Spain Plant-Based Dairy Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Plant-Based Milk (Soy Drinks, Almond, Blends, Coconut, Oat, Rice, Other Plant-Based Milk), Plant-Based Yoghurt, Plant-Based Cheese), Sales Channel (Offline (Grocery Retailers, Convenience Retailers, Supermarkets, Hypermarkets), Online)

- Food & Beverage

- Jan 2026

- VI0720

- 125

-

Spain Plant-Based Dairy Market Statistics and Insights, 2026

- Market Size Statistics

- Plant-based dairy in Spain is estimated at USD 825 million in 2025.

- The market size is expected to grow to USD 945 million by 2032.

- Market to register a cagr of around 1.96% during 2026-32.

- Product Type Shares

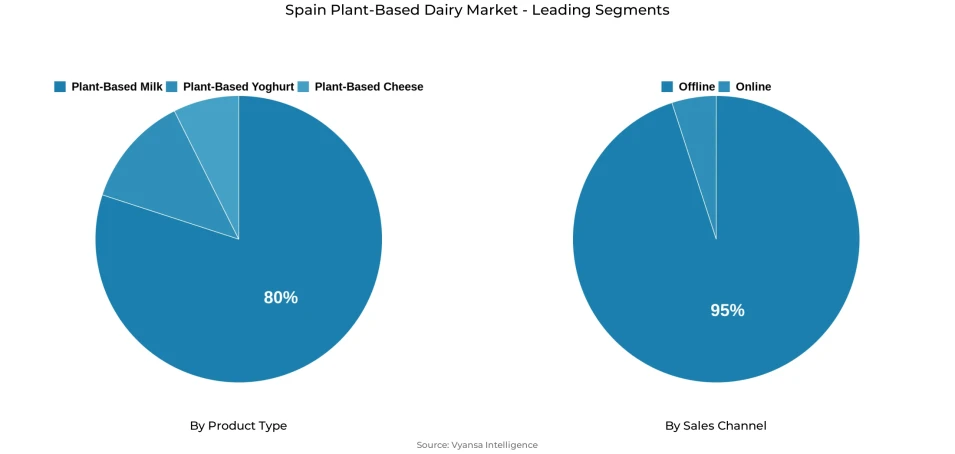

- Plant-based milk grabbed market share of 80%.

- Competition

- More than 15 companies are actively engaged in producing plant-based dairy in Spain.

- Top 5 companies acquired around 55% of the market share.

- El Pardo Cervera, Grupo; Olga España SL; Borges International Group SL; Mercadona SA; Danone SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 95% of the market.

Spain Plant-Based Dairy Market Outlook

The Spain plant-based dairy market is estimated at $825 million in 2025 and is expected to reach $945 million by 2032, registering a CAGR of around 1.96% during 2026-32. Growth will be driven by rising health awareness and end user interest in products offering specific benefits, such as no added sugar, fortified options, and high-protein alternatives. Plant-based milk remains the dominant segment, capturing around 80% of the market, with oat milk leading in popularity and almond and mixed varieties gaining traction due to taste and nutritional appeal.

Plant-based cheese and yogurt growth will be fueled by end user demand and development investment. The vegan cheese and yogurt sector will grow due to an influx of demand from end user and increased innovation. With a focus on improving flavour, texture and functionality to attract a wider range of end user, a number of Spanish start-ups, as well as established players, are investing in R&D. They aim to develop fortified and high protein products using unique ingredients and techniques, including using fungal biomass protein to provide enhanced nutrition and sustainability.

Retail offline will keep a dominant position in the allocation of the market and will remain responsible for about 95% of all sales. Other channels such as hypermarkets and supermarkets, specifically Mercadona, will provide the majority of physical distribution points for plant-based dairy products and offer an extensive selection of plant-based dairy products sold under their private label. The growth of online retailing will continue to grow exponentially due to the increasing use of omnichannel shopping strategies, the development of hybrid purchasing patterns for end user, and the advent of numerous delivery systems that allow for end user to convenienceally access the full range of plant-based dairy products across multiple platforms.

Health-consciousness, diversification of products, and environmental concerns drive innovative opportunities within spain plant-based dairy market. Brands with clean, functional ingredient profiles, superior taste, and environmental sustainability are positioned best to attract end user attention. Additionally, R&D and associated government regulations and collaborations will be vital to delivering new products to the marketplace while positively increasing overall quality within the sector throughout the forecast period.

Spain Plant-Based Dairy Market Growth Driver

Rising Health Awareness and Functional Innovation

Spain an increasing amount of end user are now choosing to buy plant based dairy sources with few simple products, lower sugar levels, and extra nutrition. As such, companies such as El Almendro and Biogran provide almond based beverages enriched with calcium, vitamins A, D, and B12 along with sugar free choices that build up end user confidence that plant based dairy options are becoming a mainstay in their daily diets, not just for a few people.

In addition to this, there is also a growing need for functional beverages for individuals who live already active and balanced lifestyles. These individuals want easy to prepare and nutritious options to continue to promote the innovation of these types of beverages through focus on the use of natural, clean label, and fortified choices. The ongoing release of oat, almond and mixed products, as well as a variety of barista style and flavored yogurts, is showing how health related innovation is helping to develop the growth of the category through both retail and food service.

Spain Plant-Based Dairy Market Challenge

Shelf Space Constraints and Private Label Dominance

The increasing interest in plant-based Dairy Products has created a significant amount of unmet demand. However, the current distribution problems facing plant-based Dairy Products also due to limited shelf space at retailers combined with heavy competition from private label products prevent many smaller or premium brands from being able to attract end user. Major players in retail, such as Mercadona, have become the dominant force in plant-based Dairy Products by offering low-price private label products to shoppers. As a result, it has become increasingly difficult for many smaller or premium brands to establish themselves in the marketplace and reach more end user.

Even with significant growth, Plant-based Cheese is struggling with limited shelf space and high entry barriers. Innovative start-up brands leading the way in plant-based Cheese quality and product innovation often struggle to secure a place for their products within supermarket chains, which limits the variety offered and decreases the pace of innovation development within these retailers.

Spain Plant-Based Dairy Market Trend

Diversification and Premiumisation of Offerings

Spanish end user are beginning to diversify their menus when it comes to plant-based dairy, which has shifted toward premiumisation in terms of price and product quality. Oat Milk has become the most popular plant-based alternative in Spain almond and blend varieties are gaining popularity also. A growing number of brands now produce style ranges of oat milk, as well as flavoured yoghurt and indulgent products, catering to the need for flavourful and quality experiences.

Brands such as Alpro and Yosoy are releasing premium products that are intended to fit into cafe-style and modern dining habits, such as Alpro's Yoghurt Flavour with Lemon Cheesecake and Yosoy's Drink Matcha Avena. As end user become more adventurous in their choices of nutritious and indulgent plant-based dairy alternatives, this trend is creating a significant shift toward the mainstream lifestyle for the product category.

Spain Plant-Based Dairy Market Opportunity

Advancing Innovation and Sustainability Partnerships

Innovation and sustainable initiatives will provide New Growth Opportunities for Spain's Plant-Based Dairy Industry. Collaborative efforts between organizations such as Lidl and ProVeg Incubator working to spur growth in the development of High-Quality Plant-Based Cheese and Delifungus exploring the use of Sustainable High-Protein Ingredients are expanding growth within spain plant-based dairy market

The establishment of a regulatory framework will increase R&D and investment in the PBD Industry throughout Spain while enabling businesses to create new Palatable and Nutritionally Balanced Products. The expansion and acceptance of new plant-based dairy products will depend mainly on three end user behaviours health, functionality and premium experience.

Spain Plant-Based Dairy Market Segmentation Analysis

By Product Type

- Plant-Based Milk

- Plant-Based Yoghurt

- Plant-Based Cheese

The segment with highest market share under product type is plant-based milk with approximately 80% of share. In addition to being the most common type of plant-based milk consumed by end user in their homes, oat milk is still the most preferred variety compared to almond or mixed types. Alpro is a major manufacturer of plant-based milk products and is joined by numerous private labels who produce a greater selection of plant-based milk including those supplemented with vitamins and minerals and those without any added sugar.

The segment continues to be propelled by greater access to plant-based milk through retail locations and the increase in penetration of plants-based milk into more households. Barista style and alternative blends of plant-based milk have contributed to the significant growth of this segment as they have met end user needs for taste and convenience. Therefore, plant-based milk remains the largest contributor to retail sales of plant-based dairy products in Spain.

By Sales Channel

- Offline

- Online

The segment with highest market share under sales channels is offline retail, with around 95% of share. Supermarkets and discounters have a very wide variety of products available, they try to keep their prices low and accommodate end user for their everyday grocery needs. Leading Supermarket Chains such as Mercadona heavily rely on their private label ranges they are now actively expanding into Health-specific Plant-Based Milk, and introducing new products such as innovative blends and sugar-free products.

The main advantages for retail offline are the very large shelf space and high visibility of product range, making it easy for the end user to select the right product and be aware of it. While retail online is rapidly growing as a sales channel, retail offline continues to have the largest market share and delivers the widest access to all different types of branded and private label Plant-Based Dairy Products, playing an important role in growing overall market sales.

List of Companies Covered in Spain Plant-Based Dairy Market

The companies listed below are highly influential in the Spain plant-based dairy market, with a significant market share and a strong impact on industry developments.

- El Pardo Cervera, Grupo

- Olga España SL

- Borges International Group SL

- Mercadona SA

- Danone SA

- Liquats Vegetals SA

- Leche Pascual SA

- Biogran SL

- Nutrition & Sante Iberia SL

- Upfield España SLU

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Spain Plant Based Dairy Market Policies, Regulations, and Standards

4. Spain Plant Based Dairy Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Spain Plant Based Dairy Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Plant-Based Milk- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Soy Drinks- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Almond- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.3. Blends- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.4. Coconut- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.5. Oat- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.6. Rice- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.7. Other Plant-Based Milk- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Plant-Based Yoghurt- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Plant-Based Cheese- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Sales Channel

5.2.2.1. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.1. Grocery Retailers- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.2. Convenience Retailers- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.3. Supermarkets- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.4. Hypermarkets- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Competitors

5.2.3.1. Competition Characteristics

5.2.3.2. Market Share & Analysis

6. Spain Plant-Based Milk Market Outlook, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Spain Plant-Based Yoghurt Market Outlook, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Spain Plant-Based Cheese Market Outlook, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Mercadona SA

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Danone SA

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Liquats Vegetals SA

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Leche Pascual SA

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Biogran SL

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.El Pardo Cervera, Grupo

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Olga España SL

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Borges International Group SL

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Nutrition & Sante Iberia SL

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Upfield España SLU

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.