UAE Lightweight Aggregates Market Report: Trends, Growth and Forecast (2026-2032)

Aggregate Type (Lightweight Expanded Clay Aggregate, Sintered Lightweight Aggregate, Fly Ash Lightweight Aggregate, Foam/Cellular Concrete, Others), Particle Size (Fine, Medium, Coarse), Application (Building & Construction (Residential, Commercial), Infrastructure (Roads & Bridges, Railways & Metro Systems, Marine Structures, Airports & Runways), Oil & Gas, Energy, Chemical & Petrochemical, Others)

- Infrastructure

- Feb 2026

- VI0679

- 115

-

UAE Lightweight Aggregates Market Statistics and Insights, 2026

- Market Size Statistics

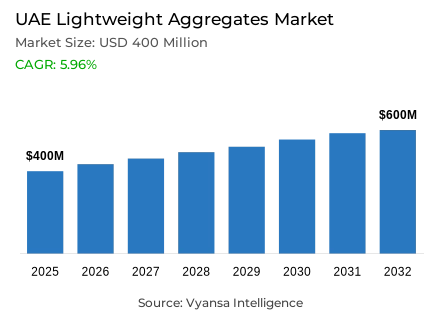

- Lightweight aggregates in UAE is estimated at USD 400 million.

- The market size is expected to grow to USD 600 million by 2032.

- Market to register a cagr of around 5.96% during 2026-32.

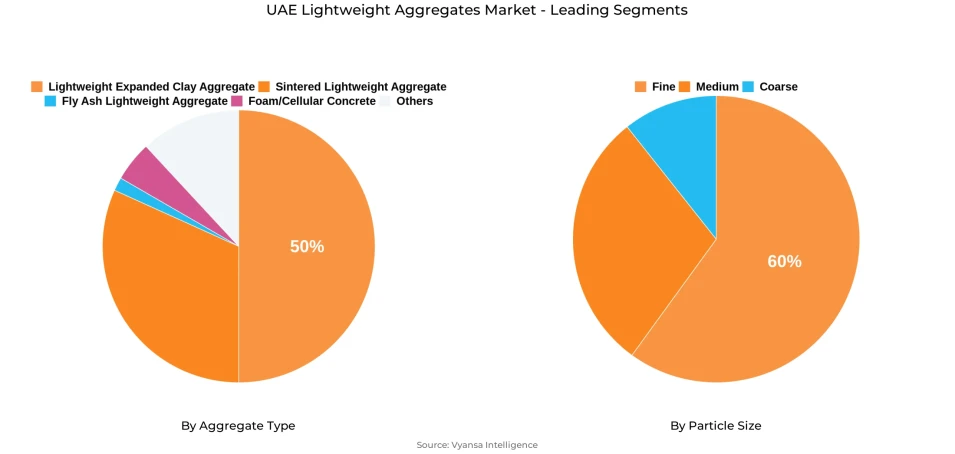

- Aggregate Type Shares

- Lightweight expanded clay aggregate grabbed market share of 50%.

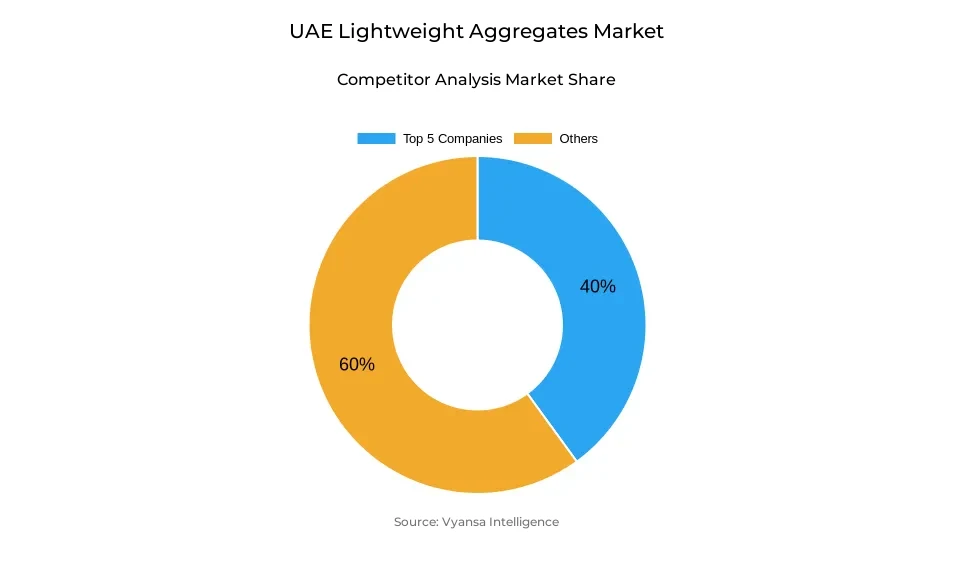

- Competition

- More than 10 companies are actively engaged in producing lightweight aggregates in UAE.

- Top 5 companies acquired around 40% of the market share.

- Arcosa; Leca; Liapor; LafargeHolcim; Holcim Ltd etc., are few of the top companies.

- Particle Size

- Fine grabbed 60% of the market.

UAE Lightweight Aggregates Market Outlook

The UAE lightweight aggregates market is experiencing consistent growth, fueled by the nation's constant drive towards sustainable and energy-efficient building techniques. With an estimated value of about USD 400 million in 2025, the market is expected to grow to around USD 600 million in 2032, with a cagr of around 5.96% from 2026-2032. This expansion is in line with the UAE's green focus on standards like the Estidama Pearl Rating System, which favors the adoption of green m`aterials that minimize structural load and improve building performance. Already, more than 7,000 buildings in Abu Dhabi have been rated under such systems, and sustainable construction is now a primary source of demand for lightweight aggregates.

Government policies encouraging waste recycling and circular building further drive market growth. The UAE's target for recycling almost half of its waste stream has boosted demand for aggregates produced with recycled or substitute raw materials, providing end consumers with effective and eco-friendly alternatives. Such products contribute to national sustainability goals while enhancing cost effectiveness and lowering landfill waste.

Lightweight Expanded Clay Aggregate dominates the market by product type with a 50% share on account of its low weight, high strength, and superior thermal insulation-properties that fit the UAE's climate and energy efficiency requirements. Likewise, Fine lightweight aggregates dominate the market by particle size with a 60% share through their preference for precast and modular construction, which require precision and even surface finishes.

Looking forward, ongoing spending on high-rise buildings, smart cities, and transport infrastructure will underpin healthy demand for lightweight aggregates. As big projects grow, producers that emphasize quality, compliance, and innovation will be best positioned to address changing construction needs and exploit new opportunities in the UAE's increasing sustainable materials market.

UAE Lightweight Aggregates Market Growth DriverGrowing Emphasis on Sustainable Construction Materials

Initiatives to encourage sustainable construction practices are redefining demand for lightweight aggregates in the UAE. With the emphasis by the country on green standards such as the Estidama Pearl Rating System, developers are opting more and more for environmentally friendly materials that lower structural loads and increase energy efficiency. In Abu Dhabi, over 7,000 buildings were already awarded green building ratings up to 2023, indicative of the increasing demand for sustainable solutions in both public and private developments. Lightweight aggregates play a critical role in this shift towards resource efficiency and better environmental performance.

Government programs further reinforce this transition to greener products. The UAE's ambition to recycle almost half of its waste stream is part of a greater commitment to circular economy methods. Lightweight aggregates made from recycled or substitute raw materials advance these national goals by providing end consumers with materials consistent with both construction productivity and sustainability requirements. This increasing focus makes lightweight aggregates an integral element in contemporary, climate-resilient infrastructure.

UAE Lightweight Aggregates Market ChallengeStringent Standards Shaping Material Certification Landscape

Producers are increasingly finding it challenging to cope with the UAE's strict certification and compliance regulations for construction materials. Regulatory bodies implement stringent standards to guarantee structural stability, safety, and sustainability, which cover all building materials including aggregates. Practically, a high percentage of material approval requests are delayed as a result of missing certification or performance testing. Although these controls maintain market quality, they also prolong project durations and increase cost for manufacturers looking to obtain approval.

Achieving such stringent standards necessitates ongoing investment in research, documentation, and third-party certification. For smaller producers, this can restrict product innovation and slow market entry. While the regulatory framework protects construction excellence, it creates operational complexity along the supply chain. Manufacturers are therefore forced to emphasize advanced quality assurance systems and responsive R&D tactics to achieve compliance and stay competitive in this heavily regulated environment.

UAE Lightweight Aggregates Market TrendShift Toward Recycled and Circular Construction Materials

An increasing emphasis on circular construction practices is shaping material selection across the UAE’s infrastructure sector. Increased application of recycled aggregates, which are processed construction and demolition waste, demonstrates the industry's support for landfill pressure mitigation and efficiency in resource recovery. Significant recycling quantities have been reported by a number of municipalities for incorporation in road, infrastructure, and urban development projects, which suggests active take-up of recycled inputs.

These recycled light aggregates thus give double benefits in terms of sustainability and cost effectiveness, thus becoming even more appealing to end customers looking for environmentally friendly solutions. With green certification and carbon emissions reduction targets going mainstream, recycled products will also be at the forefront in addressing both performance and policy targets. This shift points towards the construction industry being aligned with the UAE's vision for long-term sustainable and circular development.

UAE Lightweight Aggregates Market OpportunityInfrastructure Expansion Emphasizes Market Growth

Prolonged investment in massive construction and city infrastructure remains a significant expansion area for lightweight aggregate suppliers. The government of the UAE has allocated considerable budgetary allocations to new projects, such as high-rise developments, transport systems, and city revamps. All these require high-performance products that can decrease the weight of buildings without compromising durability and performance, where lightweight aggregates are a definite competitive advantage.

These megaprojects also create avenues for producers to provide tailored aggregate mixes appropriate to project-specific performance and sustainability needs. With the growth of smart cities and intermodal transport networks, demand for lightweight aggregates will increase steadily. This infrastructure-driven momentum not only drives innovation but also stimulates supplier-contractor collaboration to fulfill changing construction standards and project design specifications.

UAE Lightweight Aggregates Market Segmentation Analysis

By Aggregate Type

- Lightweight Expanded Clay Aggregate

- Sintered Lightweight Aggregate

- Fly Ash Lightweight Aggregate

- Foam/Cellular Concrete

- Others

The most prominent segment under the aggregate type segment is the Lightweight Expanded Clay Aggregate with a dominant share of aroud 50%. It is because of the favorable attributes such low density, high strength, and excellent thermal insulation properties-attributes that address the UAE's stringent energy efficiency and sustainability goals. Reduced building weight is also achieved through these aggregates, allowing cost savings in structural design and foundation.

The supremacy is also solidified by compatibility with the hot and humid climate of the region since expanded clay aggregates efficiently control heat transfer and moisture accumulation. Growing adoption of the materials in sustainable and large-scale construction works continues to solidify their dominance, guaranteeing stable demand among developers and end-users seeking high-quality, energy-efficient construction results.

By Particle Size

- Fine

- Medium

- Coarse

Under particle size segment, fine lightweight aggregates constitute the largest share of around 60%. They are used extensively in lightweight concrete, precast components, and concrete blocks because of their better workability and surface finish. Fine aggregates increase the flow of the concrete, making moldability more efficient and enabling more uniform, smoother structures.

Their popularity is a reflection of the increasing uptake of prefabricated and modular construction methods in the UAE that are underpinned by precision casting as well as uniform material performance. The fine aggregate segment enjoys the advantage of flexibility and affordability, due to which it is the developers' and end users' go-to option for residential, commercial, as well as infrastructure developments. The segment is likely to continue its dominating position in the future as prefabrication continues to grow.

List of Companies Covered in UAE Lightweight Aggregates Market

The companies listed below are highly influential in the UAE lightweight aggregates market, with a significant market share and a strong impact on industry developments.

- Arcosa

- Leca

- Liapor

- LafargeHolcim

- Holcim Ltd

- CEMEX S.A.B. de C.V.

- CRH plc

- Boral Limited

- Norlite

- Charah Solutions

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UAE Lightweight Aggregate Market Policies, Regulations, and Standards

4. UAE Lightweight Aggregate Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UAE Lightweight Aggregate Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Aggregate Type

5.2.1.1. Lightweight Expanded Clay Aggregate- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sintered Lightweight Aggregate- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Fly Ash Lightweight Aggregate- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Foam/Cellular Concrete- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Particle Size

5.2.2.1. Fine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Medium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Coarse- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Building & Construction- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Infrastructure- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1. Roads & Bridges- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2. Railways & Metro Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.3. Marine Structures- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.4. Airports & Runways- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Oil & Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Energy- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Chemical & Petrochemical- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. UAE Lightweight Expanded Clay Aggregate Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Particle Size- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7. UAE Sintered Lightweight Aggregate Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Particle Size- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8. UAE Fly Ash Lightweight Aggregate Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Particle Size- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9. UAE Foam/Cellular Concrete Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Particle Size- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. LafargeHolcim

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Holcim Ltd

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. CEMEX S.A.B. de C.V.

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. CRH plc

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Boral Limited

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Arcosa

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Leca

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Liapor

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Norlite

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Charah Solutions

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Aggregate Type |

|

| By Particle Size |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.