Saudi Arabia Industrial Gases Market Report: Trends, Growth and Forecast (2026-2032)

By Gas Type (Nitrogen Gas, Oxygen Gas, Carbon Dioxide Gas, Argon Gas, Helium Gas, Hydrogen Gas, Other), By Supply Mode (Cylinders, Bulk, On-Site Production, Captive, Other), By Application (Combustion and Process Oxygen, Welding and Metal Fabrication, Inerting Blanketing and Heat Treating, Cryogenics and liquefaction, Chemical Synthesis and Hydrogenation, Purging and Purifications, Analytical and Calibration), By End User Industry (General Manufacturing, Food, Metallurgy, Chemicals, Healthcare, Electronics, Refining & Energy, Glass, Pulp & Paper, Others)

- Energy & Power

- Jan 2026

- VI0853

- 110

-

Saudi Arabia Industrial Gases Market Statistics and Insights, 2026

- Market Size Statistics

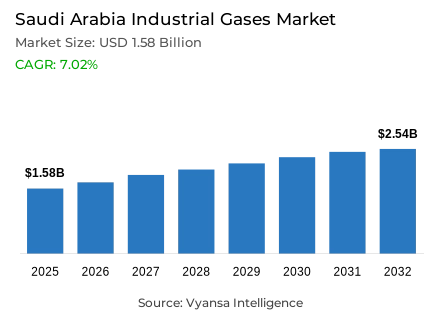

- Industrial gases in Saudi Arabia is estimated at USD 1.58 billion in 2025.

- The market size is expected to grow to USD 2.54 billion by 2032.

- Market to register a cagr of around 7.02% during 2026-32.

- Gas Type Shares

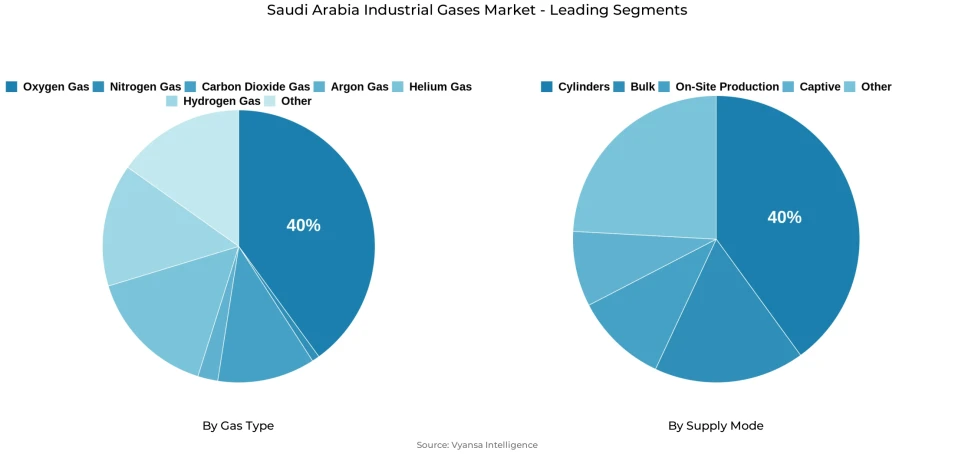

- Oxygen gas grabbed market share of 40%.

- Competition

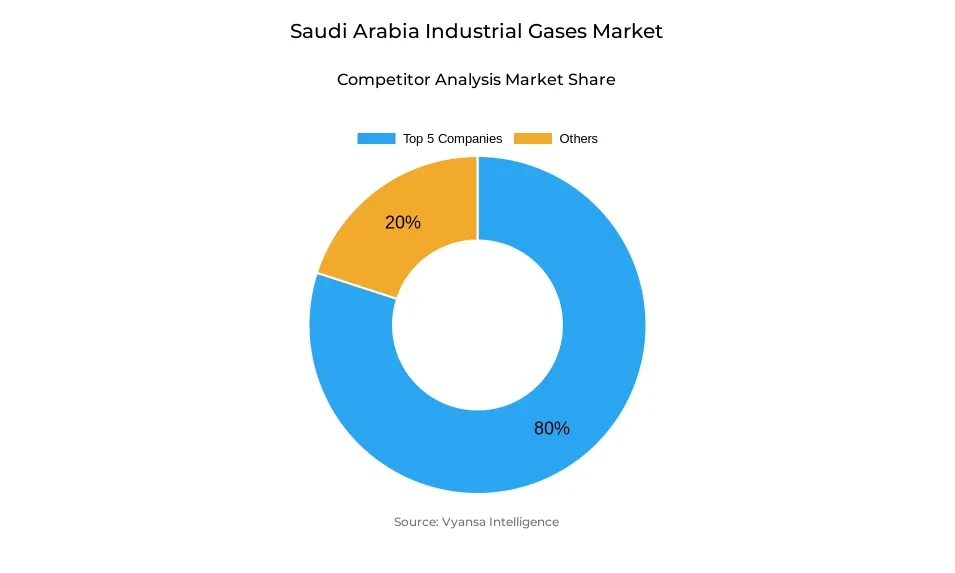

- More than 5 companies are actively engaged in producing industrial gases in Saudi Arabia.

- Top 5 companies acquired around 80% of the market share.

- Air Products and Chemicals; Gulf Cryo; Aldakheel Industrial Gases Plant (DIGAS); Linde; Air Liquide etc., are few of the top companies.

- Supply Mode

- Cylinders grabbed 40% of the market.

Saudi Arabia Industrial Gases Market Outlook

Saudi Arabia industrial gases market is set for steady growth as national industrial expansion under Vision 2030 continues to strengthen demand across refining, petrochemical, healthcare, and manufacturing activities. With the market estimated at USD 1.58 billion in 2025 and projected to reach USD 2.54 billion by 2032, it is expected to grow at around 7.02% CAGR during 2026–2032. Rising non-oil sector activity, new manufacturing capacities, and large national projects are increasing the use of oxygen, nitrogen, hydrogen, and specialty gases in fuel production, chemical processing, power generation, and logistics operations.

Broader economic diversification further expands gas consumption in healthcare, pharmaceuticals, and food processing. Hospital network upgrades and medical service expansion drive higher medical oxygen demand, while food processing relies on nitrogen for packaging and preservation. The semiconductor and electronics ecosystem is also strengthening, with research institutions increasing their use of high-purity gases for precision manufacturing steps such as lithography and deposition. These developments support a wider industrial base that complements traditional refining and petrochemical demand.

Workforce skill shortages and technology-integration gaps remain notable hurdles, particularly for advanced cryogenic operations and digital manufacturing systems. Small and mid-sized enterprises face challenges in adopting modern equipment due to capital constraints and limited technical expertise. Infrastructure disparities across regions also slow upgrades to production and distribution networks, affecting efficiency and increasing operational costs. These constraints highlight the need for stronger skill development and modernization efforts to support rising national demand.

Renewable electricity expansion and clean hydrogen projects are reshaping gas production as solar- and wind-powered systems improve efficiency and support lower-emission output. Within the market, oxygen leads with a 40% share due to its essential role in refining and hydrogen-related processes, while cylinders account for 40% of supply thanks to their flexibility for healthcare, food processing, and smaller industrial users. Together, these dynamics indicate sustained and diversified growth for the Saudi Arabia Industrial Gases Market through 2032.

Saudi Arabia Industrial Gases Market Growth DriverExpanding Industrial Output Underpins Market Advancement

The industrialization momentum in Saudi Arabia using the Vision 2030 initiative is further propelling the consumption of industrial gases in the refining, petrochemical, and high-tech manufacturing sectors. An increasing non-oil economy and the implementation of large-scale nation-wide projects will further create the needs of oxygen, nitrogen, and hydrogen in fuel industry processes, specialty chemical plants, and electricity generation sectors. Clean energy projects in the form of large-scale hydrogen plants and solar projects will further widen the needs of industrial gases to sustain operations in high-tech industrial parks. An increasing non-oil economy will continue to sustain gas demand in various sectors of industry.

The need for economic diversification of the Kingdom’s economy is an important driving factor that contributes to the increasing demand for the use of industrial gases. For instance, the food industry depends on the use of nitrogen for packaging purposes. In turn, the expansion of the health industry translates to an increase in the demand for medical oxygen. All these aspects outline the critical role that gases perform in facilitating the processes of the respective industries.

Saudi Arabia Industrial Gases Market ChallengeWorkforce Limitations and Technology Constraints Restrict Growth Momentum

The Saudi Arabian government is still grappling with the skills gap and lack of technological integration in the scaling of the operations of industrial gas. The manufacturing industry is still facing challenges in recruiting technical personnel in areas of advanced operations such as cryogenics, management of digital systems, and automatic manufacturing processes. The skills gap in Industry 4.0 areas is hindering the maximization of the use of equipment and hindering the upgrades of the operations in the areas of liquefaction, compression, and purification. Small and medium enterprises have been affected due to the lack of specialized skills in the manufacturing industry.

The use of technology can also be hindered by barriers associated with large capital investments and different levels of infrastructure development. Some of the resources involved in the production and supply chain are working below the efficiency threshold of today’s technology, especially in rural areas where further development of the resources would be an economic burden. Issues with the use of technology would also be countered by better contributions to the labor force, but some skills shortages would continue in essential areas of industry.

Saudi Arabia Industrial Gases Market TrendRising Renewable Integration Shapes Evolving Supply Landscape

The market is undergoing a transformation due to the country's progress in utilising renewable gases and clean hydrogen. Major solar and wind-driven hydrogen projects are leading to innovative production methods, making it possible to produce gas in a clean and more efficient manner through electrolysers. The growing use of renewable energy is promoting reduced carbon dioxide emission levels for industrial gases and meeting the country's objectives of strengthening efficiency in general power production.

The long-term vision for the use of renewable energies in the Kingdom promotes further integration of solar and wind energies into the production environment for industrial gases. Large-scale projects for the production of hydrogen and ammonia using renewable energy sources further improve the competitiveness of the country in the production of gas related to clean energy. The adoption of such an approach promotes decarbonization strategies and further increases the importance of the use of hydrogen and oxygen as feedstocks in future industrial uses.

Saudi Arabia Industrial Gases Market OpportunityExpanding High-Value Sectors Create New Growth Pathways

Growth areas like the extension of the healthcare sector, the modernization of the food processing sector, and the development of the electronics sector are increasing new demand streams for industrial gases within the Kingdom. The continued growth and development efforts of the healthcare sector, particularly the development of hospital capacity and specialized medical care, create consistent demand streams for medical oxygen, nitrogen, and argon. The growth of the food processing sector, particularly driven by the increasing appeal among consumers of convenience products, continues to create consistent demand streams for gases related to nitrogen atmosphere packaging and freezing applications.

The electronics and semiconductor technologies are in motion as the country’s research institutions push the boundaries of semiconductors design and development by accelerating the design and development of chips in the country. The semiconductors and electronics technologies use high-purity gases in their design and development processes such as deposition, lithography, and packaging of components in the country’s manufacturing sector. The growing electronics sector in the Kingdom of Saudi Arabia boosts the relevance of specific gases used in electronic components in this manner.

Saudi Arabia Industrial Gases Market Segmentation Analysis

By Gas Type

- Nitrogen Gas

- Oxygen Gas

- Carbon Dioxide Gas

- Argon Gas

- Helium Gas

- Hydrogen Gas

- Other

Oxygen leads the Saudi Arabia Industrial Gases Market with a 40% share, reflecting its essential role across refining, petrochemical, and hydrogen-related processes. Large refining and petrochemical complexes depend on oxygen for oxidation reactions, sulfur management, and process stabilization, making it a critical input for core industrial operations. Expanding specialty chemical production reinforces this reliance, as oxygen is required in several high-temperature and high-purity transformation steps. Major hydrogen initiatives also incorporate oxygen within electrolyzer systems and auxiliary functions that support integrated ammonia and clean fuel production.

Oxygen maintains premium positioning due to its crucial contribution to refining throughput and product quality. Nitrogen, although widely used in packaging, blanketing, and inerting applications, holds a secondary position because its functions are more commoditized and subject to substitution across certain end-use environments. The strategic importance of oxygen supply reliability shapes investment priorities within the national industrial gas ecosystem, ensuring strong alignment with petrochemical, hydrogen, and advanced materials development pathways.

By Supply Mode

- Cylinders

- Bulk

- On-Site Production

- Captive

- Other

Cylinder supply holds a 40% share of the Saudi Arabia Industrial Gases Market and remains the preferred distribution method for diverse industrial and commercial end users. Its logistical flexibility allows for efficient service across widespread industrial clusters, including remote sites, temporary projects, and smaller manufacturing units where on-site generation is not economically justified. Healthcare facilities, food processors, and specialized workshops depend on portable cylinders for consistent supply without committing to long-term infrastructure investments. This versatility supports operational continuity and enables end users to adjust gas consumption based on immediate production requirements.

While on-site generation offers efficiency advantages for large-scale operations, cylinder supply maintains dominance because of lower capital barriers, simpler regulatory requirements, and faster deployment capabilities. Planned enhancements to transmission and distribution infrastructure will support multiple supply modes, but widespread dispersion of industrial activity continues to favor cylinder-based logistics. Pipeline and bulk liquid supply remain concentrated among large industrial anchors, whereas cylinders serve a broad end-user base across manufacturing, healthcare, and commercial sectors, reinforcing their leading position in the national supply framework.

List of Companies Covered in Saudi Arabia Industrial Gases Market

The companies listed below are highly influential in the Saudi Arabia industrial gases market, with a significant market share and a strong impact on industry developments.

- Air Products and Chemicals

- Gulf Cryo

- Aldakheel Industrial Gases Plant (DIGAS)

- Linde

- Air Liquide

- Buzwair Industrial Gases

- Dubai Industrial Gases

Market News & Updates

- Gulf Cryo, 2025:

At ADIPEC 2025, Gulf Cryo announced the Phase 2 expansion of its Advanced Technology Center (ATC) at King Salman Energy Park (SPARK). This expansion strengthens the company’s work in low-carbon hydrogen and advanced industrial gas technology. The investment supports Saudi Arabia’s Vision 2030 goals and builds regional capabilities for cleaner energy solutions.

- Air Products, 2025:

Air Products adjusted its strategy for the NEOM green hydrogen project, choosing to focus first on producing green ammonia while waiting for detailed regulations for green hydrogen in Saudi Arabia. Construction of the NEOM plant was 80% complete in mid-2025, and first ammonia production is expected in 2027. This shift helps reduce financial risk while still supporting the Vision 2030 energy transition.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Saudi Arabia Industrial Gases Market Policies, Regulations, and Standards

4. Saudi Arabia Industrial Gases Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Saudi Arabia Industrial Gases Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Quantity Sold in Tons

5.2. Market Segmentation & Growth Outlook

5.2.1.By Gas Type

5.2.1.1. Nitrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.2. Oxygen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.3. Carbon Dioxide Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.4. Argon Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.5. Helium Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.6. Hydrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.7. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.By Supply Mode

5.2.2.1. Cylinders- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.2. Bulk- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.3. On-Site Production- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.4. Captive- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.By Application

5.2.3.1. Combustion and Process Oxygen- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.2. Welding and Metal Fabrication- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.3. Inerting Blanketing and Heat Treating- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.4. Cryogenics and liquefaction- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.5. Chemical Synthesis and Hydrogenation- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.6. Purging and Purifications- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.7. Analytical and Calibration- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.By End User Industry

5.2.4.1. General Manufacturing- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.2. Food- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.3. Metallurgy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.4. Chemicals- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.5. Healthcare- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.6. Electronics- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.7. Refining & Energy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.8. Glass- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.9. Pulp & Paper- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.10. Others- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Saudi Arabia Nitrogen Gas Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Quantity Sold in Tons

6.2. Market Segmentation & Growth Outlook

6.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7. Saudi Arabia Oxygen Gas Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Quantity Sold in Tons

7.2. Market Segmentation & Growth Outlook

7.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8. Saudi Arabia Carbon Dioxide Gas Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Quantity Sold in Tons

8.2. Market Segmentation & Growth Outlook

8.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9. Saudi Arabia Argon Gas Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Quantity Sold in Tons

9.2. Market Segmentation & Growth Outlook

9.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10. Saudi Arabia Helium Gas Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Quantity Sold in Tons

10.2. Market Segmentation & Growth Outlook

10.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11. Saudi Arabia Hydrogen Gas Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.1.2. By Quantity Sold in Tons

11.2. Market Segmentation & Growth Outlook

11.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Linde

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Air Liquide

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Air Products and Chemicals

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Gulf Cryo

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Aldakheel Industrial Gases Plant (DIGAS)

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Buzwair Industrial Gases

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Dubai Industrial Gases

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Gas Type |

|

| By Supply Mode |

|

| By Application |

|

| By End User Industry |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.