GCC Industrial Gases Market Report: Trends, Growth and Forecast (2026-2032)

By Gas Type (Nitrogen Gas, Oxygen Gas, Carbon Dioxide Gas, Argon Gas, Helium Gas, Hydrogen Gas, Other), By Supply Mode (Cylinders, Bulk, On-Site Production, Captive, Other), By Application (Combustion and Process Oxygen, Welding and Metal Fabrication, Inerting Blanketing and Heat Treating, Cryogenics and liquefaction, Chemical Synthesis and Hydrogenation, Purging and Purifications, Analytical and Calibration), By End User Industry (General Manufacturing, Food, Metallurgy, Chemicals, Healthcare, Electronics, Refining & Energy, Glass, Pulp & Paper, Others), Country (UAE, Saudi Arabia, Qatar, Kuwait, Oman, Bahrain)

- Energy & Power

- Jan 2026

- VI0835

- 160

-

GCC Industrial Gases Market Statistics and Insights, 2026

- Market Size Statistics

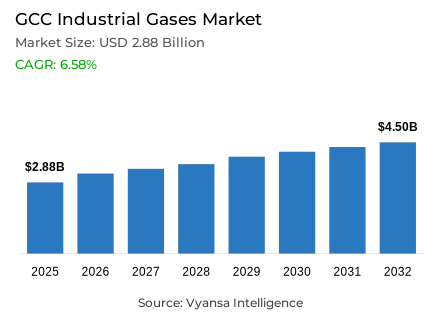

- GCC industrial gases market is estimated at USD 2.88 billion in 2025.

- The market size is expected to grow to USD 4.5 billion by 2032.

- Market to register a cagr of around 6.58% during 2026-32.

- Gas Type Shares

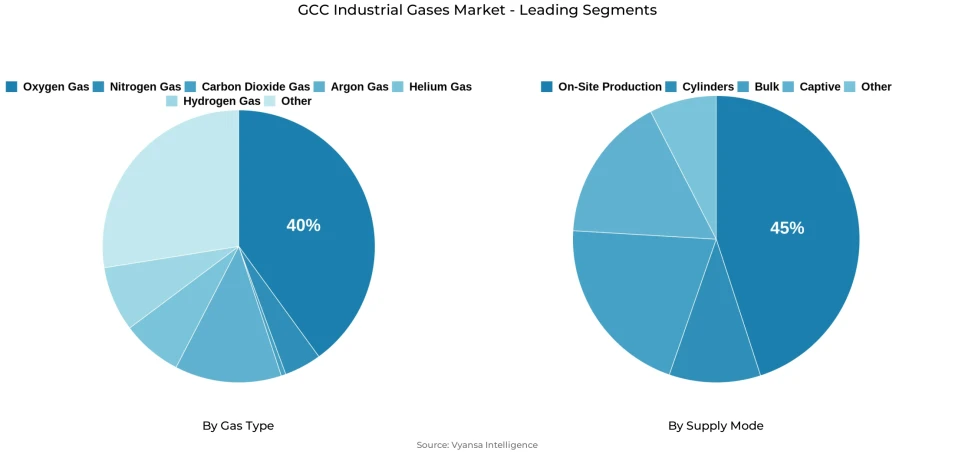

- Oxygen gas grabbed market share of 40%.

- Competition

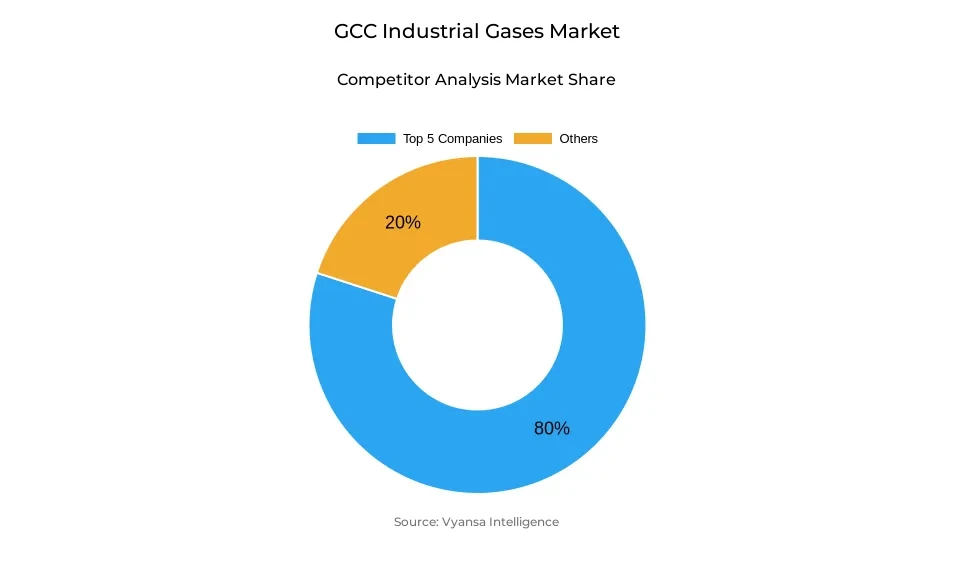

- More than 10 companies are actively engaged in producing industrial gases in GCC.

- Top 5 companies acquired around 80% of the market share.

- Buzwair Industrial Gases; Emirates Industrial Gases (EIG); Pure Gas; Linde; Air Products etc., are few of the top companies.

- Supply Mode

- On-Site Production grabbed 45% of the market.

- Country

- Saudi Arabia leads with a 45% share of the GCC market.

GCC Industrial Gases Market Outlook

The GCC industrial gases industry remains poised for smooth growth in 2026-2032, driven by economic diversification initiatives in Saudi Arabia, UAE, Qatar, and other countries. The industry had reached an estimated 2.88 billion USD in 2025 and is forecasted to reach approximately 4.5 billion USD in 2032, growing at a CAGR of 6.58%. Extensive production in industries such as petrochemicals, metals, and fabrication continues underpinning large-volume requirements for oxygen, nitrogen, and hydrogen gases in these industries. Manufacturing's GDP contribution in Saudi Arabia, standing at 9.6%, illustrates massive production in industry that requires constant production support from industrial gases.

The increasing demand is also being reinforced by the development of healthcare infrastructure, with over 500 new healthcare facilities being planned in the GCC, thereby increasing the need for the consistent supply of medical-grade oxygen and specialty respiratory gases. Macroeconomic conditions are also providing an impetus, with an expected GDP growth of 3.2% in the GCC in the year 2025, further accelerating to 4.5% in the year 2026. Large schemes, such as the USD 68 billion Jafurah unconventional gas project, are also creating an ongoing need for the use of nitrogen, oxygen, and hydrogen.

Moreover, oxygen gas has the major market demand share of approximately 40% because of its significance in steel production, fabrication, chemical processing, medical applications, as well as refining operations. On-site production leads the market for gas supply with approximately 45% market demand because of the strategic importance of continuous supply, purity, and logistics of large-end users. On-site integrated systems are most preferred by continuous plants, especially petrochemicals, and refineries because of their continuous mode of operations.

Additionally, the GCC’s market on industrial gases has been headed by Saudi Arabia, which has a regional market share of close to 45% due to the country’s large industries located in Jubail and Yanbu, its strong petrochemicals sector, as well as the government’s various initiatives on the country’s industrial sector. The UAE, Qatar, and Kuwait follow in the ranking as a result of the country’s strong industries in the areas of manufacturing, oil refinement, as well as the health sector.

GCC Industrial Gases Market Growth DriverIndustrial Diversification and Capital Investment Accelerate Market Expansion

The GCC industrial gases market is undergoing a consistent growth as economies in the region continue to intensify diversification efforts beyond hydrocarbons. Expansion in manufacturing operations in petrochemicals, metals, welding and fabrication is also creating a significant demand in oxygen, nitrogen and hydrogen. In Saudi Arabia, the manufacturing sector’s contribution of 9.6% to GDP underscores the magnitude of industrial activity necessitating a continuous supply of gases. The consumption is also strengthened by large-scale infrastructure projects under the Vision 2030, as well as similar national plans in the UAE and Qatar, where cutting, welding, and process optimization processes require industrial gases. The growth of healthcare infrastructure, where over 500 new medical facilities are to be built across GCC countries, reinforces long-term demand of medical-grade oxygen and specialised respiratory gases.

Macroeconomic stability underpins this demand trajectory, with projected GCC economic growth of 3.2% in 2025 and 4.5% in 2026, thereby supporting capital‑intensive manufacturing investments. The petrochemical industry remains at the center, with Saudi Arabia Jafurah unconventional gas field development being an example, with USD 68 billion of capital investment in 10 years. These projects create long-term nitrogen, oxygen, and hydrogen demand in refining, processing, and enhanced-recovery. The strategic alliances between international industrial-gas providers and local businesses also indicate the trust in the long-term market growth.

GCC Industrial Gases Market ChallengeEnvironmental Compliance and Cost Pressures Reshape Operating Models

The tightening of regulations across the GCC is putting a quantifiable strain on industrial-gas producers and distributors. Environmental frameworks, such as the UAE Federal Law 24, mandate comprehensive emissions monitoring, life‑cycle reporting, and compliance with high‑purity capture standards that exceed 99% CO₂ thresholds. These mandates force suppliers to invest in sealed-combustion systems, sophisticated filtration, and monitoring systems, which are costly in terms of capital and operation. Smaller suppliers face disproportionate cost pressures due to a lack of compliance infrastructure, which in turn hastens market consolidation and benefits well-capitalised operators that can afford to comply with high standards. Increased satellite surveillance and enforcement systems have also made the tolerance of non-compliant venting and emissions practices even less.

The increase in energy prices exacerbates regulatory issues, especially as plants shift to low-carbon manufacturing operations. Several manufacturing facilities in Saudi Arabia and the UAE have witnessed operational hiccups associated with environmental inspections, highlighting the level of enforcement. Carbon capture, storage and energy efficient air-separation technologies are becoming more and more inevitable in order to retain operating licences. Although these upgrades are conducive to long-term sustainability goals, they put strain on margins and require cautious pricing policies to stay competitive and to meet international environmental standards.

GCC Industrial Gases Market TrendHydrogen Economy Integration Alters Market Structure

The advent of green and low-carbon hydrogen is transforming the supply-chain dynamics in the GCC industrial-gases market. The 2.9 million tonnes of hydrogen that Saudi Arabia aims to produce by 2030 and 4 million tonnes by 2035 are indicative of a structural transition to hydrogen-based industrial ecosystems. The USD 8.4 billion NEOM Green Hydrogen Project is one such example, which incorporates long-term demand of oxygen, nitrogen, and air-separation products needed to support electrolysis and downstream processing. The suppliers of industrial gases are also repositioning their portfolios to include hydrogen-related infrastructure, storage, and distribution.

This change is supported by international standards, and the International Energy Agency estimates that the world will have 38 million tonnes of low-emission hydrogen capacity by 2030 and the Middle East will be one of the main centers. The BHIG partnership between Saudi Aramco and Air Products is an example of regional programs that show commercial-scale interest in blue hydrogen production. These changes generate a gradual need in nitrogen blanketing, oxygen supply, and carbon-capture gases, which will hasten the implementation of technologically advanced and sustainable gas-production methodologies in the region.

GCC Industrial Gases Market OpportunityLocalized Production and Infrastructure Investment Unlock Growth Potential

Localized industrial-gas generation is becoming a major growth avenue throughout the GCC. The current capacity of 60,000 tonnes per day of nitrogen production in Saudi Arabia shows the size of the current infrastructure and the potential of its further growth. Sustained multinational investment in capacity enhancement is seen in investments like Air Products Quadra megaproject in Jubail and SABIC air-separation units in Jubail and Yanbu. These developments have reduced regional import dependency from nearly 30% to below 10%, thereby strengthening supply security and enabling technology transfer under national industrial‑localisation programmes.

On-site and near-site production is becoming more popular with end users to maintain continuous supply, accurate purity control and less complexity in logistics. Integrated gas-generation systems are prioritized by petrochemical complexes, refineries, and large chemical manufacturers in accordance with continuous operations. Programmes like the In-Kingdom Total Value Add initiative are also government incentives that promote domestic production and development of workforce. The combination of policy backing, capital investment, and end-user preferences is an attractive setting to long-term infrastructure growth throughout the GCC.

GCC Industrial Gases Market Country Analysis

By Country

- UAE

- Saudi Arabia

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia leads the GCC industrial gases market with around 45% regional market share, supported by its extensive petrochemical base in Jubail and Yanbu. These complexes represent the Middle East’s largest integrated industrial hubs, generating sustained demand for oxygen, nitrogen, and hydrogen across refining, processing, and manufacturing operations. Abundant hydrocarbon reserves and established gas infrastructure enable cost-efficient feedstock access and large-scale air separation deployment. Government-led initiatives under the National Industrial Development and Logistics Program further reinforce domestic production through preferential investment frameworks.

The UAE, Qatar, and Kuwait form the next tier of contributors, each supported by strong petrochemical, pharmaceutical, and manufacturing sectors. The UAE benefits from advanced logistics and trade connectivity, while Qatar’s natural gas reserves provide integrated production advantages. Kuwait continues to expand refining capacity, supporting steady gas demand. With GCC economic growth projected at 4.5% in 2026, Saudi Arabia remains the primary engine driving regional industrial gas consumption and investment momentum.

GCC Industrial Gases Market Segmentation Analysis

By Gas Type

- Nitrogen Gas

- Oxygen Gas

- Carbon Dioxide Gas

- Argon Gas

- Helium Gas

- Hydrogen Gas

- Other

Oxygen holds the largest share in the GCC industrial gases market, accounting for around 40% of total gas type composition. This leadership reflects oxygen’s indispensable role across steelmaking, metal fabrication, chemical oxidation processes, healthcare delivery, and food processing applications. In oil and gas refining, high-purity oxygen is essential for enhanced oil recovery, sour gas treatment, and advanced refinery operations requiring concentrations above standard industrial specifications. The expansion of healthcare infrastructure further reinforces oxygen demand, particularly for medical-grade and respiratory applications across public and private facilities.

Nitrogen represents the second-largest gas segment, supporting inerting, blanketing, and safety applications across oil and gas operations, food processing, and industrial fabrication. Its role in corrosion prevention and modified atmosphere packaging ensures steady demand growth. Hydrogen is gaining strategic importance, driven by refining applications and large-scale investments in green and blue hydrogen projects aligned with national energy transition strategies. Together, these gas types form a diversified demand base supporting stable market growth.

By Supply Mode

- Cylinders

- Bulk

- On-Site Production

- Captive

- Other

Bulk liquid and cylinder-based supply modes account for the remaining market share, serving mid-sized facilities and geographically dispersed applications. Cylinder distribution offers flexibility for smaller operations and maintenance activities, while bulk liquid transport provides cost-effective solutions where pipeline integration is not feasible. Despite these alternatives, the dominance of on-site production reflects strong capital availability among regional industrial enterprises and the strategic advantages of operational control and supply reliability.

Various Market Players in GCC Industrial Gases Market

The companies mentioned below are highly active in the GCC industrial gases market, occupying a considerable portion of the market and shaping industry progress.

- Buzwair Industrial Gases

- Emirates Industrial Gases (EIG)

- Pure Gas

- Linde

- Air Products

- Air Liquide

- Gulf Cryo

- Abdullah Hashim (AHG)

- Messer Group

- Mohamad Al-Nahdi & Co.

- Yateem Oxygen

- Bristol Gases

Market News & Updates

- Linde, 2025:

Linde strengthened its GCC dominance through the September 2025 acquisition of Airtec, raising ownership to over 90% and consolidating operations across Bahrain, Kuwait, Qatar, Saudi Arabia, and the UAE. The integration enhances supply chain efficiency and leverages Linde’s broader EMEA expertise, creating substantial operational synergies for the region.

- Gulf Cryo, 2025:

Gulf Cryo maintained its leadership position in the GCC by advancing its decarbonization portfolio, including a mega-scale CO₂ expansion project in Saudi Arabia under a 20-year agreement. The company also operates the region’s first high-purity CO₂ capture facility in the UAE (commissioned October 2025), capturing 17,000 tons annually, while pushing solar energy adoption across more than 20 regional operating sites.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. GCC Industrial Gases Market Policies, Regulations, and Standards

4. GCC Industrial Gases Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. GCC Industrial Gases Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Quantity Sold in Tons

5.2. Market Segmentation & Growth Outlook

5.2.1.By Gas Type

5.2.1.1. Nitrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.2. Oxygen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.3. Carbon Dioxide Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.4. Argon Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.5. Helium Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.6. Hydrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.7. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.By Supply Mode

5.2.2.1. Cylinders- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.2. Bulk- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.3. On-Site Production- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.4. Captive- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.By Application

5.2.3.1. Combustion and Process Oxygen- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.2. Welding and Metal Fabrication- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.3. Inerting Blanketing and Heat Treating- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.4. Cryogenics and liquefaction- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.5. Chemical Synthesis and Hydrogenation- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.6. Purging and Purifications- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.7. Analytical and Calibration- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.By End User Industry

5.2.4.1. General Manufacturing- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.2. Food- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.3. Metallurgy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.4. Chemicals- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.5. Healthcare- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.6. Electronics- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.7. Refining & Energy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.8. Glass- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.9. Pulp & Paper- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.10. Others- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.5.By Country

5.2.5.1. UAE

5.2.5.2. Saudi Arabia

5.2.5.3. Qatar

5.2.5.4. Kuwait

5.2.5.5. Oman

5.2.5.6. Bahrain

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. UAE Industrial Gases Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Quantity Sold in Tons

6.2. Market Segmentation & Growth Outlook

6.2.1.By Gas Type- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.2.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.4.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7. Saudi Arabia Industrial Gases Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Quantity Sold in Tons

7.2. Market Segmentation & Growth Outlook

7.2.1.By Gas Type- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.2.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.4.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8. Qatar Industrial Gases Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Quantity Sold in Tons

8.2. Market Segmentation & Growth Outlook

8.2.1.By Gas Type- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.2.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.4.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9. Kuwait Industrial Gases Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Quantity Sold in Tons

9.2. Market Segmentation & Growth Outlook

9.2.1.By Gas Type- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.2.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.4.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10. Oman Industrial Gases Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Quantity Sold in Tons

10.2. Market Segmentation & Growth Outlook

10.2.1. By Gas Type- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.2. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.4. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11. Bahrain Industrial Gases Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.1.2. By Quantity Sold in Tons

11.2. Market Segmentation & Growth Outlook

11.2.1. By Gas Type- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.2. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.4. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Linde

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Air Products

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Air Liquide

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Gulf Cryo

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Abdullah Hashim (AHG)

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Buzwair Industrial Gases

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Emirates Industrial Gases (EIG)

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Pure Gas

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Messer Group

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Mohamad Al-Nahdi & Co.

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Gas Type |

|

| By Supply Mode |

|

| By Application |

|

| By End User Industry |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.