Singapore Premium Beauty and Personal Care Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Colour Cosmetics, Fragrances, Deodorants, Hair Care, Skin Care, Bath and Shower, Baby and Child-specific Products), By End User (Men’s, Women’s, Unisex), By Sales Channel (Online, Offline)

- FMCG

- Dec 2025

- VI0035

- 130

-

Singapore Premium Beauty and Personal Care Market Statistics, 2025

- Market Size Statistics

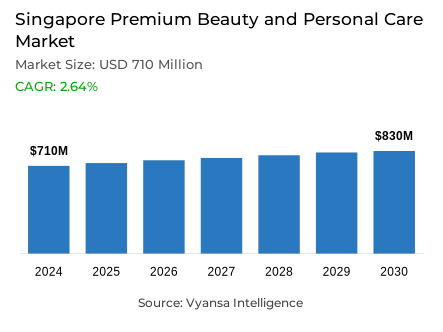

- Premium Beauty and Personal Care in Singapore is estimated at $ 710 Million.

- The market size is expected to grow to $ 830 Million by 2030.

- Market to register a CAGR of around 2.64% during 2025-30.

- Product Shares

- Premium Skin Care grabbed market share of 55%.

- Competition

- More than 20 companies are actively engaged in producing Premium Beauty and Personal Care in Singapore.

- Top 5 companies acquired 45% of the market share.

- Clarins Pte Ltd, Chanel (S) Pte Ltd, Coty Asia Pte Ltd, L'Oréal (S) Pte Ltd, Estée Lauder Cosmetics Pte Ltd etc., are few of the top companies.

Singapore Premium Beauty and Personal Care Market Outlook

From 2025 through 2030, Singapore's premium beauty and personal care market will continue to expand steadily underpinned by consumers' emphasis on quality, personalisation, and well-being. Categories such as premium skin care, colour cosmetics, and fragrances will remain top contributors, with skin care continuing to lead strongly. Anti-ageing solutions and sophisticated formulas based on ingredients such as peptides and antioxidants will continue to captivate consumers who view beauty care as a means of long-term investment and self-care.

Hair care, while expanding from a smaller base, will experience high gains, particularly organic or chemical-free products. In contrast, high-end baby and child-specific offerings should recover decisively after recent falls as parents increasingly are more comfortable paying more for perceived safety and effectiveness. The ongoing premiumisation trend follows a wider consumer pattern of perceiving beauty and personal care as necessary versus discretionary.

The market will also be supported by continuous innovation, such as AI-based diagnostics and personalized product recommendations. As demand increases for personalization, brands offering bespoke skincare or fragrance options will gain customer loyalty. Luxury driven by nature, with ethically harvested botanicals and sustainable manufacture, will also influence buying behavior among wellness-oriented and sustainable customers.

Finally, although the market is dominated by big players like L'Oréal, opportunities for growth will arise for niche brands that present distinctive value – for example, clinically tested results or focused care. As competition gets fiercer, luxury brands need to balance strong performance, innovation, and engaging brand stories to be relevant in Singapore's discriminating beauty market.

Singapore Premium Beauty and Personal Care Market Growth Driver

In Singapore, where economic uncertainty is leading many shoppers to consider cost-effective alternatives, premium beauty and personal care brands are focusing on innovation to stay ahead. Instead of relying only on packaging or celebrity endorsements, these brands are using advanced technologies like AI-based skin care diagnostics, unique ingredient delivery systems, and products that adapt to environmental changes. These innovations keep consumer interest alive and deserve the premium price by delivering actual performance advantages that mass-market "dupes" cannot easily replicate.

Beyond product innovation, premium brands are further facilitating the whole experience for customers. They are facilitating personalized consultations, interactive store formats, and lifestyles with their loyalty programs. Singaporean sophisticated consumers expect more than quality products. By integrating science, design, and service, premium brands can differentiate and build long-lasting connections in an environment that can value both authenticity and progress.

Singapore Premium Beauty and Personal Care Market Trend

Singapore's high-end beauty and personal care market is experiencing a growing demand for unique brand personalities and individualised experiences. High-end baby and child-specific products are to experience the most robust growth as consumers switch from mass products with a move towards safer and more efficient solutions at a higher cost. This category is rebounding after years of decline on the back of quality improvements in the upper-end mass market.

Today, consumers are attracted to products that reflect who they are, with brands employing storytelling, artful packaging, and high-profile collaborations to bond emotionally. With personalisation transforming from a trend to an expectation, retailers are supplying tools that scan skin type, lifestyle, and surroundings to suggest individualised products. From a flawless foundation colour to a bespoke fragrance, Singaporean shoppers prefer one-of-a-kind offerings and will remain loyal to brands that offer them.

Singapore Premium Beauty and Personal Care Market Opportunity

Singaporean consumers are being increasingly attracted to premium beauty and personal care products that emphasize natural, plant-based ingredients. Such products are perceived as gentle, efficient, and indulgent, particularly when produced from ethically-sourced botanicals and sustainable production processes. As there is greater health awareness and a focus on sustainability, consumers now link purity to luxury, driving demand for products containing rare flowers, algae extracts, and exotic essential oils.

This trend is also supported by international luxury brands introducing limited-edition ranges featuring organic or wild-harvested ingredients. From a scent containing ethically-sourced rose petals to a marine plankton-infused serum, such products enable brands to differentiate themselves and justify higher prices. Clear supply chains and environmentally friendly sourcing also appeal to Singapore's high-net-worth individuals who consider themselves conscious consumers, hence "natural" as an area of growth potential in the premium category.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 710 Million |

| USD Value 2030 | $ 830 Million |

| CAGR 2025-2030 | 2.64% |

| Largest Category | Premium Skin Care segment leads with 55% market share |

| Top Drivers | Ongoing Innovation Strengthening Brand Differentiation |

| Top Trends | Rising Demand for Personalisation and Distinct Brand Identity |

| Top Opportunities | Rising Preference for Natural and Ethical Formulations |

| Key Players | Clarins Pte Ltd, Chanel (S) Pte Ltd, Coty Asia Pte Ltd, L'Oréal (S) Pte Ltd, Estée Lauder Cosmetics Pte Ltd, Procter & Gamble (S) Pte Ltd, Shiseido (S) Co Pte Ltd, AmorePacific Singapore Pte Ltd, Christian Dior Singapore Pte Ltd, Kosé Singapore Pte Ltd and Others. |

Singapore Premium Beauty and Personal Care Market Segmentation

The largest segment in the Singapore Premium Beauty and Personal Care Market is skin care, with more than half of premium product sales. It is fueled by increasing consumer interest in keeping and improving nature-derived features, with consumers many of whom perceive high-quality formulations as a long-term investment in their overall wellbeing. Anti-ageing products are particularly in vogue, with consumers showing high demand for serums, creams, and treatments containing sophisticated ingredients such as peptides, retinol substitutes, and antioxidants. Products that provide both short-term and long-term benefits to the skin are thus a part of consumers' daily routine.

Perfumes and color cosmetics also command prominent positions in the upper-end. Perfumes, especially, are growing in popularity as consumers look for scents that describe who they are and how they feel. Increased interest in customized perfumes—whereby people can personalize notes for various moods or occasions—is demonstrating the way self-expression is becoming increasingly integral to personal care, in conjunction with functionality and daily use.

Top Companies in Singapore Premium Beauty and Personal Care Market

The top companies operating in the market include Clarins Pte Ltd, Chanel (S) Pte Ltd, Coty Asia Pte Ltd, L'Oréal (S) Pte Ltd, Estée Lauder Cosmetics Pte Ltd, Procter & Gamble (S) Pte Ltd, Shiseido (S) Co Pte Ltd, AmorePacific Singapore Pte Ltd, Christian Dior Singapore Pte Ltd, Kosé Singapore Pte Ltd, etc., are the top players operating in the Singapore Premium Beauty and Personal Care Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Singapore Premium Beauty and Personal Care Market Policies, Regulations, and Standards

4. Singapore Premium Beauty and Personal Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Singapore Premium Beauty and Personal Care Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Colour Cosmetics- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Eye Make-Up- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Facial Make-Up- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.3. Lip Products- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.4. Nail Products- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Fragrances- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Deodorants- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Hair Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5. Skin Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.1. Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.2. Facial Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.3. Hand Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.4. Skin Care Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.5. Sun Protection- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6. Bath and Shower- Market Insights and Forecast 2020-2030, USD Million

5.2.1.7. Baby and Child-specific Products- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By End User

5.2.2.1. Men’s- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Women’s- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Unisex- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Sales Channel

5.2.3.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Singapore Premium Colour Cosmetics Market Outlook, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Singapore Premium Fragrances Market Outlook, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Singapore Premium Deodorants Market Outlook, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Singapore Premium Hair Care Market Outlook, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. Singapore Premium Skin Care Market Outlook, 2020-2030F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product- Market Insights and Forecast 2020-2030, USD Million

10.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

11. Singapore Premium Bath and Shower Market Outlook, 2020-2030F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By End User- Market Insights and Forecast 2020-2030, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

12. Singapore Premium Baby and Child-specific Products Market Outlook, 2020-2030F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. L'Oréal (S) Pte Ltd

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Estée Lauder Cosmetics Pte Ltd

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Procter & Gamble (S) Pte Ltd

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Shiseido (S) Co Pte Ltd

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. AmorePacific Singapore Pte Ltd

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Clarins Pte Ltd

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Chanel (S) Pte Ltd

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Coty Asia Pte Ltd

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Christian Dior Singapore Pte Ltd

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Kosé Singapore Pte Ltd

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.