Sweden Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Feb 2026

- VI0911

- 125

-

Sweden Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

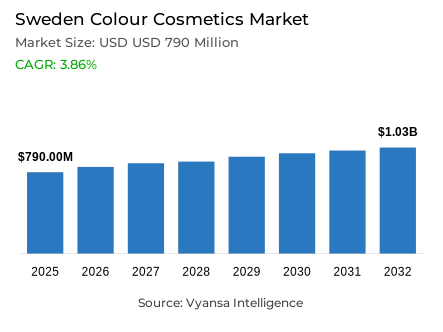

- Colour cosmetics in Sweden is estimated at USD 790 million in 2025.

- The market size is expected to grow to USD 1.03 billion by 2032.

- Market to register a cagr of around 3.86% during 2026-32.

- Category Shares

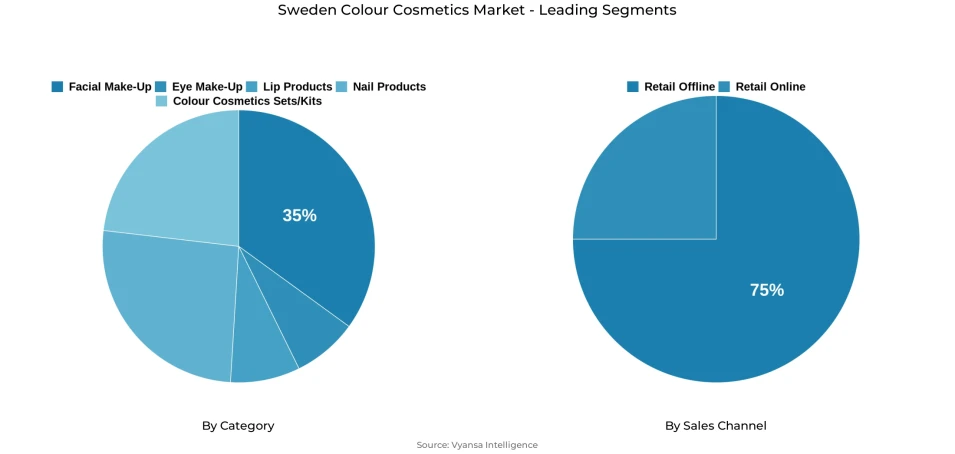

- Facial make-up grabbed market share of 35%.

- Competition

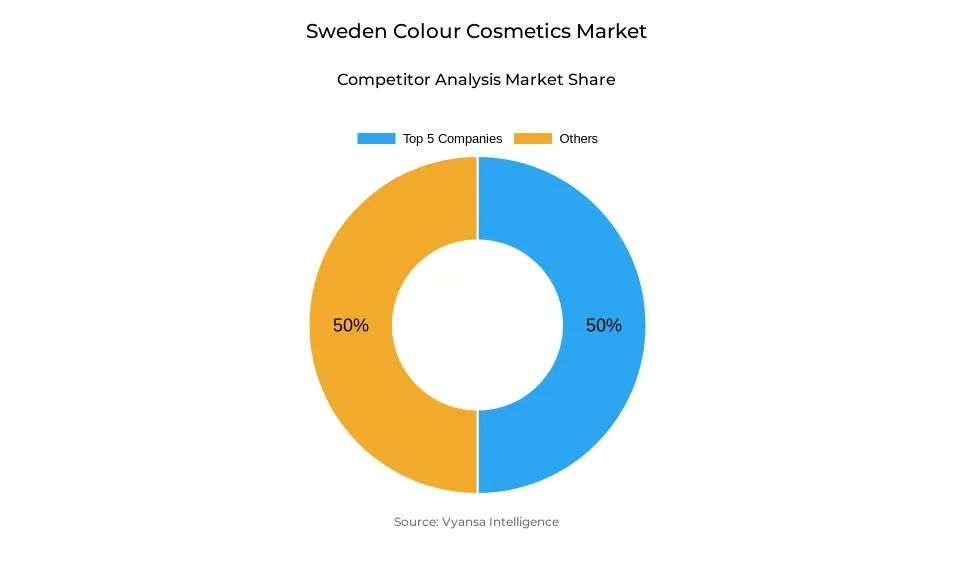

- More than 20 companies are actively engaged in producing colour cosmetics in Sweden.

- Top 5 companies acquired around 50% of the market share.

- Scandinavian Cosmetics AB; Depend Cosmetic AB; H&M Hennes & Mauritz AB; L'Oréal Sverige AB; E Saether AB etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Sweden Colour Cosmetics Market Outlook

The Sweden colour cosmetics market is expected to record a consistent growth through to 2032, owing to the changing beauty habits that blend natural beauty with performance-based innovation. The market is projected to be USD 790 million in 2025 and USD 1.03 billion in 2032, which implies a CAGR of about 3.86% in 2026–32. The rising demand of hybrid, skin-first products with make-up and skincare benefits such as BB/CC creams, tinted moisturisers with SPF, and multifunctional setting sprays is driving growth.

Facial make-up is about 35% of the overall category value, with foundations and concealers continuing to be the focus of regimens that emphasize a perfect but natural skin tone. The younger end users are also adding colour cosmetics to daily beauty routines, changing consumption patterns of occasional use to frequent self-expression and styling.

Physical channels still dominate retail distribution, with retail offline comprising about 75% of total sales. Beauty brands like Kicks and Lyko, along with extended ideas like H&M Beauty, offer edited collections, customized service, and exclusive product releases that keep the brick-and-mortar retail relevant despite the growth of retail online.

over the forcastperiod, the trends of clean beauty, multifunctionality, and social-media influence are expected to keep the interest and make the conversion in both offline and online platforms possible. Those retailers and brands that manage to integrate omnichannel accessibility with product innovation that is compelling are in a good position to achieve long-term value in the dynamic colour cosmetics environment in Sweden.

Sweden Colour Cosmetics Market Growth DriverPremiumisation and Hybrid Product Demand.

The Sweden colour cosmetics market is being driven by a strong shift towards high-end and hybrid multifunctional products, a trend clearly reflected in its performance during 2024. Premium and affordable-premium brands like CAIA, Rituals, Yves Saint Laurent, Chanel and Nars enjoyed strong marketing performance, innovation and unique packaging. These brands resonate with the emerging trend of clean, vegan, and skin-enhancing colour cosmetics that reinforce the minimalist and skin-first beauty ethos in Sweden.

Hybrid products, such as BB/CC creams, tinted moisturisers with SPF, and setting sprays with skincare benefits, remained popular in 2024, thus proving the need to have products that make routines easier and provide visible performance. Premium positioning and multifunctionality promote purchases of higher value, especially in younger users who are more concerned with aesthetics and ingredient efficacy.

Sweden Colour Cosmetics Market ChallengeMarket Polarisation and Price Pressure on Mass Brands.

The widening gap between high-end and mass-market offerings is emerging as a significant constraint within the Sweden colour cosmetics market. Whereas premium brands are growing and gaining popularity, mass brands like Maybelline New York, L'Oreal Paris, and IsaDora, though with a significant share, are under pressure due to changing preferences and stiff competition in terms of prices. Discount-based retailers like Normal and Rusta sell popular brands at lower prices, thus squeezing the margins and undermining the value perception in the mass market.

Brands that have celebrities as their leaders also have uneven performance with some performing poorly even when they are highly visible. This climate forces mass-market participants to intensify innovation and focused communication initiatives as end users begin to focus on more premium-positioned and cleaner products, which integrate cosmetic attractiveness with skincare utility.

Sweden Colour Cosmetics Market TrendSocial Media and Influencer-led Brand Discovery.

Social media and digital platforms have become the key factors in defining beauty behaviour in Sweden. The internet penetration is high with about 95.5% of the population accessing the internet in 2024, thus facilitating a wide access to digital content and online communication. Such a high degree of connectivity reinforces the influence of beauty tutorials, influencer recommendations, and social commerce on product discovery, trial, and purchase decisions.

End users are growing brand-agnostic, seeking smaller and niche brands that are marketed via social platforms and through the use of so-called genuinfluencer content instead of the traditional celebrity endorsement. This change increases the visibility of the products and promotes experimentation, especially among younger audiences that are very sensitive to digital storytelling and peer-driven validation.

Sweden Colour Cosmetics Market OpportunityClean, Inclusive, and Innovative Product Development.

The Sweden colour cosmetics market has a good opportunity due to innovation that is in line with clean beauty, inclusivity, and multifunctional performance. The end users are becoming more demanding of products that provide not only aesthetic value but also skin benefits, such as the application of active ingredients, such as niacinamide, hyaluronic acid, and SPF protection. Brands that manage to incorporate these qualities into colour cosmetics are well placed to stand out and attract value-conscious, health-conscious end users.

The increasing demand of inclusive shade ranges also presents opportunity, which is facilitated by the fact that the population of Sweden is becoming more diverse. Long-term loyalty can be reinforced by retailers and brands investing in personalised shade matching, refillable packaging, and sustainable formulations. E-commerce engagement and conversion are further supported by digital tools that improve product selection and recommendations and contribute to conversion in both physical and online environments.

Sweden Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

Facial Make-Up represents the largest category segment, accounting for approximately 35% of Sweden’s colour cosmetics market. Strong demand for foundations, concealers, and hybrid complexion products reflects preference for natural, skin-first looks. Facial make-up functions both as a daily essential and as the base for trend-led styling, supporting its continued value leadership.

As skincare-infused and multifunctional formulations expand, facial make-up remains central to category growth, balancing performance with everyday usability. Its adaptability across routines and age groups positions it as a core revenue driver within the wider colour cosmetics category.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline holds the largest share within the sales-channel structure, capturing about 75% of total market sales. Beauty specialists, department stores, and concept beauty retailers play a vital role in enabling shade matching, product trial, and personalised service — all of which are particularly important for colour cosmetics purchasing.

Although e-commerce continues to expand with stronger digital discovery tools and curated assortments, many end users still prefer in-store interaction for core purchases. The continued dominance of offline retail highlights the lasting importance of physical presence and specialist expertise in Sweden’s colour cosmetics market.

List of Companies Covered in Sweden Colour Cosmetics Market

The companies listed below are highly influential in the Sweden colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Scandinavian Cosmetics AB

- Depend Cosmetic AB

- H&M Hennes & Mauritz AB

- L'Oréal Sverige AB

- E Saether AB

- Invima AB

- Estée Lauder Cosmetics A/S

- Beauty Icons AB

- Lumene Oy

- Christian Dior AB

Competitive Landscape

Sweden colour cosmetics market is highly competitive, marked by strong participation from premium, affordable premium, and mass brands. Premium and affordable premium players such as CAIA, Rituals, Yves Saint Laurent, Chanel, Nars, and Dolce & Gabbana perform strongly, driven by skinification, clean beauty, and hybrid product trends. Mass brands including Maybelline New York, L’Oréal Paris, and IsaDora retain large volume shares due to wide distribution, though they face pressure from premiumisation and low-cost retailers like Normal. Beauty specialists such as Kicks and Lyko dominate distribution, particularly for premium brands, while H&M Beauty strengthens competition by introducing niche and influencer brands. E-commerce and social media further intensify rivalry by accelerating brand discovery and consumer switching.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Sweden Colour Cosmetics Market Policies, Regulations, and Standards

4. Sweden Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Sweden Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Sweden Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Sweden Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Sweden Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Sweden Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Sweden Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. L’Oréal Sverige AB

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. E Saether AB

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Invima AB

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Estée Lauder Cosmetics A/S

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Beauty Icons AB

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Scandinavian Cosmetics AB

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Depend Cosmetic AB

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. H&M Hennes & Mauritz AB

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Lumene Oy

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Christian Dior AB Parfums

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.