Middle East & Africa Industrial Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By Country (UAE, Saudi Arabia, South Africa, Qatar, Rest of Middle East & Africa)

- Energy & Power

- Jan 2026

- VI0850

- 145

-

Middle East & Africa Industrial Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

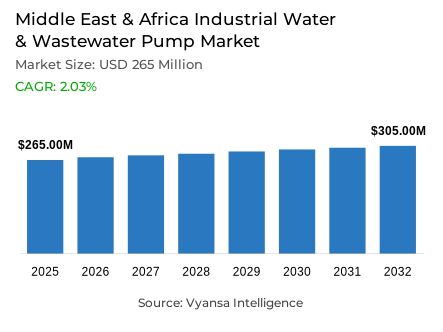

- Middle East & Africa industrial water & wastewater pump market is estimated at USD 265 million in 2025.

- The market size is expected to grow to USD 305 million by 2032.

- Market to register a cagr of around 2.03% during 2026-32.

- Pump Type Shares

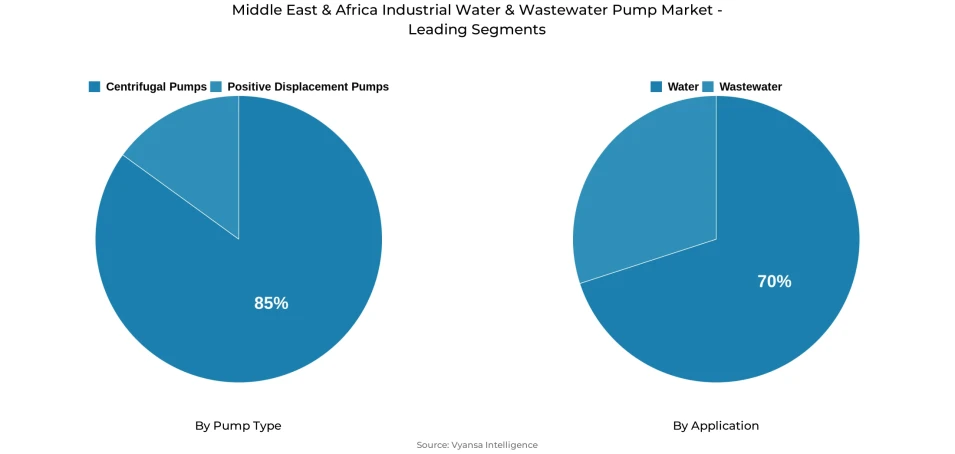

- Centrifugal pumps grabbed market share of 85%.

- Competition

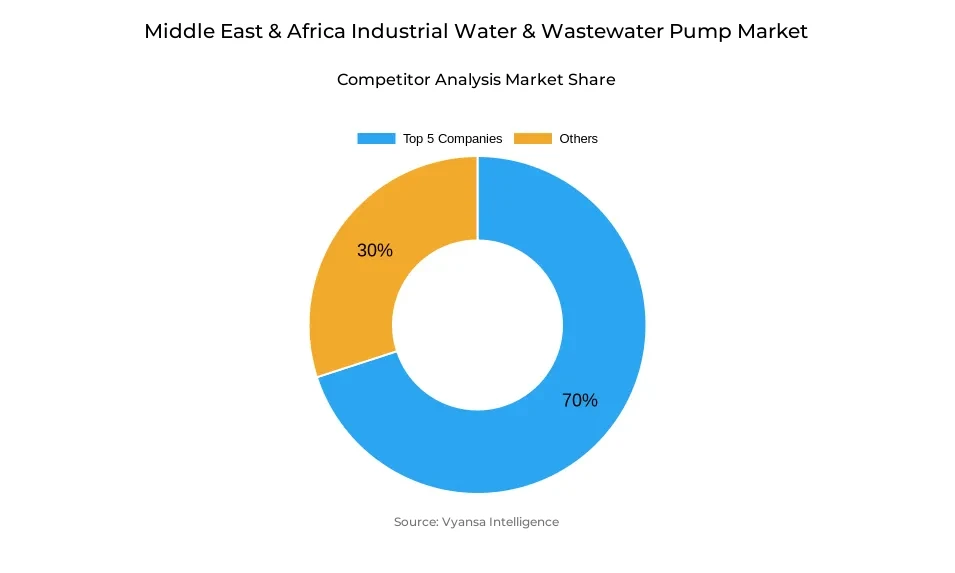

- Industrial water & wastewater pump in Middle East & Africa is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 70% of the market share.

- Wilo SE; EBARA Corporation; ITT Inc.; Flowserve Corporation; Sulzer Ltd. etc., are few of the top companies.

- Application

- Water grabbed 70% of the market.

- Country

- Saudi Arabia leads with a 20% share of the Middle East & Africa market.

Middle East & Africa Industrial Water & Wastewater Pump Market Outlook

The Middle East and Africa industrial water and wastewater pump market was estimated to be USD 265 million in 2025 and is estimated to grow to almost USD 305 million in 2032, with a CAGR of about 2.03% in the period 2026-2032. The main cause of this growth pattern is the continued fresh water scarcity in the region with 17 out of 21 countries still under the water-poverty line set by the United Nations Food and Agriculture Organization. The increasing industrialization, urbanization, and population growth have been putting a long-term strain on finite water resources, which further substantiates the necessity of desalination, water treatment, and the creation of effective conveyance systems.

Structural water stress is taking the form of a steady stream of investment in the construction of desalination plants, wastewater recycling plants, and industrial water treatment systems. The end users within the utilities, energy sector, petrochemicals, and manufacturing are focusing on high capacity pumping solutions to ensure continuity in water supply to support the continuity of operations. However, the growth of the market is checked by the high level of non-revenue water between 30-50%, the ageing infrastructure, and the increased energy and maintenance expenses, which all limit the capital outlay despite the strong underlying demand.

Technologically, centrifugal pumps hold approximately 85% of the total market share, thus indicating their appropriateness in high volume and continuous operation in desalination, treatment and distribution systems. Their scalability, ease of operation and ability to manage variable water qualities support extensive use. Through application, water supply and treatment control the market with about 70% share, as national programmes to increase desalination capacity and modernise treatment and transmission systems are underway, whereas wastewater uses are becoming increasingly significant in response to increasing reuse requirements.

Saudi Arabia has a market share of about 20 in the Middle East and Africa industrial water and wastewater pump market, which is estimated to be 20 in the region, and this is backed by massive investments in line with Vision 2030. The United Arab Emirates and Egypt are major secondary markets, driven by large-scale treatment projects and progressive water-management schemes. In general, the market perspective is stable and structurally sound; the long-term water-security agenda still maintains steady demand of industrial pumping systems across the region.

Middle East & Africa Industrial Water & Wastewater Pump Market Growth DriverStructural Water Scarcity Accelerating Industrial Demand

Extreme freshwater scarcity remains a cornerstone of the industrial water and wastewater pump market in the Middle East and Africa with fourteen of the twenty-one member states in the region having a water poverty level of less than the United Nations Food and Agriculture Organization water poverty level of 1,000 cubic metres per capita per year. The pressure on renewable water resources is further exacerbated by growing industrialisation, urbanisation and population growth, and the water demands in the region are expected to rise by almost half by 2050 under current climatic and population growth conditions. This has been complicated by the fact that the average temperatures in the Arab region are increasing at a rate of about twice that of the global average, thus increasing the rate of evaporation losses and decreasing the availability of surface and ground water, thus enhancing the dependence on non-conventional water sources.

These institutional demands are triggering massive investments in desalination, wastewater reclamation and industrial water treatment facilities. The end users in the utilities, energy, petrochemicals and manufacturing sectors are increasingly focusing on high capacity pumping systems in order to ensure that their operations are not affected by lack of water. The growth of desalination plants, modern treatment plants, and transmission systems are directly being converted into long-term demand of industrial water and wastewater pumps designed to operate continuously and in large volumes under severe climatic conditions.

Middle East & Africa Industrial Water & Wastewater Pump Market ChallengeInfrastructure Losses and Capital Intensity Constraining Market Efficiency

The market is faced with serious constraints due to high water losses and deteriorating infrastructure despite the strong fundamentals of demand. The non-revenue water in various cities in the Middle East and Africa is between 30% and 50%, which is significantly higher than the global best-practice level of about 10%. In economies that rely on desalination, these losses have a disproportionate economic impact due to the high cost of water production, which puts an extreme strain on utility budgets and operational performance. At the same time, the water-demand gap in the region is expected to increase dramatically, with the gap growing 42 billion cubic metres per annum in 2000 to almost 199 billion cubic metres in 2050.

Ageing distribution networks, high intensity of pumping systems and high maintenance costs contribute to this imbalance. According to World Bank estimates, the region has a water-infrastructure funding gap of about US 110.8 billion that includes treatment plants, conveyance systems and wastewater plants. This means that utilities have to decide between capacity growth and loss minimisation and asset renewal, increasing the stress on the need to implement efficient, digitally-controlled pump systems whilst operating within limited capital budgets.

Middle East & Africa Industrial Water & Wastewater Pump Market TrendClimate Extremes Driving Water Reuse and System Adaptation

The pace of climate change is transforming the operational priorities in the Middle East and Africa industrial water and wastewater pump market. Record heatwaves, extended droughts, and intermittent extreme rainfall events are causing unprecedented strain on water infrastructure, and some countries have recorded temperatures of over 50°C in recent summers. These extremities interfere with traditional water availability patterns, augment evaporation losses and urgency to have resilient and adaptable water management systems that can maintain reliable operation in the face of thermal stress.

Utilities and industrial end users are responding by quickly developing water reuse and recycling programs in order to decrease freshwater abstraction. The strategic change to treated effluent reuse can be seen in large-scale projects, like the New Delta wastewater treatment facility in Egypt, with a capacity of 7.5 3 million cubic metres per day. This shift creates a need to have pumps that can accommodate the changing water quality, increased solids content and continuous recirculation, and this change fundamentally changes the equipment specifications compared to the traditional freshwater pumping applications.

Middle East & Africa Industrial Water & Wastewater Pump Market OpportunityFinancing Innovation and Regulatory Mandates Creating Long Term Opportunities

The untapped investment needs that offer a great potential of long term market growth. The reported USD 110.8 billion financing gap of water infrastructure is driving other financing models, such as public-private partnerships, green bonds, and involvement of sovereign-wealth funds. All these channels will mobilise over USD 500 billion to fund regional water projects, thereby increasing procurement pipelines of industrial pumping systems in desalination, treatment and conveyance applications. Saudi Arabia has already come up with more than 40 water PPP projects and is still increasing investments in line with the Vision 2030 goals.

Long-term demand is further enhanced by regulatory frameworks. The Unified Water Strategy of the Gulf Cooperation Council requires up to 90% of treated effluent to be reused by 2035, which will require large-scale upgrades to pumping and treatment systems. Structural demand is reinforced by similar national programmes in Egypt and other markets, which place pumping solutions as key facilitators of compliance, sustainability goals and long-term water security.

Middle East & Africa Industrial Water & Wastewater Pump Market Country Analysis

By Country

- UAE

- Saudi Arabia

- South Africa

- Qatar

- Rest of Middle East & Africa

Saudi Arabia holds the largest country level share in the Middle East & Africa industrial water & wastewater pump market, accounting for approximately 20% of total regional demand. This leadership is underpinned by the Kingdom’s extensive desalination and water infrastructure investment pipeline, including over USD 9.33 billion allocated across more than 60 projects. Water security remains a strategic priority under Vision 2030, ensuring sustained deployment of advanced pumping systems across treatment, transmission, and integrated water projects at national scale.

Egypt and the United Arab Emirates represent key secondary growth markets shaping regional dynamics. Egypt’s large population base and aggressive investment in water and wastewater infrastructure, including the New Delta facility, are generating substantial equipment demand. Meanwhile, the UAE’s advanced infrastructure standards, smart water management initiatives, and ambitious reuse targets position it as a regional benchmark market, influencing technology adoption and procurement standards across the broader Middle East and Africa.

Middle East & Africa Industrial Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- End Suction

- Split Case

- Vertical

- Turbine

- Axial Pump

- Mixed Flow Pump

- Submersible Pump

- Positive Displacement Pumps

- Progressing Cavity

- Diaphragm

- Gear Pump

- Others

Centrifugal pumps represent the dominant pump type within the Middle East & Africa industrial water & wastewater pump market, accounting for approximately 85% of total market share. Their prevalence reflects strong alignment with regional infrastructure priorities, which emphasize high volume water movement across desalination plants, municipal distribution networks, cooling systems, and large scale wastewater facilities. Centrifugal designs offer operational simplicity, scalability across flow rates, and lower maintenance requirements, making them the preferred choice for utilities and industrial end users managing continuous duty applications.

The technology’s ability to handle a wide range of fluid qualities, from desalinated and potable water to treated effluent, further reinforces adoption. Positive displacement pumps occupy a smaller, specialized niche, primarily serving high viscosity fluids, sludge handling, and low flow high pressure scenarios. Overall, the dominance of centrifugal pumps underscores the region’s focus on capacity driven infrastructure expansion rather than highly specialized pumping applications.

By Application

- Water

- Wastewater

Wastewater management forms the secondary application segment, expanding steadily as reuse and recycling gain regulatory and economic importance. Investments in secondary and tertiary treatment, sludge management, and reclaimed water distribution are increasing pump demand for more complex operating conditions. The application mix highlights a dual strategy across the region: immediate augmentation of water supply capacity alongside progressive expansion of wastewater recycling to improve long term resource efficiency and resilience.

Various Market Players in Middle East & Africa Industrial Water & Wastewater Pump Market

The companies mentioned below are highly active in the Middle East & Africa industrial water & wastewater pump market, occupying a considerable portion of the market and shaping industry progress.

- Wilo SE

- EBARA Corporation

- ITT Inc.

- Flowserve Corporation

- Sulzer Ltd.

- Grundfos Holding A/S

- KSB SE & Co. KGaA

- Xylem Inc.

- Pentair plc

- Tsurumi Manufacturing Co.Ltd.

Market News & Updates

- Wilo SE, 2025:

Officially inaugurated newly expanded Dubai factory (February 2025) doubling facility size with His Excellency Abdullah Bin Touq Al Marri, UAE Minister of Economy, and German Ambassador Alexander Schonfelder in attendance. The expanded facility features state-of-the-art testing capabilities with 500 kW power capacity and 9,000 m³/h flow capability—the largest accredited test bench in the region. Wilo further solidified its market leadership as a Diamond Exhibitor at Cairo Water Week 2025 (October 12-16), showcasing IoT-enabled water management solutions aligned with Egypt’s Vision 2030.

- Flowserve Corporation, 2025:

Awarded a major contract to supply dry gas seals and systems in collaboration with Celeros Flow Technology for ADNOC's groundbreaking carbon capture initiative (January 2025). The project, located at the Habshan gas plant, involves capturing 1.5 million tons of CO₂ annually and represents the first deployment of continuous supercritical CO₂ (sCO₂) pump injection services for enhanced oil recovery in the market. This win reinforces Flowserve's leadership in the region's energy transition sector.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Middle East & Africa Industrial Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Middle East & Africa Industrial Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Middle East & Africa Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold (Million Units)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Country

5.2.3.1. UAE

5.2.3.2. Saudi Arabia

5.2.3.3. South Africa

5.2.3.4. Qatar

5.2.3.5. Rest of Middle East & Africa

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. UAE Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold (Million Units)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

7. Saudi Arabia Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold (Million Units)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

8. South Africa Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold (Million Units)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

9. Qatar Industrial Water & Wastewater Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Units Sold (Million Units)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Flowserve Corporation

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Sulzer Ltd.

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Grundfos Holding A/S

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. KSB SE & Co. KGaA

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Xylem Inc.

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Wilo SE

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. EBARA Corporation

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. ITT Inc.

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Pentair plc

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Tsurumi Manufacturing Co., Ltd.

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.