Global Pet Sitting Services Market Report: Trends, Growth and Forecast (2026-2032)

Service Type (In-Home Sitting, Boarding/Kennel Services, Drop-In Visits, Dog Walking, Daycare), Pet Type (Dogs, Cats, Birds, Small Mammals, Reptiles & Exotics), Booking Channel (Online Platforms & Apps, Traditional/Offline Agencies), Region (North America, South America, Europe, The Middle East & Africa, Asia Pacific)

- Healthcare

- Dec 2025

- VI0709

- 220

-

Global Pet Sitting Services Market Statistics and Insights, 2026

- Market Size Statistics

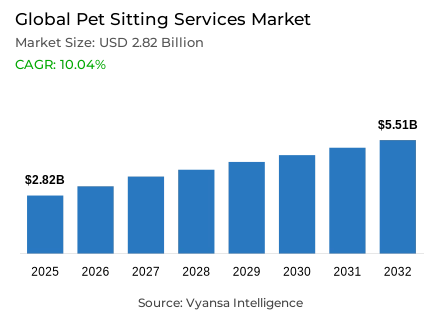

- Global pet sitting services market is estimated at USD 2.82 billion in 2025.

- The market size is expected to grow to USD 5.51 billion by 2032.

- Market to register a CAGR of around 10.04% during 2026-32.

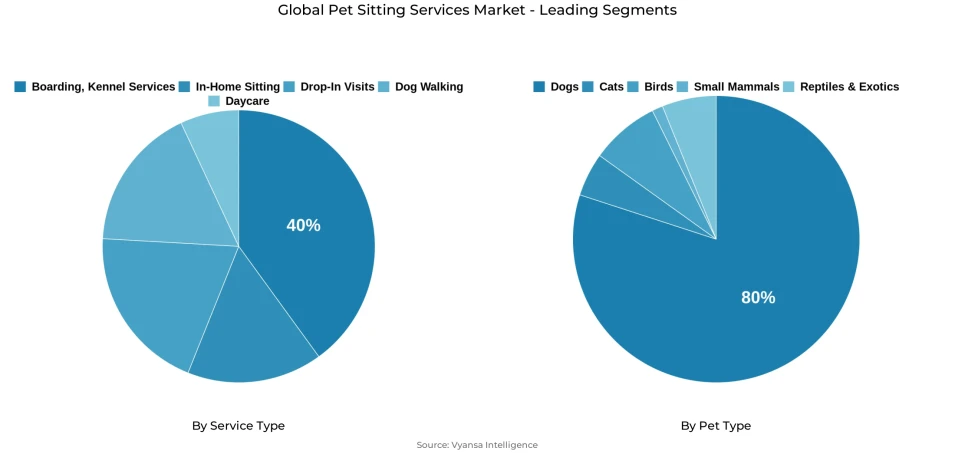

- Service Type Shares

- Boarding/kennel services grabbed market share of 40%.

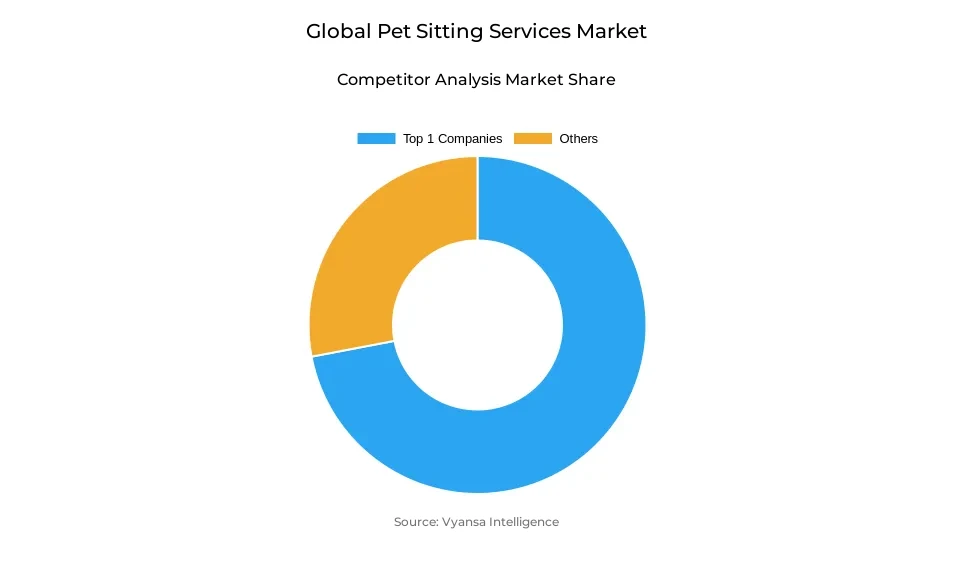

- Competition

- Global pet sitting services market is currently being catered to by more than 30 companies.

- Top 10 companies acquired the maximum share of the market.

- Care.com Inc.; PetSmart Inc.; Camp Bow Wow; Rover Group, Inc.; Wag! Group Co. etc., are few of the top companies.

- Pet Type

- Dogs grabbed 80% of the market.

- Region

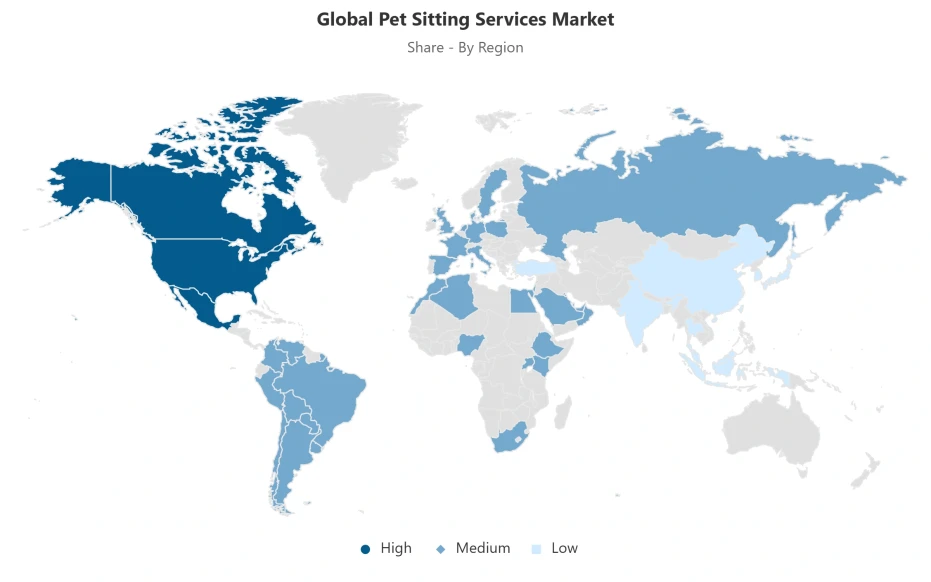

- North America leads with a 40% share of the global market.

Global Pet Sitting Services Market Outlook

Global Pet Sitting Services Market was valued at USD 2.82 billion in 2025 and is forecasted to reach USD 5.51 billion by 2032, registering a CAGR of about 10.04% during 2026-2032. Growing pet ownership among working professionals is the main growth driver, with 94 million U.S. households-71% of total households-keeping pets in 2025. Behind the trend lies a more emotional bond between owners and pets, making reliable daytime and boarding care a key element of modern urban life. Working professionals, especially those in double-income households, increasingly turn to professional solutions to manage everyday care, travel plans, and long working hours.

Affordability and access limitations continue to constrain full-scale expansion, with the majority of pet owners mentioning fear of exorbitant service charges and non-availability of appointments. Urban markets are good, but rural and semi-urban regions continue to suffer from lack of access to professional services. Innovation brought about by technology through the use of AI-based booking and automated scheduling is improving efficiency and accessibility, thus making small-scale providers competitive.

Within service type categories, Boarding/Kennel Services are the market leaders with a 40% share, fueled by strong demand over vacations and extended business trips. The services have upgraded with high-end features such as nutrition management and web-based monitoring tools to build trust and convenience.

80% of the market is held by dogs because of their higher need for supervision and activity management. North America leads globally in terms of market share at 40% driven by better infrastructure and pet insurance adoption, with the Asia Pacific region expected to be the region with the fastest growth up to 2032 on the back of increasing urbanization and increased pet ownership.

Global Pet Sitting Services Market Growth Driver

Expanding Pet Ownership Among Working Professionals Accelerates Service Demand

Pet ownership has increased across the global workforce, creating strong demand for professional pet sitting services. 94 million U.S. households owned pets as of 2025, which was 71% of all households-a rise from 82 million households in 2023. Of these, 51% owned dogs and 37% owned cats, which is approximately 68 million and 49 million households respectively. This growth parallels extensive demographic transformation, with companionship from pets as a more central aspect of working professionals' lifestyles. Greater employment-related pressures to be at work have amplified reliance on third-party care givers, generating stable demand for services in residential and commercial urban settings alike.

Research from Vetster's 2024 poll of 1,800 working pet owners indicated that 60% of them would consider leaving their jobs if work commitments conflict with pet care, while 24% have already considered this. Such profound emotional investment has amplified the demand for reliable daytime boarding and care, particularly among professionals with lengthy working hours and regular business trips, thereby cementing pet sitting services as a fundamental part of modern urban life.

Global Pet Sitting Services Market Challenge

Affordability Constraints and Limited Access Hindering Market Potential

Pet care affordability and access limitations continue to keep the industry from achieving its full potential, even with ownership rates at record levels. According to APPA's 2025 State of the Industry Report 37% of owners remain concerned about access to veterinary services, and 38% cite elevated cost as the main disincentive to professional treatment. These cost factors hit hardest among Gen Z customers, who are extremely price conscious in balancing repeat pet sitting expenses. Rising cost of doing business-in effect, everything from insurance to upkeep on facilities-only contributes to affordability gaps in prime metropolitan markets.

Accessibility concerns extend beyond cost since 31% of pet owners indicate that it is difficult to arrange timely service appointments. Low capacity in networks established in advance creates bottlenecks, restricting market scalability and triggering instead competitive consolidation by service providers. Interregional disparities add to these limitations, particularly in rural and semi-urban areas where professional pet-sitting services are scarce.

Global Pet Sitting Services Market Trend

Integration of Digital Platforms and Hybrid Work Influencing Service Models

Digitalization has assumed pole position in operational efficiency in the pet sitting industry. Providers are increasingly dependent on computer-based scheduling software and AI-powered reservation interfaces to streamline reservation management, personalize service recommendations, and enhance client interaction. Such solutions facilitate instant verification and service personalization from data, instilling confidence and user trust. The shift to digital interfaces has also broadened visibility for small-scale providers, facilitating competitive participation in otherwise consolidated markets.

The global imitation of hybrid and remote work habits further changed service demand trends. Remote workers now average five daily pet interaction breaks, as Vetster's 2024 report highlights, demonstrating the increasingly dynamic interaction between work habits and pet care requirements. Meanwhile, 30% of owners would be happy to reverse this trend and return to working from the office if pet-friendly opportunities or mid-day pet sitting arrangements are possible. This behavioral change creates typical weekday service alternatives with adaptable, technology-enabled providers as prime beneficiaries of this emerging work-life model.

Global Pet Sitting Services Market Opportunity

Urbanization and Humanization Elevating Long-Term Market Growth

Accelerating global urbanization is remodeling pet tendencies of ownership and increasing dependency on commercial care. The United Nations reports that more than 55% of global populations inhabit urban areas where congested living conditions limit space and time for in-home surveillance. These urban constraints have been countering with more reliance on external care professionals for pet exercise, socialization, and overnight accommodations. Urban employees, particularly two-income households, are becoming more welcoming to outsourcing pet care functions, allowing further industry expansion.

Concurrently, the emotional redefinition of pets as family members has triggered more expenditures on all levels of services. In 2023, according to a TGM Global survey, 59% of respondents consider the pet part of the family, and 16% consider them to be children. This sentiment has created excitement among Millennials and Gen Z to spend big budgets on good care, and 70% of pet owners from Gen Z are caring for more than one pet.

Global Pet Sitting Services Market Regional Analysis

By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

North America is the largest market in the world for pet sitting services, with a 40% revenue share. The region boasts the greatest rate of pet ownership-71% of U.S. households as per APPA 2025 statistics-enabling consistent demand through mature infrastructures, densely populated urban areas, and mature regulation systems. Spending by urban residents on high-end services combined with high insurance penetration has improved market resilience, hence North America's status as the global industry practice exemplar.

However, the Asia-Pacific will be the fastest-growing market through 2032, fueled by urbanization, rising disposable incomes, and cultural shift toward pet companionship. The growth in pet ownership in China, India, and Southeast Asia is creating new avenues for digital and facility-based pet care models. With regional players enhancing service networks and moving towards Western quality, Asia-Pacific is poised to close considerably the gap with North America, staging the next phase of global pet sitting service expansion.

Global Pet Sitting Services Market Segmentation Analysis

By Service Type

- In-Home Sitting

- Boarding/Kennel Services

- Drop-In Visits

- Dog Walking

- Daycare

Boarding/kenneling services dominate the global market for pet sitting services with share of around 40% of industry revenue. The segment provide critical backup for vacations, prolonged business travel, or night emergencies. The dominance is based on necessity-filling critical voids when end users are not available for lengthy periods. Holiday-driven seasonal demand creates repeat, high-margin revenue streams that underpin boarding-intensive operators' financial well-being.

The segment's leadership demonstrates its incorporation of high-end care standards, providing expert nutrition management, around-the-clock observation, and behavioral tracking. More facilities now include digital monitoring equipment that enables real-time owner communication, building client trust and brand loyalty. As professional boarding matures into hospitality-level service models, differentiation through added amenities and tailored pet routines continues to shape competitiveness for this high-value market segment.

By Pet Type

- Dogs

- Cats

- Birds

- Small Mammals

- Reptiles & Exotics

This concentration has encouraged specialization for professionals in services, and individualized exercise routines, breed-based handling, and behavior-driven interaction guidelines have become competitive strengths. Dog care services command premium pricing on the basis of high labor and expertise requirements, underpinning greater revenue returns than other pet categories. As operators continue to invest in age-specific care customization and online monitoring technology, the dog segment is still the pillar of worldwide demand, dictating norms for quality, safety, and service innovation.

Market Players in Global Pet Sitting Services Market

These market players maintain a significant presence in the Global pet sitting services market sector and contribute to its ongoing evolution.

- Care.com Inc.

- PetSmart Inc.

- Camp Bow Wow

- Rover Group, Inc.

- Wag! Group Co.

- Fetch! Pet Care Inc.

- PetBacker

- Holidog

- Pawshake

- Mad Paws Holdings

- TrustedHousesitters

- Gudog

- PetSitter.com

- HouseMyDog

- Barkly Pets

Market News & Updates

- PetBacker, 2025:

PetBacker's establishment of its new regional headquarters in Singapore in May 2025 underscores the accelerating expansion of the market across the Asia Pacific region.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Pet Sitting Service Market Policies, Regulations, and Standards

4. Global Pet Sitting Service Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Pet Sitting Service Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Service Type

5.2.1.1. In-Home Sitting- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Boarding/Kennel Services- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Drop-In Visits- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Dog Walking- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Daycare- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Pet Type

5.2.2.1. Dogs- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Cats- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Birds- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Small Mammals- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Reptiles & Exotics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Booking Channel

5.2.3.1. Online Platforms & Apps- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Traditional/Offline Agencies- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Region

5.2.4.1. North America

5.2.4.2. South America

5.2.4.3. Europe

5.2.4.4. The Middle East & Africa

5.2.4.5. Asia Pacific

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. North America Pet Sitting Service Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Service Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Pet- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Country

6.2.4.1. The US

6.2.4.2. Canada

6.2.4.3. Mexico

6.3. The US Pet Sitting Service Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Pet Sitting Service Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Pet Sitting Service Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

7. South America Pet Sitting Service Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Service Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Pet- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Country

7.2.4.1. Brazil

7.2.4.2. Argentina

7.2.4.3. Rest of South America

7.3. Brazil Pet Sitting Service Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

7.4. Argentina Pet Sitting Service Market Statistics, 2022-2032F

7.4.1.Market Size & Growth Outlook

7.4.1.1. By Revenues in USD Million

7.4.2.Market Segmentation & Growth Outlook

7.4.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

7.4.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

8. Europe Pet Sitting Service Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Service Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Pet- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Country

8.2.4.1. Germany

8.2.4.2. The UK

8.2.4.3. France

8.2.4.4. Spain

8.2.4.5. Italy

8.2.4.6. Rest of Europe

8.3. Germany Pet Sitting Service Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

8.4. France Pet Sitting Service Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

8.5. The UK Pet Sitting Service Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

8.6. Spain Pet Sitting Service Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

8.7. Italy Pet Sitting Service Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Pet Sitting Service Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Service Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Pet- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Country

9.2.4.1. The UAE

9.2.4.2. Saudi Arabia

9.2.4.3. South Africa

9.2.4.4. Rest of the Middle East & Africa

9.3. The UAE Pet Sitting Service Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

9.4. Saudi Arabia Pet Sitting Service Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

9.5. South Africa Pet Sitting Service Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in USD Million

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Pet Sitting Service Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Booking Channel- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Country

10.2.4.1. China

10.2.4.2. India

10.2.4.3. Japan

10.2.4.4. South Korea

10.2.4.5. Australia

10.2.4.6. Rest of Asia Pacific

10.3. China Pet Sitting Service Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

10.4. India Pet Sitting Service Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

10.5. Japan Pet Sitting Service Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

10.6. South Korea Pet Sitting Service Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

10.7. Australia Pet Sitting Service Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Service Type- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Pet- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Rover Group, Inc.

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Wag! Group Co.

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Fetch! Pet Care, Inc.

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. PetBacker

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Holidog

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Care.com, Inc.

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. PetSmart, Inc. (PetsHotel & Doggie Day Camp)

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Camp Bow Wow

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Pawshake

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Mad Paws Holdings

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. TrustedHousesitters

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. Gudog

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. PetSitter.com

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. HouseMyDog

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. Barkly Pets

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Service Type |

|

| By Pet Type |

|

| By Booking Channel |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.