Singapore Alcoholic Drinks Market Report: Trends, Growth and Forecast (2026-2032)

By Type (Beer, Cider/Perry, RTDs, Spirits, Wine), By Alcohol Content (High, Medium, Low), By Flavor (Unflavored, Flavored), By Packaging Type (Glass Bottles, Tins, Plastic Bottles, Others), By Sales Channel (On-Trade, Off-Trade (Retail Offline, Retail Online))

- Food & Beverage

- Dec 2025

- VI0461

- 125

-

Singapore Alcoholic Drinks Market Statistics and Insights, 2026

- Market Size Statistics

- Alcoholic Drinks in Singapore is estimated at $ 5.13 Billion.

- The market size is expected to grow to $ 5.98 Billion by 2032.

- Market to register a CAGR of around 2.21% during 2026-32.

- Type Shares

- Beer grabbed market share of 45%.

- Beer to witness a volume CAGR of around 1.93%.

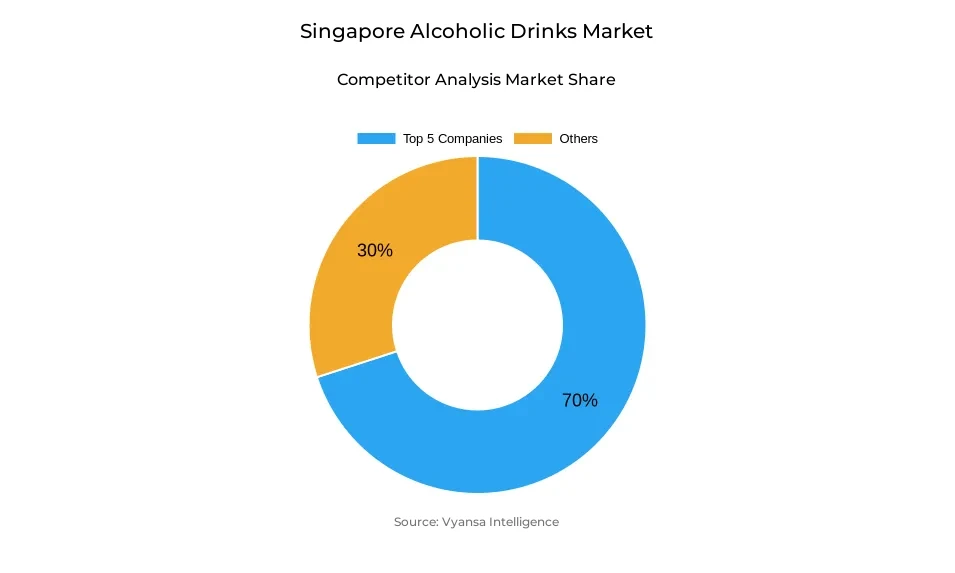

- Competition

- More than 10 companies are actively engaged in producing Alcoholic Drinks in Singapore.

- Top 5 companies acquired 70% of the market share.

- Treasury Wine Estates Ltd, Asahi Group Holdings Ltd, Pernod Ricard Groupe, Heineken NV, Carlsberg A/S etc., are few of the top companies.

- Sales Channel

- On-Trade grabbed 75% of the market.

Singapore Alcoholic Drinks Market Outlook

The Singapore Alcoholic Drinks Market is projected at $5.13 billion in 2025 and should continue growing steadily to $5.98 billion in 2032. Growth would be stimulated through a mix of premiumisation, innovation in flavours, and experiential consumption. Beer, as the largest category, is projected to experience a volume CAGR of approximately 1.93% driven by mid-range and craft-style products that find favour among mainstream and trend-conscious shoppers. Spirits and wine will remain driven by cocktail culture, mixology fashion, and premiumisation trends as end users seek increasingly high-quality, flavour-driven experiences.

On-trade channels will continue to be at the heart, accounting for 75% of the market, as bars, hotels, and restaurants continue to offer social and immersive drinking experiences. Big events, lifestyle festivals, and organized venue experience will underpin the on-trade's appeal, especially for beer and spirits. The off-trade channels of supermarkets and e-commerce, meanwhile, will rise steadily, providing convenience, choice, and access to premium and wellness-driven products, responsive to home consumption patterns.

Innovation will be instrumental in defining future growth. Brands will invest in low-ABV, non-alcoholic, and botanics-led products, in addition to flavour-forward limited-edition releases. Experiential marketing, such as pop-up events and digital activity, will remain crucial in terms of establishing emotional relationships with end users and building brand desirability.

The Singaporean end users outlook signals that Singaporean end users will increasingly value premium and value experiences, opting for deliberate, wellness-oriented, and culturally appropriate drinking occasions. Businesses that are able to integrate quality, creativity, and experiential interaction across both on-trade and off-trade channels will be most able to take the largest share of the growing market.

Singapore Alcoholic Drinks Market Growth Driver

Mindful Drinking and Health Wellness

Growing focus on responsible drinking and consumer well-being is shaping the Singapore Alcoholic Drinks Market. The end users increasingly desires low-ABV, alcohol-free, and health-centric drinks that enable them to have social and flavorful experiences without jeopardizing their well-being. The change inspires brands to innovate with no-alcohol wines, botany infusions, and low-sugar RTDs in a bid to achieve shifting tastes.

Bars, pubs, and retail brands proactively extend ranges to service this health-oriented end users group. By synchronizing product innovation with wellness trends, business can deepen end users involvement, build stronger brand loyalty, and tap emerging market opportunities. Mindful drinking not only transforms occasions of consumption but also stimulates innovation and makes wellness and restraint a key driver of growth within the market.

Singapore Alcoholic Drinks Market Trend

Rising Focus on Premiumisation & Flavour Innovation to Enhance End users Appeal

Premiumisation and flavour innovation are key trends in the Singapore Alcoholic Drinks Market. End users are attracted to quality drinks with standout flavours, international brands, and craft-style products that deliver a different and memorable drinking experience. This compels companies to bring out limited editions, test-product blends, and flavour-driven offerings that cater to trend-conscious end users.

Innovation cuts across the product to packaging, branding, and experiential activation, instilling deeper emotional connections with end users. The trend is all about creativity and differentiation, with brands pushing new combinations, international cues, and flavor experimentation to drive perceived value. Premiumisation and innovation remain key drivers of end users decisions and market trends.

Singapore Alcoholic Drinks Market Opportunity

Experiential and Culturally Resonant Products

The rising demand for experiential and culturally relevant products is opening new growth avenues for Singapore’s Alcoholic Drinks Market. Brands will continue to create limited-edition, hybrid, and culturally driven drinks that provide experiential experiences and memorable moments for end users. These products enable companies to connect with end users emotionally and socially.

Upcoming strategies will be centered on fusing storytelling, design, and lifestyle relevance into product launches. Festivals, pop-ups, and online campaigns will increase participation, as hybrid alcoholic and non-alcoholic innovations broaden customer choice. Through the use of experiential and culturally aligned products, companies can induce differentiation, loyalty, and sustained growth, securing a solid competitive edge in a mature and dynamic marketplace.

Singapore Alcoholic Drinks Market Segmentation Analysis

By Type

- Beer

- Cider/Perry

- RTDs

- Spirits

- Wine

The segment with highest market share under Type segment is beer, which controls approximately 45% of Singapore's Alcoholic Drinks Market. Beer's dominance is being driven by steady demand from a wide range of end users, drawn by convenience, brand appeal, and cultural acceptability. The category performs well particularly at mass social gatherings like Beerfest Asia, which drives involvement and benefits mainstream and premium beer brands.

Beer is projected to record a volume CAGR of nearly 1.93% in the next few years, reflecting its continued popularity and flexibility to changing tastes. Premiumisation, launching new innovative craft and international products, and engagement in experiential drinking experiences all contribute to maintaining beer's dominance. Sellers and brewers tactically balance quality with price to make beer remain relevant in Singapore's dynamic Alcoholic Drinks Market market.

By Sales Channel

- On-Trade

- Off-Trade

The segment with highest market share under sales channel is on-trade, with a market share of approximately 75% of the Singapore Alcoholic Drinks Market. The dominance of the on-trade channel represents the urban social culture of the city, where bars, pubs, and restaurants are the focal points for social drinking and experiential consumption. Channels like rooftop lounges and gastropubs spearhead demand through providing experiential environments, curated menus, and premium pours emphasis.

Even in the face of economic pressures and some movement towards home and off-trade consumption, on-trade is still the dominant channel because of its focus on environment, events, and bespoke experiences. Big festivals, innovative activations, and premium products place the on-trade category at the vanguard of industry expansion, continuing to be the preferred setting for Singaporeans who want social interaction and good liquor.

Top Companies in Singapore Alcoholic Drinks Market

The top companies operating in the market include Treasury Wine Estates Ltd, Asahi Group Holdings Ltd, Pernod Ricard Groupe, Heineken NV, Carlsberg A/S, Anheuser-Busch InBev NV, Diageo Plc, Tsingtao Brewery Co Ltd, Hite Jinro Co Ltd, Sapporo Holdings Ltd, etc., are the top players operating in the Singapore Alcoholic Drinks Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Singapore Alcoholic Drinks Market Policies, Regulations, and Standards

4. Singapore Alcoholic Drinks Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Singapore Alcoholic Drinks Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.1.2. By Quantity Sold in Million Litres

5.2. Market Segmentation & Growth Outlook

5.2.1. By Type

5.2.1.1. Beer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Cider/Perry- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. RTDs- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Spirits- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Wine- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Alcohol Content

5.2.2.1. High- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Medium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Low- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Flavor

5.2.3.1. Unflavored- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Flavored- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Packaging Type

5.2.4.1. Glass Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Tins- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Plastic Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Sales Channel

5.2.5.1. On-Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Off-Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6. By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Singapore Beer Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.1.2. By Quantity Sold in Million Litres

6.2. Market Segmentation & Growth Outlook

6.2.1. By Alcohol Content- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Flavor- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Singapore Cider/Perry Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.1.2. By Quantity Sold in Million Litres

7.2. Market Segmentation & Growth Outlook

7.2.1. By Alcohol Content- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Flavor- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Singapore Ready-to-Drink Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.1.2. By Quantity Sold in Million Litres

8.2. Market Segmentation & Growth Outlook

8.2.1. By Alcohol Content- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By Flavor- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Singapore Spirits Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.1.2. By Quantity Sold in Million Litres

9.2. Market Segmentation & Growth Outlook

9.2.1. By Alcohol Content- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By Flavor- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.4. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Singapore Wine Market Statistics, 2022-2032F

10.1.Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.1.2. By Quantity Sold in Million Litres

10.2.Market Segmentation & Growth Outlook

10.2.1. By Alcohol Content- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Flavor- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1.Company Profiles

11.1.1. Heineken NV

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Carlsberg A/S

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Anheuser-Busch InBev NV

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Diageo Plc

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Tsingtao Brewery Co Ltd

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Treasury Wine Estates Ltd

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Asahi Group Holdings Ltd

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Pernod Ricard Groupe

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Hite Jinro Co Ltd

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Sapporo Holdings Ltd

11.1.10.1. Business Description

11.1.10.2. Product Portfolio

11.1.10.3. Collaborations & Alliances

11.1.10.4. Recent Developments

11.1.10.5. Financial Details

11.1.10.6. Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type |

|

| By Alcohol Content |

|

| By Flavor |

|

| By Packaging Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.