South Korea Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By End User (Industrial Water & Wastewater, Municipal Water & Wastewater)

- Energy & Power

- Dec 2025

- VI0489

- 120

-

South Korea Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

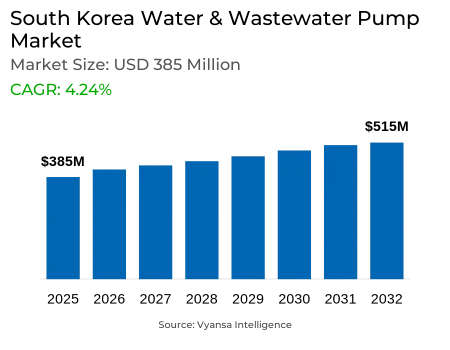

- Water & Wastewater Pump in South Korea is estimated at $ 385 Million.

- The market size is expected to grow to $ 515 Million by 2032.

- Market to register a CAGR of around 4.24% during 2026-32.

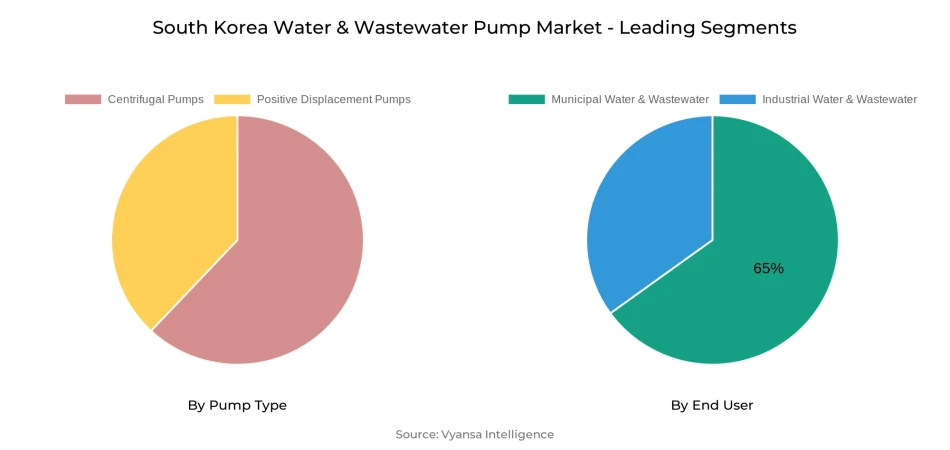

- Pump Type Segment

- Centrifugal Pumps continues to dominate the market.

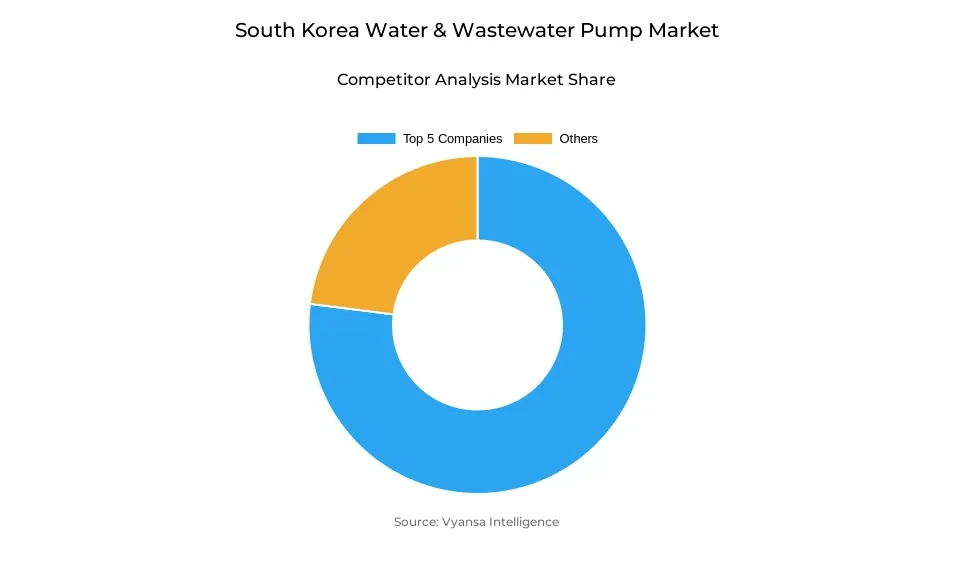

- Competition

- More than 10 companies are actively engaged in producing Water & Wastewater Pump in South Korea.

- Top 5 companies acquired the maximum share of the market.

- ITT, IDEX, Dover, Flowserve, Sulzer AG etc., are few of the top companies.

- End User

- Municipal Water & Wastewater grabbed 65% of the market.

South Korea Water & Wastewater Pump Market Outlook

The market for South Korea's water and sewer pumps is expected to grow from USD 385 million in 2025 to USD 515 million by 2032, fueled by mass-scale infrastructure updating and state-funded investments. Much of the country's pipelines and sewerage networks have exceeded their designed life, with 30.4% of sewer lines in Seoul being over 50 years old and leakage losses countrywide amounting to 670 million cubic meters every year. These conditions are necessitating immediate system improvements that rely significantly on sound and effective pumping technologies.

Government programs are the prime driver of demand, with the Ministry of Environment allocating 7.3 trillion won for water management in 2025, and Seoul alone budgeting 4.32 trillion won in improvements through 2040. These investments necessitate sophisticated pumping hardware that can deliver increased efficiency and performance. Concurrently, regulatory complexities—derived from overlapping water quality and discharge regulations—are increasing compliance costs, driving industries and municipalities toward advanced pumping technologies capable of addressing varied treatment needs.

Adoption of technology is also transforming the market, with Korea leading the way globally in smart water systems. Smart meters and monitoring systems based on IoT are improving leak detection, optimizing pressure, and allowing predictive maintenance. This trend bolsters increasing demand for smart pumps that can be easily integrated into digital water management platforms. Concurrently, Korea's dedication to recycling and reusing water in both municipal and industrial applications provides niche prospects for corrosion-inhibited, high-efficiency pump systems specifically for treated effluent applications.

On a pump-by-pump basis, centrifugal pumps have the largest market share because they are economical, versatile, and have a powerful service network. As far as end-users are concerned, municipal water and wastewater is the leader with 65% of the market, bolstered by wide geographic population coverage and public expenditure. The industrial water and wastewater segment grows at the fastest rate of 6.22% CAGR, driven by increasing environmental laws and water needs in semiconductor and steel sectors.

South Korea Water & Wastewater Pump Market Growth Driver

Infrastructure Modernization Necessitates Advanced Pumping Systems

South Korea's outdated water infrastructure is a large driver of demand for dependable pumping solutions as city governments spend heavily on infrastructure upgrades. According to Seoul Metropolitan Government, 30.4% of the city's sewer pipes are more than half a century old, with some areas such as Jongno recording 53.5% pipes older than 50 years. Korea Water Resources Corporation (K-water) indicates that 36% of water pipes across the country are over 20 years old and result in 670 million cubic meters of tap water leakage annually.

This pervasive infrastructure decay means that wide-ranging modernization schemes necessarily depend on rugged pumping equipment. Seoul alone is spending 4.32 trillion won through 2040 on water system upgrades, including 2.7 trillion won alone dedicated to pipe replacement and renovation. The Ministry of Environment has set aside a record-high 7.3 trillion won for water management in 2025, with major amounts going into infrastructure renewal programs. These huge infrastructure spending create stable demand for water and wastewater pumps due to aging systems needing replacement with contemporary, energy-saving units that can keep up with expanded capacity and performance requirements.

South Korea Water & Wastewater Pump Market Challenge

Regulatory Complexities Hinder Operational Efficiency

South Korea's water and sewage industry is seriously challenged by conflicting regulatory systems that impose compliance weights on pump system operators. Industrial plants have to deal with twin standards under the Water Quality and Aquatic Ecosystem Conservation Act and Marine Environment Management Act, generating operational uncertainty and added expense. The government of Korea controls 53 various allowable discharge limit parameters for private treatment facilities, as opposed to 7 for public, emphasizing regulatory discrepancies.

Enforcement disparities further complicate operations, as rates of violations reveal dramatic disparities between Ministry of Environment inspections (28.0%) and local government inspections (8.6%). These regulatory intricacies compel operators to have redundant compliance systems in place and to go through constant technical adjustments to suit changing standards. The recent increase of ecotoxicity management from 35 to 82 types of industrial facilities in 2021 is a good example of the mounting regulatory burden. Such regulatory uncertainty increases operational costs and requires more sophisticated pump systems capable of handling varied discharge requirements, presenting ongoing challenges for market participants seeking cost-effective solutions.

South Korea Water & Wastewater Pump Market Trend

Smart Technology Integration Transforms Water Management

South Korea is at the forefront of world adoption of smart water technologies, with municipalities adopting inclusive IoT-based systems for improved operational effectiveness. Gochang County in Korea was the first to implement countywide smart water meters, installing 24,104 units under an agreement with Australian IoT company Freestyle Technology. The Korea Electric Power Corporation (KEPCO) is undertaking a 1.7 trillion won Advanced Metering Infrastructure scheme to install 22.5 million intelligent electricity meters by the year 2020 as part of national commitment to smart infrastructure.

Smart water management systems are able to perform astounding accuracy rates of 98.9%, surpassing regulatory standards and allowing for real-time monitoring functionality. Seoul's water utility has upped revenue water ratio from 55.2% in 1989 to 94.4% in 2013 through the use of sophisticated leak detection and monitoring systems. These technology applications minimize water losses, optimize pressure management, and facilitate predictive maintenance procedures. The combination of IoT sensors, automated controls, and data analysis platforms drives need for smart pump systems that will communicate smoothly with centralized management systems, making smart-enabled pumping solutions inevitable elements of contemporary water infrastructure.

South Korea Water & Wastewater Pump Market Opportunity

Water Recycling Expansion Creates Market Opportunities

South Korea's water sustainability commitment creates huge opportunities in expanding recycling and reuse programs throughout industrial and municipal applications. The government introduces innovative Water Recycling Promotion Act policies through offering tax incentives, subsidies, and preferential procurement to promote advanced treatment system implementation. Large-scale industrial sites such as Pohang's POSCO steel complex commission 100,000 cubic meters per day wastewater reuse systems, laying out the potential for extensive application on a massive scale.

Metropolitan-scale implementation projects accelerate infrastructure development for municipal water recycling targets reaching 17% of treated sewage water by 2020. 6.6 billion won has been secured by the Ministry of Environment for 2025 to open Water Pollution Control Centers and upgrade buffer storage facilities by 162.4 billion won. Government projects involve building 10 groundwater reservoir dams and increasing recycled wastewater supply facilities for semiconductor and battery industrial complexes. These total recycling programs demand treatment effluent handling-specific pump systems, presenting niche market opportunities for companies providing corrosion-resistant, high-efficiency equipment that can withstand tight reuse quality standards while addressing Korea's circular economy goals.

South Korea Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

The category enjoys the largest market share under pump type, and Centrifugal Pumps remain the market leaders. Centrifugal pumps retain their dominance thanks to their versatility, reliability, and affordability in managing diverse water and wastewater applications in South Korea's varied infrastructure requirements. These pumps stand out in municipal water treatment facilities, industrial establishments, and sewerage systems where there is a need for constant flow rates and moderate pressure demands.

Centrifugal pumps provide operational benefits such as easier maintenance processes, reduced initial capital expenditure, and reliability in high-volume applications. The widespread use of centrifugal pumps results from compatibility with existing facility infrastructure and capability to manage varied water quality conditions efficiently. Maturity of the technology guarantees access to reliable spare parts and developed service networks across South Korea, thus making centrifugal pumps the choice for both new plant installations and replacement work in the growing water and wastewater treatment industry.

By End User

- Industrial Water & Wastewater

- Municipal Water & Wastewater

The most market share is held under the End User category by the segment, and Municipal Water & Wastewater captures 65% of the market. The leadership position indicates South Korea's massive public water infrastructure providing over 98.9% of the population with access to clean water and 93.2% with wastewater. Municipal uses propel steady demand with continuous infrastructure upgrade schemes and capacity increase projects.

Industrial Water & Wastewater is the fastest growing End User segment at 6.22% CAGR, a measure of South Korea's industrialization as well as tightening environmental regulations. Large-scale industrial complexes such as semiconductor fabrication plants and steel mills need advanced pumping solutions for process water management and effluent treatment. Government initiatives funding semiconductor industrial complexes in Yongin and secondary battery plants in Pohang are generating significant industrial water infrastructure needs, placing this segment on track to continue to grow rapidly.

Top Companies in South Korea Water & Wastewater Pump Market

The top companies operating in the market include ITT, IDEX, Dover, Flowserve, Sulzer AG, KSB, Xylem, Grundfos, Ebara, SPX Flow, etc., are the top players operating in the South Korea Water & Wastewater Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. South Korea Water & Wastewater Pump Market Policies, Regulations, and Standards

4. South Korea Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. South Korea Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Industrial Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Municipal Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. South Korea Centrifugal Water & Wastewater Pump Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. South Korea Positive Displacement Water & Wastewater Pump Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Flowserve Corporation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Ebara Corporation

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.WILO SE

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Sulzer Limited

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Grundfos Holding A/S

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Xylem Inc.

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.KSB SE & Co. KGaA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Kirloskar Brothers Limited (KBL)

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Franklin Electric

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Pentair PLC

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.