South Africa Leisure & Business Travel Booking Market Report: Trends, Growth and Forecast (2026-2032)

By Travel Sales Type (Leisure Travel, Business Travel), By Booking Channel (Offline Booking, Online Booking), By Booking Method (Travel Intermediaries, Direct Suppliers)

- ICT

- Nov 2025

- VI0403

- 110

-

South Africa Leisure & Business Travel Booking Market Statistics and Insights, 2026

- Market Size Statistics

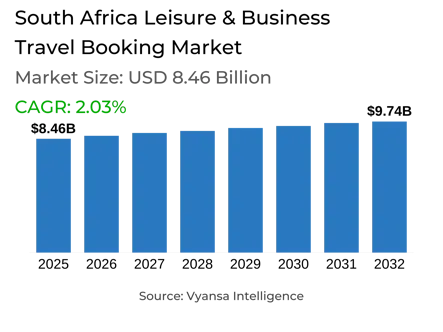

- Leisure & Business Travel Booking in South Africa is estimated at $ 8.46 Billion.

- The market size is expected to grow to $ 9.74 Billion by 2032.

- Market to register a CAGR of around 2.03% during 2026-32.

- Travel Sales Type Shares

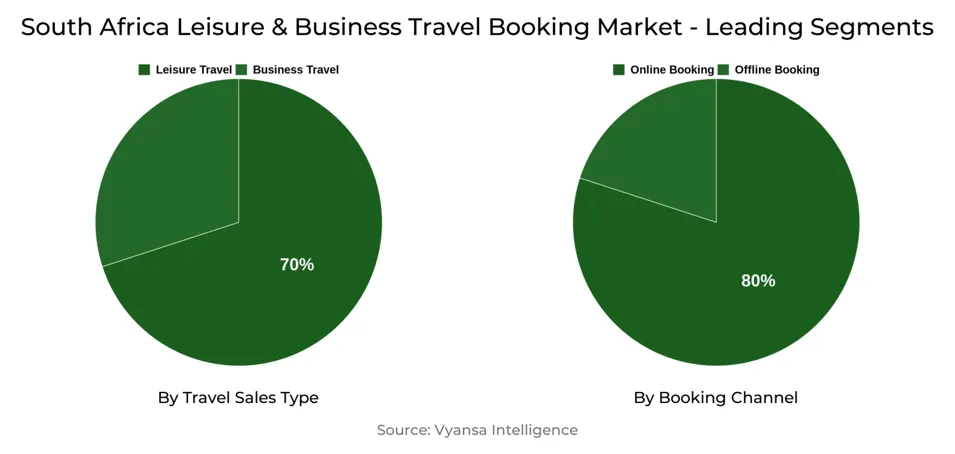

- Leisure Travel grabbed market share of 70%.

- Competition

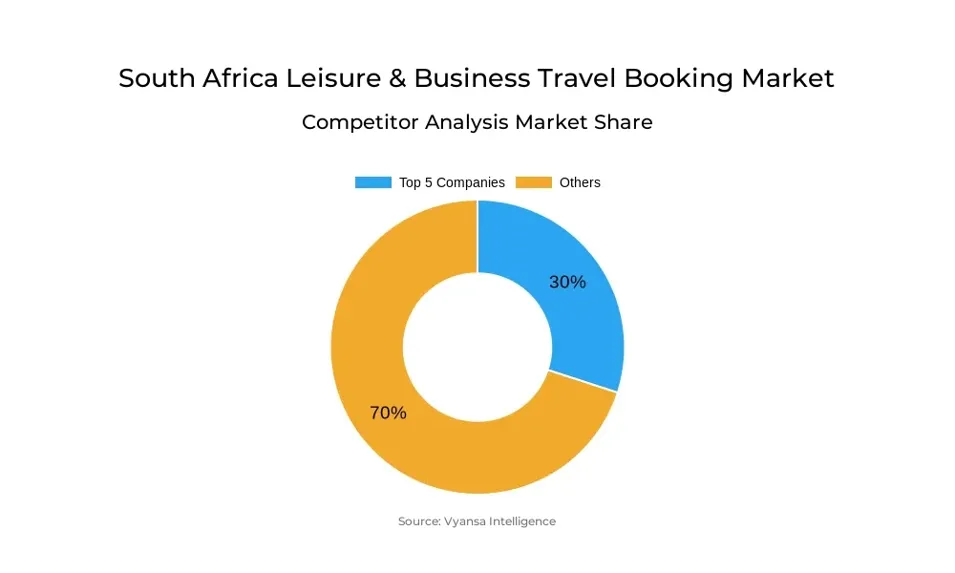

- South Africa Leisure & Business Travel Booking Market is currently being catered to by more than 10 companies.

- Top 5 companies acquired 30% of the market share.

- Holiday Holdings International Travel Group, Cullinan Holdings Ltd, Argo Icarus Travel (Pty) Ltd, Travelstart Online Travel Operations Pty Ltd, Bidvest Group Ltd etc., are few of the top companies.

- Booking Channel

- Online Booking grabbed 80% of the market.

South Africa Leisure & Business Travel Booking Market Outlook

The South Africa Leisure & Business Travel Booking market is estimated to be worth $8.46 billion and is expected to grow to $9.74 billion by 2032. Online booking already stands at 80% of the market, reflecting the trend toward increasing usage of digital platforms. Strategic collaborations with prominent travel intermediaries like Booking.com and Airbnb are becoming indispensable for service providers in order to target international travelers and gain wider visibility. Elimination of strict price parity rules by Booking.com has also provided independent hotels and accommodation suppliers more flexibility, enhancing their competitiveness and margins.

The dominance of established players continues to shape the competitive landscape. Platforms like Travelstart remain highly trusted for flight bookings, offering end users easy price comparisons across multiple airlines. Booking.com thrives in the accommodation segment by allowing travellers to compare quotes in one place, while Computicket caters to local travellers by combining online booking options with a strong network of physical outlets for cash payments. This hybrid presence remains important for end users who prefer in-person transactions.

In the future, online travel intermediaries will fuel additional growth by providing compelling promotions and employing artificial intelligence to make targeted offers based on customer information. Such innovations are likely to enhance user experience and propel internet booking volumes even higher. Meanwhile, the expansion of e-commerce and digital wallets is assisting in enhancing consumer confidence around online payments, minimizing fears of fraud and persuading additional travelers to book online.

In spite of these technological developments, a portion of local travelers will still opt for offline points of contact, particularly for bus and train reservations. Computicket will continue to be a dominant force in this category, taking advantage of its extensive retailing network. As a whole, the South Africa market for travel bookings will enjoy gradual development, with online platforms driving growth while offline networks provide convenience for a broad base of end users.

South Africa Leisure & Business Travel Booking Market Growth Driver

Strategic Partnerships Drive Expansion

Service providers seeking expansion in South Africa Leisure & Business Travel Booking market are increasingly entering into strategic alliances with large travel intermediaries. By using well-known platforms like Booking.com and Airbnb, the providers tap into a worldwide base of end users who know and trust these brands. This lowers the capital and brand risk involved in creating proprietary systems, particularly for small players with little capital.

As sites such as Booking.com make adjustments to rules—removing strict price parity constraints—free-standing hotels and accommodation businesses are no longer locked into rate constraints that in the past took money out of their pockets. This shift is creating more competitive deals and providing providers with more control over their own business, enabling healthier market growth and more equitable competition.

South Africa Leisure & Business Travel Booking Market Challenge

Payment Ease Continues to be a Hindrance

A lot of travelers in South Africa continue to opt to book via physical outlets, particularly for buses and trains, since this facilitates payment in cash and circumvents the risks associated with online transactions. Despite increased use of electronic payment options, fears over internet safety and fraud ensure that cash continues to be a popular option for most local travelers. This is a challenge to the travel service providers who are trying to move more clients onto digital platforms while making sure that their services are both inclusive and secure.

The dependence on bricks-and-mortar stores hinders digital uptake, making it more difficult for travel intermediaries to maximize operations and simplify customer experiences. Travel agents like Computicket, which have large retail networks, remain popular as clients prefer direct, face-to-face interaction and reassurance prior to making bookings. Service providers need to adjust strategies to cater to both online and offline choices and overcome suspicion regarding online payments.

South Africa Leisure & Business Travel Booking Market Trend

Trusted Brands Dominate Consumer Choices

The South Africa Leisure & Business Travel Booking market is largely dominated by well-established brands with a strong presence over time. Travelers often go to trusted intermediaries such as Travelstart for flights and Booking.com for lodging. Such websites are appreciated for the convenience of getting multiple quotes from one location, saving much time and eliminating the trouble of comparing prices between websites.

In addition to ease of use, the reputation of well-established platforms offers an additional sense of assurance for travelers. Brands that prove themselves to be reliable and have a track record of delivering positive customer experiences consistently generate repeat business. This inclination toward known platforms is driving the trend of centralized reservations, for either leisure or business purposes.

South Africa Leisure & Business Travel Booking Market Opportunity

Technology-Driven Personalization Opens New Avenues

Technological innovation is opening up exciting possibilities in the marketplace. Today, platforms use artificial intelligence to process the information provided by end users through sign-up and booking activities. With AI, travel intermediaries are able to know what personal preferences are and hence offer customized solutions that meet individual needs, resulting in a more personalized booking experience.

This data-driven strategy not only boosts booking volumes but also enables both travellers and service providers to make more educated decisions. Through deeper personalization and enticing offers, intermediaries are enhancing customer interaction and satisfaction, paving the way for additional expansion in South Africa leisure and business travel markets.

South Africa Leisure & Business Travel Booking Market Segmentation Analysis

By Travel Sales Type

- Leisure Travel

- Business Travel

The segment with highest market share under Travel Sales Type is Leisure Travel, which captured 70% of the market. South Africa leisure travelers are increasingly resorting to travel intermediaries like Booking.com and Airbnb to organize their travel. These websites enable end users to compare accommodation, flights, and other services within one location, making it a time-saving measure. The ease of online gathering, combined with reviewed feedback and brands with known reputations, places bookings for leisure travel within easier reach and greater allure.

There is smaller but still significant business travel that also depends on known intermediaries for reserving flight and hotel space at efficiency. The platform for use that has known goodwill ensures reliability and minimizes errors in booking, standing to enable steady growth in this segment in conjunction with the dominant leisure travel market.

By Booking Channel

- Offline Booking

- Online Booking

The segment with highest market share under Booking Channel is Online Booking, which held 80% of the market. South Africa travellers are becoming more confident in booking online, thanks to safe digital wallets and the ease of comparison on sites such as Booking.com and Travelstart. Flexibility, greater options, and offers by way of customer data are available through online booking, and this is the most used channel for travellers.

In spite of the dominance of web-based bookings, a segment of domestic travelers still has an affinity for tangible points of contact for specific services like buses or trains. Travel agents such as Computicket still cater to these clients, providing cash payment facilities and availability via retail networks, so that traditional channels are able to supplement the expansion of online booking.

Top Companies in South Africa Leisure & Business Travel Booking Market

The top companies operating in the market include Holiday Holdings International Travel Group, Cullinan Holdings Ltd, Argo Icarus Travel (Pty) Ltd, Travelstart Online Travel Operations Pty Ltd, Bidvest Group Ltd, Flight Centre Travel Group Ltd, Imperial Holdings Ltd, Sure Travel Group, STA Travel (ZA) Ltd, Club Travel SA (Pty) Ltd, etc., are the top players operating in the South Africa Leisure & Business Travel Booking Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. South Africa Leisure & Business Travel Booking Market Policies, Regulations, and Standards

4. South Africa Leisure & Business Travel Booking Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. South Africa Leisure & Business Travel Booking Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Travel Sales Type

5.2.1.1. Leisure Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Business Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Booking Channel

5.2.2.1. Offline Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Online Booking- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Booking Method

5.2.3.1. Travel Intermediaries- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Direct Suppliers- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. South Africa Leisure Travel Booking Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

6.2.1.1. Leisure Air Travel- Market Insights and Forecast 2022-2032, USD Million

6.2.1.2. Leisure Car Rental- Market Insights and Forecast 2022-2032, USD Million

6.2.1.3. Leisure Cruise- Market Insights and Forecast 2022-2032, USD Million

6.2.1.4. Leisure Experiences and Attractions- Market Insights and Forecast 2022-2032, USD Million

6.2.1.5. Leisure Lodging- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

7. South Africa Business Travel Booking Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Travel Sales Type- Market Insights and Forecast 2022-2032, USD Million

7.2.1.1. Business Air Travel- Market Insights and Forecast 2022-2032, USD Million

7.2.1.2. Business Car Rental- Market Insights and Forecast 2022-2032, USD Million

7.2.1.3. Business Lodging- Market Insights and Forecast 2022-2032, USD Million

7.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Booking Method- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1. Travelstart Online Travel Operations Pty Ltd

8.1.1.1. Business Description

8.1.1.2. Service Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2. Bidvest Group Ltd

8.1.2.1. Business Description

8.1.2.2. Service Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3. Flight Centre Travel Group Ltd

8.1.3.1. Business Description

8.1.3.2. Service Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4. Imperial Holdings Ltd

8.1.4.1. Business Description

8.1.4.2. Service Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5. Sure Travel Group

8.1.5.1. Business Description

8.1.5.2. Service Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6. Holiday Holdings International Travel Group

8.1.6.1. Business Description

8.1.6.2. Service Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7. Cullinan Holdings Ltd

8.1.7.1. Business Description

8.1.7.2. Service Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8. Argo Icarus Travel (Pty) Ltd

8.1.8.1. Business Description

8.1.8.2. Service Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9. STA Travel (ZA) Ltd

8.1.9.1. Business Description

8.1.9.2. Service Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Club Travel SA (Pty) Ltd

8.1.10.1. Business Description

8.1.10.2. Service Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Travel Sales Type |

|

| By Booking Channel |

|

| By Booking Method |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.