Singapore Sports Nutrition Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Sports Protein Products (Protein/Energy Bars, Sports Protein Powder, Sports Protein RTD), Sports Non-Protein Products), By Sales Channel (Retail Offline, Retail Online), By Ingredients (Vitamins and Minerals, Proteins and Amino Acids, Carbohydrates, Probiotics, Botanicals/Herbals, Others), By Functionality (Energy, Muscle growth, Hydration, Weight Management, Others), By End User (Bodybuilders, Athletes, Lifestyle Users)

|

Major Players

|

Singapore Sports Nutrition Market Statistics and Insights, 2026

- Market Size Statistics

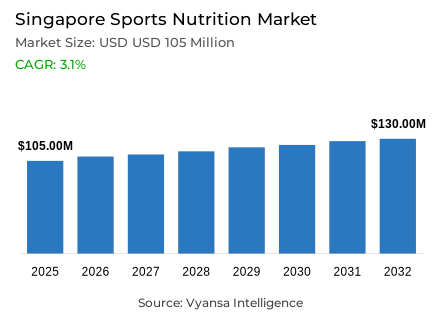

- Sports nutrition in Singapore is estimated at USD 105 million in 2025.

- The market size is expected to grow to USD 130 million by 2032.

- Market to register a cagr of around 3.1% during 2026-32.

- Product Type Shares

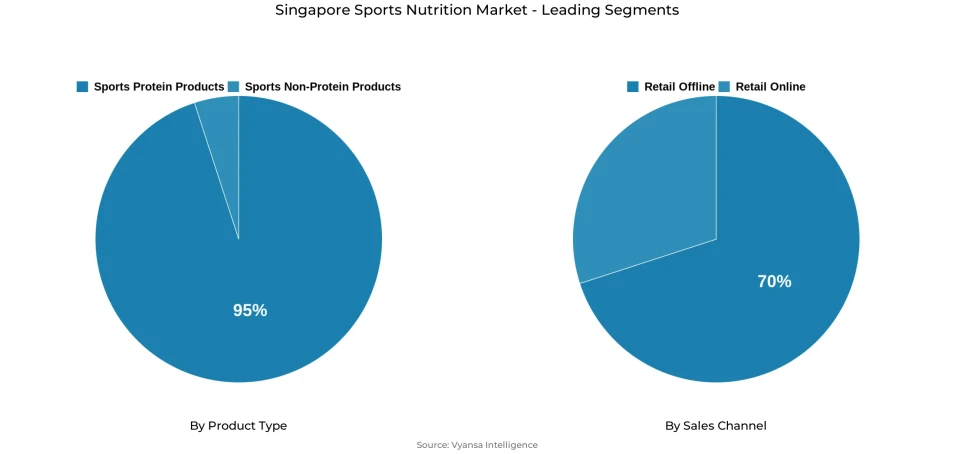

- Sports protein products grabbed market share of 95%.

- Competition

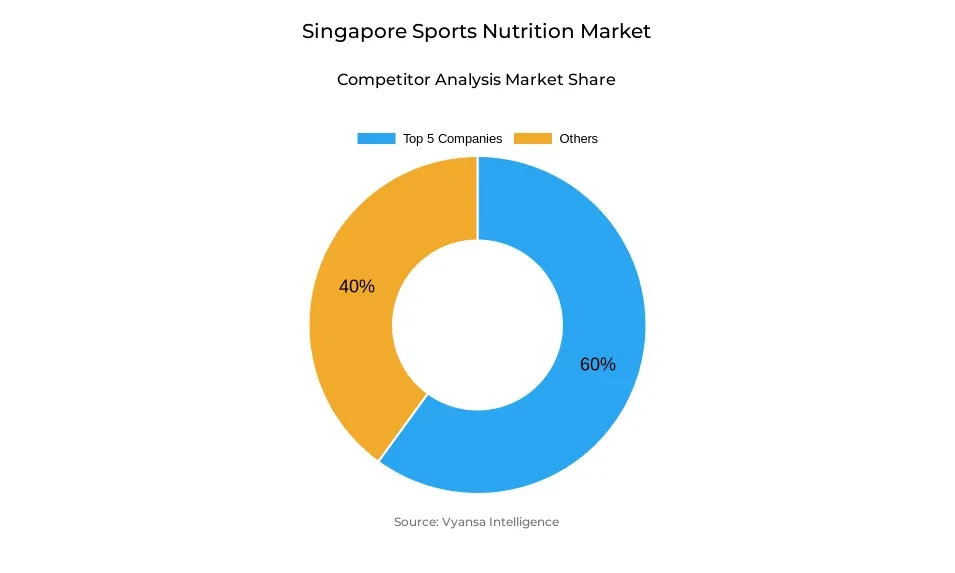

- More than 20 companies are actively engaged in producing sports nutrition in Singapore.

- Top 5 companies acquired around 60% of the market share.

- Simply Good Foods Co; LAC Global (Singapore) Pte Ltd; PhD Nutrition Ltd; Glanbia Performance Nutrition Singapore Pte Ltd; FitLife Brands Inc etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Singapore Sports Nutrition Market Outlook

The Singapore sports nutrition market is poised to experience a consistent growth up to 2032 as the country reinforces its active lifestyle and fitness trends. The market valuation is USD 105 million in 2025, and it is projected to increase to USD 130 million in 2032, which is a compound annual growth rate (CAGR) of about 3.1%. The growth trends will be largely based on the rising rates of sports participation, the improved availability of fitness facilities, and the growing awareness of the need to support performance optimisation and recovery improvement with the help of nutrition. The government programs that encourage exercise participation and preventive health measures will remain to drive the demand dynamics, making sports nutrition a fundamental part of everyday activities of the end user segments that are fitness conscious.

Sports protein products, which already control 95% of aggregate market share, will retain their leading role. Their application in muscle recovery and meal replacement purposes are well suited to the fast-paced lifestyle traits of Singapore. At the same time, non-protein products with hydration and endurance applications will show faster growth as more residents engage in long-distance running, cycling, and international sporting events. Innovations in products such as protein-enriched isotonic drinks and hybrid functional drinks will increase the usage occasions and appeal to new end user groups.

One of the key trends that are influencing the market perspective is the increasing preference of the end user towards plant-based and natural formulations. The end users are also demanding cleaner, lower fat, and vegan-friendly protein options, which are in line with the general trends in lifestyle transition. Ready-to-drink protein drinks and convenient protein bar formats will keep on gaining commercial momentum, especially among busy working adult demographics in search of on-the-go nutrition solutions.

In terms of sales channel, retail offline channels contribute to 70% of the total sales revenue, which is backed by speciality retailers such as LAC and Decathlon that offer guidance to new end users. Nevertheless, online buying is expected to speed up because of the increased availability of products, competitive pricing systems, and the large size of protein powder formats. The market will continue to experience a strong growth trend until 2032 as electronic commerce infrastructure continues to grow and brands continue to invest in innovation.

Singapore Sports Nutrition Market Growth DriverRising Physical Activity Participation Supported by Government Initiatives

The sports nutrition products are still in demand in Singapore due to government-supported programs that encourage people to lead an active lifestyle. According to the National Sport Participation Survey 2023, 74% of residents engage in sports activities at least once a week, which is higher than 64% in 2019. Equally, the National Cycling Plan increased the cycling network infrastructure in Singapore to over 500 kilometres of designated paths by 2024, making outdoor activities more accessible. These infrastructural advancements promote more organized physical activities, which strengthen the business viability of sports protein, hydration, and endurance product lines.

The 2024 Olympics in Paris also increased the popularity of fitness activities, motivating more residents to incorporate exercise into their lifestyle habits. As gymnasium facilities are running at full capacity and active mobility infrastructure is still growing, sports nutrition products are becoming part of everyday life to improve performance abilities and recovery results. The increasing levels of physical engagement remain the basis of the long-term category growth dynamics.

Singapore Sports Nutrition Market ChallengeIntensifying Competition From Adjacent Functional Categories

Sports nutrition brand positioning is increasingly challenged by competition with other functional beverage and nutritional categories. According to health authority data, 68% of adults are moving towards healthier packaged beverages, such as fortified drinks and reduced-sugar beverages. This change increases the number of options that end users have when they want convenient nutrition solutions that are not in the form of traditional sports protein products. Also, Nutri-Grade laws, which came into effect in December 2022 and will be enforced until 2024, mandate beverages to carry A–D nutrition grade labels, initiating reformulation efforts in mainstream beverage categories.

These regulatory and market trends have facilitated the adjacent functional categories of meal replacements, fortified snack products, and nutritionally enriched beverages to compete directly with sports nutrition on consumption occasions. With more and more brands positioning themselves as balanced, high-protein, or recovery-oriented solutions, the players in the sports nutrition market need to distinguish themselves based on efficacy credentials and quality of formulation to maintain market share and end user loyalty.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Singapore Sports Nutrition Market TrendRising Demand for Non-Protein Endurance Products

The trend of endurance-oriented sports nutrition products is still growing as Singaporean end users are increasingly involved in long-distance running and cycling events. Running is one of the most popular sports activities in Singapore, and 42% of active residents in 2023 reported running activities at least once a week. Also, the Standard Chartered Singapore Marathon 2023 had more than 50,000 participants, which is an indication of high interest in endurance events. Such activities raise the demand of hydration powders, electrolyte drinks, and energy gel products that aid stamina maintenance and fluid balance optimisation.

With the resumption of post-pandemic travel trends, more and more Singaporean end users are attending regional marathon events in Malaysia, Thailand, and Europe, which further drives the demand of endurance nutrition solutions. The increased focus on the maintenance of hydration and energy sustainability makes non-protein categories a fast-growing segment of the sports nutrition market.

Singapore Sports Nutrition Market OpportunityGrowth of Plant-Based Protein and Diverse Product Formats

The growth of vegetarian eating habits opens up significant prospects to the sports protein market segment. According to the National Nutrition Survey 2022, 40% of residents are consuming more plant-based foods due to the consideration of health awareness and the preference to consume less saturated fat. In line with this trend, the Muslim population in Singapore that constitutes 15.6% of the total population demographics is still in need of halal-certified and plant-based protein substitutes. These trends in demographic and dietary shifts reinforce the demand of vegan sports protein powders, bar formats, and ready-to-drink preparations.

At the same time, convenience is a decisive factor of purchase. According to health authority statistics, 52% of working adults are more inclined to on-the-go functional snacks and beverages to meet the demanding lifestyle needs. This trend is consistent with the increasing popularity of protein bars and ready-to-drink shake formats, which are expanding consumption occasions beyond workout-specific uses into daily routine incorporation. Taken together, these aspects make plant-based and convenience-oriented formats significant future growth opportunities in the market environment.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Singapore Sports Nutrition Market Segmentation Analysis

By Product Type

- Sports Protein Products

- Protein/Energy Bars

- Sports Protein Powder

- Sports Protein RTD

- Sports Non-Protein Products

Sports protein products represent the dominant segment under product type classification, capturing around 95% of the Singapore sports nutrition market. Protein powders, protein/energy bars, and ready-to-drink protein shake formats dominate consumption patterns as they support muscle recovery, growth promotion, and performance enhancement—priorities central to fitness-focused end user segments. With gymnasium facilities fully operational, outdoor sports participation rising, and endurance events gaining popularity, protein products have become essential components of post-workout routines and daily nutritional regimens.

Throughout the forecast period, this segment is expected to retain its substantial leadership position as end users increasingly adopt protein products as both workout supplements and convenient meal replacement solutions. Innovation in product formats—including plant-based protein alternatives, protein bar varieties, and ready-to-drink options—will further stimulate uptake. Growing interest in healthier, clean-label, and plant-based formulations will reinforce demand dynamics, ensuring sports protein products remain the primary driver of market value generation.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline represents the dominant segment under sales channel classification, capturing around 70% of the Singapore sports nutrition market. Speciality stores including LAC and Decathlon continue to anchor offline sales performance by providing personalised guidance services, assisting both new and experienced end users in product selection based on fitness objectives. Supermarkets and pharmacies also contribute to distribution coverage, offering accessible procurement of popular protein powders, bar formats, and ready-to-drink beverage products.

Despite rising online purchase activity driven by bulky product dimensions and competitive pricing for imported items, offline retail maintains dominance as it enables end users to physically compare products and receive tailored consultation—particularly important for non-protein and performance-specific product categories. Throughout the forecast period, offline channels are expected to maintain commercial relevance as they combine accessibility with expert interaction capabilities, supporting continued trust development and robust engagement in sports nutrition purchasing behaviours.

List of Companies Covered in Singapore Sports Nutrition Market

The companies listed below are highly influential in the Singapore sports nutrition market, with a significant market share and a strong impact on industry developments.

- Simply Good Foods Co

- LAC Global (Singapore) Pte Ltd

- PhD Nutrition Ltd

- Glanbia Performance Nutrition Singapore Pte Ltd

- FitLife Brands Inc

- Hut Group Ltd

- Xiwang Foodstuffs Co Ltd

- ONI Global Pte Ltd

- Orgain LLC

- Carman's Fine Foods Pty Ltd

Competitive Landscape

Singapore sports nutrition market was shaped by competition between established global brands, regional players, and expanding functional beverage companies responding to rising fitness participation. Major players strengthened their presence through innovation, with F&N extending its 100Plus line to include 100Plus Pro High Protein, blending hydration and protein benefits to appeal to active consumers. Protein-focused brands continued to dominate, while endurance-oriented brands gained traction as non-protein products such as electrolyte drinks and hydration powders surged in popularity. The blurring of product categories also intensified competition, as sports protein powders and bars increasingly competed with traditional meal replacement shakes. Online platforms widened market access for international brands, while specialty retailers like LAC and Decathlon remained influential by offering product guidance, helping newer consumers navigate the category.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Singapore Sports Nutrition Market Policies, Regulations, and Standards

4. Singapore Sports Nutrition Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Singapore Sports Nutrition Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Sports Protein Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Protein/Energy Bars- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Sports Protein Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Sports Protein RTD- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sports Non-Protein Products- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Ingredients

5.2.3.1. Vitamins and Minerals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Proteins and Amino Acids- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Carbohydrates- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Probiotics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Botanicals/Herbals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Functionality

5.2.4.1. Energy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Muscle growth- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Hydration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Weight Management- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By End User

5.2.5.1. Bodybuilders- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Athletes- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Lifestyle Users- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Singapore Protein Products Sports Nutrition Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Ingredients- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Functionality- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Singapore Non-Protein Products Sports Nutrition Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Ingredients- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Functionality- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Glanbia Performance Nutrition Singapore Pte Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.FitLife Brands Inc

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Hut Group Ltd, The

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Xiwang Foodstuffs Co Ltd

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.ONI Global Pte Ltd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Simply Good Foods Co, The

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.LAC Global (Singapore) Pte Ltd

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.PhD Nutrition Ltd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Orgain LLC

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Carman's Fine Foods Pty Ltd

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Sales Channel |

|

| By Ingredients |

|

| By Functionality |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.