Poland Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Jan 2026

- VI0839

- 110

-

Poland Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

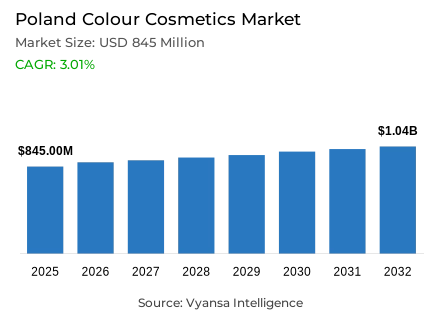

- Colour cosmetics in Poland is estimated at USD 845 million in 2025.

- The market size is expected to grow to USD 1.04 billion by 2032.

- Market to register a cagr of around 3.01% during 2026-32.

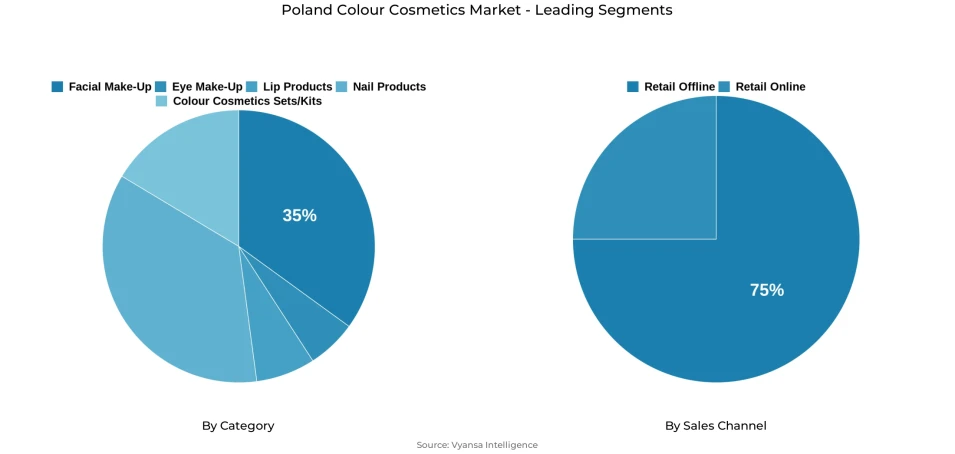

- Category Shares

- Facial make-up grabbed market share of 35%.

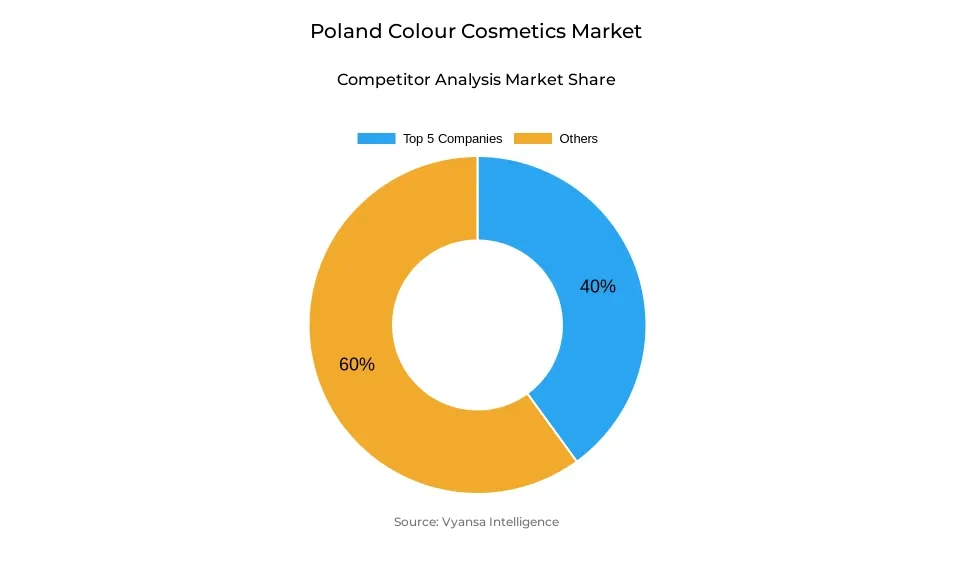

- Competition

- More than 20 companies are actively engaged in producing colour cosmetics in Poland.

- Top 5 companies acquired around 40% of the market share.

- Inglot Sp zoo; Laboratorium Kosmetyczne Dr Irena Eris SA; Avon Cosmetics Polska Sp zoo; L'Oréal Polska Sp zoo; Eveline Cosmetics SA Sp k etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Poland Colour Cosmetics Market Outlook

The Poland colour cosmetics market will grow steadily from 2026 through 2032, driven by increasingly innovative developments in the area of hybrid makeup and skin-friendly products. The market was estimated to be USD 845 million in 2025, which will grow to USD 1.04 billion in 2032, thereby recording a CAGR of 3.01% during the forecasted period. The growing need for natural finishes, multi-use products combining the benefits of skin care with the aesthetics of the cosmetic product, as well as curiosity in various end-use segments, including young people, professionals, and beauty-conscious end user, continue to drive the market.

Facial makeup is the market-leading category, with a market share of approximately 35%, with a significant adoption rate of BB/CC creams, light-as-air foundations, as well as multi-tasking formulas that have hydrating as well as beauty-enhancing functions. There is a premium version of make-up hybrids that is becoming increasingly popular, with increasingly sophisticated end user valuing functions such as quality assurance, as well as product purity.

Traditional retail remains dominant in the landscape of distribution, with Retail Offline contributing about 75% of total sales owing to consumer preference for testing, consultation, and experience of products in retail stores. Simultaneously, retail online is growing as a channel, influenced and driven by social media reach and engaging visually led content, thereby encouraging discovery and experience of products on the web.Omnichannel experiences in retail are increasingly being shaped by strategies that aim to connect exploration, experience, and purchase for all types of brands targeting beauty end user.

In the future, growth is likely to be driven by the “routinization” of the category through everyday usage habits as well as innovative product offerings in the make-up space. As young end user increasingly engage with product experimentation via the influence of social beauty trends on their online use of the internet and related platforms, the Polish market is likely to see growth in both core segments as well as niche categories, thereby ensuring Poland is a dynamic and constantly developing color cosmetics market.

Poland Colour Cosmetics Market Growth DriverIncreasing Disposable Incomes and Consumer Expenditure Power

Increased discretionary income and persistent consumer spending are major factors which help fuel the development of the color cosmetics market in Poland. Having a strong economy and being part of the European Union, Poland enjoys a stable income level and a consumer behavior pattern which supports spending on consumer and beauty products. As indicated in the International Monetary Fund Country Data, the Polish economy continues to fare well with its real GDP and consumer prices growing at a rate of 3.2% and 3.8% in 2025, respectively.

Increased levels of income mean that end-use end user are capable of allocating more and more money toward discretionary segments such as colour cosmetics. These are products that not only improve beauty but also possess skin care properties. These conditions allow end user to buy products more often, experiment with trends and new forms, and spend more money on a high-quality multifunctional formula, thus increasing market demand.

Poland Colour Cosmetics Market ChallengeOngoing Pressures of Inflation

The key threat for the colour cosmeceutics market in Poland comes from the consistently high inflation rate. It was estimated that in 2024, the annual inflation of consumer prices in Poland stood at 3.78%, reflecting the pressures of inflation on consumption patterns.

Price sensitivity may arise if higher inflation impacts income levels, especially targeting the younger and mid segments, which may encourage more judicious expenditure on semi-discretionary products such as cosmetics. This may further translate into lower frequency of purchasing or a higher demand for products driven by price sensitivity and discounts. Until such a time that a relative convergence of inflation to monetary targets occurs, price sensitivity will remain a drag factor for this segment of colored cosmetics.

Poland Colour Cosmetics Market TrendClean Beauty And Hybrid Formulations Shaping Preference

A dominant trend prevailing in the Poland color cosmetics market is the rise in the adoption ofclean beauty and hybrid products. end user at the end-users are also expressing a growing interest in the offering of products that provide both cosmetic and skincare solutions in a single product, such as BB/CC creams that possess hydrating, SPF, and complexion-correcting properties.

Minimalist skincare routines and "no-makeup" makeup looks have particularly emerged as trends among the young professional segment as well as those interested in beauty. Now, with the introduction of more skin-friendly ingredients within the portfolios of brands, the trend is transforming the competition landscape in the category

Poland Colour Cosmetics Market OpportunityThe Power of Growth through Digital Engagement and Omnichannel Access

A major opportunity that presents itself within the colour cosmetic market in Poland comes through the growing importance associated with digital engagement. The greater prominence associated with digital engagement and omnichannel retail presence presents an important opportunity for the market due to the increased emphasis on digital tutorials and reviews.

The integration of online and offline channels, through mechanisms such as in-store pickup for online purchases, virtual try-on capabilities, and the use of digital catalogues backed by rich visuals, has enhanced accessibility. The omnichannel business models also impact the ability to reach more end user beyond metropolitan areas and drive product accessibility, besides fostering long-term loyalty. The enhanced digital engagement, thereby, also becomes an increasingly influential element in the future growth of the category.

Poland Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

The segment with highest market share under Category is Facial Make-Up contributing about 35% of share. The core products of BB or CC creams, foundations, and lightweight products are very essential in people’s day-to-day lives, and this is due to the preference for natural looks and the no-makeup style.

This category has been stimulated and driven by ongoing innovation in hybrid formats that merge a concern with beauty with characteristics such as hydration and sun care. Its leading status is a result of market adoption and a deliberate focus in the market to enhance use.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channels is retail offline with approximately 75% of total colour cosmetic sales in Poland, as this is where end user can familiarize themselves with a product by touching and trying it.

Touch engagement allows the consumer to evaluate the touch and color suitability and even texture for the product, which would specifically be applicable for facial make-up products and mixtures. Though the trend for retail online continues to grow and increase, with the support of social-media-driven discovery, the supremacy of offline shopping points to the importance of the shopping experience.

List of Companies Covered in Poland Colour Cosmetics Market

The companies listed below are highly influential in the Poland colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Inglot Sp zoo

- Laboratorium Kosmetyczne Dr Irena Eris SA

- Avon Cosmetics Polska Sp zoo

- L'Oréal Polska Sp zoo

- Eveline Cosmetics SA Sp k

- Cosnova GmbH

- Coty Polska Sp zoo

- Estée Lauder Poland Sp zoo

- Mary Kay Cosmetics Poland Sp zoo

- Oriflame Poland Sp zoo

Competitive Landscape

The Poland Colour Cosmetics Market in 2025 remained highly competitive, led by established brands such as L’Oréal, which sustained its leadership through broad product portfolios, strong retail reach, and innovation targeted toward younger demographics. Frequent launches and promotional activity helped the brand stay visible in a trend-driven environment. Meanwhile, digitally oriented brands like Kiko Milano strengthened their position by combining accessible pricing with aspirational, social-media-driven aesthetics, appealing strongly to younger consumers seeking fashionable yet affordable options. Competition was further intensified by the rise of brands promoting cleaner formulations and skin-friendly ingredients, reflecting growing demand for natural and minimalist beauty solutions. The interplay between legacy leaders and agile digital disruptors continues to shape market dynamics and consumer loyalty.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Poland Colour Cosmetics Market Policies, Regulations, and Standards

4. Poland Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Poland Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Poland Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Poland Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Poland Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Poland Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Poland Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. L’Oréal Polska Sp zoo

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Eveline Cosmetics SA Sp k

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Cosnova GmbH

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Coty Polska Sp zoo

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Estée Lauder Poland Sp zoo

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Inglot Sp zoo

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Laboratorium Kosmetyczne Dr Irena Eris SA

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Avon Cosmetics Polska Sp zoo

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Mary Kay Cosmetics Poland Sp zoo

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Oriflame Poland Sp zoo

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.