Italy Amphibious Assault Ships Market Report: Trends, Growth and Forecast (2026-2032)

Class Type (Trieste-Class (LHD), San Giorgio-Class (LPD) (ITS San Giorgio, ITS San Marco, ITS San Giusto)), Propulsion (Conventional Propulsion, Diesel / Gas Turbine Combinations (CODAG), Hybrid / Electric Propulsion Assistance, Integrated Power Systems), Size (Medium (5,000-20,000 tons), Large (20,000-45,000+ tons)), Technology (Steel Hull Ships, Advanced Radar/C4ISR-Equipped Ships, V/STOL Aircraft–Capable Ships), Application (Amphibious Assault, Power Projection, Humanitarian Assistance & Disaster Relief (HA/DR), Medical/Hospital Mission Support, Command & Control Operations, Helicopter Carrier Operations), End User (Marina Militare, Italian Ministry of Defense / Segredifesa, Protezione Civile (for HA/DR Missions))

- Aerospace & Defense

- Jan 2026

- VI0756

- 125

-

Italy Amphibious Assault Ships Market Statistics and Insights, 2026

- Market Size Statistics

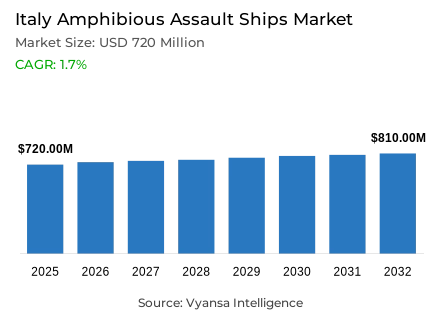

- Amphibious assault ships in Italy is estimated at USD 720 million in 2025.

- The market size is expected to grow to USD 810 million by 2032.

- Market to register a cagr of around 1.7% during 2026-32.

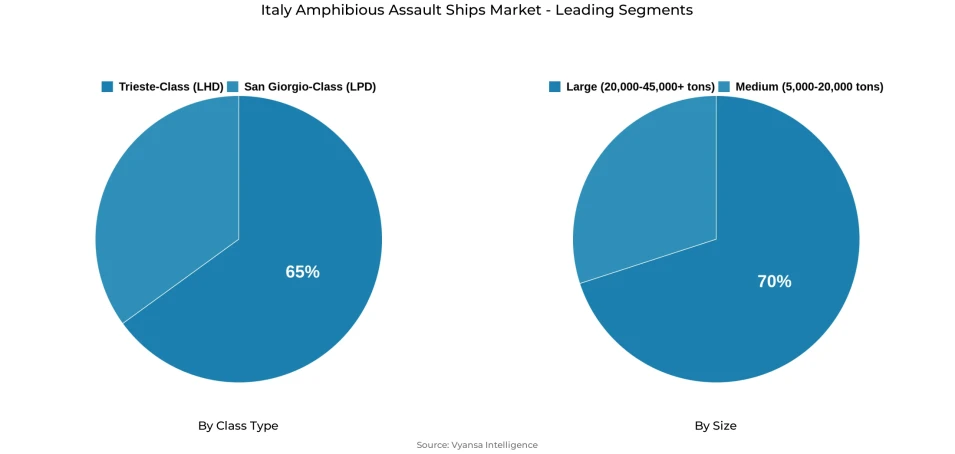

- Class Type Shares

- Trieste-class (lhd) grabbed market share of 65%.

- Competition

- Amphibious assault ships in Italy is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 80% of the market share.

- Avio S.p.A.; ASELSAN A.Ş.; Kongsberg Gruppen ASA; Leonardo S.p.A.; MBDA Italia (MBDA) etc., are few of the top companies.

- Size

- Large (20,000-45,000+ tons) grabbed 70% of the market.

Italy Amphibious Assault Ships Market Outlook

Italy amphibious assault ships market was valued at roughly $720 million in 2025. It is anticipated that this market would reach roughly $810 million by 2032, growing at a CAGR of around 1.7% from 2026 to 2032. These market trends clearly establish that Italy continues to invest in its credible amphibious and expeditionary forces despite its security challenges in the Mediterranean Sea. These security issues include increased geopolitical tensions, migration control, and fulfillment of NATO obligations.

The Italian government’s support for its maritime readiness budget of €31.3 billion in 2025 reflects its strategic emphasis. The country’s involvement in NATO’s exercise like Dynamic Mariner/Flotex 25 and other military interventions aimed at maintaining stability and humanitarian requirements emphasize the operational requirement for an amphibious assault ship. The need for an amphibious assault ship has also been underlined by the reduction in cross-border refugee movements into the EU, but a constant requirement exists in the Central Mediterranean route.

In the class type segment, the Trieste class LHD has a strong market presence, and it contributes around 65% to the market. The vessel was delivered in December 2024 and has a displacement of 36,770 tonnes, along with the capability to carry 600 Personnel Battalions and support a maximum of 20 F-35B aircraft; hence it forms the backbone of the Italian Amphibious Force. Upgrades are also being done to completely support F-35B operations and will continue to maintain dominance till 2032.

In terms of capacity, the larger amphibious ships with capacities of 20,000-45,000+ tons currently occupy about 70% market share. Such ships are equipped with better endurance capabilities and flying capabilities, meeting the Italian requirement of employment and crisis response within the Mediterranean region during the period 2026-2032 according to NATO collaboration requirements.

Italy Amphibious Assault Ships Market Growth DriverRising Regional Security Needs Shape Naval Investment Strategies

Italy’s defense budget of €31.3 billion in 2025 is indicative of the increasing geopolitical pressures in the Mediterranean, where Italy is committed to contributing 2% of its GDP to NATO’s target in 2025 and will scale up to 5% in 2035, underlining the importance of naval preparedness in the Mediterranean. In the early part of 2025, the irregular entries into the EU were down by 27% but the Central Mediterranean is an essential route through which most of the entries take place, and thus the need for Italy’s participation in NATO’s Dynamic Mariner/Flotex 25 exercise, where Italy has committed 30 surface ships and 1,500 personnel.

The overall military expenditure of European NATO, at €343 billion in 2024, with a growth of equipment procurement of 39%, adds more institutional thrust to Italy to upgrade their fleet. The Trieste Class LHD, with a displacement of 36,770 tons, introduced into service in December 2024, has boosted the projection of NATO's capability alignment. Alongside the procurement of Maritime Multi-Mission Aircraft, Italy's spending focus addresses ambitions to maintaining amphibious operations and crisis response efforts through 2032.

Italy Amphibious Assault Ships Market ChallengeBudgetary Pressures Influence Procurement and Readiness

Despite the higher allocations made to the defensive budgets, Italy still experiences funding pressures owing to several national spending demands, as well as changed allocations in fields like pensions and paramilitary force engagement. To meet the 3.5% GDP goal in 2035, as advocated in the NATO bodies, Italy requires substantial spending; thus, procurements in the fleets are constrained. The Trieste-class contract valued at over €1.1 billion with Fincantieri restricts the acquisition of multiple units of similar ships and/or amphibious ships. Upgrading the existing old fleets competes with funding.

The integration of operation timetables also remains a pertinent issue. The F-35B capability of the Trieste will take time to be completely certified because by Q3 of 2025. In contrast to this, the German defense spending will increase from €86 billion in 2025 to €162 billion in 2029; henceforth, there emerge certain spending patterns in the region to which Italy will have to comply to take swift actions regarding the development of certain NATO-standardized operations concerning ammunition and control that cannot easily be done to affect the operational employment of certain amphibs.

Italy Amphibious Assault Ships Market TrendExpanded Mediterranean Operational Concepts and Amphibious Roles

The Italian landing platforms are finding increased synergy between the NATO paradigm of Mediterranean operations, under which there is a focus on littoral operations, crisis response, and humanitarian roles. The Trieste-class LHD can support 600-man battalions and Role 2E hospital capabilities. The ship has nine spots for helicopters and can support autonomous systems, thereby raising the level of operational flexibility offered by this platform. Such NATO exercises as BALTOPS and Amphibious Leaders Expeditionary Symposium highlight the operational use of platforms that can deploy effectively and rapidly.

Enhanced air powers enhance operativity. The Trieste is designed to support a total of 20 F-35B aircraft, in addition to those on board the Cavour aircraft carrier, ensuring a continuous air shield for any amphibious operations. Operations like Sea Guardian, which emphasized building capacities, situation awareness, and counter-terrorism, prove the requirement for supporting amphibious operations in a prolonged Mediterranean engagement. Its compatibility with six Maritime Multi-Mission Aircraft and Large Autonomous Underswater Vehicles showcases Italy's full-scale strategy in supporting multi-domain amphibious operations, thereby reiterating assault ships' relevance in NATO strategy until 2032.

Italy Amphibious Assault Ships Market OpportunityIndustrial Strength and NATO-Aligned Procurement Potential

Italy's defense industry, led by Fincantieri, is on track to address increasing NATO and European modernization requirements. The shipyard also works on developing Multipurpose Offshore Patrol Ships, logistic support ships, and frigates for the FREMM EVO export program, signifying strong capabilities for complex amphibs. Increasing European procurements, driven by German and Spanish purchasing, together with EU defense expenditure estimated at €381 billion by 2025, open a new market for amphibs and naval ships in Italy.

The NATO prioritization for the protection of critical subsea infrastructure and responding to maritime risks such as cyber threats at landing points helps ensure that the procurement of the amphibious ships continues until 2032. "Italy’s geographical positioning within the Mediterranean and the established ability for the on-time delivery of the larger vessels" will enable the country to increase the production of amphibious ships.

Italy Amphibious Assault Ships Market Segmentation Analysis

By Class Type

- Trieste-Class LHD

- San Giorgio-Class LPD

The Trieste-class LHD commands approximately 65% of Italy’s amphibious assault ship market under the class type segment, reflecting its technical sophistication and operational flexibility. At 245 meters in length, with a 36,770-tonne displacement, the platform accommodates 600-personnel battalions and up to 20 F-35B aircraft. Commissioned in December 2024, the vessel’s capabilities establish a benchmark for NATO-aligned modernization, with proven construction quality and international security endorsements reinforcing market leadership.

This class dominance is further sustained by planned operational enhancements through 2032. F-35B certification in Q3 2025 and autonomous systems integration create standardized platform characteristics influencing European naval procurement preferences. NATO exercises like Dynamic Mariner/Flotex 25, involving multiple allied nations, validate the Trieste-class’s operational versatility, supporting sustained Mediterranean deployment, hospital facilities, and humanitarian mission readiness. This operational and technical convergence underpins the 65% market share for the class throughout the forecast period.

By Size

- Medium 5,000-20,000 tons

- Large 20,000-45,000+ tons

Large amphibious vessels, ranging from 20,000 to 45,000+ tonnes, capture approximately 70% of Italy’s market. This segment includes the Trieste-class LHD, which operates at the upper end with 36,770 tonnes full load displacement, meeting NATO requirements for sustained deployment, humanitarian response, and power projection across the Mediterranean. Large vessels offer operational advantages including accommodation for 1,000+ personnel, extensive cargo space, and dual-hangar air and surface capabilities, enabling concurrent multi-domain operations.

Sustained modernization underpins this segment’s dominance. Fincantieri’s focus on multipurpose large platforms, combined with NATO’s strategic emphasis on amphibious crisis response, ensures procurement preference for vessels exceeding 20,000 tonnes. European defense investment patterns, with procurement projected above €100 billion in 2025, support continued acquisition of high-capability platforms. The 70% share held by large-capacity vessels reflects structural market characteristics favoring integrated amphibious and multi-domain operational readiness through 2032.

List of Companies Covered in Italy Amphibious Assault Ships Market

The companies listed below are highly influential in the Italy amphibious assault ships market, with a significant market share and a strong impact on industry developments.

- Avio S.p.A.

- ASELSAN A.Ş.

- Kongsberg Gruppen ASA

- Leonardo S.p.A.

- MBDA Italia (MBDA)

- Thales Group

- Rheinmetall AG

- OTO Melara

- Saab AB

- Israel Aerospace Industries

Market News & Updates

- Leonardo, 2025:

Leonardo delivered VBA 8×8 amphibious vehicles to the Italian Navy’s San Marco Marine Brigade in 2025, equipped with Hitrole Light remotely operated weapon stations capable of mounting 12.7mm machine guns or 40mm grenade launchers. The company is also developing the LIONFISH 30 naval turret featuring the X-GUN 30×173mm unmanned system for future amphibious and naval applications. The new turret system was unveiled at SEAFUTURE 2025, supporting modernization for FREMM frigates and future DDX vessels.

- MBDA Italia, 2025:

MBDA Italy unveiled the Harpax loitering munition family at SEAFUTURE 2025 in La Spezia, developed jointly with Italian SMEs Siralab and Sky Eyes Systems. Designed for urban and naval operations, the lineup includes the Harpax Mini quadcopter (under 2.5kg, 5km range) and the Harpax Small fixed-wing variant (under 8kg, 15-20km range), both offering modular payload options. MBDA also secured a production contract with the Italian Navy for TESEO MK2/E anti-ship missiles, which feature satellite datalinks and RF seekers to support current FREMM frigates and next-generation naval platforms.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Italy Amphibious Assault Ships Market Policies, Regulations, and Standards

4. Italy Amphibious Assault Ships Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Italy Amphibious Assault Ships Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Class Type

5.2.1.1. Trieste-Class (LHD)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. San Giorgio-Class (LPD)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. ITS San Giorgio- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. ITS San Marco- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. ITS San Giusto- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Propulsion

5.2.2.1. Conventional Propulsion- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Diesel / Gas Turbine Combinations (CODAG)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Hybrid / Electric Propulsion Assistance- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Integrated Power Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Size

5.2.3.1. Medium (5,000-20,000 tons)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Large (20,000-45,000+ tons)- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Technology

5.2.4.1. Steel Hull Ships- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Advanced Radar/C4ISR-Equipped Ships- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. V/STOL Aircraft–Capable Ships- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Application

5.2.5.1. Amphibious Assault- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Power Projection- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Humanitarian Assistance & Disaster Relief (HA/DR)- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Medical/Hospital Mission Support- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Command & Control Operations- Market Insights and Forecast 2022-2032, USD Million

5.2.5.6. Helicopter Carrier Operations- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Marina Militare- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Italian Ministry of Defense / Segredifesa- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Protezione Civile (for HA/DR Missions)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Italy Trieste-Class (LHD) Amphibious Assault Ships Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Propulsion- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Size- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Italy San Giorgio-Class (LPD) Amphibious Assault Ships Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Propulsion- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Size- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Leonardo S.p.A.

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.MBDA Italia (MBDA)

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Thales Group

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Rheinmetall AG

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.OTO Melara

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Avio S.p.A.

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.ASELSAN A.Ş.

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Kongsberg Gruppen ASA

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Saab AB

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Israel Aerospace Industries

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Class Type |

|

| By Propulsion |

|

| By Size |

|

| By Technology |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.