South Africa Skin Care Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Body Care, Facial Care, Hand Care, Skin Care Sets/Kits), By Category (Premium, Mass), By Gender (Men, Women, Unisex), By End User (Adults, Teenagers, Children), By Packaging (Tubes, Bottles, Jars, Others), By Sales Channel (Online, Offline)

- FMCG

- Dec 2025

- VI0124

- 123

-

South Africa Skin Care Market Statistics, 2025

- Market Size Statistics

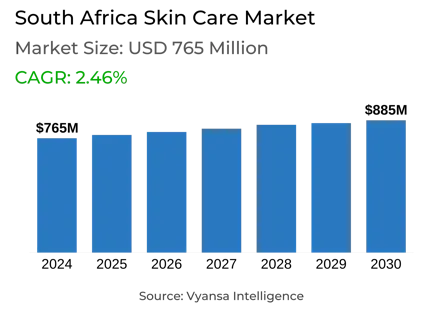

- Skin Care in South Africa is estimated at $ 765 Million.

- The market size is expected to grow to $ 885 Million by 2030.

- Market to register a CAGR of around 2.46% during 2025-30.

- Product Shares

- Facial Care grabbed market share of 55%.

- Competition

- More than 20 companies are actively engaged in producing Skin Care in South Africa.

- Top 5 companies acquired 40% of the market share.

- L'Oréal South Africa (Pty) Ltd, Tiger Consumer Brands Ltd, Procter & Gamble (Pty) Ltd, Unilever South Africa (Pty) Ltd, Beiersdorf Consumer Products (Pty) Ltd etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 90% of the market.

South Africa Skin Care Market Outlook

South Africa skin care market is projected to experience sustained growth between 2025 and 2030 due to high consumer demand for self-care and ingredient-driven products. Despite economic hardship, most consumers have stuck with their skin care routines, making room for both domestic and international brands to grow. New brands such as The Ordinary and local brand names like Silki have become popular by providing products with certain claims and affordable payment methods through clothing retailers like Foschini and Mr Price.

Shoppers are expressing a definite interest in products that emphasize primary active or natural ingredients. Ingredient consciousness is on the rise, particularly as social media personalities and companies inform consumers about the merits of ingredients like niacinamide, vitamin C, and rooibos tea. Cost-effective skin care with well-known and reliable ingredients is now a priority, particularly for those addressed at specific issues such as irritation or complexion.

Another up-and-coming trend is the request for customized skin care analysis and consulting services. Most South Africans are learning about their skin concerns and like brands to lead them with personal solutions. Brands that provide skin evaluations are more likely to earn consumer loyalty and trust, as customers become more engaged in selecting products that suit their own individual conditions.

Packaging is also critical in determining whether or not a purchase will be made. South Africans are attracted to premium-looking, uncomplicated, and travel-friendly packaging—right down to non-premium products. Consequently, skin care brands will need to keep investing in designs that have both visual and functional appeal, standing out in a competitive and expanding market.

South Africa Skin Care Market Growth Driver

More and more skin care brands are placing emphasis on improving their product packaging, as many South Africans are attracted to a high-end appearance—even when the product itself is not positioned as high-end. To capitalize on this trend, brands are utilizing minimal labeling on packaging but maintaining clear descriptions of the product's intent and usage. This simple, sophisticated design attracts consumers looking for visually pleasing products that draw attention on shelves.

As per a survey, aside from the visual appeal, functionality is key in packaging preferences. Consumers are increasingly drawn to packaging that accommodates their lifestyle—smaller, more portable, and perfect for everyday use like a visit to the gym. Small packs are particularly favored for their convenience of portability and affordability, hence becoming a first choice for price-sensitive consumers without neglecting style and convenience.

South Africa Skin Care Market Trend

South African consumers are likely to increasingly focus on ingredient-driven skin care over the 2025–30 period, according to a survey. While cost pressures are still strong and value promotions still drive buying, ingredients have become the second most significant consideration when selecting products. Consumers are now increasingly focused on their individual skin problems and actively looking for products that treat these conditions.

The position of social media influencers has also gained strength, with them leading the consumers in demystifying product descriptions and the advantages of some ingredients, either active or natural. This increased awareness will enable the South Africans to comprehend which ingredients are appropriate for their skin types. Ingredient transparency and effectiveness are thus poised to continue serving as key decision drivers, determining future demand in the skin care category.

South Africa Skin Care Market Opportunity

South Africans are increasingly seeking out local skin care brands that are responsive to local conditions and help develop the national economy. In a survey, emerging local brands have attracted attention by being aware of South Africans' specific skin care needs. They emphasize affordability, locally appropriate ingredients such as rooibos tea, and solutions for women of colour, e.g., sunscreens that do not produce a white cast on darker skin tones.

Brands like Silki are becoming popular due to their relatable offerings and educational approach. For instance, Silki’s SPF30 sunscreen, priced at ZAR130, specifically targets African consumers of colour with inclusive formulations. These domestic brands not only meet consumer expectations but also educate them on ingredients, skin types, and routines—giving them a competitive edge over global players. This growing trust in local brands presents a strong growth opportunity for the South Africa skin care industry.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 765 Million |

| USD Value 2030 | $ 885 Million |

| CAGR 2025-2030 | 2.46% |

| Largest Category | Facial Care segment leads with 55% market share |

| Top Drivers | Growing Consumer Demand for Premium-Looking and Convenient Packaging |

| Top Trends | Traction Towards Ingredient-Led Skin Care |

| Top Opportunities | Growing Preference for Domestic Skin Care Brands |

| Key Players | L'Oréal South Africa (Pty) Ltd, Tiger Consumer Brands Ltd, Procter & Gamble (Pty) Ltd, Unilever South Africa (Pty) Ltd, Beiersdorf Consumer Products (Pty) Ltd, Estée Lauder Cos South Africa (Pty) Ltd, Johnson & Johnson (Pty) Ltd, Avon Justine (Pty) Ltd, Clicks Group Ltd, Amka Products (Pty) Ltd and Others. |

Top Companies in South Africa Skin Care Market

The top companies operating in the market include L'Oréal South Africa (Pty) Ltd, Tiger Consumer Brands Ltd, Procter & Gamble (Pty) Ltd, Unilever South Africa (Pty) Ltd, Beiersdorf Consumer Products (Pty) Ltd, Estée Lauder Cos South Africa (Pty) Ltd, Johnson & Johnson (Pty) Ltd, Avon Justine (Pty) Ltd, Clicks Group Ltd, Amka Products (Pty) Ltd, etc., are the top players operating in the South Africa Skin Care Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. South Africa Skin Care Market Policies, Regulations, and Standards

4. South Africa Skin Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. South Africa Skin Care Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Firming Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. General Purpose Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Facial Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Acne Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Face Masks- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3. Facial Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.1. Liquid- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.2. Cream- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.3. Gel- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.4. Bar Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.5. Facial Cleansing Wipes- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4. Moisturisers and Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.1. Basic Moisturisers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.2. Anti-Agers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.5. Lip Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.6. Toners- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Hand Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Skin Care Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Women- Market Insights and Forecast 2020-2030, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By End User

5.2.4.1. Adults- Market Insights and Forecast 2020-2030, USD Million

5.2.4.2. Teenagers- Market Insights and Forecast 2020-2030, USD Million

5.2.4.3. Children- Market Insights and Forecast 2020-2030, USD Million

5.2.5.By Packaging

5.2.5.1. Tubes- Market Insights and Forecast 2020-2030, USD Million

5.2.5.2. Bottles- Market Insights and Forecast 2020-2030, USD Million

5.2.5.3. Jars- Market Insights and Forecast 2020-2030, USD Million

5.2.5.4. Others- Market Insights and Forecast 2020-2030, USD Million

5.2.6.By Sales Channel

5.2.6.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.6.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. South Africa Body Care Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

6.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. South Africa Facial Care Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

7.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. South Africa Hand Care Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

8.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. South Africa Skin Care Sets/Kits Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

9.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Unilever South Africa (Pty) Ltd

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Beiersdorf Consumer Products (Pty) Ltd

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Estée Lauder Cos South Africa (Pty) Ltd

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Johnson & Johnson (Pty) Ltd

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Avon Justine (Pty) Ltd

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. L'Oréal South Africa (Pty) Ltd

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Tiger Consumer Brands Ltd

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Procter & Gamble (Pty) Ltd

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Clicks Group Ltd

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Amka Products (Pty) Ltd

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Gender |

|

| By End User |

|

| By Packaging |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.