Saudi Arabia Crane Rental Market Report: Trends, Growth and Forecast (2026-2032)

Crane Type (Mobile Crane, Fixed Crane, Marine/Offshore Crane, Others), Lifting Capacity (Up to 150 Tons, 151-300 Tons, 301-600 Tons, Above 600 Tons), Application (Construction & Infrastructure, Oil & Gas, Mining & Excavation, Others)

- Infrastructure

- Dec 2025

- VI0621

- 115

-

Saudi Arabia Crane Rental Market Statistics and Insights, 2026

- Market Size Statistics

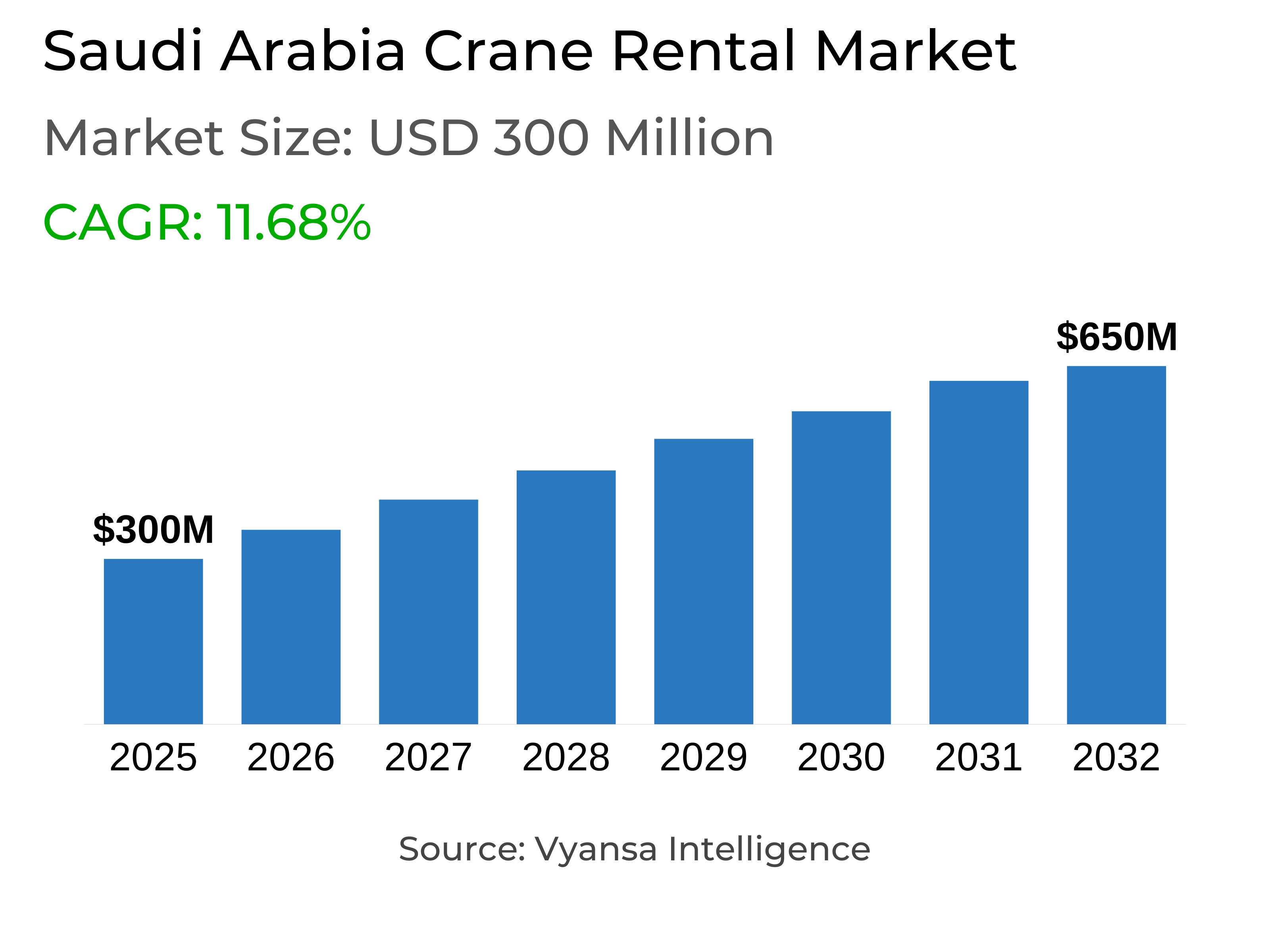

- Crane rental in saudi arabia is estimated at USD 300 million.

- The market size is expected to grow to USD 650 million by 2032.

- Market to register a cagr of around 11.68% during 2026-32.

- Crane Type Shares

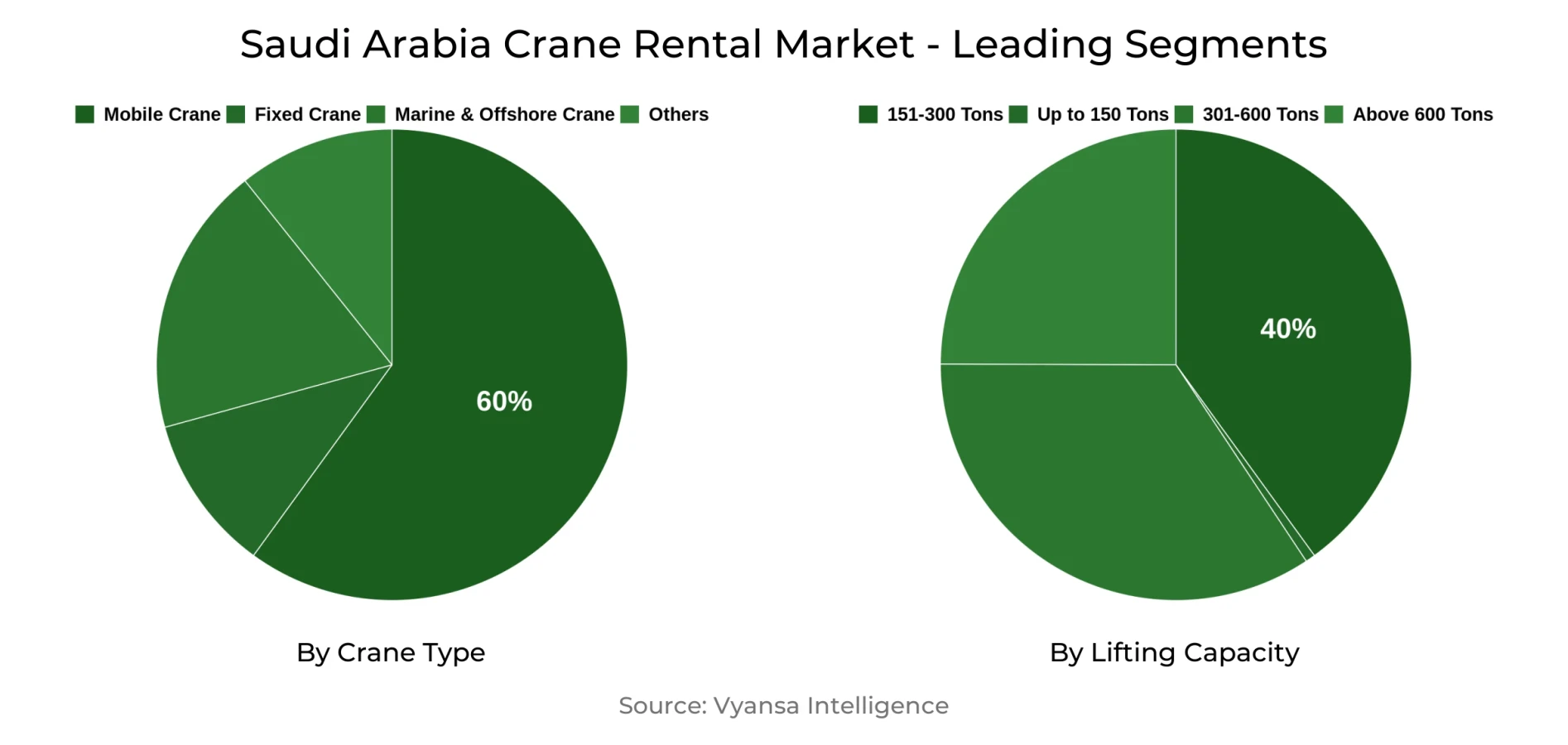

- Mobile cranes grabbed market share of 60%.

- Competition

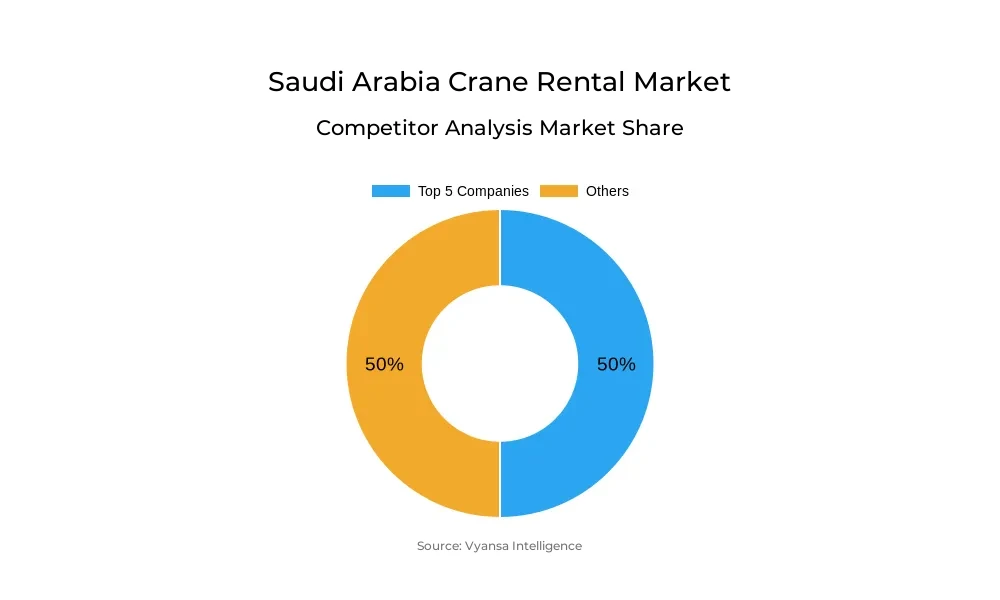

- Saudi arabia crane rental market is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 50% of the market share.

- Sarens Nass Middle East, The Crane Club, Tamimi Rentals, Arabian Machinery & Heavy Equipment Company, Bin Quraya etc., are few of the top companies.

- Lifting Capacity

- 151-300 tons grabbed 40% of the market.

Saudi Arabia Crane Rental Market Outlook

Saudi Arabia's crane rental industry is experiencing robust growth as Vision 2030 transitions from the planning to implementation stage. The industry, which was worth approximately USD 300 million in 2025, is anticipated to grow to USD 650 million by 2032 at a CAGR of close to 11.68% from 2026-2032. The surge in giga-projects such as NEOM, Diriyah Gate, and the Red Sea Project-together worth over USD 196 billion-has created sustained demand for crane rentals to support large-scale assembly and infrastructure construction. End users increasingly prefer rentals over ownership to reduce capital costs while maintaining access to advanced, project-specific machinery.

Speedy infrastructure growth in Riyadh, Jeddah, and Dammam continues to provide steady demand for rental business. Mobile cranes are the leaders with a 60% market share because of their adaptability and capacity to function effectively at multiple locations. Mobility and rapid setup qualify them as indispensable for mid-rise construction, modular, and bridge projects. Tower and fixed cranes operate niche high-rise demand but are secondary overall in usage.

The 151-300 tons lifting capacity category leads with a 40% market share, as it offers the right balance between operational efficiency and cost-effectiveness. These cranes are widely used for structural steel placement, industrial installations, and medium-scale infrastructure projects. The segment’s adaptability to varied project requirements ensures consistent demand across sectors.

Technological integration, such as AI, telematics, and IoT-connected systems, is further redefining crane operations through enhanced efficiency, safety, and predictive maintenance. With consistent infrastructure investment and digitalization quickening under Vision 2030, crane rentals will continue to be a vital pillar of Saudi Arabia's construction infrastructure through 2032.

Saudi Arabia Crane Rental Market Growth Driver

Vision 2030 Infrastructure Expansion Stimulates Equipment Demand

Saudi Vision 2030 has progressed into mass-scale implementation, fueling a boom in crane rental demand on giga-projects worth $196 billion-a 20% increase from 2024. Projects like NEOM ($24 billion), Diriyah Gate ($63 billion), and the Red Sea Project necessitate massive heavy lifting for assembly and installation. The construction industry accounts for 61% of total awarded contracts, affirming its central position in economic transformation. End users continue to prefer rental over ownership to control capital expenses and access high-end, project-specific cranes that conform to construction schedules. This increasing demand is a key market driver that enhances operational flexibility and utilization efficiency in large-scale projects.

Moreover, the ongoing infrastructure expenditure under Vision 2030 sustains a strong project pipeline that ensures steady fleet utilization and stable revenues for rental companies. Metropolitan hubs like Riyadh, Jeddah, and Dammam continue to be major demand points, supplemented by industrial areas growing under government-private sector programs. Fast deployment-capable mobile cranes with terrain versatility are necessary for these far-flung locations. The sustained project activity guarantees stable long-term demand until 2032, making crane rentals a central part of Saudi Arabia's construction program.

Saudi Arabia Crane Rental Market Challenge

Regulatory Compliance Elevates Operational Expenditure

Improved safety regulations in Saudi Arabia have driven up operating expenses for crane rental companies. The Ministry of Labor and Social Development applies rigorous workplace safety measures involving written policies, exhaustive risk evaluations, and training for the operators. The Saudi Building Code also requires scaffolding protocols, fall protection measures, and recurring site inspections. Such requirements entail enormous investments in safety equipment, the training of the workforce, and certification of the equipment. Small companies are especially hard-pressed to keep up with such high standards, restricting their capacity to compete with bigger, better-capitalized operators.

Ongoing recording of safety management systems and regular employee health checks raise administrative costs even more. The differences in compliance for big projects versus small ones cause uneven enforcement but participation in Vision 2030 infrastructure projects continues to necessitate adherence. These standards increase site reliability but narrow rental margins, forcing firms to embrace digital safety monitoring and training programs. The consequent increase in compliance costs is reforming market structures, benefiting established players with proven safety records and operating refinements.

Saudi Arabia Crane Rental Market Trend

Technological Integration Enhances Operational Precision

Technological evolution is revolutionizing crane operations in Saudi Arabia. Automated, AI-powered cranes deployed in 2025 at NEOM were a seminal milestone in equipment upgrades. Artificial Intelligence, Machine Learning, and IoT technology integrations provide real-time monitoring of fuel economy, utilization, and wear of parts. This information helps in predictive maintenance and enhanced operational reliability, reducing downtime and maximizing fleet productivity. These developments enable Vision 2030 initiatives requiring high-precision lifting and ongoing performance monitoring.

End users increasingly value cranes fitted with telematics systems to achieve greater control and transparency. Real-time analytics enable operators to streamline usage patterns and monitor compliance measures remotely. Rental suppliers with AI-telematics embedded have competitive edges in winning long-term contracts, especially in mega-projects with a focus on efficiency and safety. With digitalization racing ahead, technological innovation is becoming key to differentiation in the market, shaping future success in the Saudi Arabia Crane Rental Market.

Saudi Arabia Crane Rental Market Opportunity

Tourism and Hospitality Investments Strengthen Market Outlook

Tourism-driven development remains a strong driver of equipment demand, with the Red Sea Global project building 22 islands with 8,000 hotel rooms across 50 hotels and six resorts in 2030. Over 15,000 workers are involved onsite at present, while inbound tourism totaled 30 million visitors in 2024-increase spending by 19% to SR168.5 billion ($44 million). The role of the project in adding SR22 billion to GDP and 70,000 jobs highlights its significance. Increasing hospitality and transport facilities demands constant crane hiring for installations and structural construction.

Long-term vision 2030 objectives include 108,000 hotel rooms across the country and large-scale sports projects during the 2034 FIFA World Cup, driving long-term crane usage. These long-term developments create stable rental contracts, providing stability of revenue for service providers. Leasing is preferred by end users in order to reduce initial costs while gaining access to specialized equipment appropriate to massive tourism development. With increasing hospitality and entertainment infrastructure, rental businesses located close to coastal and urban projects will see sustained growth until 2032.

Saudi Arabia Crane Rental Market Segmentation Analysis

By Crane Type

- Mobile Crane

- Fixed Crane

- Marine/Offshore Crane

- Others

Mobile cranes possess the largest share of around 60%, this is due to the flexibility in different project conditions. Because they are easily transportable and can be moved swiftly between locations, high operational efficiency can be achieved for mid-rise buildings, modular construction, and bridge building. Contractors prefer their quicker setup times, ease of movement, and applicability to different terrain types, making them essential to Saudi Arabia's geographically spread projects. End users like using mobile cranes to balance mobility and lifting capacity so that they can complete projects on time within budgets.

Tower cranes continue to serve high-rise and hospitality markets but are still secondary because of their site-specific constraints. Mobile units have the benefit of swift response and greater application, which matches Vision 2030's emphasis on speedy construction implementation. Flexible crane fleets are a necessity with projects scattered across Riyadh, NEOM, and Dammam. Cost efficiency, versatility, and dependability guarantee this segment's continued dominance, solidifying mobile cranes as the lifting solution of choice in Saudi Arabia's growing construction universe.

By Lifting Capacity

- Up to 150 Tons

- 151-300 Tons

- 301-600 Tons

- Above 600 Tons

The 151-300 tons capacity segment has a demand of around 40%, which is the most acceptable range for getting optimal cost savings and operational efficiency. The capacity caters to varied project requirements, such as structural steel erection, precast concrete placing, and industrial equipment location. Contractors count on this segment for mid- to big-ticket Vision 2030 projects, achieving optimal lifting performance without prohibitive costs related to ultra-heavy cranes. Its applicability in construction, energy, and infrastructure projects renders it a practical and cost-effective norm.

Lighter cranes up to 150 tons are for low-key projects, while those over 300 tons are for specialized mega-projects. Mid-range machines, though, prevail because of their wider suitability and advantageous operating economics. Load flexibility reduces idle hours, allowing rental companies to maintain higher rates of fleet utilization. With Saudi Arabia pushing forward on its development agenda, cranes with capacities between 151-300 tons will be the industry standard, facilitating both general and specialized lifting activities up to 2032.

Top Companies in Saudi Arabia Crane Rental Market

The top companies operating in the market include Sarens Nass Middle East, The Crane Club, Tamimi Rentals, Arabian Machinery & Heavy Equipment Company, Bin Quraya, Al-Arabi Heavy Equipment Lease Co., Rezayat Sparrow Arabian Crane Hire, ACT Crane & Heavy Equipment, Fahad S. Al Tamimi & Partners, Arabian Consolidated Trading, etc., are the top players operating in the Saudi Arabia crane rental market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Saudi Arabia Crane Rental Market Policies, Regulations, and Standards

4. Saudi Arabia Crane Rental Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Saudi Arabia Crane Rental Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Crane Type

5.2.1.1. Mobile Crane- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fixed Crane- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Marine/Offshore Crane- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Lifting Capacity

5.2.2.1. Up to 150 Tons- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. 151-300 Tons- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. 301-600 Tons- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Above 600 Tons- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Construction & Infrastructure- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Oil & Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Mining & Excavation- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Saudi Arabia Mobile Crane Rental Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Lifting Capacity- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7. Saudi Arabia Fixed Crane Rental Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Lifting Capacity- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8. Saudi Arabia Marine/Offshore Crane Rental Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Lifting Capacity- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Arabian Machinery & Heavy Equipment Company

9.1.1.1. Business Description

9.1.1.2. Service Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Bin Quraya

9.1.2.1. Business Description

9.1.2.2. Service Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Al-Arabi Heavy Equipment Lease Co.

9.1.3.1. Business Description

9.1.3.2. Service Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Rezayat Sparrow Arabian Crane Hire

9.1.4.1. Business Description

9.1.4.2. Service Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.ACT Crane & Heavy Equipment

9.1.5.1. Business Description

9.1.5.2. Service Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Sarens Nass Middle East

9.1.6.1. Business Description

9.1.6.2. Service Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.The Crane Club

9.1.7.1. Business Description

9.1.7.2. Service Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Tamimi Rentals

9.1.8.1. Business Description

9.1.8.2. Service Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Fahad S. Al Tamimi & Partners

9.1.9.1. Business Description

9.1.9.2. Service Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Arabian Consolidated Trading

9.1.10.1. Business Description

9.1.10.2. Service Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Crane Type |

|

| By Lifting Capacity |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.