Middle East Industrial Gases Market Report: Trends, Growth and Forecast (2026-2032)

By Gas Type (Nitrogen Gas, Oxygen Gas, Carbon Dioxide Gas, Argon Gas, Helium Gas, Hydrogen Gas, Other), By Supply Mode (Cylinders, Bulk, On-Site Production, Captive, Other), By Application (Combustion and Process Oxygen, Welding and Metal Fabrication, Inerting Blanketing and Heat Treating, Cryogenics and liquefaction, Chemical Synthesis and Hydrogenation, Purging and Purifications, Analytical and Calibration), By End User Industry (General Manufacturing, Food, Metallurgy, Chemicals, Healthcare, Electronics, Refining & Energy, Glass, Pulp & Paper, Others), By Country (Qatar, UAE, Saudi Arabia, Kuwait, Oman, Rest of Middle East)

- Energy & Power

- Jan 2026

- VI0851

- 150

-

Middle East Industrial Gases Market Statistics and Insights, 2026

- Market Size Statistics

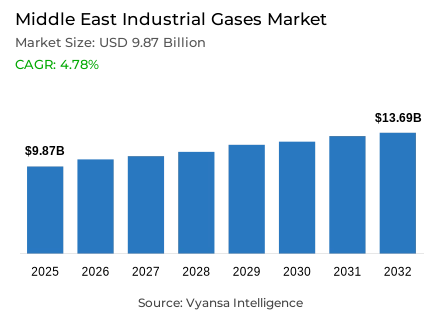

- Middle East industrial gases market is estimated at USD 9.87 billion in 2025.

- The market size is expected to grow to USD 13.69 billion by 2032.

- Market to register a cagr of around 4.78% during 2026-32.

- Gas Type Shares

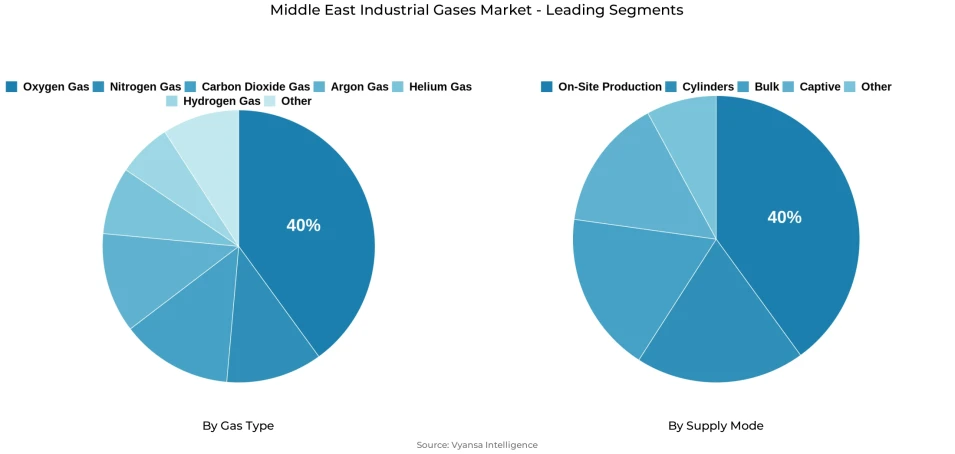

- Oxygen gas grabbed market share of 40%.

- Competition

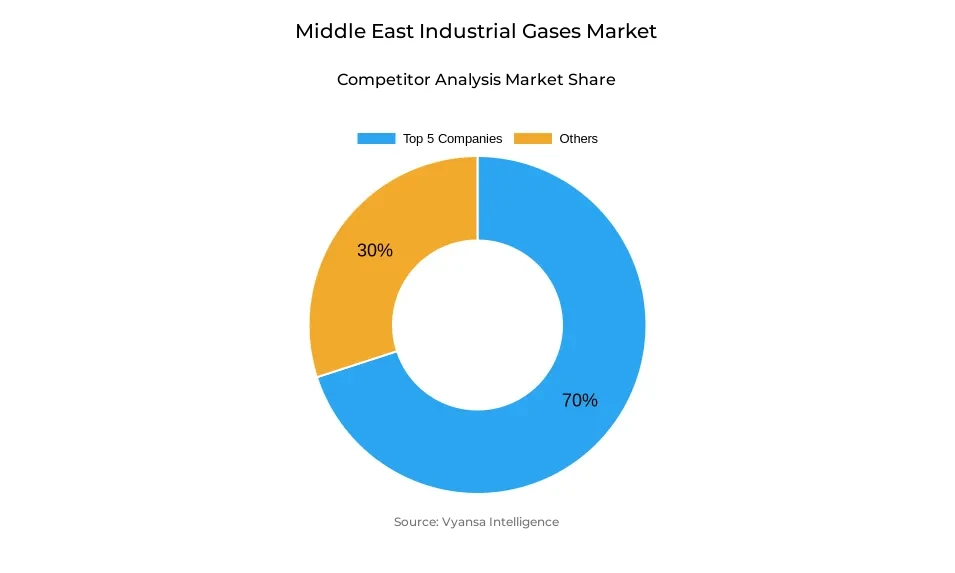

- More than 10 companies are actively engaged in producing industrial gases in Middle East.

- Top 5 companies acquired around 70% of the market share.

- Messer Group; Air Products and Chemicals; Abdullah Hashim (AHG); Linde; Air Liquide etc., are few of the top companies.

- Supply Mode

- On-Site Production grabbed 40% of the market.

- Country

- Saudi Arabia leads with a 35% share of the Middle East market.

Middle East Industrial Gases Market Outlook

The Middle East Industrial Gases Market, valued at USD 9.87 billion in 2025, is set to reach USD 13.69 billion by 2032, growing at a CAGR of about 4.78% during 2026–32. Strong petrochemical and refining expansion across Saudi Arabia, the UAE, and Qatar continues to be the primary growth engine, with large integrated complexes increasing their need for oxygen, nitrogen, and other gases. Major projects such as Saudi Arabia’s Amiral complex and the UAE’s Ruwais upgrades drive sustained demand, while Qatar’s LNG expansion further boosts requirements for cryogenic processing and separation systems.

Despite strong demand, geopolitical risks and logistics disruptions remain key challenges. Tensions around the Strait of Hormuz, high freight insurance costs, and congestion at ports increase delivery delays and push suppliers to maintain larger inventories. Varying regulatory regimes across countries, especially in the UAE, add to operational complexity and extend permitting timelines. These pressures affect distribution efficiency and create higher delivered costs for smaller industrial zones.

A major structural shift is unfolding as end users increasingly adopt on-site production and pipeline networks. On-site systems now represent 40% of total supply, reducing logistics dependence and ensuring consistent high-purity gas availability. Large refiners, steel producers, and petrochemical operators in Saudi Arabia and the UAE are driving this transition, supported by long-term utility-style contracts that improve supply stability and efficiency.

Long-term demand is further reinforced by major green hydrogen developments, including the NEOM project, which require substantial nitrogen, oxygen, and specialty gases. Oxygen remains the leading gas type with a 40% share, supported by steel, aluminum, petrochemical, and healthcare applications. Saudi Arabia dominates the regional landscape with a 35% share, underpinned by its extensive industrial base and large-scale energy transition investments.

Middle East Industrial Gases Market Growth DriverPetrochemical Expansion and Refining Growth Amplify Industrial Gas Requirements

The region is experiencing aggressive petrochemical and refining growth that is putting a lot of pressure on the demand of oxygen, nitrogen, and related gases. The production capacity of Saudi Arabia will increase dramatically in the next five years, with the help of large-scale integrated projects, including the USD 11 billion Amiral complex. These petrochemical centers and refineries depend on oxygen and nitrogen to carry out hydrocracking, catalytic reactions, combustion, and inerting processes, and thus, industrial gases are vital to their daily operations. The Ruwais complex in the UAE is being significantly upgraded, which is increasing the demand on gas to process more, and strengthening the necessity of large air-separation and pipeline systems.

The North Field East LNG expansion to 142 million tonnes per year by 2030 in Qatar further increases the industrial gas requirements in the cryogenic processing, separation, and quality control. The Saudi doubling of petrochemical, UAE expansion of refining, and Qatar expansion of LNG generate long-term structural demand of major energy complexes. These combined operations create multi-year offtake agreements that sustain consistent industrial gas use up to 2032, cementing the reliance of the region on high-volume, dedicated supply infrastructure.

Middle East Industrial Gases Market ChallengeGeopolitical and Logistics Disruptions Restrict Supply Chain Efficiency

The supply chain of industrial gases in the region is still facing friction due to geopolitical instability and logistics constraints. The Strait of Hormuz is a strategic shipping route that is experiencing a repetitive tension that is raising freight insurance rates and delivery time of compressed and liquefied gases. The congestion of major ports such as Jebel Ali and Ras Tanura, coupled with the lack of transport connections to remote industrial areas, leads to transportation delays of 15-25%, which compels suppliers to hold larger inventories and puts pressure on working capital. These issues make distribution planning of large-volume industrial operations difficult.

The regulatory fragmentation also introduces additional limitations, especially in the UAE where separate regulatory frameworks necessitate numerous permitting procedures across emirates. These conflicting needs prolong deployment schedules and add complexity to operations of gas distributors operating across borders. Bottlenecks in infrastructure increase the cost of delivery to smaller industrial areas, reducing the reliability of supply and increasing the gap between established petrochemical centers and secondary areas. Consequently, new distribution assets are less likely to be invested in, and less-developed sites have more delivered costs and reduced supply stability.

Middle East Industrial Gases Market TrendShift Toward On-Site Generation and Pipeline Systems Strengthens Supply Security

The end users are moving to on-site generation and pipeline networks because they are more concerned with high-purity supply and continuity. On-site systems and pipeline infrastructure have now become 40 percent of the regional market, backed by refiners and petrochemical operators who have purchased dedicated air-separation units to maintain consistent purity levels and avoid logistics upheavals. This decentralised supply model has the potential to cut down transport-related expenses by approximately 20% and enhance operational efficiency of industrial plants in Saudi Arabia and the UAE.

ADNOC Industrial Gas exemplifies this change by on-site production centers in Al Ruwais and Mirfa, which provide oxygen and nitrogen via specific pipeline networks that connect large industrial areas. These networks increase reliability of steel, aluminium and petrochemical complexes that need continuous flow of gas. Less trucking emissions and localised production also contribute to national sustainability and environmental targets. With the continued shift to long-term, utility-type supply contracts by major industrial operators, the shift toward merchant gas models is accelerating, creating a more integrated regional supply structure.

Middle East Industrial Gases Market OpportunityGreen Hydrogen Mega-Projects Establish Long-Duration Growth Avenues

The development of large-scale green hydrogen projects in the region is generating long-term demand of nitrogen, oxygen, and specialty gases. The NEOM Green Hydrogen Project, currently in the development phase of commissioning in 2026-2027, will be based on large volumes of gas to be electrolyzed and produce green ammonia. Its multi-decade contracts on nitrogen and other industrial gas services create one of the longest assured demand cycles in the region, creating a consistent foundation of long-term supply commitments past 2050.

Other low-carbon hydrogen and ammonia projects in Saudi Arabia, the UAE, Oman, and Qatar also need large volumes of gas to process, purify, capture carbon, and convert. The Ammonia-7 project in Qatar is an example of integrated hydrogen and CO₂ systems that support recurring demand of high-purity compression and separation technologies. These hydrogen ecosystems establish some of the most important long-horizon infrastructure investments in the region, anchoring multi-year procurement contracts and enhancing industrial gas needs across energy-transition initiatives through 2045 to 2050.

Middle East Industrial Gases Market Country Analysis

By Country

- Qatar

- UAE

- Saudi Arabia

- Kuwait

- Oman

- Rest of Middle East

Saudi Arabia leads the Middle East Industrial Gases Market with a 35% share, driven by its extensive petrochemical and refining base and rapid growth in energy transition projects. Major integrated industrial zones operate large cryogenic production units and pipeline networks that support consistent long-term gas demand for cracking, polymerization, and advanced processing. Continuous expansion under national development programs further strengthens the requirement for oxygen, nitrogen, hydrogen, and specialty gases across industrial applications.

Significant public investment in petrochemical, construction, and energy infrastructure reinforces the Kingdom’s position as the region’s largest industrial hub. Strategic initiatives promoting advanced manufacturing and hydrogen development—including the large-scale NEOM project—continue to elevate demand for industrial gases. Strong feedstock competitiveness, large integrated complexes, and long-term industrial expansion plans collectively ensure Saudi Arabia’s continued leadership within the regional industrial gases landscape through 2032.

Middle East Industrial Gases Market Segmentation Analysis

By Gas Type

- Nitrogen Gas

- Oxygen Gas

- Carbon Dioxide Gas

- Argon Gas

- Helium Gas

- Hydrogen Gas

- Other

Oxygen leads the Middle East Industrial Gases Market with a 40% share, supported by extensive use in steel plants, aluminum smelters, petrochemical oxidation units, and expanding healthcare infrastructure. Established production and pipeline networks in major industrial hubs enable continuous large-scale supply, reinforcing oxygen’s position as the primary gas required for high-temperature processing, combustion control, and chemical conversion. These end-use requirements promote long-term offtake contracts that justify new air separation unit investments across leading industrial cities.

Healthcare expansion further strengthens oxygen demand, supported by national initiatives to construct and upgrade hospitals and implement extensive piped medical gas systems. Nitrogen holds the second-largest share and supports a broad range of applications including inerting, enhanced oil recovery, electronics manufacturing, and food processing. Its rising relevance in advanced manufacturing and energy operations continues to reinforce the segment’s growth trajectory as industrial diversification deepens across the region.

By Supply Mode

- Cylinders

- Bulk

- On-Site Production

- Captive

- Other

On-site and pipeline supply together account for 55% of market revenue, signaling a clear shift from traditional cylinder and bulk deliveries. This model supports sustainability goals by reducing trucking emissions and lowering energy consumption for gas movement. Large-volume projects such as hydrogen and ammonia complexes depend entirely on integrated on-site systems due to their stringent purity and throughput requirements. Although merchant packaged gas remains relevant for smaller-scale operations, its regional share is gradually declining as industrial consolidation increases.

Various Market Players in Middle East Industrial Gases Market

The companies mentioned below are highly active in the Middle East industrial gases market, occupying a considerable portion of the market and shaping industry progress.

- Messer Group

- Air Products and Chemicals

- Abdullah Hashim (AHG)

- Linde

- Air Liquide

- Dubai Industrial Gases

- Gulf Cryo

- Buzwair Industrial Gases

- National Industrial Gas Plants (NIGP)

- Emirates Industrial Gases (EIG)

- Sipchem

Market News & Updates

- Linde, 2025:

Linde completed the acquisition of Airtec on September 1, 2025, increasing its ownership from 49% to over 90%. This move significantly strengthened Linde’s presence across the Middle East, unifying operations in Bahrain, Kuwait, Qatar, Saudi Arabia, and the UAE. The expanded platform integrates Airtec’s ASUs, CO₂ plants, and onsite gas generation facilities, enhancing regional supply reliability and supporting energy, healthcare, and manufacturing industries.

- Gulf Cryo, 2025:

Gulf Cryo announced a long-term agreement to develop the Middle East’s largest CO₂ emissions capture plant in Saudi Arabia using modular capture technology from SIAD Group. The facility will capture more than 250,000 tons of CO₂ annually, doubling existing regional capacity. The company also inaugurated the UAE’s first high-purity CO₂ capture plant in Ras Al Khaimah in October 2025, developed with RAK Ceramics and designed to capture 17,000 tons of CO₂ per year.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Middle East Industrial Gases Market Policies, Regulations, and Standards

4. Middle East Industrial Gases Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Middle East Industrial Gases Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Quantity Sold in Tons

5.2. Market Segmentation & Growth Outlook

5.2.1.By Gas Type

5.2.1.1. Nitrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.2. Oxygen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.3. Carbon Dioxide Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.4. Argon Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.5. Helium Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.6. Hydrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.7. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.By Supply Mode

5.2.2.1. Cylinders- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.2. Bulk- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.3. On-Site Production- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.4. Captive- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.By Application

5.2.3.1. Combustion and Process Oxygen- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.2. Welding and Metal Fabrication- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.3. Inerting Blanketing and Heat Treating- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.4. Cryogenics and liquefaction- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.5. Chemical Synthesis and Hydrogenation- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.6. Purging and Purifications- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.7. Analytical and Calibration- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.By End User Industry

5.2.4.1. General Manufacturing- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.2. Food- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.3. Metallurgy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.4. Chemicals- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.5. Healthcare- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.6. Electronics- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.7. Refining & Energy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.8. Glass- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.9. Pulp & Paper- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.10. Others- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.5.By Country

5.2.5.1. Qatar

5.2.5.2. UAE

5.2.5.3. Saudi Arabia

5.2.5.4. Kuwait

5.2.5.5. Oman

5.2.5.6. Rest of Middle East

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Qatar Industrial Gases Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Quantity Sold in Tons

6.2. Market Segmentation & Growth Outlook

6.2.1.By Gas Type- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.2.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.4.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7. UAE Industrial Gases Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Quantity Sold in Tons

7.2. Market Segmentation & Growth Outlook

7.2.1.By Gas Type- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.2.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.4.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8. Saudi Arabia Industrial Gases Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Quantity Sold in Tons

8.2. Market Segmentation & Growth Outlook

8.2.1.By Gas Type- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.2.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.4.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9. Kuwait Industrial Gases Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Quantity Sold in Tons

9.2. Market Segmentation & Growth Outlook

9.2.1.By Gas Type- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.2.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.4.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10. Oman Industrial Gases Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Quantity Sold in Tons

10.2. Market Segmentation & Growth Outlook

10.2.1. By Gas Type- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.2. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.4. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Linde

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Air Liquide

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Air Products and Chemicals

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Gulf Cryo

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Messer Group

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Abdullah Hashim (AHG)

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Buzwair Industrial Gases

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Emirates Industrial Gases (EIG)

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Dubai Industrial Gases

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. National Industrial Gas Plants (NIGP)

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Gas Type |

|

| By Supply Mode |

|

| By Application |

|

| By End User Industry |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.