Argentina Footwear Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Children's Footwear (Infants (0-9 Months) Foot Length (CM) (8.3-8.9, 9.2-9.5, 10.1-10.5), Toddlers (9 Months - 4 Years) Foot Length (CM) (10.8, 11.4-11.7, 12.1-12.7, 13.0-13.3, 14.0-14.3, 14.6-15.2, 15.6-15.9, 16.5), Little Kids (4-7 Years) Foot Length (CM) (16.8, 17.1-17.8, 18.1-18.4, 19.1-19.4, 19.7-20.6, 21.0-21.6), Big Kids (7-12 Years) Foot Length (CM) (21.9, 22.2-23.5, 24.1-24.8)), Women's Footwear (Foot Length (CM) (20.8, 21.3-21.6, 22.2-22.5, 23.0-23.8, 24.1-24.6, 25.1-25.9, 26.2-26.7, 27.6)), Men's Footwear (Foot Length (CM) (23.5, 24.1-24.8, 25.4-25.7, 26.0-26.7, 27.0-27.9, 28.3-28.6, 29.4, 30.2, 31.0-31.8))), By Product Type (Casual, Athletic/Sports, Formal, Others), By Sales Channel (Retail Online, Retail Offline), By Material (Leather, Textile, Rubber, Synthetic, Canvas), By Price (Mass, Premium), By Footwear Type (Shoes (Sneakers, Boots), Sandals & Slippers (Flip-Flops)), By Application (Conventional Footwear (Daily Wear, Work/Office Wear, Outdoor & Adventure, Sports & Fitness, Party/Occasion Wear), Functional/Therapeutic Footwear (Therapeutic/Orthopedic, Medicated Slippers, Acupressure Slippers))

- FMCG

- Jan 2026

- VI0856

- 120

-

Argentina Footwear Market Statistics and Insights, 2026

- Market Size Statistics

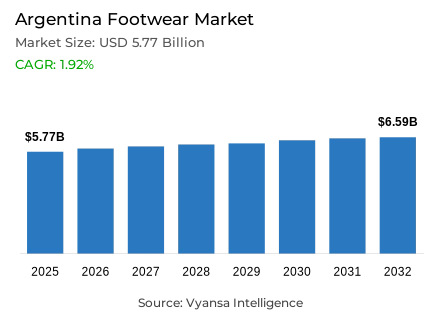

- Footwear in Argentina is estimated at USD 5.77 billion in 2025.

- The market size is expected to grow to USD 6.59 billion by 2032.

- Market to register a cagr of around 1.92% during 2026-32.

- Category Shares

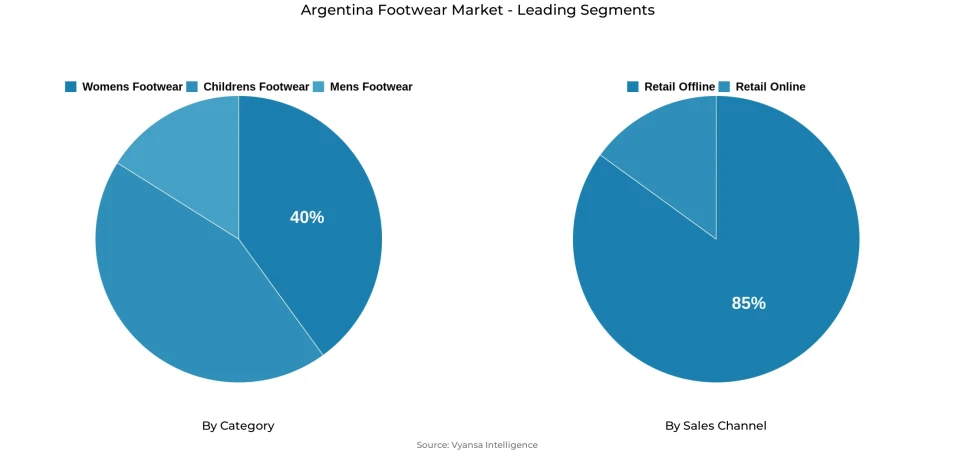

- Women’s footwear grabbed market share of 40%.

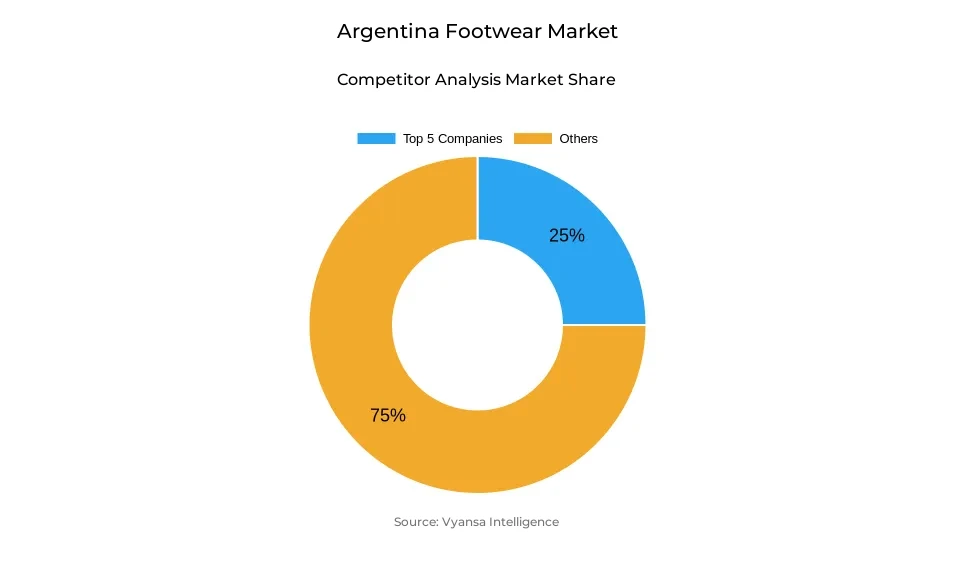

- Competition

- More than 20 companies are actively engaged in producing footwear in Argentina.

- Top 5 companies acquired around 25% of the market share.

- Distrinando SA; Sport Icon SA; Dass Argentina SA; adidas Argentina SA; Southbay SRL etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Argentina Footwear Market Outlook

The Argentina footwear market is expected to grow moderately during 2026–2032, supported by changing import policies and more diversified end user preferences. The market is projected to reach USD 5.77 billion in 2025, driven by strong demand for casual, athletic, and fashion footwear. Since late 2023, economic reforms have gradually opened imports and helped stabilize inflation, making it easier for international brands to enter and expand product variety.

Women’s footwear, with about a 40% share, continues to drive demand, supported by fashion, lifestyle, and everyday footwear. Product innovation—such as customized sneakers and the revival of iconic local designs—keeps domestic brands relevant and attractive.

Retail Offline continues to dominate with about 85% of sales, as end users still prefer physical stores for fitting and personalized service. Specialist chains and branded stores remain key shopping destinations where face-to-face purchasing behavior is strong.

By 2032, the market is expected to reach around USD 6.59 billion, growing at a CAGR of about 1.92% during 2026–2032. Growth will be supported by expanding imports of sports and lifestyle footwear, renewed interest in local heritage brands, and broader end user access to footwear across multiple price ranges

Argentina Footwear Market Growth Driver

Urbanisation and Consumer Choice Expansion

The Argentina footwear market is largely driven by urban density and the proximity of retail outlets. In Argentina, most of the population lives in urban areas. According to Argentina National Statistics, about 92% of the population resides in urban zones, mainly in major provinces such as Buenos Aires, Córdoba, Santa Fe, and Mendoza. This high level of urban concentration supports dense retail networks, with physical stores and specialized footwear outlets spread across cities, making it easy for end users to access a wide variety of footwear products.

With recent economic reforms, Argentina end users are gaining better access to international and higher-quality footwear brands as import restrictions have been eased. This wider availability, especially in large cities, increases interest in both fashion-oriented and practical footwear categories, supporting continued market relevance and end user engagement.

Argentina Footwear Market Challenge

Consumption Declines and Price Sensitivity

The Argentina footwear market is witnessing a clear trend shaped by declining purchasing power, which is directly influencing more cautious spending behavior and lower overall consumption. According to the Argentine Chamber of Commerce and Services, consumption of clothing and footwear fell by around 27% yearly in the first five months of 2024, highlighting the impact of economic pressure on retail demand. This contraction reflects weakened household spending and ongoing macroeconomic volatility.

Discretionary spending is heavily constrained by high inflation and low real incomes, particularly for non-essential footwear such as fashion or premium products. End users have become highly price-sensitive, forcing brands to rely on promotions and discounts to sustain sales, which in turn reduces margins and pressures profitability.

Argentina Footwear Market Trend

Rising Imports and Product Diversification

Rising imports are a key trend shaping the Argentina footwear market. Trade statistics show that in 2023 Argentina imported around USD 723 million worth of footwear. This reflects a broader opening of trade and stronger cross-border retail integration, which is increasing product availability.

Higher imports provide access to foreign brands and specialized footwear, especially athletic and performance designs that were previously limited by domestic production capacity. This diversification is expanding the footwear ecosystem, where international collections and new designs influence domestic demand, particularly among young and urban end users seeking modern branded footwear.

Argentina Footwear Market Opportunity

Retail Online Acceleration and International Access

The Argentina footwear industry holds strong growth potential, supported by expanding demand across its end user base. Easier import rules and growing online shopping adoption allow end users to access international brands beyond traditional retail limitations. Rising online orders align with wider digital retail growth, opening new space for both local and foreign footwear brands.

Smaller brands and emerging designers can expand through online channels without high physical store costs. Digital marketing and cross-border delivery make it easier to launch new product lines—such as customized sneakers, performance sports footwear, and seasonal fashion styles—and reach end users beyond major metropolitan areas.

Argentina Footwear Market Segmentation Analysis

By Category

- Children's Footwear

- Infants (0-9 Months) Foot Length (CM)

- 8.3-8.9

- 9.2-9.5

- 10.1-10.5

- Infants (0-9 Months) Foot Length (CM)

- Toddlers (9 Months - 4 Years) Foot Length (CM)

- 10.8

- 11.4-11.7

- 12.1-12.7

- 13.0-13.3

- 14.0-14.3

- 14.6-15.2

- 15.6-15.9

- 16.5

- 10.8

- Little Kids (4-7 Years) Foot Length (CM)

- 16.8

- 17.1-17.8

- 18.1-18.4

- 19.1-19.4

- 19.7-20.6

- 21.0-21.6

- 16.8

- Big Kids (7-12 Years) Foot Length (CM)

- 21.9

- 22.2-23.5

- 24.1-24.8

- 21.9

- Women's Footwear

- Foot Length (CM)

- 20.8

- 21.3-21.6

- 22.2-22.5

- 23.0-23.8

- 24.1-24.6

- 25.1-25.9

- 26.2-26.7

- 27.6

- 20.8

- Foot Length (CM)

- Men's Footwear

- Foot Length (CM)

- 23.5

- 24.1-24.8

- 25.4-25.7

- 26.0-26.7

- 27.0-27.9

- 28.3-28.6

- 29.4

- 30.2

- 31.0-31.8

- 23.5

- Foot Length (CM)

The category with the highest share is Women’s Footwear, accounting for about 40% of the Argentina footwear market. This segment leads due to its wide range of styles, including fashion sneakers, casual shoes, and lifestyle designs that match diverse preferences. Strong urban demand and active retail environments in major cities support this dominance.

end user interest in both local and international women’s footwear reflects broader fashion trends that prioritize style, comfort, and seasonal обновление. Its leadership highlights the importance of trend-driven design and strong retail presentation.

By Sales Channel

- Retail Online

- Retail Offline

Retail Offline is the leading sales channel, representing around 85% of total footwear sales. Brick-and-mortar stores—including specialist shoe stores, multi-brand outlets, and branded boutiques—remain the primary purchase points. Physical retail is preferred because end users value fitting, comfort testing, and personal service.

Offline stores also offer immediate availability, in-store promotions, and professional fitting, which are critical in footwear buying. While end user is growing, especially for international and niche brands, offline retail remains the backbone of distribution.

List of Companies Covered in Argentina Footwear Market

The companies listed below are highly influential in the Argentina footwear market, with a significant market share and a strong impact on industry developments.

- Distrinando SA

- Sport Icon SA

- Dass Argentina SA

- adidas Argentina SA

- Southbay SRL

- Puma Argentina SA

- Alpargatas SAIC

- Grimoldi SA

- John Foos

- Asics Argentina

Competitive Landscape

Argentina footwear market is becoming more competitive as local heritage brands, fashion labels, and imported sports brands strengthen their presence. Ricky Sarkany is reinforcing its premium positioning through personalised sneakers using 3D and augmented reality tools, appealing to consumers seeking uniqueness. Flecha, the historic low-price canvas sneaker brand, is returning under new ownership, combining local manufacturing with nationwide distribution to target value-oriented buyers. At the same time, international performance brand On has entered Argentina, focusing on affluent consumers familiar with the brand from abroad and purchasing through specialist stores and online channels. Liberalised import policies are intensifying competition, as global brands expand availability and push local players to rely more on innovation, pricing strategies, and brand heritage to defend their positions.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Argentina Footwear Market Policies, Regulations, and Standards

4. Argentina Footwear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Argentina Footwear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Children's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Infants (0-9 Months) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. 8.3-8.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. 9.2-9.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.3. 10.1-10.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Toddlers (9 Months - 4 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. 10.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. 11.4-11.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.3. 12.1-12.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.4. 13.0-13.3- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.5. 14.0-14.3- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.6. 14.6-15.2- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.7. 15.6-15.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.8. 16.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Little Kids (4-7 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. 16.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. 17.1-17.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. 18.1-18.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.4. 19.1-19.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.5. 19.7-20.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.6. 21.0-21.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Big Kids (7-12 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.1. 21.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.2. 22.2-23.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.3. 24.1-24.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Women's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.1. 20.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.2. 21.3-21.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.3. 22.2-22.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.4. 23.0-23.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.5. 24.1-24.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.6. 25.1-25.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.7. 26.2-26.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.8. 27.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Men's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. 23.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. 24.1-24.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.3. 25.4-25.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.4. 26.0-26.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.5. 27.0-27.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.6. 28.3-28.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.7. 29.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.8. 30.2- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.9. 31.0-31.8- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product Type

5.2.2.1. Casual- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Athletic/Sports- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Formal- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material

5.2.4.1. Leather- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Textile- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Rubber- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Synthetic- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Canvas- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Price

5.2.5.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Footwear Type

5.2.6.1. Shoes- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.1. Sneakers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.2. Boots- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Sandals & Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.1. Flip-Flops- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Application

5.2.7.1. Conventional Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Daily Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Work/Office Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.3. Outdoor & Adventure- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.4. Sports & Fitness- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.5. Party/Occasion Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Functional/Therapeutic Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.1. Therapeutic/Orthopedic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.2. Medicated Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.3. Acupressure Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Argentina Children's Footwear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

7. Argentina Women's Footwear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

8. Argentina Men's Footwear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold in Thousand Units

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.adidas Argentina SA

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Southbay SRL

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Puma Argentina SA

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Alpargatas SAIC

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Grimoldi SA

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Distrinando SA

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Sport Icon SA

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Dass Argentina SA

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.John Foos

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Asics Argentina

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Product Type |

|

| By Sales Channel |

|

| By Material |

|

| By Price |

|

| By Footwear Type |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.