Italy Integrated Air & Missile Defense Systems Market Report: Trends, Growth and Forecast (2026-2032)

System (Anti-Aircraft Systems, Counter-Unmanned Aerial Systems, Counter-Rocket Artillery and Mortar Systems, Counter-Hypersonic Defense Systems, Integrated Multi-Threat Systems), Component (Weapon Systems, Fire Control Systems, Radars & Sensors, Launchers, Command & Control, System Integration), Range (SHORAD, MRAD, LRAD), End User (Army, Navy, Air Force)

- Aerospace & Defense

- Dec 2025

- VI0702

- 120

-

Italy Integrated Air & Missile Defense Systems Market Statistics and Insights, 2026

- Market Size Statistics

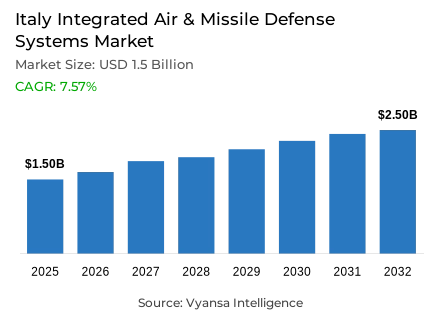

- Integrated air & missile defense systems in Italy is estimated at USD 1.5 billion in 2025.

- The market size is expected to grow to USD 2.5 billion by 2032.

- Market to register a cagr of around 7.57% during 2026-32.

- System Shares

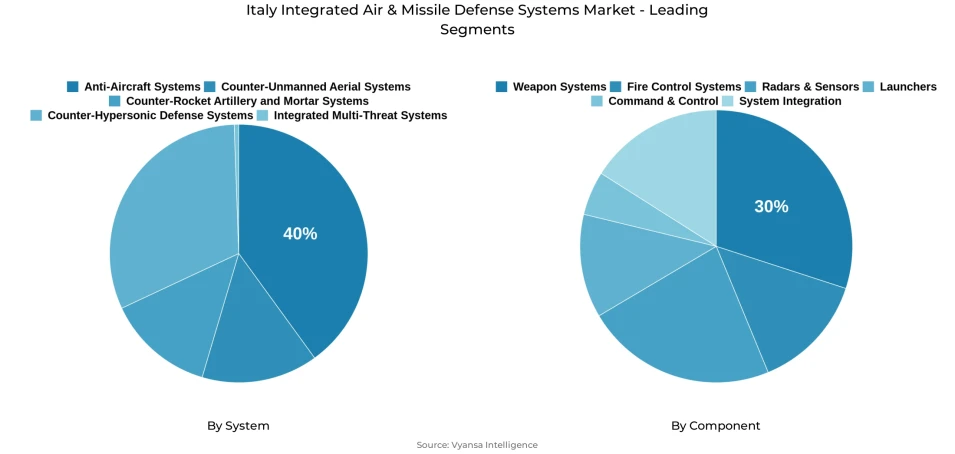

- Anti-aircraft systems grabbed market share of 40%.

- Competition

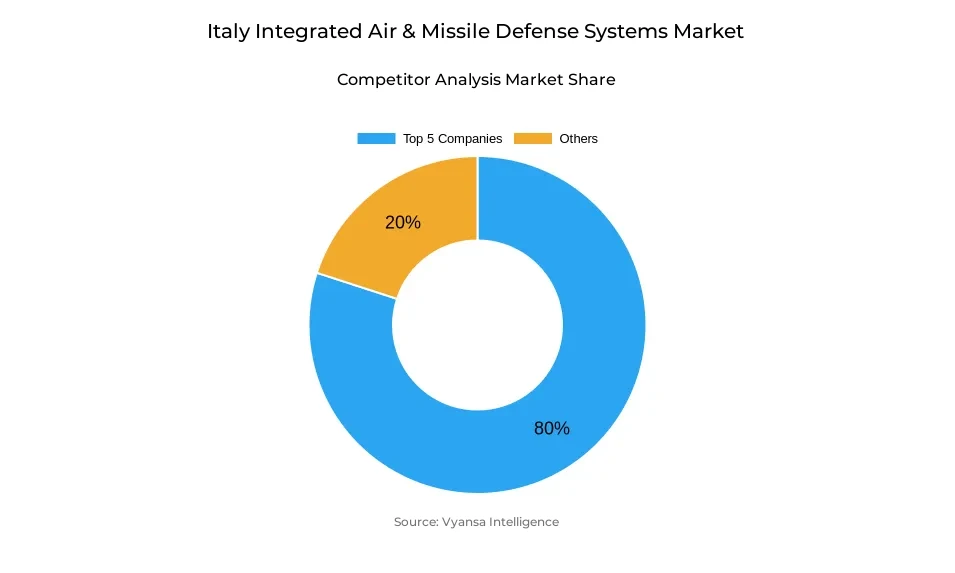

- Integrated air & missile defense systems in Italy is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 80% of the market share.

- Lockheed Martin; HENSOLDT; Northrop Grumman; Leonardo S.p.A.; MBDA / MBDA Italia etc., are few of the top companies.

- Component

- Weapon systems grabbed 30% of the market.

Italy Integrated Air & Missile Defense Systems Market Outlook

Italy's integrated air and missile defense systems market is set to achieve steady growth from an estimated $1.5 billion in 2025 to $2.5 billion by 2032, at a CAGR of approximately 7.57% during 2026-2032. In particular, such growth is driven by NATO's commitments on defense spending and Italy's priorities for homeland and allied protection. The investment of the country in multi-layered air defense networks, which also comprises SAMP/T New Generation batteries and Skynex short-range platforms, has reflected the strategic focus on interception at low and medium altitudes of ballistic missiles, cruise missiles, and unmanned aerial systems. It enhances national protection and the interoperability of the end users' operations with those of the allied forces.

Anti-aircraft systems dominate the landscape with 40% share and form the backbone of Italy's layered air defense strategy. Such systems, comprising medium-range SAMP/T batteries and short-range Skynex automated cannon platforms, ensure rapid engagement with full redundancy across multiple threat altitudes. The complementary deployments of very-short-range defense systems and emerging counter-unmanned aerial system technologies further reinforce this threat coverage, thereby assuring that the end users are able to respond effectively against a wide range of aerial challenges in real time. On the component side, weapon systems account for the largest percentage at 30%, including missile interceptors, automated cannon systems, and launch platforms.

These core elements enable precise threat neutralization across low- to high-altitude engagements. Other critical components contributing to enhanced situational awareness, rapid-response capabilities, and resilience against hybrid threats include fire control systems, radars and sensors, launchers, command-and-control infrastructure, and system integration that make for cohesive multi-domain defense operations. The market trajectory is further supported by Italy’s modernization efforts to emphasize NATO-aligned interoperability, autonomous system integration, and software-driven command solutions.

Strategic partnerships with leading defense players strengthen technological advancement and operational readiness, making Italy a key contributor to European air and missile defense modernization. The market will, therefore, witness consistent growth driven by technological upgrades, growing capabilities, and rising commitments of defense expenditure.

Italy Integrated Air & Missile Defense Systems Market Growth DriverStrategic Drivers Shaping Italy’s Air and Missile Defense Expansion

The integrated air and missile defense systems market in Italy is growing rapidly due to NATO's 2025 defense spending commitment, along with increased efforts towards the protection of Italy as well as allied homelands. Italy has committed €31.2 billion for 2025, up from 7.2% on 2024, with further expansion to €31.7 billion by 2027 to endorse a pledge at the Hague Summit to increase defense expenditure to 5% of GDP by 2035. This rise in fund allocation allows the acquisition of sophisticated systems that comprise SAMP/T New Generation batteries and Skynex short-range air defense platforms, fully conforming to NATO capability targets. This underlines increasing concerns over ballistic missiles, cruise missiles, and unmanned aerial systems as the emergent threats to national safety, which calls for multiple layers of defense architecture. In this context, end users get greater protection for the nation, interoperability with allied systems.

Italy's current modernization program underscores integrated, multi-tier air defense networks. A mix of medium-range SAMP/T batteries, short-range Skynex platforms, and emerging counter-unmanned aerial system technologies secures full-spectrum coverage. In turn, this bolsters investments in rapid-response capabilities, enabling end users to respond effectively against high- and low-altitude threats. NATO's push toward common command-and-control frameworks and information sharing supports the Italy transition toward a coherent, federated air defense structure. For example, cooperation with key players like MBDA and Leonardo in the co-development of advanced missile interceptors, laser-based anti-drone solutions, and integrated combat vehicle platforms further strengthens Italy's positioning in European air defense modernization.

Italy Integrated Air & Missile Defense Systems Market ChallengeOperational and Procurement Constraints is Hindering Market Growth

Italy is hardly in a position to make up historical shortfalls in short and very-short-range air defense. Current Italy capabilities display critical weaknesses in low-level threat engagement, rapid-response targeting, and deployment area coverage. Europe is plagued by key shortages of interceptors in the face of increasing annual Russian missile production between 840 and 1,020 units. European NATO members are heavily reliant on US origin Patriot and SAMP/T interceptors that cost between five to ten times more than the missiles these systems address. Budgetary pressures coupled with deficit reduction targets further limit the possibility of rapid acquisition and deployment.

Managing complex supply chains of interceptors, spare parts and advanced sensor systems presents an additional layer of challenge. In this regard, the Italy defense establishment coordinates with NATO Allies to ensure uniform availability of critical components while balancing modernization ambitions with continuity of operations. The expansion of capability portfolios to include counter-unmanned aerial systems, laser-based solutions, and advanced radar integration further adds to the programmatic complexity that demands extensive planning, software standardization, and interoperability testing. The nature and pace of these constraints determine whether timely resolution is achieved to maintain effective multi-layered air and missile defense cover across a diverse set of operational scenarios for end users, whether national military units or NATO operational commands.

Italy Integrated Air & Missile Defense Systems Market TrendEmerging Patterns in Multi-Layered Air Defense Architecture

Italy's defense transformation focuses on a multi-layered and NATO-integrated approach to combine medium-range, short-range, and counter-unmanned aerial systems. Expanding the SAMP/T New Generation batteries with anti-ballistic capabilities and buying CAMM-ER short-range missiles illustrates a pattern of interoperable and networked platforms. The Combat Dome concept unites sensors, weapons and command nodes into multiple-domain resilient networks, where end users can react autonomously to evolving threats while sharing situational awareness across other NATO allies. This model gives emphasis to the ability for rapid response, sensor fusion, and unified protocols of engagement, setting the threshold for European multi-tiered defense deployment.

Integration of autonomous systems and emerging technologies is a key trend that shapes Italy's market. Development of the FULGUR very-short-range air defense system, coupled with laser counter-drone technologies, showcases the nation's turn toward advanced threat-neutralization methods. Emphasis on software-driven command-and-control solutions in key programs ensures seamless interoperability with NATO's Integrated Air and Missile Defence System-namely, NATINAMDS. All this enables the end users to tackle hybrid threats like ballistic missiles, cruise missiles, and unmanned aerial systems and ensures coherent responses across the board at both national and allied platforms. Italy's strategic embracing of those technologies positions it at the very forefront of European multi-domain defense integration.

Italy Integrated Air & Missile Defense Systems Market OpportunityInvestment Opportunities in Advanced Air Defense Capabilities

A growing Italy defense budget, in line with NATO spending requirements, presents a much-needed opportunity for investments in emerging technologies. Priorities ensure the development of AI-enabled command systems, autonomous unmanned platforms, and cyber-physical integration that further enhances the resilience of air defense. Growing cybersecurity threats, as manifested in the 53% increase in cybersecurity incidents during the first half of 2025, make the case for integrated cyber defense frameworks protecting national air defense networks. This supports the combined effect of kinetic, digital, and sensor-based systems, ensuring a robust protection of end-users against contemporary aerial threats.

Industrial partnerships introduce other avenues for growth. Cooperation with leading players such as MBDA and Leonardo in the co-development of FULGUR, Skynex, and other advanced platforms reinforces Italy's technological sovereignty while enabling a standard-setting influence among NATO allies. Serving as the launch customer for a number of systems enhances Italy's ability to establish norms of interoperability and operational standards, a position that could attract export opportunities for NATO-compatible solutions. These investments will go toward not only strengthening national defense but also establishing Italy as a leader in integrated air and missile defense development within Europe, offering strategic advantages in joint procurement initiatives and multinational operational collaborations.

Italy Integrated Air & Missile Defense Systems Market Segmentation Analysis

By System

- Anti-Aircraft Systems

- Counter-Unmanned Aerial Systems

- Counter-Rocket Artillery and Mortar Systems

- Counter-Hypersonic Defense Systems

- Integrated Multi-Threat Systems

Anti-aircraft systems dominate Italy’s integrated air and missile defense market, accounting for 40% of total market share. This segment encompasses medium-range SAMP/T platforms and short-range Skynex automated cannon systems, forming the backbone of Italy’s layered air defense architecture. These systems are central to NATO-mandated multi-altitude coverage, addressing threats from manned aircraft, cruise missiles, and emerging unmanned platforms. End users rely on this segment to deliver operational redundancy, rapid engagement, and interoperability with allied assets, reflecting Italy’s strategic focus on modernizing aging air defense inventories.

Remaining market share is distributed among medium-range ballistic missile defense systems, very-short-range point-defense platforms, and emerging counter-unmanned aerial system (C-UAS) solutions. Italy’s procurement strategy ensures complementary system deployment to avoid gaps across the threat spectrum. Integration of these systems into unified command-and-control architectures aligns with NATO’s federated air and missile defense model, facilitating shared situational awareness and coordinated engagement. This multi-tiered approach guarantees end users a coherent defense capability from low-altitude drones to high-altitude ballistic threats, reinforcing Italy’s operational readiness and strategic alignment with European defense objectives.

By Component

- Weapon Systems

- Fire Control Systems

- Radars & Sensors

- Launchers

- Command & Control

- System Integration

Weapon systems constitute the largest component segment in Italy’s integrated air and missile defense market, capturing 30% of total market share. This category includes missile interceptors, automated cannon systems, launch platforms, and targeting mechanisms—the core elements engaging aerial threats. Key examples include SAMP/T Aster 30 Block 1NT missiles, CAMM-ER interceptors, and Skynex 35mm Revolver Gun systems. End users benefit from these advanced systems as they provide the lethal capability required for operational success and effective threat neutralization across multi-altitude engagements.

The remaining component market includes fire control systems, radars & sensors, launchers, command & control, launchers and system integration. These components are essential for enabling deployment, coordination, and operational efficiency of integrated air defense systems. Italy’s digital architecture program emphasizes sensor fusion, AI-enabled targeting, and cybersecurity to achieve NATO interoperability standards. End users increasingly depend on these components for comprehensive situational awareness, rapid engagement decisions, and resilience against hybrid threats, reflecting a broader shift toward technologically sophisticated, multidomain air defense operations.

List of Companies Covered in Italy Integrated Air & Missile Defense Systems Market

The companies listed below are highly influential in the Italy integrated air & missile defense systems market, with a significant market share and a strong impact on industry developments.

- Lockheed Martin

- HENSOLDT

- Northrop Grumman

- Leonardo S.p.A.

- MBDA / MBDA Italia

- Thales (Thales Italia / Thales Alenia Space)

- ELT Group / Elettronica

- Raytheon (RTX)

- Saab

- BAE Systems

Market News & Updates

- Leonardo S.p.A., 2025:

Leonardo demonstrated integrated air and missile defense capabilities aboard Italian Navy's Giovanni delle Bande Nere during NATO Formidable Shield 2025 exercises held May 3-23, 2025. The demonstration featured the SADOC 4 command system and Dual Band Radar for coordinated air and missile defense operations. This showcased Italy's advanced defense systems integration capabilities within the NATO alliance.

- MBDA / MBDA Italia, 2025:

MBDA expanded European missile production with plans for 2,600 new hires in 2025, targeting to double 2023 production levels by end of year. Following 2,500 new hires in 2024, the expansion reflects growing European demand for advanced missile defense systems amid security concerns. MBDA Italia's increased capacity supports European defense modernization and NATO capability requirements.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Italy Integrated Air and Missile Defense Systems Market Policies, Regulations, and Standards

4. Italy Integrated Air and Missile Defense Systems Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Italy Integrated Air and Missile Defense Systems Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By System

5.2.1.1. Anti-Aircraft Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Counter-Unmanned Aerial Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Counter-Rocket Artillery and Mortar Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Counter-Hypersonic Defense Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Integrated Multi-Threat Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Component

5.2.2.1. Weapon Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Fire Control Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Radars & Sensors- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Launchers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Command & Control- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. System Integration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Range

5.2.3.1. SHORAD- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. MRAD- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. LRAD- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End User

5.2.4.1. Army- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Navy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Air Force- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Italy Anti-Aircraft Systems Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Range- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Italy Counter-Unmanned Aerial Systems Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Range- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Italy Counter-Rocket Artillery and Mortar Systems Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Range- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Italy Counter-Hypersonic Defense Systems Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Range- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

10. Italy Integrated Multi-Threat Systems Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Component- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Range- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Northrop Grumman

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Raytheon (RTX)

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Lockheed Martin

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. MBDA / MBDA Italia

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. ELT Group / Elettronica

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Thales Group

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. HENSOLDT

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Leonardo S.p.A.

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Saab AB

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. BAE Systems

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By System |

|

| By Component |

|

| By Range |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.