Saudi Arabia Construction Glass Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Annealed Glass, Tempered Glass, Laminated Glass, Insulated Glass, Others (Coated, Patterned, Decorative, Wired, Extra clear, etc.)), By Technology (Float Glass, Rolled Glass, Sheet Glass), By Application (Residential, Commercial, Industrial, Infrastructure)

- Infrastructure

- Jan 2026

- VI0759

- 115

-

Saudi Arabia Construction Glass Market Statistics and Insights, 2026

- Market Size Statistics

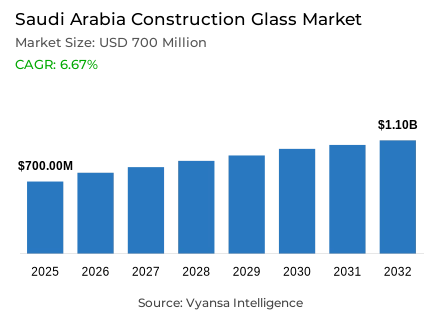

- Construction glass in Saudi Arabia is estimated at USD 700 million in 2025.

- The market size is expected to grow to USD 1.1 billion by 2032.

- Market to register a cagr of around 6.67% during 2026-32.

- Product Type Shares

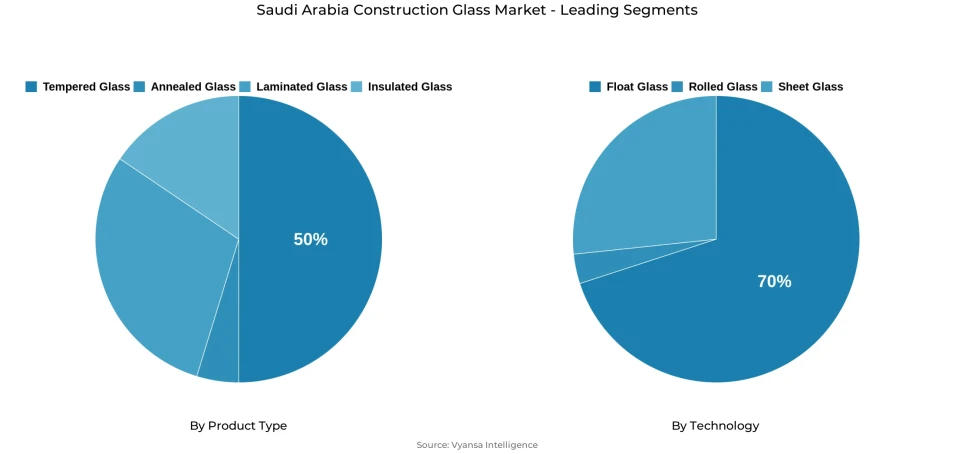

- Tempered glass grabbed market share of 50%.

- Competition

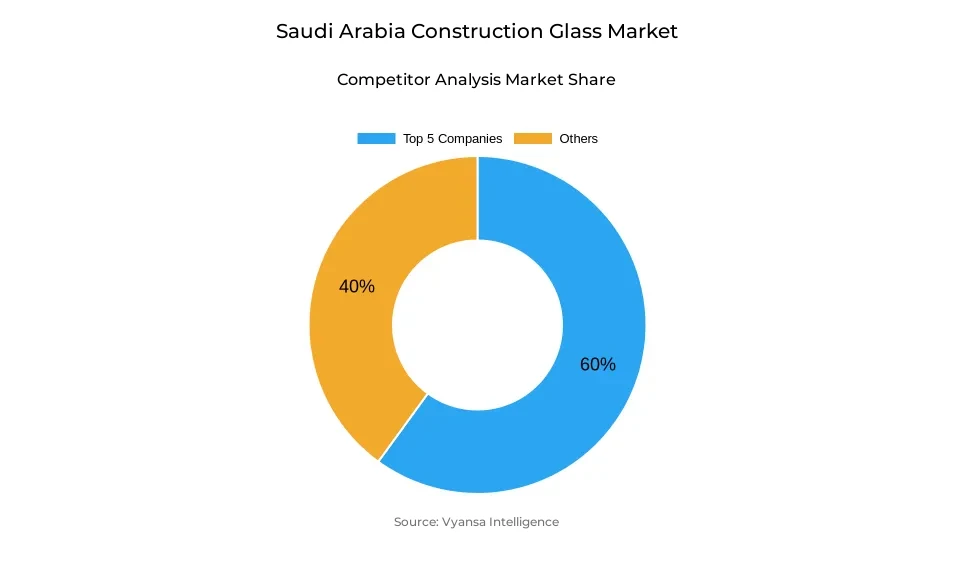

- More than 10 companies are actively engaged in producing construction glass in Saudi Arabia.

- Top 5 companies acquired around 60% of the market share.

- Komate Glass; Arabian (Processing) Glass Co.; Glass Specialized Industries; Obeikan Glass Company; Saudi American Glass Company Limited etc., are few of the top companies.

- Technology

- Float glass grabbed 70% of the market.

Saudi Arabia Construction Glass Market Outlook

Saudi Arabia's construction glass market is observing high growth, significantly propelled by Vision 2030's mega development initiatives and sustained government infrastructure expenditure. The market, which stands at approximately USD 700 million in 2025, is estimated to grow to about USD 1.1 billion by 2032, expanding at a CAGR of almost 6.67% over the period from 2026-2032. It is driven by the upsurge in residential, industrial, and commercial construction, and the swift development of mega-projects like NEOM, Qiddiya, and the Red Sea Project, which require high-performance, energy-efficient glass products.

Government initiatives to diversify the economy have resulted in heavy investment in urban renewal and green infrastructure. With SAR 1.3 trillion (USD 346.6 billion) of the 2025 national budget earmarked for building and infrastructure, the need for higher-performance materials increases. The focus on sustainability and energy efficiency in Vision 2030 has further boosted the use of sustainable and smart glass products for the contribution to lower energy consumption and improved building performance.

Tempered glass has the largest share of products at around 50% due to its high safety, strength, and adherence to Saudi standards in buildings. Its heat resistance and durability make it most apt for the desert climate of the Kingdom and for applications with structural stability requirements. Float glass, on the other hand, leads the technology segment with a 70% share based on its cost-effectiveness, scalability, and capacity to manufacture large-sized high-quality sheets of glass that suit contemporary architecture.

As continuing digitalization, smart city growth, and growing use of intelligent glass systems, the construction glass market in Saudi Arabia will continue to grow strongly. Sustained public investment coupled with advancing technology will keep the market central to the country's sustainable future in construction.

Saudi Arabia Construction Glass Market Growth DriverMassive Infrastructure Investment Accelerates Market Expansion

Saudi Arbia is experiencing unprecedented growth in the construction sector, driven by Vision 2030's revolutionary agenda and massive-scale infrastructure investments. The government allocated SAR 1.3 trillion (USD 346.6 billion) in the 2025 national budget to infrastructure projects and construction in response to its long-term development ambitions. The worth of contracted construction projects increased to USD 97 billion in 2023 from USD 60 billion in 2022, making Saudi Arabia the world's biggest construction market. The momentum is creating enormous demand for construction materials, especially high-end glass products, in residential, commercial, and industrial markets.

The Kingdom's diversification plan based on mega-projects like NEOM, Qiddiya, and the Red Sea Project continues to hasten material demand. These projects need high-performance glass solutions that are energy-efficient, structurally strong, and visually engaging. Through ongoing public investment and steady project implementation, construction glass continues to be part of the country's urbanization experience.

Saudi Arabia Construction Glass Market ChallengeShortage of Skilled Labor Impacts Construction Efficiency

The underlying shortage of a steady workforce is a significant challenge to Saudi Arabia's rapidly expanding construction industry. More than 70% of contractors indicate challenges in accessing skilled technicians and general laborers who can match rising project requirements. The sector has approximately 2.1 million employees, but still struggles with skill gaps and safety regulation shortfalls affecting project quality and schedule. This shortage has fueled labor expense increases and decelerated installation speed for sophisticated materials such as high-construction glass systems.

On top of this, increasing machinery and equipment hire expenses-increased by approximately 1.8% every year-add to the pressure on project budgets. The scarce availability of experienced workers restricts the effective utilization of glass technologies that involve technical skills in their handling, fitting, and finishing. Therefore, the gap in skills is essential to bridge in order to enhance efficiency and maintain the speedy construction pace in line with Vision 2030 targets.

Saudi Arabia Construction Glass Market TrendIntegration of Digital Technologies Reshapes Construction Practices

Saudi Arabia's construction environment is embracing leading-edge digital technologies that reset industry norms and project efficiency. The general use of Building Information Modeling (BIM) enables accurate 3D visualization and coordinated project planning, further improving accuracy in massive developments. The Saudi Contractors Authority's digitalization programs and the adoption of automation at mega-projects such as NEOM are further proof of the Kingdom's leadership in construction technology uptake.

Smart building integration is quickly progressing, with artificial intelligence, robotics, and the Internet of Things becoming the core drivers of construction processes. Buildings now account for nearly 80% of Saudi Arabia's electricity consumption, promoting a strong drive toward smart and energy-efficient buildings. The shift creates need for intelligent glass solutions that can integrate into automated building management systems, leading to lower energy consumption and higher sustainability of urban environments in the modern world.

Saudi Arabia Construction Glass Market OpportunitySustainability Goals Foster Demand for Energy-Efficient Glass

Saudi Arabia's increasing focus on sustainability in the environment is changing the face of its construction glass sector. The Kingdom, under Vision 2030, has emerged as a green construction leader in the region with 2,000 out of the 5,000 Arab green certified buildings.

The Ministry of Housing Mostadam rating system sets performance targets that prioritize reducing energy intensity by at least 30% as a benchmark for green financing eligibility. As part of the Saudi Green Initiative-10 billion trees planted and carbon neutrality by 2060-developers increasingly choose energy-efficient glass, smart glazing, and other sustainable materials. These strategies open profitable opportunities for end users requiring robust, high-performance glass solutions that promote energy savings and environmental protection.

Saudi Arabia Construction Glass Market Segmentation Analysis

By Product Type

- Annealed Glass

- Tempered Glass

- Laminated Glass

- Insulated Glass

Tempered Glass holds the largest market share, accounting for around 50% of the Saudi Arabia construction glass market. Its widespread adoption is attributed to its superior safety properties and compliance with Saudi building standards requiring enhanced structural resilience. The material’s thermal resistance and strength make it ideal for the Kingdom’s harsh desert climate and for large-scale projects demanding durability and safety.

This dominance fits with the country's emphasis on high-quality construction and compliance with international safety standards. Vision 2030's banner projects, ranging from commercial skyscrapers to smart cities, increasingly depend on tempered glass for both functionality and aesthetic appeal. Its capacity for impact resistance, reduced breakage risk, and long-term stability makes tempered glass the choice of end users and developers across the country.

By Technology

- Float Glass

- Rolled Glass

- Sheet Glass

Float Glass is the dominant technology segment, with about 70% market share in the Saudi Arabia construction glass market. This is due to the float process's capacity for producing large, uniform sheets of high-clarity glass for various architectural uses. The technology supports mass-scale and uniform production, maintaining quality and accuracy necessary for contemporary construction requirements.

The scalability of float glass production perfectly fits with the vast infrastructure plans of Saudi Arabia. Being cost-effective as well as compatible with energy-saving coatings makes it a prime material in high-rise construction, commercial buildings, and urban renewal projects. With Vision 2030 projects going at full throttle, float glass technology facilitates fast supply chain management and strengthens the nation as a global construction leader.

List of Companies Covered in Saudi Arabia Construction Glass Market

The companies listed below are highly influential in the Saudi Arabia construction glass market, with a significant market share and a strong impact on industry developments.

- Komate Glass

- Arabian (Processing) Glass Co.

- Glass Specialized Industries

- Obeikan Glass Company

- Saudi American Glass Company Limited

- Saudi Guardian International Float Glass Co.

- Zamil Glass Industries

- Alma Glass Co.

- DimGlass

- Seele Saudi Arabia

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Saudi Arabia Construction Glass Market Policies, Regulations, and Standards

4. Saudi Arabia Construction Glass Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Saudi Arabia Construction Glass Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Annealed Glass- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Tempered Glass- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Laminated Glass- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Insulated Glass- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Others (Coated, Patterned, Decorative, Wired, Extra clear, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Technology

5.2.2.1. Float Glass- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Rolled Glass- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Sheet Glass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Infrastructure- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Saudi Arabia Annealed Glass Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7. Saudi Arabia Tempered Glass Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8. Saudi Arabia Laminated Glass Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9. Saudi Arabia Insulated Glass Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Obeikan Glass Company

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Saudi American Glass Company Limited

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Saudi Guardian International Float Glass Co.

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Zamil Glass Industries

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Alma Glass Co.

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Komate Glass

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Arabian (Processing) Glass Co.

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Glass Specialized Industries

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. DimGlass

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Seele Saudi Arabia

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Technology |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.