Saudi Arabia Cement Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Portland Cement, Blended Cement, Fiber Cement, Specialty Cement, Green Cement, White Cement, Others), By End Use (Commercial, Industrial and Institutional, Infrastructure, Residential)

- Infrastructure

- Dec 2025

- VI0572

- 115

-

Saudi Arabia Cement Market Statistics and Insights, 2026

- Market Size Statistics

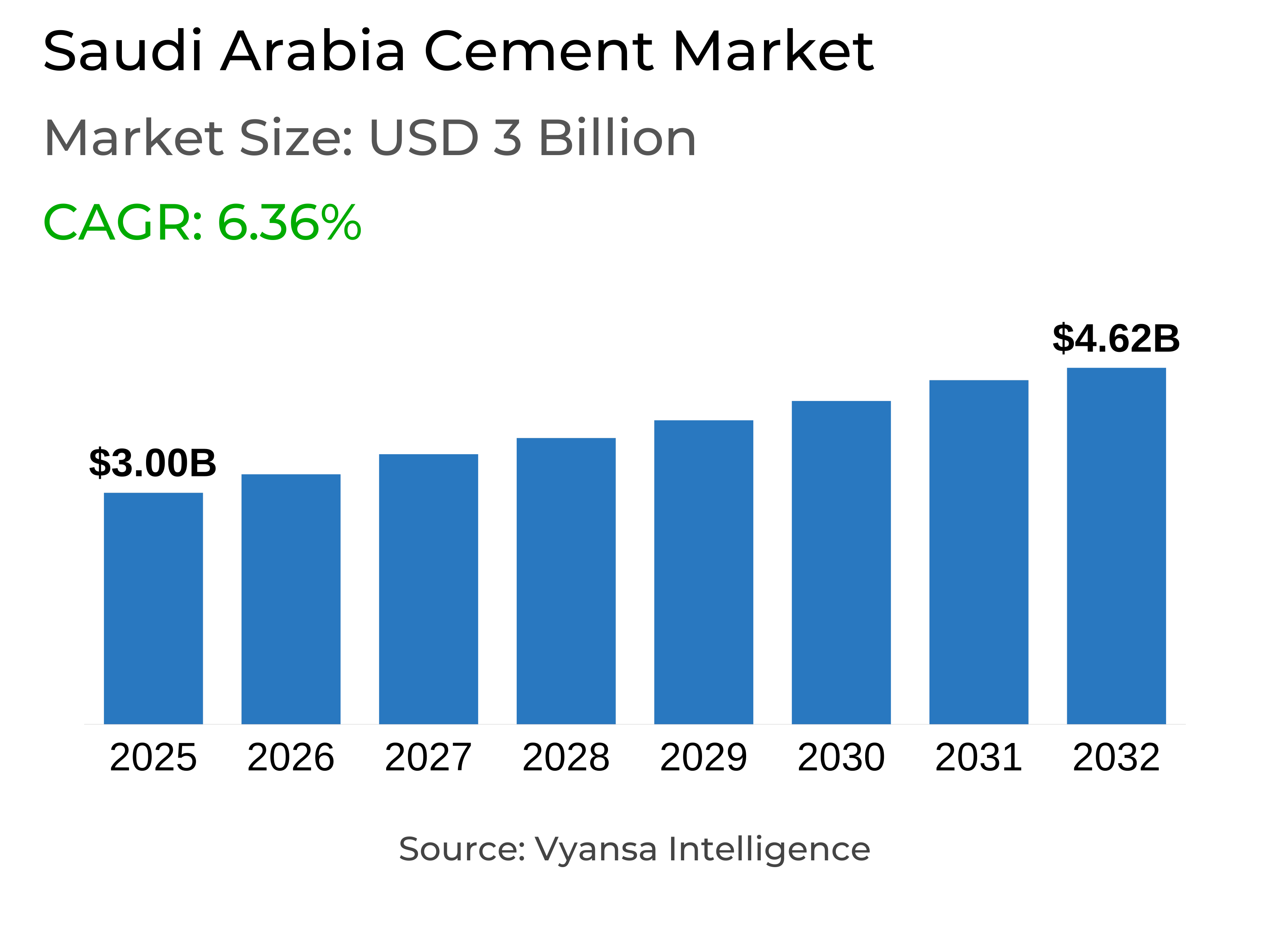

- Cement in Saudi Arabia is estimated at $ 3 Billion.

- The market size is expected to grow to $ 4.62 Billion by 2032.

- Market to register a CAGR of around 6.36% during 2026-32.

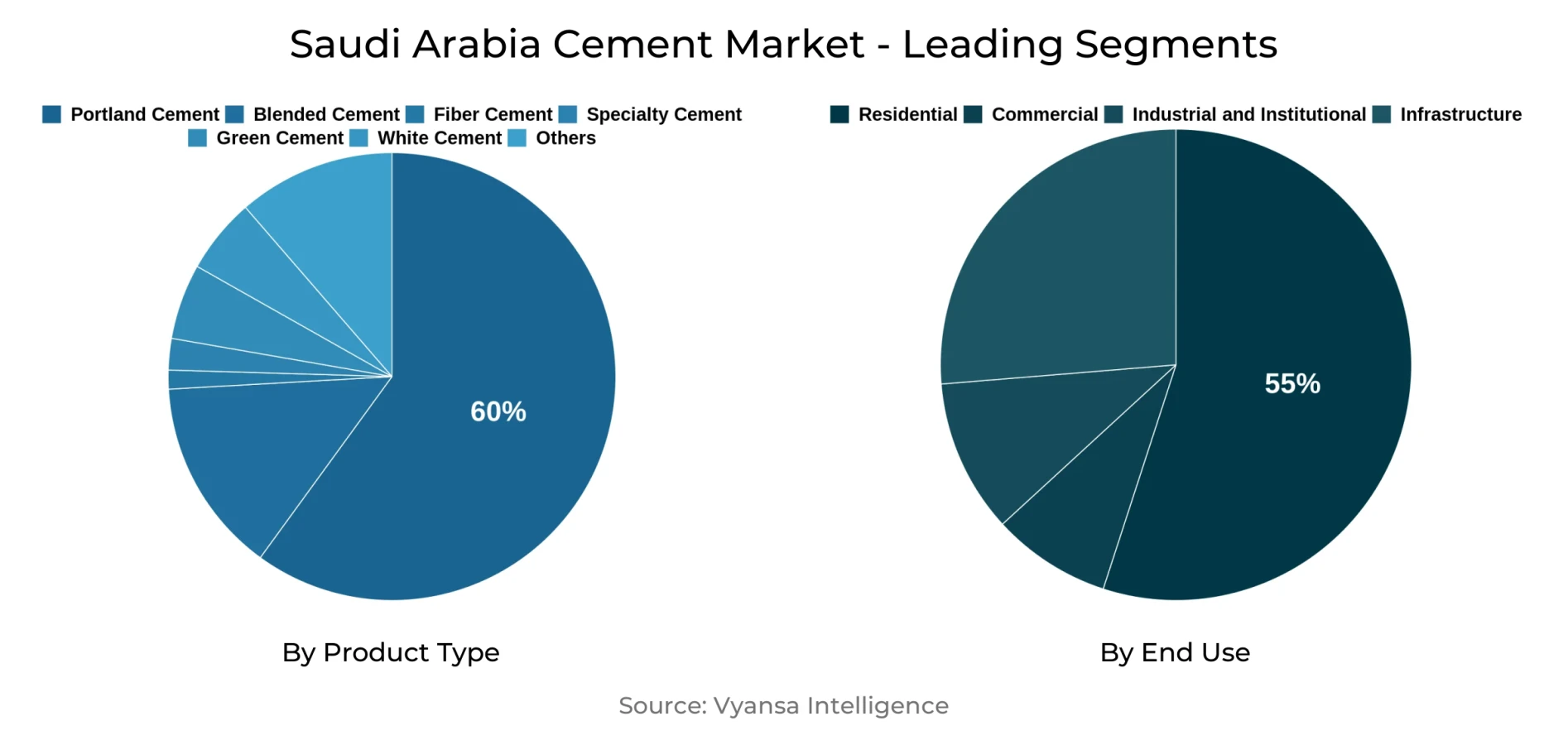

- Product Type Shares

- Portland Cement grabbed market share of 60%.

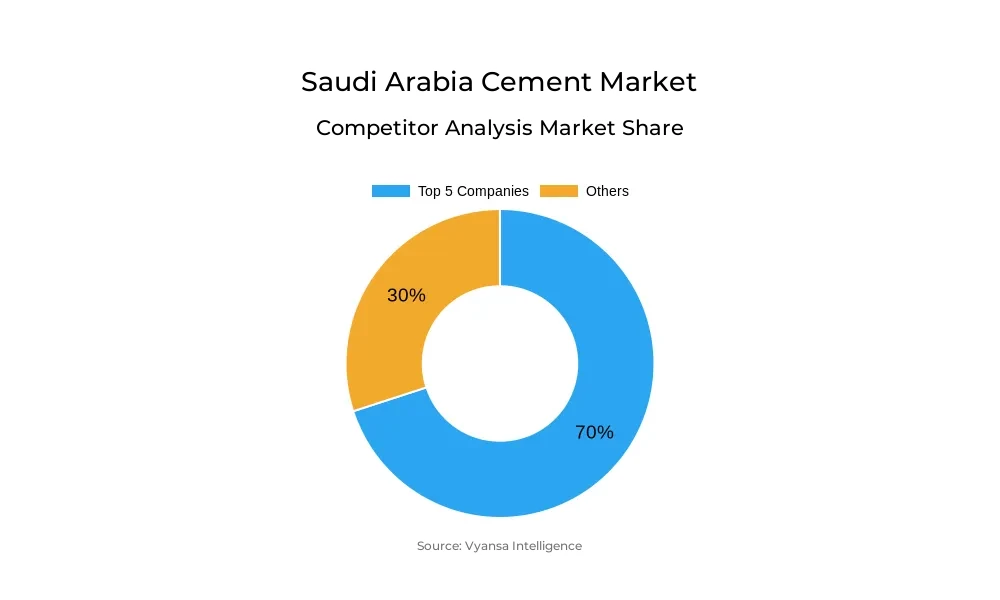

- Competition

- More than 15 companies are actively engaged in producing Cement in Saudi Arabia.

- Top 5 companies acquired around 70% of the market share.

- Southern Province Cement, Riyadh Cement, Najran Cement Co., Yamama Saudi Cement Co., Qassim Cement Co. etc., are few of the top companies.

- End Use

- Residential grabbed 55% of the market.

Saudi Arabia Cement Market Outlook

Saudi Arabia’s cement industry is witnessing strong expansion, driven by Vision 2030 infrastructure investments and rapid urbanization. The market, valued at around USD 3 billion in 2025, is projected to reach nearly USD 4.62 billion by 2032, growing at a CAGR of about 6.36% during 2026–2032. Major projects such as NEOM, the Red Sea Project, and Qiddiya, along with government housing schemes targeting 600,000 new homes by 2030, are significantly boosting cement consumption. Cement sales rose by 21% year-on-year to 13.1 million tonnes in Q2 2025, reflecting solid domestic demand accounting for 97% of total despatches.

Residential development remains the core growth engine, capturing nearly 55% of total cement consumption. Programs such as Sakani, the National Housing Company’s projects, and ROSHN’s community developments continue to expand homeownership, aligning with the Kingdom’s 70% ownership target by 2030. Infrastructure ventures like the Riyadh Metro and city expansion projects in Riyadh, Jeddah, and Dammam further reinforce steady market growth.

Portland Cement dominates Saudi Arabia’s product mix with a 60% market share due to its proven reliability under the Kingdom’s climatic conditions and suitability for major construction works. However, growing sustainability goals under Vision 2030 and the Saudi Green Initiative are encouraging manufacturers to adopt green and specialty cements, integrating eco-friendly materials like fly ash and slag.

Despite challenges from rising energy costs and regional overcapacity, ongoing investments, favorable government policies, and technological advancements are supporting long-term stability. With strong infrastructure pipelines and emerging low-carbon innovations, Saudi Arabia is poised to remain a leading cement producer and exporter in the Middle East through 2032.

Saudi Arabia Cement Market Growth DriverExpanding Infrastructure Pipeline Supporting Cement Consumption

Saudi Arabia’s Vision 2030 program continues to act as a key catalyst for cement demand through extensive infrastructure investments. Cement sales rose by 21% year-on-year to reach 13.1 million tonnes in Q2 2025, with domestic demand representing nearly 97% of total despatches. Flagship giga-projects such as NEOM (USD 500 billion), the Red Sea Project, and Qiddiya, alongside housing schemes targeting 600,000 new homes by 2030, are expected to elevate national cement consumption to 78 million tonnes annually within the next five years. Government capital expenditure of around USD 80 billion for transportation and public works further reinforces market stability and long-term growth potential.

Urbanization and residential expansion remain critical contributors to cement consumption, driven by Saudi Arabia’s target of 70% homeownership by 2030. The Riyadh Metro, valued at SAR 86 billion, and city expansions across Riyadh, Jeddah, and Dammam—where urbanization levels reach approximately 84%—are bolstering ongoing cement requirements. These large-scale projects support the Kingdom’s diversification strategy and demonstrate the government’s sustained commitment to developing robust infrastructure beyond its oil-based economy.

Saudi Arabia Cement Market ChallengeRising Energy Costs and Overcapacity Pressuring Profit Margins

The Saudi cement sector faces mounting cost pressures as energy and fuel expenses continue to rise, accounting for 30–40% of total production costs. In early 2025, producers including Al Jouf Cement, Arabian Cement and Southern Province Cement reported higher energy tariffs from Saudi Aramco, resulting in up to a 10% increase in overall production costs. Concurrently, diesel prices surged 27.3%, while construction labor costs grew by 1.5%, directly inflating on-site expenditure and eroding manufacturer profitability. Despite robust demand, these cost escalations pose challenges to maintaining competitive margins.

Regional overcapacity further strains profitability, with utilization levels expected to remain below 80% throughout the next decade. Operating 22 plants with a combined capacity of 86.6 million tonnes, Saudi Arabia faces persistent oversupply despite expanding demand from infrastructure megaprojects. This imbalance limits producers’ pricing flexibility and intensifies competition across the industry, compelling cement manufacturers to optimize operational efficiency and explore export opportunities to balance domestic oversupply.

Saudi Arabia Cement Market TrendAccelerating Shift Toward Sustainable Cement Production

Saudi Arabia’s cement industry is undergoing a pivotal transformation toward environmentally sustainable manufacturing practices in line with Vision 2030 and the Saudi Green Initiative. These policies aim to cut national carbon emissions by 278 million tonnes annually by 2030. Manufacturers are adopting green cement technologies utilizing byproducts like fly ash and slag to reduce carbon intensity. For instance, Al Jouf Cement’s eco-certified formulation, approved for NEOM projects, lowers cement consumption and CO2 emissions by 35%, while NEOM’s Water Innovation Center’s brine concrete reduces freshwater usage by up to 75%, setting a new benchmark in sustainable construction.

Technological advancements are also reshaping cement production economics. Partnerships such as that between Next Generation SCM and Nizak Mining demonstrate 99% emission reductions and a drastic drop in fuel requirements to just one-sixth of conventional processes. As government policies tighten environmental compliance through LEED and Mostadam certifications, manufacturers investing in carbon capture, waste-derived fuels, and digital optimization are positioned to gain a competitive advantage within this evolving sustainability-driven landscape.

Saudi Arabia Cement Market OpportunityExpanding Opportunities in Low-Carbon Cement and Global Exports

Saudi Arabia’s geographical and resource advantages enable it to emerge as a leading exporter of low-carbon cement through the adoption of carbon capture and storage (CCS) technologies. The Kingdom’s proximity to CO2 storage basins and competitive energy pricing provide a USD 20 per tonne cost advantage over global averages, enhancing international market competitiveness. A domestic joint venture launched in 2025 targeting 700,000 tonnes of supplementary cementitious materials annually is set to supply both local and global markets, supporting the nation’s ambition to become a regional hub for sustainable cement exports.

Public-private partnerships and growing foreign direct investment further amplify market opportunities. FDI in the construction sector surged by 30.8% in 2024, driven by Vision 2030 projects and supportive government policies. Incentives promoting the use of alternative fuels, waste-derived raw materials, and high-efficiency production systems attract international participation. These initiatives foster a favorable business climate for advanced cement plants, positioning Saudi Arabia at the forefront of global decarbonization and construction innovation.

Saudi Arabia Cement Market Segmentation Analysis

By Product Type

- Portland Cement

- Blended Cement

- Fiber Cement

- Specialty Cement

- Green Cement

- White Cement

- Others

Portland Cement is the largest segment with market share of around 60% under the product type segment. Its continued dominance stems from the proven suitability for the Kingdom’s climatic conditions and established compatibility with existing construction practices. This cement type remains the backbone for residential, commercial, and infrastructure development, ensuring consistent demand across expanding urban regions. Production facilities are largely optimized for Portland Cement, ensuring steady output to meet core infrastructure and housing requirements linked to Vision 2030.

However, demand diversification is gradually emerging as sustainability priorities shape procurement decisions. Alternative products such as green and specialty cements are gaining ground as major developers, including those managing NEOM, increasingly specify low-carbon materials. This gradual transition signals a longer-term structural shift in the product landscape, yet Portland Cement continues to underpin national construction momentum and supply reliability across Saudi Arabia’s evolving building sector.

By End Use

- Commercial

- Industrial and Institutional

- Infrastructure

- Residential

The residential sector captures around 55% of total cement consumption in Saudi Arabia, underscoring its major role in national development goals. Housing initiatives such as the Sakani program, National Housing Company’s projects delivering around 300,000 units annually, and ROSHN’s community developments collectively fuel consistent cement demand across major cities and secondary regions. The drive to increase homeownership to 70% by 2030, supported by 355,000 expected new real estate financing contracts by 2025, reinforces residential construction as the key end-use driver for the industry.

Infrastructure and commercial developments together account for the remaining 45% of cement usage, propelled by transportation, hospitality, and economic diversification projects. Key undertakings like the Riyadh Metro and Red Sea tourism developments complement residential expansion, maintaining healthy market balance across end-user categories. Sustained government funding for public infrastructure ensures that residential cement demand remains the foundation of overall market growth through 2030.

Top Companies in Saudi Arabia Cement Market

The top companies operating in the market include Southern Province Cement, Riyadh Cement, Najran Cement Co., Yamama Saudi Cement Co., Qassim Cement Co., Saudi Cement Co., Yanbu Cement Co., Arabian Cement, Eastern Province Cement, Al Safwa Cement, etc., are the top players operating in the Saudi Arabia Cement Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Saudi Arabia Cement Market Policies, Regulations, and Standards

4. Saudi Arabia Cement Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Saudi Arabia Cement Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Portland Cement- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Blended Cement- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Fiber Cement- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Specialty Cement- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Green Cement- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. White Cement- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By End Use

5.2.2.1. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Industrial and Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Infrastructure- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Competitors

5.2.3.1. Competition Characteristics

5.2.3.2. Market Share & Analysis

6. Saudi Arabia Portland Cement Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By End Use- Market Insights and Forecast 2022-2032, USD Million

7. Saudi Arabia Blended Cement Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By End Use- Market Insights and Forecast 2022-2032, USD Million

8. Saudi Arabia Fiber Cement Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By End Use- Market Insights and Forecast 2022-2032, USD Million

9. Saudi Arabia Specialty Cement Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By End Use- Market Insights and Forecast 2022-2032, USD Million

10. Saudi Arabia Green Cement Market Statistics, 2022-2032F

10.1.Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2.Market Segmentation & Growth Outlook

10.2.1. By End Use- Market Insights and Forecast 2022-2032, USD Million

11. Saudi Arabia White Cement Market Statistics, 2022-2032F

11.1.Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2.Market Segmentation & Growth Outlook

11.2.1. By End Use- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1.Company Profiles

12.1.1. Yamama Saudi Cement Co.

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Qassim Cement Co.

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Saudi Cement Co.

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Yanbu Cement Co.

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Arabian Cement

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Southern Province Cement

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Riyadh Cement

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Najran Cement Co.

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Eastern Province Cement

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Al Safwa Cement

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By End Use |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.