Spain UAVs and Counter-Drone Systems Market Report: Trends, Growth and Forecast (2026-2032)

By Platform (UAVs (Rotary-Wing UAVs, Fixed-Wing UAVs, Hybrid/VTOL UAVs, Mini UAVs, Micro & Nano UAVs, Tactical UAVs, MALE UAVs, HALE UAVs), Counter-Drone System Platforms (Ground-Based C-UAS Systems, Man-Portable / Handheld C-UAS, Vehicle-Mounted C-UAS, Airborne C-UAS, Naval/Shipborne C-UAS)), By Application (UAV Applications (Precision Agriculture, Industrial Inspection, Disaster & Wildfire Management, Environmental Monitoring, Logistics & Urban Delivery, Intelligence, Surveillance & Reconnaissance, Mapping & Surveying, Urban Air Mobility, Tourism & Commercial Filmmaking, Civil Beach & Marine Safety Operations), Counter-Drone System Applications (Airport Protection, Stadium & Event Security (Critical Infrastructure Security, Renewable Energy Sites, Power Plants & Distribution Networks, Oil/Gas Terminals & Distribution Facilities, Coastal/Maritime Perimeter Defense), Homeland Security & Law Enforcement, Border Protection, Civil Aviation Protection)), By System Type (UAV Systems (Airframe, Payload, Propulsion System, Avionics, Ground Control System, Communications & Data Links (Line-of-Sight, Beyond-Line-of-Sight, IoT Integration for Smart Cities)), Counter-Drone Systems (Detection (Radar, RF Sensors, EO/IR Cameras, Acoustic Sensors, Multi-Sensor Fusion), Neutralization (Soft Kill (RF Jamming, GNSS Jamming, Spoofing, Cyber Takeover), Hard Kill (Anti-Drone Guns, Interceptor Drones, Kinetic Missiles, High-Energy Lasers, High-Power Microwave Systems)))), By End User (Government & Civil Guard, Agriculture & Agribusiness, Energy & Utilities, Airports & Aviation Authorities, Fire & Emergency Services, Maritime Agencies, Commercial & Research), By Technology (UAV Technologies (Autonomous Navigation, Computer Vision / AI, Beyond Visual Line of Sight (BVLOS), Swarm Technology, Collision Avoidance, 5G/6G Connectivity, Hybrid/Electric Propulsion, Cloud & Edge Computing), Counter-Drone System Technologies (AI-Based Threat Classification, Sensor Fusion, Electronic Warfare (EW), Directed Energy Weapons (DEW), Cyber Counter-Drone Tools, Advanced Radar Processing)), By Range (UAV Range (Short Range UAVs (<10 km), Medium Range UAVs (10–50 km), Long Range UAVs (>50 km)), Counter-Drone System Range (Close Range (<1 km), Tactical Range (1–5 km), Medium Range (6–20 km), Long Range (21–50 km), Extended Range (>50 km)))

- Aerospace & Defense

- Jan 2026

- VI0739

- 125

-

Spain UAVs and Counter-Drone Systems Market Statistics and Insights, 2026

- Market Size Statistics

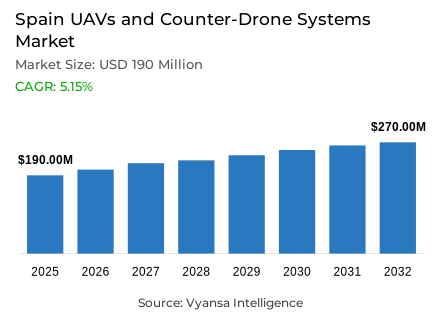

- UAVs and counter-drone systems in Spain is estimated at USD 190 million in 2025.

- The market size is expected to grow to USD 270 million by 2032.

- Market to register a cagr of around 5.15% during 2026-32.

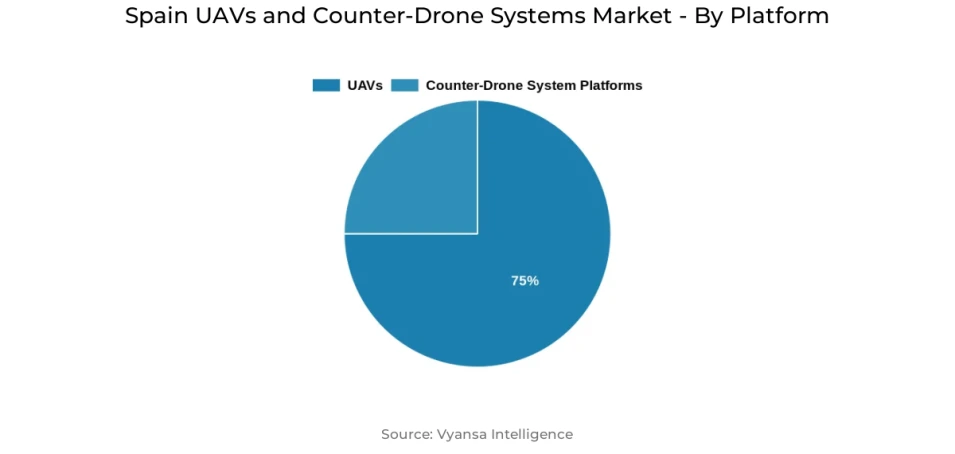

- Platform Shares

- UAVs grabbed market share of 75%.

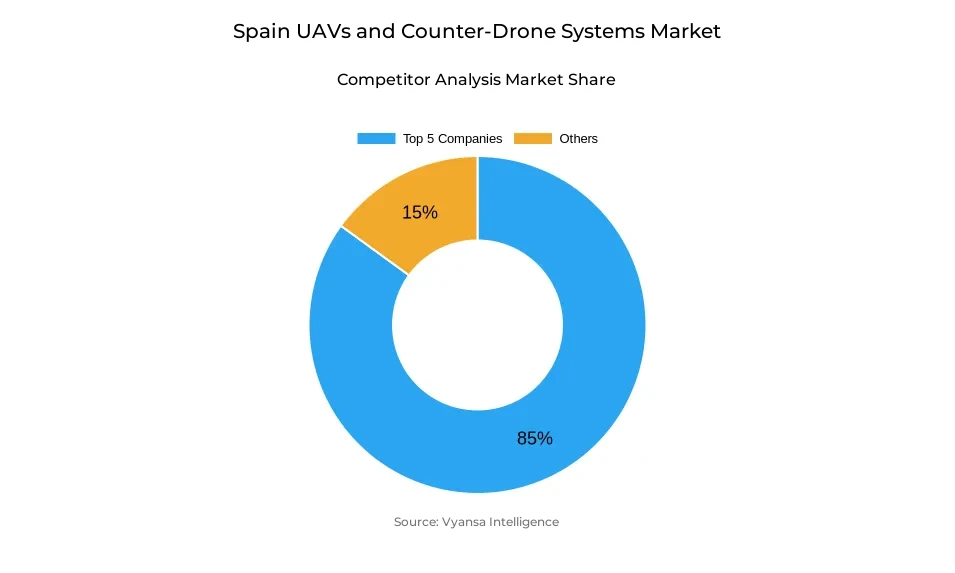

- Competition

- UAVs and counter-drone systems in Spain is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 85% of the market share.

- Skydio; Yuneec; Raytheon (RTX); DJI; Parrot SA etc., are few of the top companies.

Spain UAVs and Counter-Drone Systems Market Outlook

Spain’s UAVs and counter-drone systems market is expanding steadily as rising aerial incursions and over 1,700 drone-related incidents recorded by AESA highlight persistent airspace vulnerabilities. These disruptions at major airports such as Madrid-Barajas, Palma de Mallorca, and Alicante-Elche have increased the urgency for integrated detection, tracking, and neutralization solutions. With the market valued at about USD 190 million in 2025 and expected to reach USD 270 million by 2032, the sector is projected to grow at a CAGR of nearly 5.15% during 2026–32, supported by sustained national defense modernization efforts.

Growing defense spending strengthens this momentum, with Spain’s Ministry of Defense expanding its 2023 budget by more than 26% and accelerating procurement to meet NATO’s 2% spending target before 2029. These investments are improving access to advanced tactical UAV platforms and counter-UAS technologies, although regulatory gaps remain. Despite Royal Decree 517/2024 establishing a civil operating framework for unmanned systems, security agencies still lack clear mandates for counter-UAS actions, creating uncertainty for end users and slowing coordinated operational responses.

Technological progress is reshaping the competitive landscape, especially through multi-sensor fusion and AI-driven threat classification. Radar, RF analytics, optical imaging, and acoustic sensing now work together to enhance detection accuracy in complex environments. Programs such as SIRTAP, Eurodrone, and NGSR reflect Spain’s growing commitment to autonomous ISR-capable UAVs. At the same time, EU initiatives including the European Defense Fund and EUDIS are enabling faster prototyping, domestic manufacturing expansion, and stronger cross-border collaboration.

UAVs continue to dominate Spain’s platform landscape, capturing around 75% share due to their long-range, high-endurance, and ISR-focused capabilities. They play a crucial role in border monitoring, maritime patrol, and emergency response. Counter-drone systems form the second key segment, supporting airspace protection for airports, energy infrastructure, and defense sites. Together, these platforms will remain central to Spain’s layered airspace security strategy through 2032.

Spain UAVs and Counter-Drone Systems Market Growth Driver

Escalating Security Pressures Strengthening Market Advancement

A heightened rate of aerial intrusions is affecting Spain, in turn driving an increasing need to develop more sophisticated UAVs and anti-drone technologies. With more than 1,700 recorded cases of UAV-related events tracked by AESA within four years alone, disrupting airport activities in Palma de Mallorca, Madrid-Barajas, and Alicante-Elche airports, exposure to UAV threats remains a challenge in the national airspace. The need to protect critical infrastructure is therefore increasing the adoption rate of multi-sensor anti-UAS technology designed to withstand high-risk environments.

The growing defense expenditure of Spain creates an even stronger foundation for this momentum to build upon. The country’s Ministry of Defense increased its budget for 2023 by a staggering 26.2% to focus specifically on protecting its airspace and the comprehensive modernization of its defense systems. The efforts to comply with the 2% threshold for spending and meet NATO requirements by 2029 further quicken the acquisition of tactical UAVs and counter-drone systems.

Spain UAVs and Counter-Drone Systems Market Challenge

Regulatory and Structural Barriers Restricting Deployment Scalability

Spain has enforced Royal Decree 517/2024 on the civil operating framework for unmanned systems, there are still some gaps in terms of approval frameworks related to the use of counter-UAS. There are limited approvals for law enforcement and security agencies to use technologies to detect and/or disable unauthorized drones in real time, especially when airspace has been violated. The current scenario in terms of national standards has still not been appropriate in terms of conveying operating realms to provide joint defense action.

Fragmentation among the member states of the EU adds to these difficulties, as it hinders a harmonious development of operational procedures. Even as it advances a set of harmonized rules for UAS, a lack of centralization in counter-drone policies has slowed an interoperability initiative among these systems across international boundaries. Spain is a member of Counter-UAS, a project within PESCO, but a set of normalized testing procedures, as well as harmonized operational policies, hinders its ability to seamlessly integrate into a fully functional European defense system.

Spain UAVs and Counter-Drone Systems Market Trend

Technological Enhancements Accelerating System Evolution

Breakthroughs in multi-sensor fusion algorithms and autonomous decision-making are proving revolutionary for the UAV as well as the counter-drone systems being developed in Spain. Various integrated platforms, incorporating radar analysis, RF signal analysis, optical image analysis, or acoustic sensors, have been found to provide remarkably enhanced accuracy levels in the ATLAS25 demonstrations. AI algorithms are now capable of processing various data feeds together, thus facilitating quicker identification of the target in enhanced environments. Indra has showcased naval as well as land-based systems at ATLAS25 that are capable of handling multi-domain data through integrated C2 platforms.

Simultaneously, progress in tactical UAS technology also enhances intelligence, surveillance, and reconnaissance operations with the support of Spain's expenditure in developing these indigenous technologies. The SIRTAP project costing €495 million includes the development of 27 high-end tactical UASs capable of performing tasks in long-range operations, stealth tactics, as well as improved EW scenarios. Spain's involvement in Eurodrone and NGSR projects also highlight their commitment to developing autonomous technologies adapted for ISR applications.

Spain UAVs and Counter-Drone Systems Market Opportunity

Innovation Funding and Defense Industrial Expansion Supporting Growth

The EU has been providing substantial financial support through their innovation initiatives in the field of defense, thus creating the right market dynamics for the development of UANs and corresponding anti-UAN systems. The allocation of over €200 million from the European Defense Fund in 2024 and the allocation of €2 billion from the European Union Defense Investment System (EUDIS) will provide adequate support for prototyping and collaboration. The key initiatives taken by Spain through initiatives like NGSR will improve the access to such resources and promote the development of local manufacture capabilities.

The country's industrial policy accentuates this expansion rate. The chips initiative of the Spanish PERTE invested €4.8 billion by the year 2025, focusing substantially on aerospace and defense technologies. Domestic involvement of prominent companies such as Indra, Airbus Defence and Space, and Leonardo subsidiaries bolsters supply chain robustness and interconnectivity capability within UAVs and counter-UAS systems. Opportunities exist within the country's procurement strategy set forth within its modernization plan of defense between 2026 and 2032.

Spain UAVs and Counter-Drone Systems Market Segmentation Analysis

By Platform

- UAVs

- Counter-Drone System Platforms

UAVs hold the highest share of Spain’s UAV and counter-drone systems market, representing approximately 75% of platform utilization across defense and specialized government operations. This leadership is anchored in Spain’s strategic investment in the SIRTAP program, which delivers long-range, high-payload, and extended-endurance capabilities essential for ISR missions. These platforms support applications including border monitoring, maritime patrol, and disaster response, making them indispensable to national security operations. Their operational versatility and compatibility with Spanish and European defense architectures reinforce their market dominance.

Counter-drone technologies form the second major platform category supporting airspace protection for airports, energy sites, and military installations. Solutions integrating radar, RF sensing, electro-optical systems, and advanced command-and-control platforms address the growing threat of unauthorized drone intrusions. With increasing frequency of aerial disruptions at critical sites, demand for integrated detection and mitigation tools continues to rise. Together, tactical UAVs and counter-drone systems form the core of Spain’s layered airspace security strategy.

List of Companies Covered in Spain UAVs and Counter-Drone Systems Market

The companies listed below are highly influential in the Spain uavs and counter-drone systems market, with a significant market share and a strong impact on industry developments.

- Skydio

- Yuneec

- Raytheon (RTX)

- DJI

- Parrot SA

- Lockheed Martin

- Thales Group

- Autel Robotics

- Leonardo

- Northrop Grumman

Market News & Updates

- Skydio, 2025:

Spain’s Ministry of Defence awarded Skydio, in partnership with Paukner Group, a contract worth up to US$18.7 million to deliver Skydio X10D autonomous drones for ISR missions. The platform’s onboard AI, advanced autonomy, and rugged sensor suite enhance human-machine teaming for defence applications including reconnaissance, force protection, facility security, crowd monitoring, and target acquisition.

- Parrot SA, 2025:

Parrot expanded its global defence and security distribution network by adding five new partners across Europe and the Asia-Pacific region. The move strengthens support for the ANAFI UKR ISR micro-UAV platform, which integrates secure European design, edge AI, high-performance EO/IR payloads, and advanced mission software tailored for defence, public safety, and government operations.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Spain UAVs and Counter-Drone Systems Market Policies, Regulations, and Standards

4. Spain UAVs and Counter-Drone Systems Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Spain UAVs and Counter-Drone Systems Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Platform

5.2.1.1. UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Rotary-Wing UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Fixed-Wing UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Hybrid/VTOL UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Mini UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Micro & Nano UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Tactical UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.7. MALE UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.8. HALE UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Counter-Drone System Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Ground-Based C-UAS Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Man-Portable / Handheld C-UAS- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Vehicle-Mounted C-UAS- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Airborne C-UAS- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Naval/Shipborne C-UAS- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. UAV Applications- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.1. Precision Agriculture- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.2. Industrial Inspection- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.3. Disaster & Wildfire Management- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.4. Environmental Monitoring- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.5. Logistics & Urban Delivery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.6. Intelligence, Surveillance & Reconnaissance- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.7. Mapping & Surveying- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.8. Urban Air Mobility- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.9. Tourism & Commercial Filmmaking- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.10. Civil Beach & Marine Safety Operations- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Counter-Drone System Applications- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.1. Airport Protection- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.2. Stadium & Event Security- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.2.1. Critical Infrastructure Security- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.2.2. Renewable Energy Sites- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.2.3. Power Plants & Distribution Networks- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.2.4. Oil/Gas Terminals & Distribution Facilities- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.2.5. Coastal/Maritime Perimeter Defense- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.3. Homeland Security & Law Enforcement- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.4. Border Protection- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.5. Civil Aviation Protection- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By System Type

5.2.3.1. UAV Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Airframe- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Payload- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.3. Propulsion System- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.4. Avionics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.5. Ground Control System- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.6. Communications & Data Links- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.6.1. Line-of-Sight- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.6.2. Beyond-Line-of-Sight- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.6.3. IoT Integration for Smart Cities- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Counter-Drone Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1. Detection- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1.1. Radar- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1.2. RF Sensors- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1.3. EO/IR Cameras- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1.4. Acoustic Sensors- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1.5. Multi-Sensor Fusion- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2. Neutralization- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2.1. Soft Kill- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2.1.1. RF Jamming- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2.1.2. GNSS Jamming- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2.1.3. Spoofing- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2.1.4. Cyber Takeover- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2.2. Hard Kill- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2.2.1. Anti-Drone Guns- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2.2.2. Interceptor Drones- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2.2.3. Kinetic Missiles- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2.2.4. High-Energy Lasers- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2.2.5. High-Power Microwave Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End User

5.2.4.1. Government & Civil Guard- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Agriculture & Agribusiness- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Energy & Utilities- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Airports & Aviation Authorities- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Fire & Emergency Services- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Maritime Agencies- Market Insights and Forecast 2022-2032, USD Million

5.2.4.7. Commercial & Research- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Technology

5.2.5.1. UAV Technologies- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.1. Autonomous Navigation- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.2. Computer Vision / AI- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.3. Beyond Visual Line of Sight (BVLOS)- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.4. Swarm Technology- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.5. Collision Avoidance- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.6. 5G/6G Connectivity- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.7. Hybrid/Electric Propulsion- Market Insights and Forecast 2022-2032, USD Million

5.2.5.1.8. Cloud & Edge Computing- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Counter-Drone System Technologies- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2.1. AI-Based Threat Classification- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2.2. Sensor Fusion- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2.3. Electronic Warfare (EW)- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2.4. Directed Energy Weapons (DEW)- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2.5. Cyber Counter-Drone Tools- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2.6. Advanced Radar Processing- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Range

5.2.6.1. UAV Range- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.1. Short Range UAVs (<10 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.2. Medium Range UAVs (10–50 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.3. Long Range UAVs (>50 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Counter-Drone System Range- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.1. Close Range (<1 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.2. Tactical Range (1–5 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.3. Medium Range (6–20 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.4. Long Range (21–50 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.5. Extended Range (>50 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Spain UAVs Systems Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By System Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Range- Market Insights and Forecast 2022-2032, USD Million

7. Spain Counter-Drone Systems Platforms Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By System Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Range- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.DJI

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Parrot SA

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Lockheed Martin

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Thales Group

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Autel Robotics

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Skydio

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Yuneec

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Raytheon (RTX)

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Leonardo

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Northrop Grumman

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Platform |

|

| By Application |

|

| By System Type |

|

| By End User |

|

| By Technology |

|

| By Range |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.