Saudi Arabia Landscaping Market Report: Trends, Growth and Forecast (2026-2032)

Type (Installation, Maintenance), Service Type (Hardscape (Decks, Patios & Driveways, Cycling Tracks & Walkways, Fountains & Aesthetic Sculptures, Others), Softscape (Plantation & Gardening, Architectural Services, Watering & Fertilizing, Others)), Component (Design & Planning, Irrigation Systems, Lighting & Water Features, Outdoor Furniture & Accessories, Green Infrastructure (Vertical Gardens, Rooftops, etc.)), Technology (Smart Irrigation Systems, Drone Landscaping, 3D Landscape Design Software, Autonomous Mowers, Others), Application (Housing, Hospitality, Office, Healthcare, Institutional, Retail, Others), End User (Commercial, Residential, Public Sector, Industrial)

- Infrastructure

- Dec 2025

- VI0668

- 125

-

Saudi Arabia Landscaping Market Statistics and Insights, 2026

- Market Size Statistics

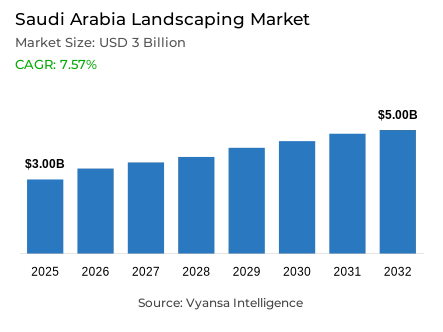

- Landscaping in Saudi Arabia is estimated at USD 3 billion.

- The market size is expected to grow to USD 5 billion by 2032.

- Market to register a cagr of around 7.57% during 2026-32.

- Type Shares

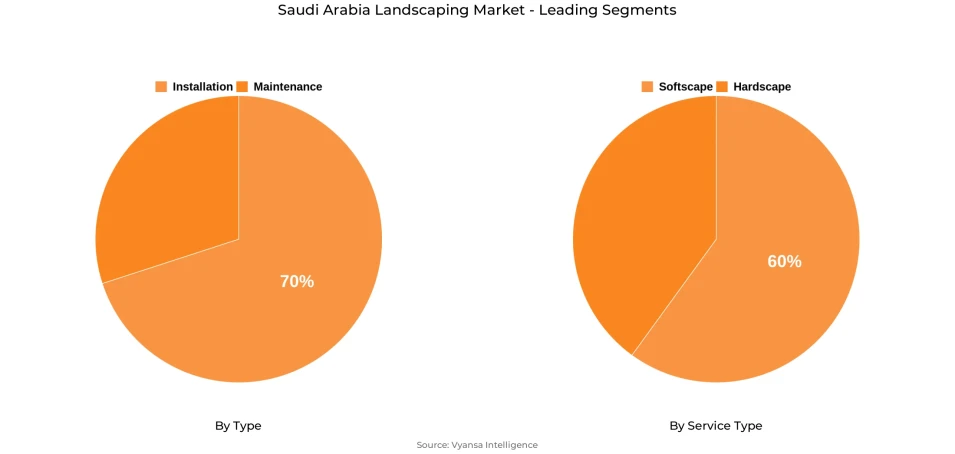

- Installation grabbed market share of 70%.

- Competition

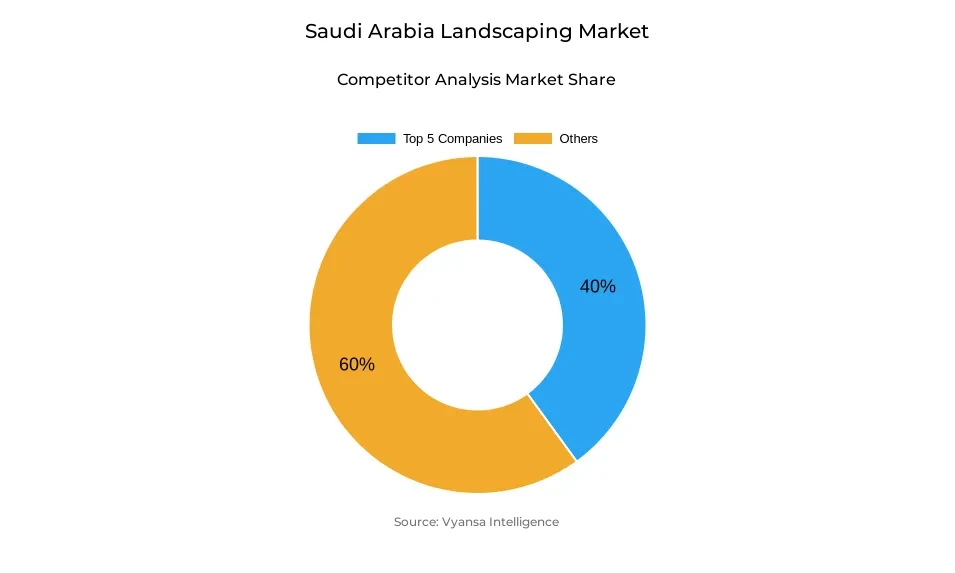

- Landscaping in Saudi Arabia is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 40% of the market share.

- BEC Arabia; Ruppert Landscape; Marina Landscape Inc.; BrightView Landscapes LLC; The Davey Tree Expert Company etc., are few of the top companies.

- Service Type

- Softscape grabbed 60% of the market.

Saudi Arabia Landscaping Market Outlook

The Saudi Arabia Landscaping Market, which was worth USD 3 billion in 2025, is expected to grow up to USD 5 billion by 2032, growing at a CAGR of approximately 7.57% from 2026-2032. This growth is heavily backed by Saudi Arabia's Vision 2030 plan, which is reshaping the country's urban and environmental environment. Projects on such a massive scale as the Green Riyadh project-attacking 7.5 million trees and doubling green space per capita to 28 square meters from 1.7-along with the Saudi Green Initiative's 10 billion-tree target, are fueling enormous demand for landscaping services throughout the Kingdom.

Despite the promising outlook, the country’s extreme climate presents major challenges for landscaping operations. With annual rainfall averaging only 59 millimeters and temperatures often exceeding 45°C, maintaining vegetation is difficult and costly. Water scarcity-exacerbated by agriculture consuming up to 85% of freshwater resources-has prompted the adoption of advanced irrigation systems and heat-resilient plants. Landscaping firms are now integrating efficient water management solutions and smart technologies to ensure sustainability under these harsh conditions.

Innovation is revolutionizing the sector as Saudi Arabia adopts intelligent irrigation and data-based systems. These technologies employ soil moisture sensors and automated systems to minimize water loss and optimize efficiency. Initiatives supported by government, including the application of smart irrigation systems in demonstration farms, are also driving the move toward water-efficient landscape practices.

By type, Installation leads with a 70% market share due to high growth in urban development projects and establishment of new green areas. Among service types, Softscape takes 60% of the market through initiatives to increase the country's vegetation cover and fight desertification across the country. These are some of the factors that indicate Saudi Arabia's high level of advancement towards developing greener, sustainable, and livable cities.

Saudi Arabia Landscaping Market Growth Driver

Government Programs Accelerating Urban Greening Efforts

Saudi Arabia's Vision 2030 plan is playing a major role in driving landscaping demand with large-scale afforestation and urban greening programs. Green Riyadh aims to plant 7.5 million trees by 2030, growing the amount of green space per capita from 1.7 to 28 square meters-a 16-fold growth presenting huge prospects for landscaping companies. Adding to this, the Saudi Green Initiative targets 10 billion trees planting and the rehabilitation of 40 million hectares of land degradation within the Kingdom, setting an unprecedented level of green infrastructure development.

These programs are transforming the country's cityscapes and establishing new standards for sustainability. The Green Riyadh program alone includes building more than 533 kilometers of irrigation systems and using 1 million cubic meters of treated water each day. With almost 70% of the territory in Saudi Arabia being impacted by desertification, these programs are creating high, consistent demand for professional landscaping services in line with national environmental restoration objectives.

Saudi Arabia Landscaping Market Challenge

Severe Climatic Conditions Constraining Landscaping Operations

Saudi Arabia's harsh climate creates major operating and economic difficulties for landscaping operations. With only 59 millimeters of average annual rainfall and temperatures frequently reaching more than 45°C, the Kingdom's desert conditions drastically reduce water supply and plant life. Agriculture draws approximately 80-85% of freshwater supplies, leaving little in reserve to irrigate urban landscaping, compelling companies to implement sophisticated water-conservation methods.

Severe heat exposure also limits working hours, as the summer prohibition on working from 12:00 PM to 3:00 PM cuts effective working hours. Wet bulb globe temperature of 31-33°C from 9 a.m. to noon is recorded by studies, which are levels that are health-threatening to outdoor workers. Such conditions increase costs and complexity in projects, pushing landscaping businesses to spend on heat-tolerant plant varieties, effective irrigation systems, and equipment to make landscapes sustainable and the project economically viable in the long term.

Saudi Arabia Landscaping Market Trend

Integration of Smart Irrigation and Efficient Water Management

The landscape market in Saudi Arabia is rapidly moving to smart irrigation and data-driven water management technologies to increase efficiency in arid conditions. Technologies with soil moisture sensors, AI-based analytics, and automated weather-based adjustments, allows highest efficiency in water delivery and the ability for remote monitoring to provide accuracy in the delivery to the root zone and avoid waste. This tool allows end users to manage high-quality landscapes while complying with water conservation mandates.

Moreover, Drip irrigation and subsurface irrigation systems are now readily accepted as they reduce surface evaporation and maintain soil moisture. As of June 2024, the public sector and the Food and Agriculture Organization has introduced smart irrigation in 17 demonstration farms in Jazan, Al Baha, and the Eastern Province. These initiatives are part of an overall push to increase the pace of adoption of water-saving technologies across the country and help Saudi Arabia meet its own stated goal of increasing renewable sources of water for consumption from 9.5% to 22.3% by 2025.

Saudi Arabia Landscaping Market Opportunity

Expanding Public-Private Collaborations in Green Infrastructure

Saudi Arabia's drive towards enhancing private sector involvement is creating robust investment opportunities in green infrastructure and landscaping. More than 200 projects in 17 sectors, valued at around USD 42.9 billion, have been approved by the National Centre for Privatization and PPPs in the MENA region. These frameworks seek to take private sector contribution to 65% of GDP by 2030, providing long-term partnership opportunities to landscaping companies.

Large-scale mega-developments like NEOM, the Red Sea Project, and Qiddiya are including large-scale landscaping elements under PPP schemes, providing stable revenue streams and improving technical partnerships. The Kingdom has also initiated more than 40 water PPP projects, which include the reuse of treated wastewater in irrigation. Such projects grant landscaping firms access to capital, advanced technologies, and ongoing project pipelines, directly aiding Vision 2030's goal of creating greener, habitable cities throughout the country.

Saudi Arabia Landscaping Market Segmentation Analysis

By Type

- Installation

- Maintenance

Under the Type segment, Installation occupies the largest market share of around 70% due to the growth stage of Saudi Arabia's urban infrastructure. The segment involves groundwork, planting, hardscape works, and irrigation installation, which forms the basis for the majority of public and private landscaping projects. Demand is fueled by massive residential and commercial expansions bolstered by Vision 2030's transformation objectives.

Initiatives like Green Riyadh, which has proposed planting 7.5 million trees by 2030, and the construction of more than 1,000 new parks point to the boom in installation work. As the Kingdom keeps finding new green areas and public spaces to develop, installation is the sector's central growth driver. Though maintenance demands will increase as these areas mature, installation work is currently on top as the nation works through its biggest-ever era of urban greening and infrastructure development.

By Service Type

- Hardscape

- Softscape

Under the Service Type segment, Softscape has around 60% share, indicating the kingdom's focus on living landscape elements to enhance urban livability. The segment encompasses tree planting, garden design, turf installation, and horticultural maintenance, in line with the Saudi Green Initiative's objectives to plant 10 billion trees and rehabilitate degraded land. Softscape development plays a critical role in preventing desertification and augmenting aesthetic and environmental quality for cities.

These services focus on native and drought-tolerant plants, complemented by xeriscaping techniques that reduce water consumption while promoting biodiversity. With around 70% of the Kingdom's land subject to desertification risks, the demand for softscape services keeps rising. The goal of the government to increase Riyadh's green cover from 1.5% to 9% guarantees regular investment in vegetation-based landscaping, which makes softscape treatments the backbone of Saudi Arabia's sustainable urban transformation process.

List of Companies Covered in Saudi Arabia Landscaping Market

The companies listed below are highly influential in the Saudi Arabia landscaping market, with a significant market share and a strong impact on industry developments.

- BEC Arabia

- Ruppert Landscape

- Marina Landscape Inc.

- BrightView Landscapes LLC

- The Davey Tree Expert Company

- TruGreen Limited

- Yellowstone Landscape Inc

- The Landscape Company

- Landscape Development Inc.

- Elite Landscape Contracting Company

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Saudi Arabia Landscaping Market Policies, Regulations, and Standards

4. Saudi Arabia Landscaping Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Saudi Arabia Landscaping Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type

5.2.1.1. Installation- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Maintenance- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Service Type

5.2.2.1. Hardscape- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.1. Decks, Patios & Driveways- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.2. Cycling Tracks & Walkways- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.3. Fountains & Aesthetic Sculptures- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Softscape- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.1. Plantation & Gardening- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.2. Architectural Services- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.3. Watering & Fertilizing- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Component

5.2.3.1. Design & Planning- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Irrigation Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Lighting & Water Features- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Outdoor Furniture & Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Green Infrastructure (Vertical Gardens, Rooftops, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Technology

5.2.4.1. Smart Irrigation Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Drone Landscaping- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. 3D Landscape Design Software- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Autonomous Mowers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Application

5.2.5.1. Housing- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Hospitality- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Office- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Healthcare- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.5.6. Retail- Market Insights and Forecast 2022-2032, USD Million

5.2.5.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Public Sector- Market Insights and Forecast 2022-2032, USD Million

5.2.6.4. Industrial- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Saudi Arabia Landscaping Installation Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Service Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Component- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Saudi Arabia Landscaping Maintenance Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Service Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Component- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.BrightView Landscapes, LLC

8.1.1.1. Business Description

8.1.1.2. Service Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.The Davey Tree Expert Company

8.1.2.1. Business Description

8.1.2.2. Service Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.TruGreen Limited

8.1.3.1. Business Description

8.1.3.2. Service Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Yellowstone Landscape, Inc

8.1.4.1. Business Description

8.1.4.2. Service Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.The Landscape Company

8.1.5.1. Business Description

8.1.5.2. Service Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.BEC Arabia

8.1.6.1. Business Description

8.1.6.2. Service Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Ruppert Landscape

8.1.7.1. Business Description

8.1.7.2. Service Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Marina Landscape, Inc.

8.1.8.1. Business Description

8.1.8.2. Service Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Landscape Development, Inc.

8.1.9.1. Business Description

8.1.9.2. Service Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Elite Landscape Contracting Company

8.1.10.1. Business Description

8.1.10.2. Service Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type |

|

| By Service Type |

|

| By Component |

|

| By Technology |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.