South America Industrial Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By Country (Brazil, Argentina, Chile, Peru, Rest of South America)

- Energy & Power

- Jan 2026

- VI0854

- 145

-

South America Industrial Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

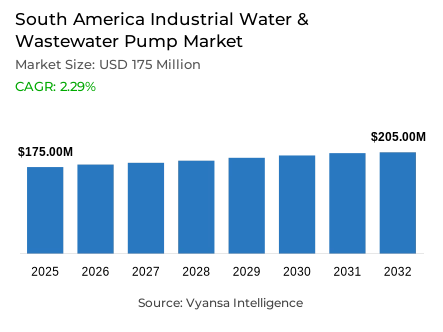

- South America industrial water & wastewater pump market is estimated at USD 175 million in 2025.

- The market size is expected to grow to USD 205 million by 2032.

- Market to register a cagr of around 2.29% during 2026-32.

- Pump Type Shares

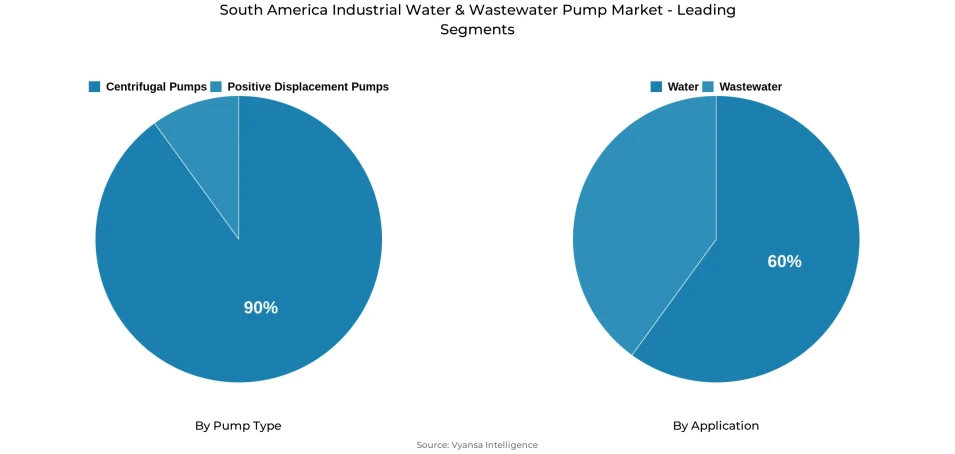

- Centrifugal pumps grabbed market share of 90%.

- Competition

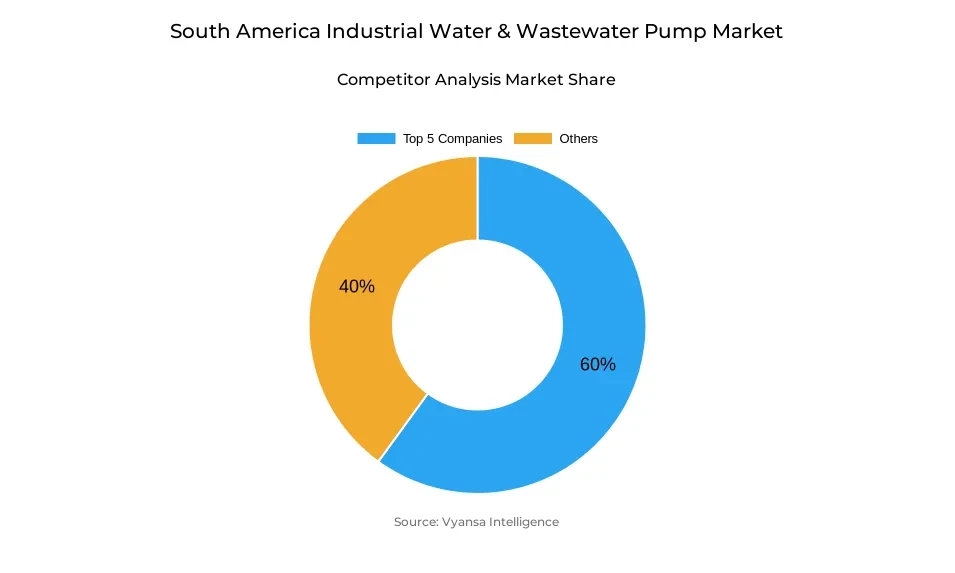

- Industrial water & wastewater pump in South America is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 60% of the market share.

- Metso; Netzsch; TechnipFMC; Flowserve Corporation; Sulzer Ltd. etc., are few of the top companies.

- Application

- Water grabbed 60% of the market.

- Country

- Brazil leads with a 40% share of the South America market.

South America Industrial Water & Wastewater Pump Market Outlook

The South America industrial water and wastewater pump market is expected to have a consistent growth trend in 2026-2032, which will be backed by binding regulatory requirements and continued capital inflows into water infrastructure. The market is estimated to be USD 175 million in 2025 and is expected to be USD 205 million in 2032 with a compound annual growth rate of approximately 2.29% within the forecast period. Growth is mostly pegged on federally required universalization goals, especially in Brazil, where explicit regulatory goals of water access and sewage treatment are converting into long-term demand transparency of pumping systems in both municipal and industrial uses.

The growth of infrastructure is still being strengthened by the increase in the involvement of the private sector and massive investment pipelines. The clarity of regulations has seen an increase in the penetration of water utilities by the private operators so that the project is always executed and the equipment is always procured. Simultaneously, chronic shortages in wastewater treatment capacity throughout South America are imposing operational pressure on the available facilities, stimulating replacement demand in addition to new installations. The use of energy-saving and dependable pumps is becoming a priority in treatment plants to handle high operating expenses, variable inflows, and more stringent discharge regulations.

Market demand is also being influenced by structural changes in water sourcing. The growing water scarcity has increased the use of desalination and seawater reuse particularly in the industrial sectors like mining. This shift is increasing the need to have high capacity and corrosion resistant pumping systems that are meant to operate continuously. The centrifugal pumps continue to dominate the regional operations with about 90% of the market share since they are suitable in high volume and continuous-duty applications and also because of their low life-cycle costs.

Water treatment occupies the largest market share of 60% under the application segment, which is aided by the continued growth of potable water networks and industrial water systems. Brazil dominates the regional market with 40% market share which is supported by the size of its population, industrial base, and effective enforcement of regulations. All these factors put the market in a stable, regulation-supported growth up to 2032.

South America Industrial Water & Wastewater Pump Market Growth DriverInfrastructure Expansion Anchored by Regulatory Mandates and Capital Inflows

The targets of universalization as mandated by the federal government are radically transforming the South American market of industrial water and wastewater pumps, with Brazil being at the center of this change. Law No. 14,026/2020 sets binding targets of 99% potable water access and 90% sewage collection and treatment by 2033, in a context where almost 33 million individuals lack access to clean water and about 80 million lack access to sewage treatment. These structural shortages are directly converted to long-term need of large-scale water consumption, transmission, and treatment systems, which exacerbates the acquisition of industrial-grade pumping systems in municipal utilities and industrial plants.

The regulatory environment has also opened up unprecedented involvement of the private capital, with the penetration of the water utilities in Brazil by the private operators rising to 42% in 2024 as compared to 13% in 2012. The inflows of investments are estimated to be USD 8.5 billion in 2025 alone, with a private investment pipeline of about USD 19–21 billion in 43 privatization projects up to 2033. This climate guarantees long-term, regulation-supported demand transparency of pump producers in water supply, wastewater treatment, and industrial process applications.

South America Industrial Water & Wastewater Pump Market ChallengeOperational Stress from Inadequate Wastewater Treatment Capacity

Although there is an increasing pace of investment, wastewater treatment facilities in South America are structurally underdeveloped, with less than 50% of the wastewater generated being treated properly. This deficit causes long-term operational pressure on the available facilities, which results in excessive use of equipment, increased maintenance cycles, and service failures. The need to handle variable inflows, older networks, and stricter environmental discharge standards forces treatment plants to replace or upgrade pumping systems, which further supports replacement-based demand and new capacity additions.

The situation is especially acute in Brazil, where only 46% of the population has access to sewage collection and almost 62% of sewage is released into the environment without treatment. The cost of operation is high in wastewater treatment plants, and almost 80% of the total cost is made up of personnel, energy, maintenance, and chemicals. These cost pressures are driving faster implementation of energy efficient, low downtime pumping systems, but smaller municipalities and industrial end users are still facing limitations in terms of capital access and technical skills.

South America Industrial Water & Wastewater Pump Market TrendStructural Shift Toward Non-Freshwater and Advanced Treatment Sources

The water scarcity is transforming the industrial water sourcing approaches in South America, which is leading to a radical change in favor of desalination and seawater reuse. The water demand in the copper mining industry of Chile is expected to increase to 22.1 m³/s in 2034, as compared to 18.8 m³/s in 2023, and the freshwater consumption is expected to decrease significantly. The use of seawater is expected to increase more than twice, which is a structural realignment of the process of industrial end users to obtain a stable water supply amidst the tightening freshwater limits.

This shift has increased the pace of desalination infrastructure implementation, with Chile having 24 desalination plants with a capacity of over 10,500 liters per second, and several others in construction or approval. By 2034, seawater is likely to supply about 66% of the water consumed in copper mining in South America. These changes directly increase the need to have specialized pumping systems that can manage corrosive fluids, high flow rates, and continuous duty cycles, which further supports the strategic significance of pump suppliers in the industrial water security.

South America Industrial Water & Wastewater Pump Market OpportunityMulti-Country Investment Programs Creating Long-Term Upside

Outside of Brazil, the pace of water and sanitation investments is growing in key economies of South America, which increases the market of pumping systems. In 2024, Peru declared USD 1.3 billion portfolio of public-private partnerships, and in 2025, USD 1.5 billion was approved on 37 water infrastructure projects. The USD 115 million wastewater treatment project in Buenos Aires, Argentina, is another indicator of regional interest in capacity building and modernization.

Such efforts are also being accompanied by the implementation of modern treatment technologies like membrane bioreactors, UV disinfection, and digital monitoring. The Chilean utilities alone intend to invest more than USD 400 million, almost 60% of which is to be spent on infrastructure delivery. All these technologies demand very stable pumping solutions that have a high level of flow control and energy efficiency, which leaves a long-term future outlook of pump manufacturers in line with the progressive municipal and industrial treatment needs.

South America Industrial Water & Wastewater Pump Market Country Analysis

By Country

- Brazil

- Argentina

- Chile

- Peru

- Rest of South America

Brazil accounts for 40% of the South American industrial water and wastewater pump market, reflecting its population scale, industrial depth, and regulatory intensity. The country’s binding universalization targets, coupled with enforcement mechanisms and federal funding conditions, provide unmatched investment certainty for infrastructure developers and equipment suppliers. This regulatory clarity directly supports sustained procurement of pumping systems across municipal and industrial projects.

Private sector expansion further strengthens Brazil’s leadership position, with private operator participation rising to 42% in 2024 and annual investment projected at USD 8.5 billion in 2025. Large industrial end users, including globally significant pulp producers, operate extensive integrated water and wastewater systems requiring hundreds of pumps. Combined with a mature manufacturing base and nationwide service networks, these factors position Brazil to maintain and potentially expand its 40% regional market share through the 2033 universalization horizon.

South America Industrial Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- End Suction

- Split Case

- Vertical

- Turbine

- Axial Pump

- Mixed Flow Pump

- Submersible Pump

- Positive Displacement Pumps

- Progressing Cavity

- Diaphragm

- Gear Pump

- Others

Centrifugal pumps dominate the South America industrial water & wastewater pump market, accounting for 90% of total market share. This dominance reflects their suitability for high volume, continuous duty applications common across municipal water distribution, wastewater conveyance, industrial process circulation, and desalination operations. Their mechanical simplicity, scalability across flow ranges, and lower lifecycle costs make them the preferred solution for utilities and industrial end users managing large scale fluid movement.

The versatility of centrifugal pumps enables reliable handling of diverse fluids, including raw water, treated water, activated sludge, and seawater, without extensive mechanical modification. Major industrial facilities, such as large pulp and paper operations in Brazil processing thousands of cubic meters of water per hour, rely almost exclusively on centrifugal systems. Established service networks, spare parts availability, and operator familiarity further reinforce their entrenched position, sustaining long term dominance across South America.

By Application

- Water

- Wastewater

Beyond municipal supply, water treatment demand is reinforced by industrial end users, including mining, pulp and paper, and refining operations that require dedicated intake, pretreatment, and circulation infrastructure. Desalination facilities in Chile and emerging projects in Peru and Argentina further expand the installed base of water focused pump applications. This application leadership is expected to persist through 2032, even as wastewater investments accelerate in parallel.

Various Market Players in South America Industrial Water & Wastewater Pump Market

The companies mentioned below are highly active in the South America industrial water & wastewater pump market, occupying a considerable portion of the market and shaping industry progress.

- Metso

- Netzsch

- TechnipFMC

- Flowserve Corporation

- Sulzer Ltd.

- Grundfos Holding A/S

- KSB SE & Co. KGaA

- Xylem Inc.

- Kaiquan

- Leo Pump

Market News & Updates

- Metso, 2025:

Launched groundbreaking Life Cycle Services (LCS) framework for the minerals processing industry at Exposibram 2025 in Brazil (October 2025). The new framework offers outcome-based partnerships ranging from basic parts supply to full equipment lifecycle management, specifically tailored to the South American mining sector. This strategic move strengthens Metso's position as the leading service partner in the region, supporting customers' operational efficiency and sustainability goals.

- TechnipFMC, 2025:

Reported strong Q2 2025 Subsea segment revenue of $2.2 billion (up 14% sequentially), driven significantly by increased project activity and installation volumes in Brazil. The company continues to execute on high-value projects for Petrobras, leveraging its installed base and technological leadership in subsea processing to drive revenue growth and margin expansion in the South American industrial and energy sectors.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. South America Industrial Water & Wastewater Pump Market Policies, Regulations, and Standards

4. South America Industrial Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. South America Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold (Million Units)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Country

5.2.3.1. Brazil

5.2.3.2. Argentina

5.2.3.3. Chile

5.2.3.4. Peru

5.2.3.5. Rest of South America

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Brazil Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold (Million Units)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

7. Argentina Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold (Million Units)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

8. Chile Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold (Million Units)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

9. Peru Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Units Sold (Million Units)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Flowserve Corporation

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Sulzer Ltd.

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Grundfos Holding A/S

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. KSB SE & Co. KGaA

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Xylem Inc.

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Metso

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Netzsch

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. TechnipFMC

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Kaiquan

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Leo Pump

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.