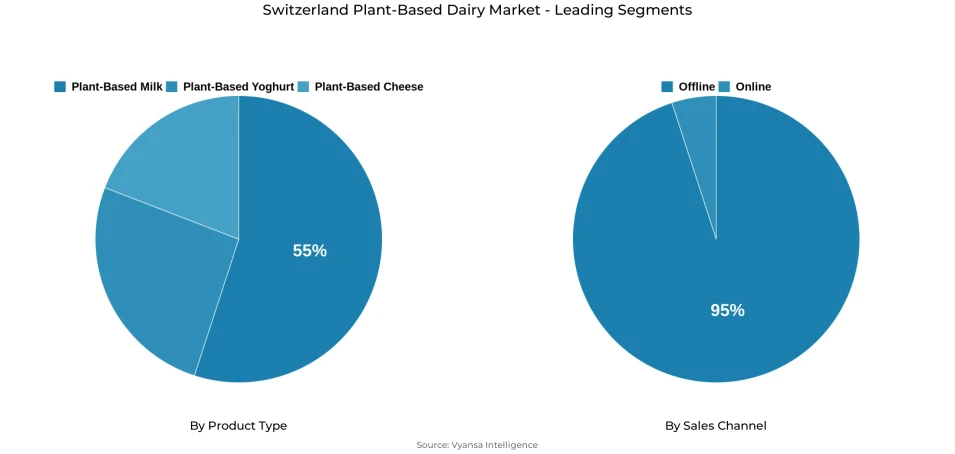

- Plant-based milk grabbed market share of 55%.

- Competition

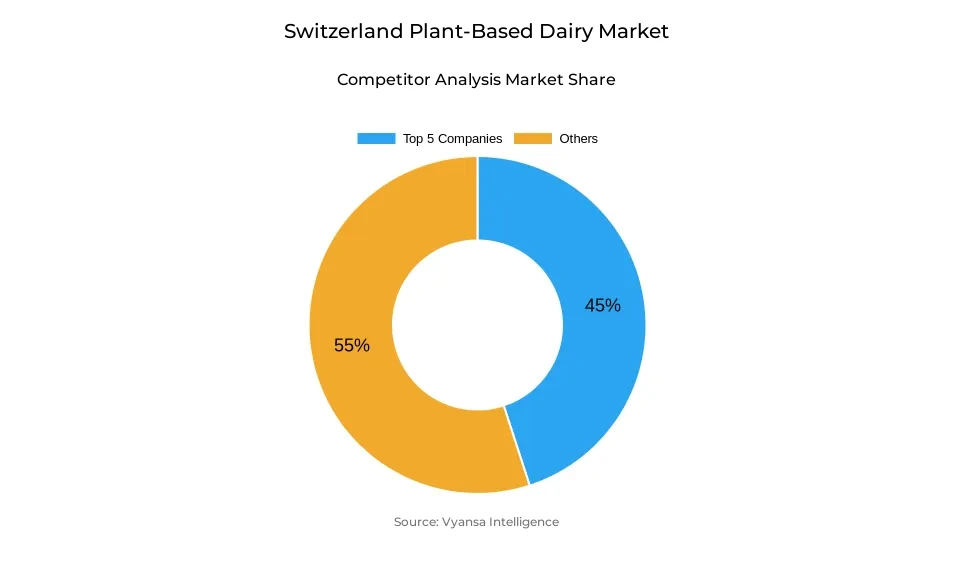

- More than 15 companies are actively engaged in producing plant-based dairy in Switzerland.

- Top 5 companies acquired around 45% of the market share.

- Alpro Suisse Sàrl; Emmi AG; Alpro NV; Migros Genossenschaftsbund eG; Coop Genossenschaft etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 95% of the market.

Switzerland Plant-Based Dairy Market Outlook

Switzerland Plant-based dairy market was valued around $165 million in 2025, which is expected to grow around $205 million in 2032, registering a CAGR of around 3.15% in forcast period. Factors such as growing end user consciousness about the health benefits, sustainability, and ethics of plant-based dairy are driving the market. Plant-based milk continues to be the leading product in the plant-based dairy market, accounting for a significant market share of 55%, owing to the growing popularity of vegan, vegetarian, and flexitarians. Oats milk and other alternatives to soy milk are likely to grow at the highest rate.

The area of health and wellness will remain an important driver in defining end user behavior. end user in Switzerland are demanding more naturally lactose-free foodsthat are low in saturated fats to cater to lactose intolerance. The use of technology in the form of health influencers on social media will continue to promote the health benefits offered by plant-based dairy alternatives, nudging younger generations to look into alternatives to regular dairy offerings. Plant-based yoghurt and cheese will also find favor with private label brands and innovative brands that drive trial consumption.

Retail offline channels will continue to dominate, accounting for approximately 95% of sales. Supermarkets such as Migros and Coop are expected to remain the primary distribution channels, offering both branded and private label plant-based dairy products. Discounters will gain share by providing competitively priced options, making plant-based dairy more accessible to cost-conscious end user. Retail online will also continue to grow dynamically, offering convenience, attractive promotions, and home delivery options.

Innovation and sustainability will remain key focus areas for manufacturers. Companies are likely to expand product portfolios with non-soy milk, fortified and functional options, and environmentally friendly packaging. Communication of sustainability practices will resonate with eco-conscious end user, further driving adoption. Overall, the Switzerland plant-based dairy market is set for steady growth, supported by health trends, ethical considerations, and the continued diversification of products.

Switzerland Plant-Based Dairy Market Growth Driver

Rising Health Consciousness Among Consumers

The Switzerland Plant-Based Dairy Market is motivated by rising end user awareness about healthy eating. More end user are turning to alternatives because of either lactose intolerance, reduced saturated fat needs, or a quest for high nutrition levels in dairy products, which are not met by regular dairy products. Plant-based products like oat, almond, and hemp milk offer healthy alternatives while still retaining culinary purposes.

The increasing demands in the area of dietary needs are being met by brands and retailers through the addition of functional types like fortified and low-fat. This expanding focus on health pushes the boundaries of innovation in plant-based dairy and makes it a crucial part of day-to-day eating in Switzerland.

Switzerland Plant-Based Dairy Market Trend

Expansion Across Dairy Categories and Convenient Formats

The market is seeing the trend of plant-based dairy extending itself from the milks to the yogurts, cheese, and niche segments. The flavored, enriched, and ready-to-drink variants are designed for end user leading busier lifestyles, thus making the plant-based alternatives more widely accessible. The retailers and companies are also expanding their offerings with more innovative products for the concerned end user.

This reflects the overall trend in food behavior, as people are increasingly choosing to explore different alternatives and including these in their daily diet. The acceptance of plant-based foods across categories indicates a long-term trend towards healthy and sustainable consumption patterns in Switzerland.

Switzerland Plant-Based Dairy Market Opportunity

Innovation and Sustainability to Drive Future Growth

Plant-based dairy companies in Switzerland will be well positioned to pursue growth opportunities through sustainability led innovation and environmentally responsible product development. Sustainability initiatives such as reducing carbon footprints, reducing water footprints, having zero waste during production, or having recyclable packaging materials would endear the brand to environmentally conscious end user.

Future growth will also come from the development of new functional foods that benefit health. These types may include lactose-free foods, nutrient-fortified foods, organic foods, among others. A company that prioritizes sustainable approaches and is able to convey its environmental and social ideals appropriately is expected to arouse increasing end user support and improve its competitiveness within the Switzerland Plant-Based Dairy Market.

Switzerland Plant-Based Dairy Market Segmentation Analysis

By Product Type

- Plant-Based Milk

- Soy Drinks

- Almond

- Blends

- Coconut

- Oat

- Rice

- Other Plant-Based Milk

- Plant-Based Yoghurt

- Plant-Based Cheese

The segment with highest market share undercategory is plant-based milk, with a share of about 55%. This type of plant-based milk is the most rapidly developing category, given its popularity among end user seeking an alternative to livestock products. Oat plant-based milk is the most preferred option, with mild and versatile flavor and lower carbon impact.

Other non-soy alternatives, such as almond milk, coconut milk, rice milk, hazelnut milk, and hemp milk, offer the additional boost to the market. The availability of these varieties and rising health and environmental concerns have further ensured the leading role played by plant-based milk in the market of plant-based dairy products in Switzerland.

By Sales Channel

- Offline

- Grocery Retailers

- Convenience Retailers

- Supermarkets

- Hypermarkets

- Online

The segment with highest market share under sales channel is retail offline, obtaining a market share of approximately 95%. Supermarkets continue to be the major distribution channels in the market led by Migros and Coop. They provide a wide range of plant-based products under their private label and branded portfolios. Discounters are also extending their lines of plant-based food products to appeal to budget-conscious end user. On the other hand, retail online remains a dynamic distribution channel.

However, the trend of retail online notwithstanding, retail offline currently comprises the greatest sales, which are primarily the platform where a significant number of end user get to access plant-based dairy products.

List of Companies Covered in Switzerland Plant-Based Dairy Market

The companies listed below are highly influential in the Switzerland plant-based dairy market, with a significant market share and a strong impact on industry developments.

- Alpro Suisse Sàrl

- Emmi AG

- Alpro NV

- Migros Genossenschaftsbund eG

- Coop Genossenschaft

- Alnatura AG

- Soyana, AW Dänzer

- Triballat-Noyal SAS

- Oatly AB

- EVA GmbH

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Switzerland Plant Based Dairy Market Policies, Regulations, and Standards

4. Switzerland Plant Based Dairy Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Switzerland Plant Based Dairy Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Plant-Based Milk- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Soy Drinks- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Almond- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.3. Blends- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.4. Coconut- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.5. Oat- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.6. Rice- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.7. Other Plant-Based Milk- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Plant-Based Yoghurt- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Plant-Based Cheese- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Sales Channel

5.2.2.1. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.1. Grocery Retailers- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.2. Convenience Retailers- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.3. Supermarkets- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.4. Hypermarkets- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Competitors

5.2.3.1. Competition Characteristics

5.2.3.2. Market Share & Analysis

6. Switzerland Plant-Based Milk Market Outlook, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Switzerland Plant-Based Yoghurt Market Outlook, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Switzerland Plant-Based Cheese Market Outlook, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Migros Genossenschaftsbund eG

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Coop Genossenschaft

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Alnatura AG

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Soyana, AW Dänzer

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Triballat-Noyal SAS

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Alpro Suisse Sàrl

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Emmi AG

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Alpro NV

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Oatly AB

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. EVA GmbH

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.