Saudi Arabia Rebar Steel Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Deformed, Mild), By End Use (Residential Sector, Commercial Sector, Industrial Sector, Public Sector), By Process (Basic Oxygen Steelmaking, Electric Arc Furnace), By Finishing Type (Epoxy-Coated Rebar, Carbon Steel Rebar)

- Infrastructure

- Dec 2025

- VI0573

- 130

-

Saudi Arabia Rebar Steel Market Statistics and Insights, 2026

- Market Size Statistics

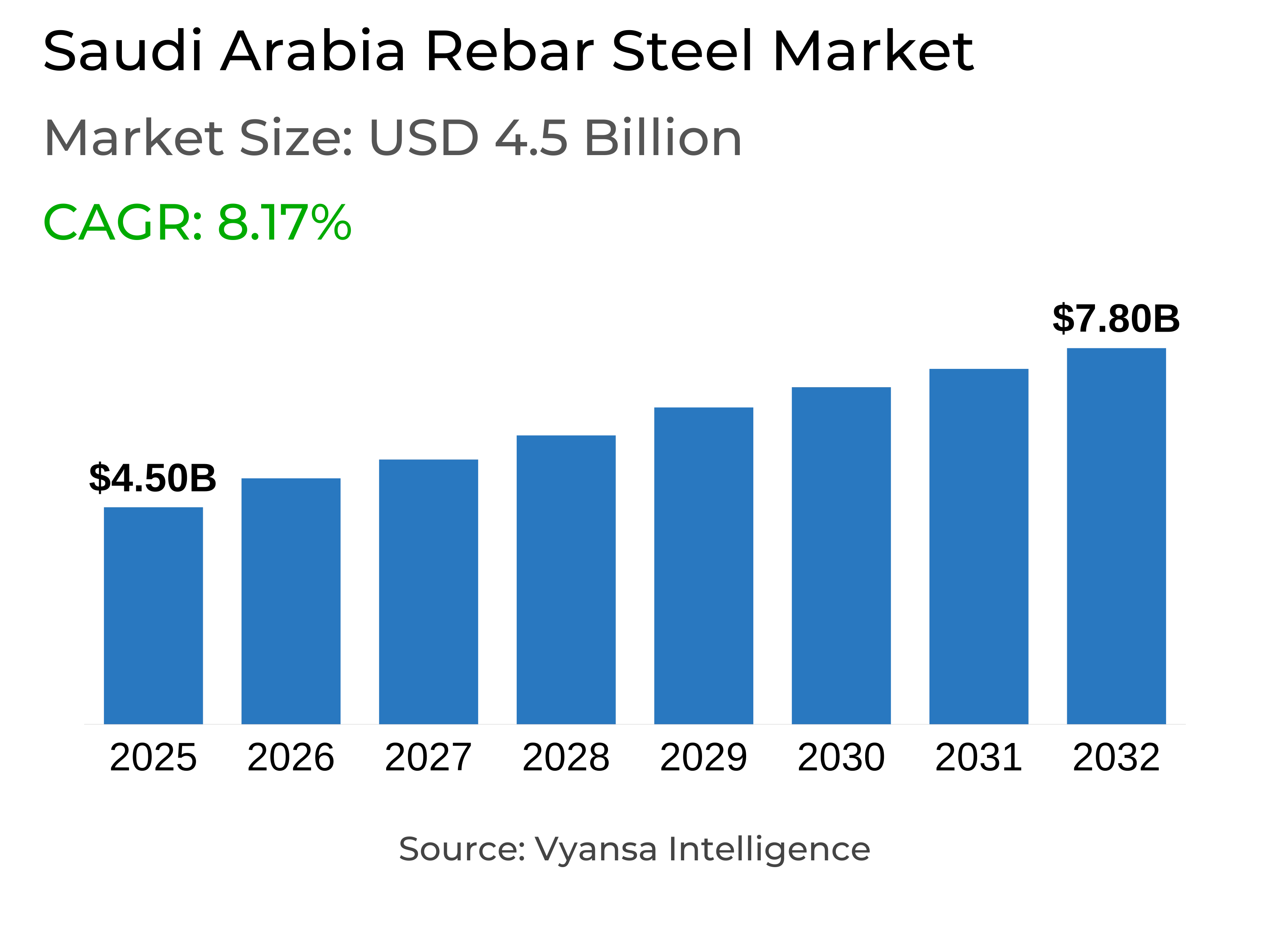

- Rebar Steel in Saudi Arabia is estimated at $ 4.5 Billion.

- The market size is expected to grow to $ 7.8 Billion by 2032.

- Market to register a CAGR of around 8.17% during 2026-32.

- By Product Type Shares

- Deformed grabbed market share of 70%.

- Competition

- More than 10 companies are actively engaged in producing Rebar Steel in Saudi Arabia.

- Top 5 companies acquired around 70% of the market share.

- Saudi National Steel Factory, Baghlaf Steel, Mass Steel, Saudi Iron & Steel Company (HADEED), Al Ittefaq Steel Products Co. etc., are few of the top companies.

- By End Use

- Public Sector grabbed 50% of the market.

Saudi Arabia Rebar Steel Market Outlook

Saudi Arabia is witnessing a strong upsurge in infrastructural expansion under Vision 2030, resulting in firm demand for rebar steel in residential, commercial, and industrial projects. Saudi Arabia's 2025 budget at SAR 1.3 trillion (USD 342.7 billion), with an increase in municipal services expenditure by 43.3% and SAR 191 billion in capital expenditure, reflects the government's resolve towards massive urban and industrial infrastructure. Large-scale development projects including Riyadh Metro, water infrastructure development, and giga projects such as the Red Sea Project and King Salman Park continue to drive rebar consumption, an indication of its pivotal use in reinforced concrete structures.

The Saudi Arabia Rebar Steel Market is projected at USD 4.5 billion in 2025 and is anticipated to reach USD 7.8 billion by 2032, at a CAGR of around 8.17% in 2026–2032. This growth is underpinned by non-oil economic diversification, increasing industrial production, and increasing construction activity. Industrial facilities have increased around 60% between 2016 and 2023, while manufacturing, chemical, and petroleum products manufacturing continues to grow, driving demand for high-strength and durable construction materials such as rebar directly.

By product type, deformed rebar leads the market with 70% market share, popular due to its ribbed surface, which allows for greater concrete adhesion, load-carrying capacity, and structural integrity. Its widespread application in residential complexes in cities, commercial buildings, and industrial complexes speaks volumes of its significance in supporting Saudi Arabia's high urbanization rate, anticipated to hit 90% by 2030. Leadership in the segment is an affirmation of the engineering standards in the country and the paramount importance of long-term structural integrity in mega infrastructure projects.

The largest market share is in the public sector at around 50%, fueled by government initiatives and huge capital investments in transport infrastructure. Developments such as sewage systems, tunnels, airports, and ports are just some of the examples of the level of public sector demand. With ongoing Vision 2030 projects, consistent government spending coupled with the take-up of technology in rebar manufacturing provides a consistent growth curve for long-term opportunity both for domestic producers and for industrial consumers throughout the Kingdom.

Saudi Arabia Rebar Steel Market Growth DriverAccelerating Infrastructure Expansion Driving Market Growth

Saudi Arabia is seeing an upsurge in infrastructure construction under Vision 2030, driving demand for rebar steel in key construction developments. The Kingdom's 2025 budget sees SAR 1.3 trillion (USD 342.7 billion) overall spending, with municipal services recording a 43.3% rise in actual expenditure over the 2024 approved budget. Capital spending came in at approximately SAR 191 billion in FY2024, backing up mega projects like the Red Sea Development, King Salman Park, Green Riyadh, and the Grand Mosque expansion. National Water Company's press release in May 2025 of 15 sewage infrastructure projects with a total value in excess of SAR 2.3 billion, including the SAR 774 million Eastern Tunnel Project in Jeddah, is an example of increasing demand for reinforced concrete structures using rebar steel.

The nation's diversification of its economy beyond oil continues to propel construction activity ahead, fueled by increasing manufacturing production and increasing urban infrastructure. Industrial facilities rose from 7,206 in 2016 to 11,549 in 2023, representing a 60% increase directly transferable to increased demand for construction inputs. With the manufacturing industry growing 11.1% from month to month in June 2025 and chemical and petroleum refining output increasing 15.3% and 18.7% respectively, growth in non-oil industries supports Saudi Arabia's reliance on high bar consumption for mass industrial and urban development initiatives.

Saudi Arabia Rebar Steel Market ChallengeVolatile Raw Material Prices Challenging Market Stability

The Saudi Arabia Rebar Steel Market continues to be plagued by common pitfalls brought about by volatility in international raw material prices that have a direct influence on production economics and market stability. The crude steel output of the Kingdom stood at 8.7 million tonnes in January–November 2024, down by 3.7% year on year. As a bright spot, output recovered by 8.2% in November 2024, but fluctuations in world commodity markets continue to raise uncertainty for domestic producers. Saudi Arabia was the second-ranked crude steel-producing Arab country after Egypt's 9.7 million tonnes in the same period, indicating regional competitiveness of the market and vulnerability to external supply chain dynamics.

Price fluctuations in significant raw materials like iron ore, scrap metal, and coal hinder production consistency and profitability. The sub-index for basic metals manufacturing fell 14.2% year-on-year in April 2025, which indicates cost-based production restrictions that impact local supply. Due to rebar's reliance on global commodity trends and geopolitical developments, manufacturers are turning towards diversified sourcing and cost management measures to protect against input volatility. Successful procurement strategies and localized raw material incorporation will be crucial in maintaining long-term competitiveness and anchoring pricing levels throughout the Saudi rebar steel sector.

Saudi Arabia Rebar Steel Market TrendIntegration of Advanced Manufacturing Technologies

The Market shows a significant change through the use of sophisticated manufacturing systems aimed at enhancing production efficiency and product quality. The manufacturing index rose 4.7% in 2024 and maintained its momentum with a 7% year-over-year increase in July 2025, GASTAT said. Manufacturing activity increased 7.4% in April 2025, sustained by refined petroleum and chemical products gains of 22.6% and 9.1%, respectively. This industrial performance reflects the Kingdom's enhanced ability to adopt advanced technologies that automate rebar production and respond to increasing regional demand for high-strength building materials.

Key producers like Hadeed, who are part of SABIC, keep annual production close to 5.5 million tonnes, further entrenching the company's position as a top supplier in the GCC. In January 2025, Hadeed's refusal to sustain stable prices for long steel products at SAR 2,400 (USD 639) per tonne reflected resilience in the face of market volatility. The continued expansion of the production index of non-oil, which increased 5.3% in 2024, is evidence of continued industrial modernization and technology uptake that increase domestic rebar production efficiency, minimize wastage, and support Saudi Arabia's strategic diversification of manufacturing ambition.

Saudi Arabia Rebar Steel Market OpportunityInfrastructure Mega-Projects Unlocking Market Potential

Saudi Arabia's Vision 2030 continues to create immense economic prospects for the rebar steel sector through high-level infrastructure investments. It has been spent around SAR 300 billion (USD 80 billion) on infrastructure building in roads, railways, and public facilities, supplemented by SAR 191 billion in capital spending in FY2024. Infrastructure and transportation spending increased by 16.5% in 2024 on account of expanding airports, ports, railways, and public facilities that are based heavily on rebar-based reinforcement structures. These types of projects are a testament to the central contribution of rebar steel to the realization of the Kingdom's long-term industrial and urban development goals.

High-profile schemes such as the SAR 86 billion Riyadh Metro and several water infrastructure projects drive sustained public and private sector demand. The 43.3% rise in municipal services spending in 2024 alongside double-digit manufacturing growth highlights the rising rate of construction activity. This continued infrastructure growth reinforces market opportunities for rebar steel manufacturers, with continuous consumption in industrial, residential, and transportation developments. With the development of Vision 2030 projects over time, the prospects for localized rebar manufacturing and downstream investments are anticipated to strengthen up to 2032.

Saudi Arabia Rebar Steel Market Segmentation Analysis

By Product Type

- Deformed

- Mild

The deformed rebar segment is the leading segment in the Saudi Arabia Rebar Steel Market with around 70% market share, making it the first choice of reinforcement material in all building applications. Its textured, ribbed surface improves adhesion to concrete, providing enhanced load-carrying capacity and structural strength in reinforced concrete structures. The Kingdom's SAR 1.3 trillion 2025 budget focuses on grand-scale construction and infrastructure projects heavily dependent on deformed rebar for stability, primarily in residential compounds, commercial high-rise buildings, and industrial plants in cities such as Riyadh, Jeddah, and Dammam.

This assumes the nation's engineering standards prioritizing structure robustness and long-term safety. With 84% of Saudi Arabia's population living in cities in 2022 and urbanization expected to be at 90% in 2030, ongoing need for strong reinforcement solutions supports deformed rebar's stronghold. The 70% market share of the segment demonstrates its critical position in helping the country develop its urbanization and infrastructure evolution under Vision 2030, which ranks it as the most pivotal product type leading the market during 2026–2032.

By End Use

- Residential Sector

- Commercial Sector

- Industrial Sector

- Public Sector

The public sector holds the major share of around 50% in the Saudi Arabia Rebar Steel Market due to government-initiated infrastructure and building projects. Public spending of SAR 191 billion in FY2024 and SAR 1.3 trillion FY2025 total budget allocation reflect the state's priority in developing cutting-edge transportation networks, water supply systems, and civic infrastructure. Infrastructure and transport spending jumped 16.5% in 2024 over the budgeted amount, highlighting rebar steel's critical importance in constructing airports, seaports, railroads, and public buildings.

There are notable government-sponsored projects, such as the 15 sewage infrastructure schemes with a value of SAR 2.3 billion and the SAR 774 million Eastern Tunnel Project in Jeddah, that represent the extent of the public sector requirement. Spending on municipal services increased by 43.3% in 2024, indicating the scale of giga projects that need to be heavily reinforced with rebar. The concentration of this 50% market share in the public sector points to its importance to the overall consumption of rebar, with Vision 2030's implementation of national infrastructure programs set to continue shaping market development and stability up to 2032.

Top Companies in Saudi Arabia Rebar Steel Market

The top companies operating in the market include Saudi National Steel Factory, Baghlaf Steel, Mass Steel, Saudi Iron & Steel Company (HADEED), Al Ittefaq Steel Products Co., Rajhi Steel Industries Company Ltd., Watania Steel Factory Corporation, Al Yamamah Company for Reinforcing Steel Bars, Madar Building Materials, LLC, Bahra Steel Co., etc., are the top players operating in the Saudi Arabia Rebar Steel Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Saudi Arabia Rebar Steel Market Policies, Regulations, and Standards

4. Saudi Arabia Rebar Steel Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Saudi Arabia Rebar Steel Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.1.2. By Quantity Sold in Tons

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Deformed- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Mild- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By End Use

5.2.2.1. Residential Sector- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Commercial Sector- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Industrial Sector- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Public Sector- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Process

5.2.3.1. Basic Oxygen Steelmaking- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Electric Arc Furnace- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Finishing Type

5.2.4.1. Epoxy-Coated Rebar- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Carbon Steel Rebar- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Saudi Arabia Deformed Rebar Steel Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.1.2. By Quantity Sold in Tons

6.2. Market Segmentation & Growth Outlook

6.2.1. By End Use- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Process- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Finishing Type- Market Insights and Forecast 2022-2032, USD Million

7. Saudi Arabia Mild Rebar Steel Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.1.2. By Quantity Sold in Tons

7.2. Market Segmentation & Growth Outlook

7.2.1. By End Use- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Process- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Finishing Type- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1. Saudi Iron & Steel Company (HADEED)

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2. Al Ittefaq Steel Products Co.

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3. Rajhi Steel Industries Company Ltd.

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4. Watania Steel Factory Corporation

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5. Al Yamamah Company for Reinforcing Steel Bars

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6. Saudi National Steel Factory

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7. Baghlaf Steel

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8. Mass Steel

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9. Madar Building Materials, LLC

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Bahra Steel Co.

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By End Use |

|

| By Process |

|

| By Finishing Type |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.