Spain Leisure & Business Travel Booking Market Report: Trends, Growth and Forecast (2026-2032)

By Travel Sales Type (Leisure Travel, Business Travel), By Booking Channel (Offline Booking, Online Booking), By Booking Method (Travel Intermediaries, Direct Suppliers)

- ICT

- Nov 2025

- VI0405

- 115

-

Spain Leisure & Business Travel Booking Market Statistics and Insights, 2026

- Market Size Statistics

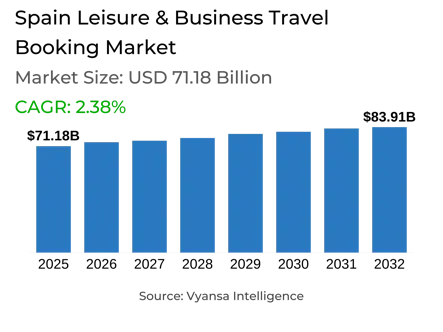

- Leisure & Business Travel Booking in Spain is estimated at $ 71.18 Billion.

- The market size is expected to grow to $ 83.91 Billion by 2032.

- Market to register a CAGR of around 2.38% during 2026-32.

- Travel Sales Type Shares

- Leisure Travel grabbed market share of 75%.

- Competition

- Spain Leisure & Business Travel Booking Market is currently being catered to by more than 10 companies.

- Top 5 companies acquired 50% of the market share.

- Expedia Group Inc, Lastminute Networks SL, Carlson Wagonlit Travel Inc, Booking.com BV, Barceló, Grupo etc., are few of the top companies.

- Booking Channel

- Online Booking grabbed 65% of the market.

Spain Leisure & Business Travel Booking Market Outlook

The Leisure & Business Travel Booking market in Spain is estimated at $71.18 billion and is expected to grow to $83.91 billion by 2032. online bookings accounting for 65% of the market. In 2024, the market was boosted by the recovery in tourism, with both online and offline intermediaries registering strong performances. Online travel agencies (OTAs) are particularly resilient, using big data, artificial intelligence (AI), and blockchain to deliver personalized services and specialized offerings. Young, technology-embracing travelers are becoming increasingly confident about booking online, as offline intermediaries continue to entice tourists who prefer face-to-face contact.

Booking.com is still the top travel intermediary in Spain, known for offering a huge selection of packages, good prices, and trustworthy search facilities. Homeland holidays remain in vogue, but people are also visiting European states and longer-distance travels. Sun and sea holidays are still big sellers, with experiential travel—entailing culture, heritage, sports, food, and wine tours—increasing fast. Local campaigns, which market "empty Spain" as an example, pick up off-season and low-traffic zones, opening doors for visitors looking for authentic and novel experiences.

Digitization and personalization are anticipated to support growth during the forecast period. OTAs are poised to offer personalized travel calendars and ancillary services, ranging from improved hotel services to bespoke airline products. These customized experiences boost end user satisfaction and yield ancillary revenues, driving overall market growth.

There are also opportunities in adventure and niche tourism, elderly travel, unique sustainable tourism projects. Combined travel types, green options, and "bleisure" products will draw end users who want flexibility, green choices, and combined business-leisure travel. Generally, Spain's travel booking market will continue to grow steadily, with intermediaries in online channels driving innovation and service delivery.

Spain Leisure & Business Travel Booking Market Growth Driver

Increasing Interest in Experiential Tourism

Beach and sun holidays remain popular in Spain, but travellers are increasingly seeking experiential tourism, which is rapidly emerging as a key growth driver. End users are increasingly interested in culture, heritage, sports, and activities, and also specialties of food and wine. This is consistent with government efforts to encourage the less-visited regions of empty Spain," where scenery for hiking, cycling, gastronomy, and wine excursions is widespread.

The public campaigns of the government, including those under the Food of Spain strategy, reinforce this trend further by associating tourism with regional diversity and local gastronomy. These campaigns promote Spain rich culture and culinary heritage, providing novel and immersive experiences for both national and foreign tourists. Thus, the shift towards experiential tourism increases demand for varied packages and stimulates long-term development in the travel booking market.

Spain Leisure & Business Travel Booking Market Trend

Development of Off-Season & Cultural Tourism

Spain is increasingly promoted as a cultural destination beyond the summer season and away from traditional high-tourism areas. Provinces like Valencia are spearheading these initiatives by providing tourists with experiences that are based on history, heritage, and traditions. This development enables destinations to encourage visitors off-season, removing pressures from congested coastal regions while expanding the appeal of tourism in Spain.

Cultural attractions are emerging as appealing options for visitors who want distinctive and real experiences rather than typical beach vacations. end users are interested in discovering local customs and heritage places, generating demand for varied products that push back the travel season. This movement mirrors how Spain is broadening its tourism focus, inviting travelers to interact with lesser-visited areas and visit outside the traditional summer period.

Spain Leisure & Business Travel Booking Market Opportunity

Senior Tourism and Extended Seasonal Offers

There is increasing potential in Spain to create trips and experiences that are specifically designed for older travelers. Most people stay active well into their 60s and 70s, considerably more than they used to in earlier decades. This change opens niche opportunities in the market since senior travel can no longer be defined as sedate activities or traveling off-season. Older tourists are increasingly booking trips immediately before or after the peak season, opening up demand for non-conventional products.

This development provides scope for activity-based tourism, including hiking, and customized seasonal travel that are attractive to this age group. By catering to the changing needs of active senior tourists, intermediaries can create niche travel products, increase their end user base, and consolidate their position in Spain leisure and business travel bookings market.

Spain Leisure & Business Travel Booking Market Segmentation Analysis

By Travel Sales Type

- Leisure Travel

- Business Travel

The segment with highest market share under Travel Sales Type with the largest market share is Leisure Travel, which controlled 75% of the market. Holiday bookings continue to dominate in Spain as end users still prioritize holidays, with beach and sun holidays remaining highly appealing. Alongside this, experiential travel like cultural, food, wine, and activity tourism is on the rise with government sponsorship to promote less-visited areas of "empty Spain." These options showcase the diversity of Spain as a destination, merging tradition and new-age trends.

Demand for leisure is also influenced by destination flexibility, and local end users appreciation for holidays at home, as well as travel exploration in Europe and long-haul travel. An increase in emphasis on niche travel, sustainable travel, and personalized travel services continues to establish leisure travel as the dominant segment, with its continued control throughout the forecast period.

By Booking Channel

- Offline Booking

- Online Booking

The segment with highest market share under Booking Channel is Online Booking, which had a market share of 65%. Online channels lead the pack because of their ease of use, enabling end users to explore destinations, compare prices, and personalize trips according to individual tastes. Younger end users with high technology usage are particularly at ease with online platforms, and therefore online bookings are the most sought-after channel. Major players like Booking.com have created firm brand awareness, providing extensive travel offerings, unbranded searches, and affordable prices, which further entrench the power of online intermediaries.

The increased application of technology, such as big data, AI, and blockchain, allows online booking providers to provide more personalization and value-added services. This does not only improve the end user experience but also opens doors for ancillary revenues through customized packages. With growing digital adoption and increased demand for customized travel, online booking is likely to be the foremost and fastest-generating channel.

Top Companies in Spain Leisure & Business Travel Booking Market

The top companies operating in the market include Expedia Group Inc, Lastminute Networks SL, Carlson Wagonlit Travel Inc, Booking.com BV, Barceló, Grupo, El Corte Inglés SA, Logitravel SL, Vacaciones EDreams SL, Atrápalo SL, Viajes Soltour SA, etc., are the top players operating in the Spain Leisure & Business Travel Booking Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Spain Leisure & Business Travel Booking Market Policies, Regulations, and Standards

4. Spain Leisure & Business Travel Booking Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Spain Leisure & Business Travel Booking Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Travel Sales Type

5.2.1.1. Leisure Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Business Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Booking Channel

5.2.2.1. Offline Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Online Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Booking Method

5.2.3.1. Travel Intermediaries- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Direct Suppliers- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Spain Leisure Travel Booking Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

6.2.1.1. Leisure Air Travel- Market Insights and Forecast 2022-2032, USD Million

6.2.1.2. Leisure Car Rental- Market Insights and Forecast 2022-2032, USD Million

6.2.1.3. Leisure Cruise- Market Insights and Forecast 2022-2032, USD Million

6.2.1.4. Leisure Experiences and Attractions- Market Insights and Forecast 2022-2032, USD Million

6.2.1.5. Leisure Lodging- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

7. Spain Business Travel Booking Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

7.2.1.1. Business Air Travel- Market Insights and Forecast 2022-2032, USD Million

7.2.1.2. Business Car Rental- Market Insights and Forecast 2022-2032, USD Million

7.2.1.3. Business Lodging- Market Insights and Forecast 2022-2032, USD Million

7.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1. Booking.com BV

8.1.1.1. Business Description

8.1.1.2. Service Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2. Barceló, Grupo

8.1.2.1. Business Description

8.1.2.2. Service Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3. El Corte Inglés SA

8.1.3.1. Business Description

8.1.3.2. Service Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4. Logitravel SL

8.1.4.1. Business Description

8.1.4.2. Service Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5. Vacaciones eDreams SL

8.1.5.1. Business Description

8.1.5.2. Service Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6. Expedia Group Inc

8.1.6.1. Business Description

8.1.6.2. Service Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7. Lastminute Networks SL

8.1.7.1. Business Description

8.1.7.2. Service Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8. Carlson Wagonlit Travel Inc

8.1.8.1. Business Description

8.1.8.2. Service Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9. Atrápalo SL

8.1.9.1. Business Description

8.1.9.2. Service Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Viajes Soltour SA

8.1.10.1. Business Description

8.1.10.2. Service Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Travel Sales Type |

|

| By Booking Channel |

|

| By Booking Method |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.