Poland Heavy Artillery and MLRS Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Howitzers, Mortars, Rocket Launchers, Multiple Launch Rocket Systems (MLRS) (By Launch Platform (Tracked, Wheeled, Naval/Shipborne), By Caliber (70 to 180 mm, 180 to 300 mm, More than 300 mm), By Pod Capacity (Up to 16, 16 to 40)), Anti-Air Artillery, Others), By Platform (Self-Propelled Artillery, Towed Artillery, Naval Artillery, Coastal Artillery), By Range (Short Range (5-30 km), Medium Range (31-60 km), Long Range (Above 60 km)), By Components (Fire Control Systems, Gun Systems, Turret Systems, Chassis, Ammunition, Auxiliary Equipment), By End User (Army Ground Forces, Air Defense Units, Naval Forces, Defense Contractors & Integrators)

- Aerospace & Defense

- Jan 2026

- VI0848

- 125

-

Poland Heavy Artillery and MLRS Market Statistics and Insights, 2026

- Market Size Statistics

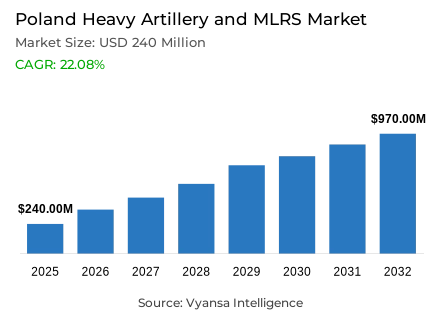

- Heavy artillery and mlrs in Poland is estimated at USD 240 million in 2025.

- The market size is expected to grow to USD 970 million by 2032.

- Market to register a cagr of around 22.08% during 2026-32.

- Product Type Shares

- Multiple launch rocket systems (mlrs) grabbed market share of 30%.

- Competition

- More than 10 companies are actively engaged in producing heavy artillery and mlrs in Poland.

- Top 5 companies acquired around 70% of the market share.

- Jelcz; Mesko S.A.; Zakłady Metalowe Dezamet; Hanwha Aerospace; Lockheed Martin etc., are few of the top companies.

- End User

- Army ground forces grabbed 80% of the market.

Poland Heavy Artillery and MLRS Market Outlook

Poland enhanced its defense on the eastern front despite russia and belarus. Poland's heavy artillery & mlrs market will experience substantial growth with an estimated value of $240 million by 2025 with a projected value of $970 million by the year 2032. this represents a CAGR of 22.08% between 2026 and 2032. Poland's heavy artillery & mlrs market is driven primarily by growing security threats, increasing defense spending and a commitment by the polish government to develop rapid response long-range precision strike capabilities supporting deterrence along Poland's eastern border (700+ km).

The majority of this growth can be attributed to Poland investing heavily in polish rocket artillery programmes such as the homar-a & homar-k programs (himars & chunmoo). accordingly, the multiple launch rocket (mlrs) systems now constitute 30% of the heavy artillery & mlrs market as the leading product category because mlrs provides the polish military high volume, flexible long-range strike platforms for use inside contested areas as well as neutralising threats within those areas. additionally, Poland's domestic development of guided rockets (cgr-080) is supporting this segment's continued success in years ahead.

Despite industrial challenges associated with the production of heavy artillery & mlrs systems within Poland (i.e., production capacity limitations, outdated manufacturing facilities, and shortages of specialised components) the challenges are being addressed steadily as a result of technology transfers from international partners, the establishment of joint ventures with foreign partners and the continued support of the polish government by funding national projects. some initiatives include establishing domestic assembly lines for missiles and modernising existing facilities as part of Poland's goals to decrease its dependence upon foreign procurement while at the same time increasing its presence in the european defence industry supply chain.

On the end-user side, the polish army ground forces are the major users of heavy artillery and mlrs systems, with approximately 80% of the total market share. as users of united nations standard 500 155mm krab and 8x8 wheeled k9 howitzers and the users of himars and chunmoo artillery systems along with the use of the increasing number of active artillery regiments currently within the polish army, the polish army ground forces are responsible for the majority of frontline fire support and long-range precision strikes for the duration of the period of 2026-2032.

Poland Heavy Artillery and MLRS Market Growth DriverStrategic Forces Shaping Market Expansion

The recent upgrades of Poland's military regarding artillery and rocket (MLRS) are a direct result of Poland's increasingly perilous nearby areas with Russian Federation and Belarus. As a result of the invasion of Ukraine by the Russian Federation in 2022, Poland's defence expenditure increased from 2.4 percent of the Gross Domestic Product (GDP) in 2022 to 4.2 percent of the GDP (38 billion dollars in defence expenditure) earmarked for 2024 and an anticipated 4.8 percent of the GDP in 2026 - poland would have the largest percentage of any of the NATO countries for defence spending. At the same time, as during the September 2025 attacks by Russian drones, with that incident triggering NATO's Operation Eastern Sentry was the need for Poland to develop artillery with the capabilities to respond quickly with precision and range as a part of a layered deterrent strategy on Poland's 700 kilometre eastern border.

Poland is demonstrating through its budget and by the defence spending increase of $126 million for the upgrading of the border with Belarus a significant commitment to developing combat power at the front line. The efforts are directed toward high-volume and longer-range artillery and MLRS, as there is a need to support Poland's modernization drive through the use of these systems. The research into developing network-oriented, survivable, and rapidly deployable strike systems will result in the ability for Poland to respond to multi-domain threats whenever and wherever they occur, thus achieving the goal of equipping Poland to be able to respond to these threats immediately.

Poland Heavy Artillery and MLRS Market ChallengeIndustrial Limitations Creating Structural Constraints

Both the size of the orders and the challenges faced by Poland's defence industry in producing large quantities of these systems are being impacted by slow production rates, obsolete manufacturing facilities, and shortages of key components.As of Nov. 23, 2023, Polish industry was only capable of supplying 5,000 units of 155mm ammunition annually—a long way from operational requirements—thereby delaying the scaling up of production to meet the objective of producing 150,000 shells per year until at least 2028. PGZ, through its subsidiary Mesko, has continued to struggle with slow project implementation timelines, limited modernisation and lack of access to critical components such as propellants. This has created a growing divergence between demand and Polish manufacturing capabilities, making self-sufficiency impossible.

As a result, the $25.3 billion or 68% of all defense contracts signed in 2024 by Poland were awarded to foreign companies thus keeping Poland dependent on external suppliers. To achieve the Government of Poland's target of producing 50% of military equipment domestically, it will be essential to invest significantly in new technologically advanced factories, the development of a skilled workforce and comprehensive technology transfer frameworks. Slow procurement times and ongoing workforce shortages continue to hinder the growth of the output, which further necessitates comprehensive structural reform across Poland's defence industrial base.

Poland Heavy Artillery and MLRS Market TrendEvolving Technological Pathways and Modernization Patterns

Poland is rapidly adopting the use of advanced technology in its artillery and rockets forces, in line with the lessons learned from modern high-intensity conflicts. The Ministry of National Defence has outlined its Artificial Intelligence Strategy until 2039, which identifies Poland's objective of embedding artificial intelligence to support human decision-making, automated targeting and expanding situational awareness in artillery units. In addition to this, in July 2025, the “drone revolution” initiative, which is supported by $55 million in funding, has resulted in increased investment in unmanned systems and the establishment of a dedicated Drone Centre in Warsaw. Together, these initiatives represent a transition from traditional formats of artillery to more data-informed, automated and networked digital battlefield operations.

Simultaneously with its digital modernization, Poland is fostering indigenous manufacturing through international cooperation. Under Homar-K, WB Group and Hanwha Aerospace are commencing domestic production of CGR-080 guided missiles, with expected production rates of several thousand missiles per year. In addition, Lockheed Martin's Homar-A program is localising assembly of 486 HIMARS launchers, using Jelcz 6x6 chassis and Polish TOPAZ systems. Collectively, these initiatives represent a sophisticated evolution from reliance on foreign procurement to building an enduring and comprehensive foundation of industrial self-sufficiency supported by sustainable technology transfer.

Poland Heavy Artillery and MLRS Market OpportunityExpanding Regional Opportunities Through Defense Integration

Poland is establishing itself as a central part of the European defence industry ecosystem as a fundamental driver of the overall modernization process. With the €43.7 Billion allocated to Poland in September 2025 under the EU's SAFE program, the largest allocation to any one country within this programme, Poland will receive significant support for modernising its air and missile defence capabilities, artillery systems, drone systems, cybersecurity and ammunition production. Additionally, Poland will have a 10-year grace period and a repayment model extending into the year 2070, allowing Poland to accelerate both procurement and expansion of industrial capabilities without an immediate effect upon Poland's fiscal budget. The financing will further align with NATO and European Union strategic priorities.

Increasingly produced domestically and in partnership with South Korean manufacturers, Poland's defence exports continue to surge, especially for products such as the Piorun MANPADs, which have significant export demand. In the last year, Poland's defence exports have nearly doubled and will increase rapidly with the scaling of platforms such as K9 howitzers, K2 tanks and Chunmoo launchers through collaborative manufacturing arrangements. As European nations increase their re-armament efforts, Poland's advancing industrial base will create pathways for integrating with cross-border supply chains and for longer-term export growth from Poland as part of NATO or beyond.

Poland Heavy Artillery and MLRS Market Segmentation Analysis

By Product Type

- Howitzers

- Mortars

- Rocket Launchers

- Multiple Launch Rocket Systems (MLRS)

- Anti-Air Artillery

- Others

The Multiple Launch Rocket Systems (MLRS) category holds the leading market share at 30%, reflecting its central role in Poland’s modernization priorities and its strategic emphasis on long-range precision fires. The dual-track procurement of HIMARS under the Homar-A program and K239 Chunmoo under Homar-K has rapidly scaled Poland’s rocket artillery capabilities, with over 100 Chunmoo launchers operational by mid-2025. MLRS platforms provide flexibility across guided rockets and tactical ballistic missiles, supporting Poland’s requirement for rapid, high-volume strikes capable of neutralizing threats deep within contested areas. Their compatibility with diverse munitions types significantly strengthens Poland’s broader strike ecosystem.

This segment’s dominance is reinforced by strong progress in domestic missile production. Agreements to produce CGR-080 guided rockets and future GMLRS variants within Poland build sustainable ammunition pipelines for both Chunmoo and HIMARS systems. Integration of Polish-developed components, including TOPAZ fire control and Jelcz chassis, further enhances interoperability with existing command networks and local sustainment infrastructure. As modernization accelerates, MLRS platforms will continue to anchor Poland’s long-range strike capabilities, shaping both operational doctrine and industrial investment priorities.

By End User

- Army Ground Forces

- Air Defense Units

- Naval Forces

- Defense Contractors & Integrators

Army Ground Forces hold an overwhelming 80% share of the Poland Heavy Artillery and MLRS Market, reflecting their central position in national defense strategy. Poland’s territorial defense model relies heavily on ground formations equipped with long-range strike capabilities, massed artillery fire, and integrated support systems placed along the eastern border. The Army operates Krab self-propelled howitzers, imported K9 units, and expanding MLRS fleets under Homar-A and Homar-K, distributing these platforms across artillery regiments and mechanized divisions to strengthen deterrence posture. Their role in sustaining high-readiness artillery assets keeps the segment firmly dominant.

This market share is further reinforced by doctrinal emphasis on layered defense-in-depth requiring swift, coordinated fire missions executed primarily by ground units. Plans to equip 27 artillery squadrons with rocket systems and expand the fleet to roughly 1,000 self-propelled howitzers by 2030 consolidate the Army’s role as the principal operator of artillery and MLRS assets. With responsibility for operating long-range precision strike, air defense integration, and high-volume fires, Army Ground Forces will continue to remain the primary end users across the forecast period.

List of Companies Covered in Poland Heavy Artillery and MLRS Market

The companies listed below are highly influential in the Poland heavy artillery and mlrs market, with a significant market share and a strong impact on industry developments.

- Jelcz

- Mesko S.A.

- Zakłady Metalowe Dezamet

- Hanwha Aerospace

- Lockheed Martin

- Polska Grupa Zbrojeniowa (PGZ)

- Huta Stalowa Wola (HSW)

- WB Group (WB Electronics)

- Rheinmetall

- BAE Systems

Market News & Updates

- Hanwha Aerospace, 2025:

Accelerated delivery of 126 Homar-K MLRS launchers and formation of a 51-49 joint venture with WB Electronics for CGR-80 missile production in Poland.

- Mesko S.A., 2025:

Mesko S.A. launched BMCS charge production with EURENCO support at its Pionki facility (100,000 units annually, operational July 2025), while its Kraśnik plant expansion targets 150,000 shell bodies annually by 2027.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Poland Heavy Artillery & MLRS Market Policies, Regulations, and Standards

4. Poland Heavy Artillery & MLRS Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Poland Heavy Artillery & MLRS Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Howitzers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Mortars- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Rocket Launchers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Multiple Launch Rocket Systems (MLRS)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. By Launch Platform- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1.1. Tracked- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1.2. Wheeled- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1.3. Naval/Shipborne- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. By Caliber- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2.1. 70 to 180 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2.2. 180 to 300 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2.3. More than 300 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. By Pod Capacity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3.1. Up to 16- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3.2. 16 to 40- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Anti-Air Artillery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Platform

5.2.2.1. Self-Propelled Artillery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Towed Artillery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Naval Artillery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Coastal Artillery- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Range

5.2.3.1. Short Range (5-30 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Medium Range (31-60 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Long Range (Above 60 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Components

5.2.4.1. Fire Control Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Gun Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Turret Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Chassis- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Auxiliary Equipment- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By End User

5.2.5.1. Army Ground Forces- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Air Defense Units- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Naval Forces- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Defense Contractors & Integrators- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Poland Howitzers Heavy Artillery & MLRS Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Platform- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Range- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Components- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Poland Mortars Heavy Artillery & MLRS Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Platform- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Range- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Components- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Poland Rocket Launchers Heavy Artillery & MLRS Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Platform- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Range- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Components- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Poland Multiple Launch Rocket Systems (MLRS) Heavy Artillery & MLRS Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Launch Platform- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Caliber- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Pod Capacity- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Platform- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Range- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Components- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By End User- Market Insights and Forecast 2022-2032, USD Million

10. Poland Anti-Air Artillery Heavy Artillery & MLRS Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Platform- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Range- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Components- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By End User- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Hanwha Aerospace

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Lockheed Martin

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Polska Grupa Zbrojeniowa (PGZ)

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Huta Stalowa Wola (HSW)

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. WB Group (WB Electronics)

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Jelcz

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Mesko S.A.

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Zakłady Metalowe Dezamet

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Rheinmetall

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. BAE Systems

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Launch Platform |

|

| By Caliber |

|

| By Pod Capacity |

|

| By Platform |

|

| By Range |

|

| By Components |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.