Poland Ammunition Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Bullets, Aerial Bombs, Grenades, Artillery Shells, Mortars), Application (Defense (Military, Homeland Security), Civil & Commercial (Sporting, Hunting, Self-Defense, Others)), Caliber (Small-Caliber Ammunition (9x19 mm Parabellum, 5.56 mm, 7.62 mm, 338 Lapua Magnum, 338 Norma Magnum, 12.7 mm, 14.5 mm, Others), Medium-Caliber Ammunition (20 mm, 25 mm, 30 mm, 40 mm), Large-Caliber Ammunition (60 mm, 81 mm, 120 mm, 155 mm, Others, Others)), Component (Fuzes & Primers (Primers (Rimfire Primers, Centerfire Primers), Fuzes (Time Fuzes, Impact Fuzes, Proximity Fuzes, Combination Fuzes)), Propellants, Bases, Projectiles & Warheads, Others), Guidance Mechanism (Guided, Non-Guided), Lethality (Less Lethal, Lethal)

- Aerospace & Defense

- Jan 2026

- VI0849

- 110

-

Poland Ammunition Market Statistics and Insights, 2026

- Market Size Statistics

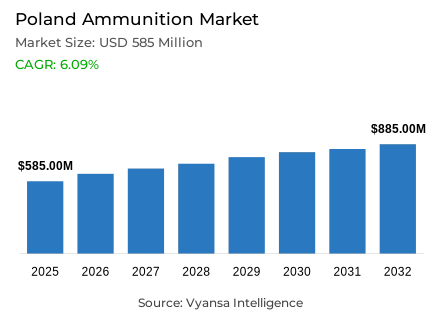

- Ammunition in Poland is estimated at USD 585 million in 2025.

- The market size is expected to grow to USD 885 million by 2032.

- Market to register a cagr of around 6.09% during 2026-32.

- Product Type Shares

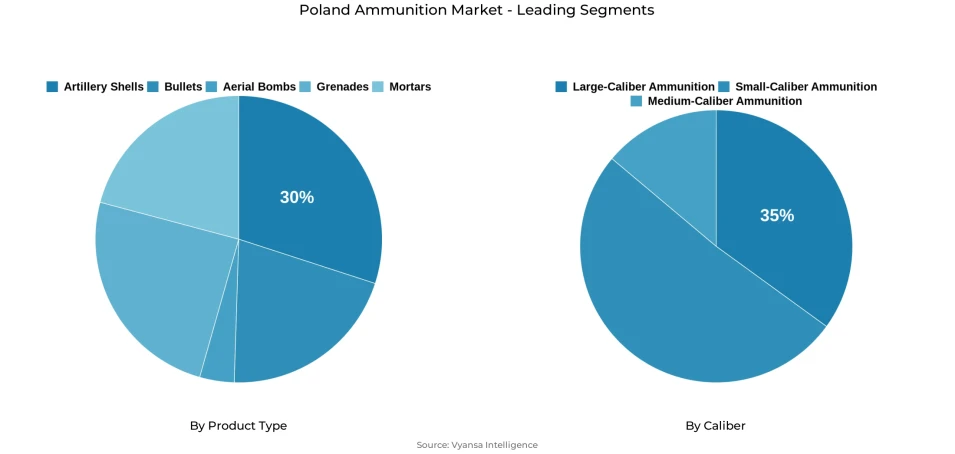

- Artillery shells grabbed market share of 30%.

- Competition

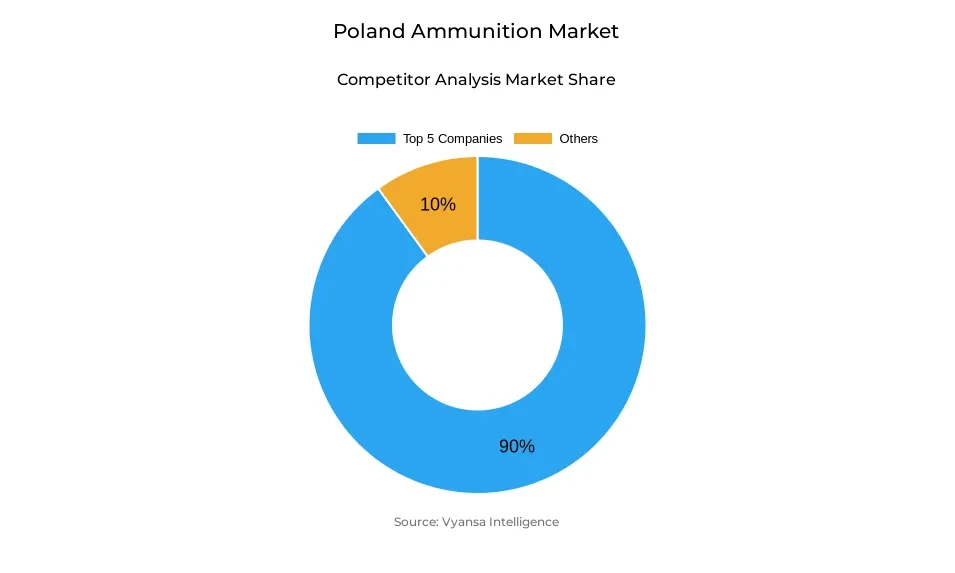

- More than 10 companies are actively engaged in producing ammunition in Poland.

- Top 5 companies acquired around 90% of the market share.

- Zaklady Mechaniczne Tarnow SA; Fabryka Broni Lucznik Radom; Wojskowe Zaklady Uzbrojenia SA; Mesko SA; Dezamet SA etc., are few of the top companies.

- Caliber

- Large-caliber ammunition grabbed 35% of the market.

Poland Ammunition Market Outlook

Poland ammunition market, valued at USD 585 million in 2025, is expected to reach USD 885 million by 2032, growing at a CAGR of approximately 6.09% during the period 2026-2032. Poland's artillery shells account for a market share of 30%, followed by large caliber ammunition like 155mm shells at 35%. The market is emerging due to Poland's focus and effort to develop its own national defenses and improve NATO compliance. Poland's artillery shells account for a market share of 30%, making it an emerging market due to Poland's focus and effort to develop its national defenses and improve NATO compliance.

The Polish Ministry of Defense is also promoting investments in infrastructure development and production modernization to respond to rising demand, estimated to reach a total of 150,000 to 180,000 units of 155mm shells per year in 2027. Capital expenditure for new equipment and integrated production system purchases alone comprises over 40% of military expenditure, contributing to growth in capacity within Poland's facilities for shells production. Collaboration with companies like BAE Systems will help increase volume to mitigate shortfalls of propellants and components.

The Polish companies are also becoming focused on acquiring full control of the ammunition chain and hence cutting their dependency for ammunition needs on imported products and meeting their high-quality demands within stipulated time for their consumption. The policy of “Polonization of production” initiated by the government aims to distribute 50% of their orders to local industries and will also help them to become self-reliant and export to other countries as well since the extra production will cater to their allies within NATO among East European countries.

Overall, the Poland ammunition market will experience growth due to sustained government outlay and the adoption of NATO standards and modernization programs. Artillery shells and high-calibre ammunition will top the acquisition plans, and capacity enhancement and integrated production schemes will drive growth. This will ensure that final users receive standardized high-volume ammunition; as a result, Poland will lead the way to 2032.

Poland Ammunition Market Growth DriverRising Defense Expenditure and NATO Alignment Driving Market Expansion

Poland is the biggest proportional spender in the NATO alliance with respect to the country’s allocated funds in the defense industry, with allocations standing at 186.6 billion PLN in 2025, or 4.7% of the GDP, aiming to rise to 200.1 billion PLN in 2026 with 4.81% of the GDP. The actual defense expenditure in 2025 will be 60% higher than in 2023 due to the strategic imperative to attain defense independence in the wake of the 2022 Russia invasion of the Ukraine. The national defense budget allocations in Poland have preferred the manufacture of ammunition as a core element of the state’s national security. The capital expenditures in the form of equipment purchases and production capacities will continue to incur 41.7% of the national budget on the basis of a strategic imperative that will see these allocations continue until 2035. The 155mm and 120mm ammunition manufactured under the NATO standard will continue to provide a stable market. The government’s plan, known as the ‘Polonization of production’ plan, will continue to provide an impetus to the user due to a focus on the manufacture of the products in Poland.

This approach has had a profound effect on the procurement plans of Poland, as it has identified artillery ammunition as a high priority in its plans. The Polish government’s focus on ensuring interoperability in its ammunition production has enabled it to provide its end users with high-volume ammunition in standard quality. This approach has improved its defenses while promoting the establishment of a strong ammunition manufacturing industry in the Polish economy that can serve its own and international purposes until 2032.

Poland Ammunition Market ChallengeProduction Limitations and Supply Chain Challenges Restricting Market Growth

There are also crucial capacity issues with the ammunition industry in Poland, which affects the country’s and the allies’ ammunition needs. Also, the current production capacity for 155mm artillery shells is about 20,000 shells each year. However, the demand estimated for the shells can go up to 150,000-180,000 by 2027. Through the partnership with BAE Systems, the target by 2026 is 130,000 shells. However, the main constraint is the production of the propellants’ bases. There is a need for the acquisition of advanced technology or the establishment of a JV for the production of the bases. There are also challenges in the European supply chain. The explosives, the production of powder, and the component sectors are not in a position to meet the operational demand. With the expansion capacity within the EU aimed for 2 million shells by 2025, the use levels are practically saturated, indicating the necessity for the upgrade of the infrastructures.

Such challenges not only impinge upon efficiency in production, and even impede strategic planning for the future by Poland as a nation. Improvement in infrastructure up to 2027 is critical in ensuring a steady supply chain for both end and military users in case Poland is not addressed as far as preparation for supply in peak operation demand is concerned. The emphasis on high-caliber artillery shells further puts pressure on production lines and hence highlights the criticality and need for strategic partnerships in augmenting capacity.

Poland Ammunition Market TrendIntegration and Localization Reshaping Industrial Operations

Polish defense companies have been increasingly turning to vertical integration, which allows them to have full control over the entire ammunition production line, right down to raw materials. A move by Polish Armaments Group (PGZ) to build additional production facilities, ensuring no dependence on imported parts, is a move in line with government guidelines on what is known as a “Polonization of production.” With the aim of acquiring no less than 50% of ammunition each year, it is set to benefit users in terms of product consistency and delivery, in turn allowing companies to attain autonomy in operations. Frameworks of capital investments, aimed at modernization, now include integrated production of explosives, propellants, shell bodies, and base-bleeds.

Major allocations of funds from the 2025 Ministry of State Assets Budget, including that of the Capital Investment Fund of PLN 2.4 billion, enable niche producers like Dezamet, Mesko, Nitro-Chem, and Gamrat to produce more. European firms like Rheinmetall have also taken up the initiative to develop integrated supply chains. They target capacities of 1.5 million shell production per year by 2027. All this indicates that Europe is undergoing change in terms of securing the whole continent through effective local production chains.

Poland Ammunition Market OpportunityExpansion Potential and Regional Hub Development

Geographically, Poland is poised to emerge as the main ammunition production center for NATO with excess capacity to satisfy allied and local needs. After satisfying local needs, PGZ aims to begin the export of excess 155mm ammunition to European NATO countries and Ukraine. In this matter, a new approach has been adopted to use export earnings as a cost-adjustment strategy for greater financial stability. The goal to double capacity for 20,000-150,000-180,000 shells a year by 2027 will benefit Poland to cater to multiple countries with modernization investment incentives valued at €43.7 billion by the EU’s SAFE program.

This regional focus enables Poland to be a key supplier to Eastern Europe, ensuring that a steady supply of compatible high-volume ammunition is made available to end users in allied forces. Export-oriented manufacturing efforts will further promote multi-caliber capacities being adopted within EU procurement terms, going beyond regional requirements related to Ukraine policy challenges. By making comprehensive investment, modernizing manufacturing processes, and securing attractive funding terms, Poland is actually positioning itself as a stable ammunition-manufacturing hub till 2032, catering to the security needs of Poland, as well as regional military operations.

Poland Ammunition Market Segmentation Analysis

By Product Type

- Bullets

- Aerial Bombs

- Grenades

- Artillery Shells

- Mortars

Artillery shells dominate the Poland ammunition market’s product type segment, accounting for approximately 30% of total market share. Their prominence reflects the critical operational role of large-caliber artillery in contemporary land warfare, particularly lessons from the Ukraine conflict. The Polish Armaments Group prioritizes 155 mm artillery shells as the cornerstone of domestic production expansion, with significant capital allocations directed to Dezamet and Mesko to establish and optimize production lines. Government mandates explicitly define artillery shells as a primary caliber focus, ensuring sustained high-volume availability for end users through 2032.

The concentration on artillery ammunition aligns with NATO standardization requirements and battlefield operational experiences, where sustained artillery fire is decisive. Funding from the 2025 Capital Investment Fund demonstrates proportional prioritization, supporting high-volume production lines while reinforcing interoperability with allied forces. This segmentation reflects clear procurement preferences and demonstrates that end users increasingly rely on standardized, high-capacity artillery shells as essential components of national and regional defense strategies.

By Caliber

- Small-Caliber Ammunition

- Medium-Caliber Ammunition

- Large-Caliber Ammunition

Large-caliber ammunition constitutes the leading segment within the caliber category, capturing roughly 35% of market share. Within this group, 155 mm shells represent the NATO-standard specification driving procurement priorities, supported by government mandates and defense ministry planning. These rounds are critical to modern combined-arms operations, with operational experiences from Ukraine underscoring the importance of sustained, high-volume artillery fire. Secondary emphasis is placed on 120 mm tank-mounted rounds, though production allocation remains proportionally lower than for 155 mm shells.

Government investment plans explicitly prioritize large-caliber production, targeting domestic facility expansions to standardize 155 mm ammunition and meet both national and allied operational requirements. Strategic alignment with NATO standards ensures end users receive consistent and interoperable munitions. This focus drives long-term procurement and export strategies, positioning large-caliber ammunition as the dominant segment influencing Poland’s industrial investment decisions, capacity expansion, and regional defense hub objectives through 2032.

List of Companies Covered in Poland Ammunition Market

The companies listed below are highly influential in the Poland ammunition market, with a significant market share and a strong impact on industry developments.

- Zaklady Mechaniczne Tarnow SA

- Fabryka Broni Lucznik Radom

- Wojskowe Zaklady Uzbrojenia SA

- Mesko SA

- Dezamet SA

- Nitro Chem SA

- Gamrat SPS Gamrat Sp zo o

- Belma Bydgoskie Zaklady Elektromechaniczne Belma SA

- Polska Amunicja

- WB Electronics WB Group

Market News & Updates

- Mesko SA, 2025:

Completed world-class modern small-caliber ammunition production hall at Skarżysko-Kamienna facility in June 2025, increasing production capacity five-fold from 50 to 250 million rounds per year; commenced commercial assembly operations for 155mm modular charges at Pionki plant with EURENCO partnership (100,000 BMCS per year capacity) following certification in August 2025.

- Dezamet SA, 2025:

Received €1.3 billion PLN (Polish government funding) announced by Prime Minister Donald Tusk (September 12, 2025) for investment in 155mm large-caliber ammunition production facility in Nowa Dęba; to receive state-of-the-art production technology from British company BAE Systems under partnership agreement, targeting annual production capacity of 130,000 155mm shells by 2027 with production commencing 2026.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Poland Ammunition Market Policies, Regulations, and Standards

4. Poland Ammunition Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Poland Ammunition Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Bullets- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Aerial Bombs- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Grenades- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Artillery Shells- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Mortars- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Defense- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.1. Military- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.2. Homeland Security- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Civil & Commercial- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.1. Sporting- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.2. Hunting- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.3. Self-Defense- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Caliber

5.2.3.1. Small-Caliber Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. 9x19 mm Parabellum- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. 5.56 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.3. 7.62 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.4. 338 Lapua Magnum- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.5. 338 Norma Magnum- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.6. 12.7 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.7. 14.5 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Medium-Caliber Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1. 20 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2. 25 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.3. 30 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.4. 40 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Large-Caliber Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3.1. 60 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3.2. 81 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3.3. 120 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3.4. 155 mm- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Component

5.2.4.1. Fuzes & Primers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1. Primers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1.1. Rimfire Primers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1.2. Centerfire Primers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2. Fuzes- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2.1. Time Fuzes- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2.2. Impact Fuzes- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2.3. Proximity Fuzes- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2.4. Combination Fuzes- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Propellants- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Bases- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Projectiles & Warheads- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Guidance Mechanism

5.2.5.1. Guided- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Non-Guided- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Lethality

5.2.6.1. Less Lethal- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Lethal- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Poland Bullets Ammunition Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Caliber- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Component- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Guidance Mechanism- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Lethality- Market Insights and Forecast 2022-2032, USD Million

7. Poland Aerial Bombs Ammunition Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Caliber- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Component- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Guidance Mechanism- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Lethality- Market Insights and Forecast 2022-2032, USD Million

8. Poland Grenades Ammunition Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Caliber- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Component- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Guidance Mechanism- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Lethality- Market Insights and Forecast 2022-2032, USD Million

9. Poland Artillery Shells Ammunition Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Caliber- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Component- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Guidance Mechanism- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Lethality- Market Insights and Forecast 2022-2032, USD Million

10. Poland Mortars Ammunition Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Caliber- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Component- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Guidance Mechanism- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Lethality- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Mesko SA

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Dezamet SA

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Nitro Chem SA

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Gamrat SPS Gamrat Sp zo o

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Belma Bydgoskie Zaklady Elektromechaniczne Belma SA

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Zaklady Mechaniczne Tarnow SA

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Fabryka Broni Lucznik Radom

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Wojskowe Zaklady Uzbrojenia SA

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Polska Amunicja

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. WB Electronics WB Group

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Application |

|

| By Caliber |

|

| By Component |

|

| By Guidance Mechanism |

|

| By Lethality |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.