Norway Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Jan 2026

- VI0831

- 110

-

Norway Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

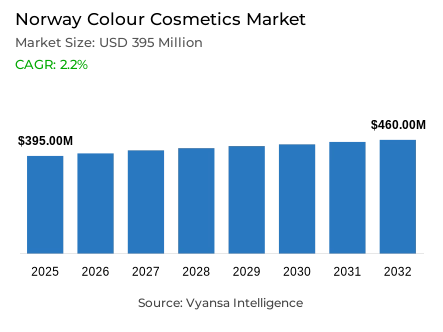

- Colour cosmetics in Norway is estimated at USD 395 million in 2025.

- The market size is expected to grow to USD 460 million by 2032.

- Market to register a cagr of around 2.2% during 2026-32.

- Category Shares

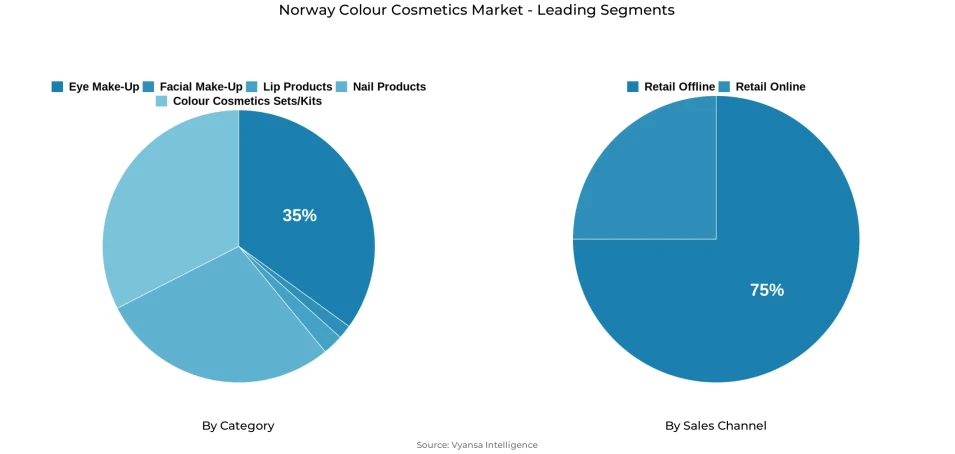

- Eye make-up grabbed market share of 35%.

- Competition

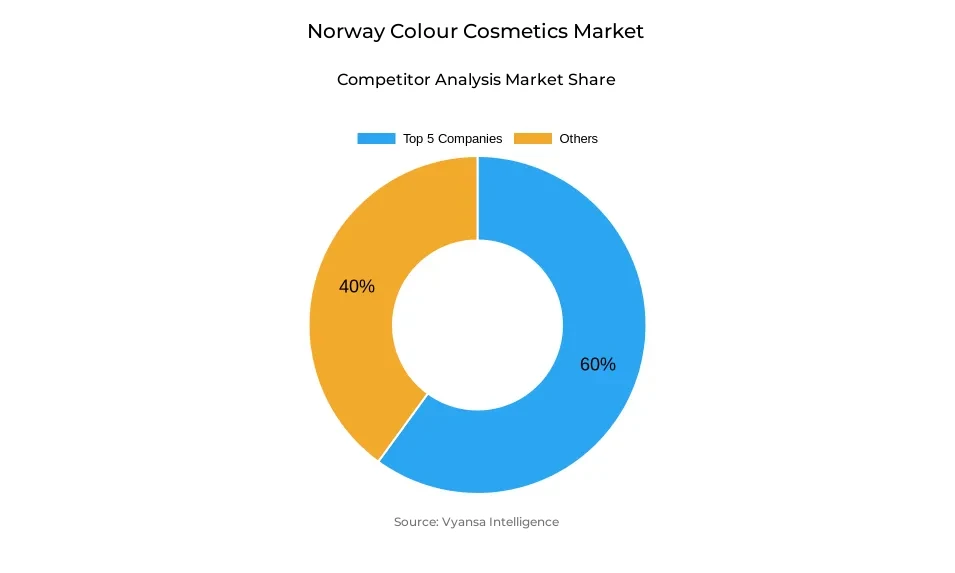

- More than 20 companies are actively engaged in producing colour cosmetics in Norway.

- Top 5 companies acquired around 60% of the market share.

- Rituals Cosmetics Norway AS; Beauty Icons AB; Kicks Norge AS; L'Oréal Norge AS; Estée Lauder Cosmetics AS etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Norway Colour Cosmetics Market Outlook

Norway Color Cosmetics market is expected to have a positive outlook during the period of 2026 to 2032, based on the positive developments, which are driven by products that offer a combination of both cosmetics functionality and skin care functionality. Norway Color Cosmetics market is valued at USD 395 million during 2025 and is expected to reach USD 460 million during 2032, based on a CAGR of approximately 2.2% during this period. This is driven by consumer demand for all in one products including BB creams, Tinted Moisturizers, and Foundation products that have SPF and Anti-Ageing properties which are in line with regional demands for natural and high performance.

A growing focus on ingredient disclosure, clean label, and responsible resource procurement has maintained a strong market for goods providing a combination of beauty enhancement and skincare benefits. In the market, Eye Make-Up holds a market share of almost 35%, marking a significant demand for items that enhance beauty, besides aligning with the beauty trends of minimalism. However, market development is still diversified, with niche, affordable premium, as well as influencer brands, along with established global brands, gaining popularity.

The distribution segment is still led by the traditional retail distribution channel, as the Retail Offline category constitutes close to 75% of the market value, which is driven by the value of consultations, testing, or specialized shopping environments offered in retail stores. Simultaneously, the role played by omnichannel engagement is also increasing in importance.

Throughout the forecast period, improvements in clean design, hybrid skincare-cosmetics, and sustainable packaging are also projected to influence developments in the category. With end user at the end of the channel embracing the importance of ethical high-performance products, those players that are able to marry dermatological authenticity with interesting digital and in-store engagement will reap the greatest rewards in Norway's developing color cosmetics market.

Norway Colour Cosmetics Market Growth DriverHigh Disposable Income and Advanced Consumer Preferences

Norway high GDP and advanced consumer culture sustain positive demand for colour cosmetics. Based on World Bank statistics, Norway had a GDP per capita of around 86,785 US dollars in 2024, marking Norway as a country that is economically affluent and equipped with enough spendable power for luxurious products such as those found within personal care. Its positive economic conditions allow end user to spend money on high-quality products that serve more purposes.

Increasing focus on transparency of ingredients, clean labels, and responsible manufacturing practices – trends noted to be on the rise in the Nordics – further adds to the demand for products meeting such expectations. Thus, the mass as well as the premium sectors continue to register increased penetration of hybrid or performance-driven color cosmetic products.

Norway Colour Cosmetics Market ChallengeEnvironmental Regulations and Sustainable Compliance

The Norway colour cosmetics market is constrained by the stringent environmental and chemical safety compliance requirements imposed on manufacturers and products. Going by EU frameworks such as REACH , as well as various country-specific products standards for safety, Norway's color cosmetics market is faced with tough standards regarding the safety of components as well as labeling.

Although these laws promote overall customer protection and sustainable practices, they also add costs associated with compliance. The laws associated with safety for use, documentation requirements, and sustainable packaging may pose operational complexities that can impact the time-to-market for a newcomer in the market. Although these laws promote customer confidence in the market, they also create operational impediments associated with quick innovation in the market.

Norway Colour Cosmetics Market TrendDigital Engagement & Influencing Beauty Behaviors Using Social Media

Digital engagement and social media networks increasingly have a significant impact on the preferred beauty trends and purchasing decisions among Norwegian end user. The online media, including tutorials, influencer-based content, and online try-ons, continue to assume importance as a significant channel of beauty product exploration, particularly among the young generation of end user in Norway. It allows them to experiment and also therefore enables the promotion of niche brands in the online environment.

Since end user act as the end users of the combined online product search and offline buying activities, the omnichannel approach to retailers is further aligning. Online platforms not only assist end user in the preliminary assessment of products, which is the online aspect, but also improve customer loyalty via interactive communication. It results in more fragmentation of the marketplace, thus providing more room to compete in the Norwegian color cosmetics market.

Norway Colour Cosmetics Market OpportunitySustainability and Clean Innovation Attracting the Eco-Minded Consumer

A major opportunity arises from the growing shift toward sustainable and clean beauty. End users in Norway increasingly value ethically sourced ingredients. They also prefer environmentally responsible formulations and packaging. Minimal, less-is-more design approaches appeal strongly to them. These preferences align closely with the pro-environment values that are deeply embedded in Nordic culture. Sustainable packaging and a diminished footprint resonate with both the environment and trend-savvy beauty enthusiasts.

Norway’s strong culture of taking responsibility for its environment and being aware of the impact of climate change on its planet has paved the way for brands to focus on transparency, green chemistry, and sustainable packaging, which will help to differentiate and build brand loyalty. Innovation in this area will become increasingly important in terms of sustaining future growth in Norway’s colour cosmetic market.

Norway Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

The segment with highest market share under category is Eye Make-Up contributing about 35%. Products like mascara, eyeliner, and eyeshadow palette find immense appeal in the user community, which tends to prefer a minimalist approach to beauty.

The segment also continues to be an essential part of beauty care routines because of its versatility, which allows for the promotion of both natural and dramatic looks. The prominence of the segment also reflects the market trends evident in the realm of personal expression and the influence of digital media, in which tutorials often feature eye products as part of the basics of refined/minimalistic beauty.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales channel is retail offline, contributing aroun 75%. Retail offline still plays a crucial role, especially in countries where this factor is important, as in Norway, as a result of the need for product testing, advice, or as a mode of experiential retailing.

These outlets are also very important for discovery and engagement experiences, especially for high and combination skincare and make-up products that require direct interaction. Although e-channel growth and improvements in convenience persist, the offline sales channel remains the dominant one, thanks to trust and experiences

List of Companies Covered in Norway Colour Cosmetics Market

The companies listed below are highly influential in the Norway colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Rituals Cosmetics Norway AS

- Beauty Icons AB

- Kicks Norge AS

- L'Oréal Norge AS

- Estée Lauder Cosmetics AS

- Scandinavian Cosmetics AS

- E Sæther AS

- Christian Dior AS (Parfums)

- Lesley Cosmetics AS

- Sisley ApS

Competitive Landscape

Norway’s Colour Cosmetics Market in 2025 remained highly fragmented and increasingly competitive, with premium, niche, and influencer-driven brands strengthening their position at the expense of several traditional mass players. Established names such as L’Oréal, Maybelline, and IsaDora continued to launch new shades and hybrid formulations but faced rising pressure from affordable premium brands like CAIA Cosmetics and Rituals, which gained traction through social media influence and aspirational branding. Luxury labels including YSL, Lancôme, and Hermès also performed well, supported by exclusive retail partnerships and elevated positioning. Clean, vegan, and minimalist beauty remained a strong differentiator; however, growing saturation intensified rivalry as brands such as BeautyAct, Lumene, NARS, and private labels from Kicks competed for visibility alongside influencer and celebrity brands like Fenty Beauty and Huda Beauty.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Norway Colour Cosmetics Market Policies, Regulations, and Standards

4. Norway Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Norway Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Norway Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Norway Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Norway Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Norway Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Norway Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. L’Oréal Norge AS

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Estée Lauder Cosmetics AS

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Scandinavian Cosmetics AS

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. E Sæther AS

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Christian Dior (Norway) Parfums AS

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Rituals Cosmetics Norway AS

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Beauty Icons AB

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Kicks Norge AS

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Lesley Cosmetics AS

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Sisley ApS

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.