Global Nitrogen Trifluoride Market Report: Trends, Growth and Forecast (2026-2032)

By Grade (Electronic Grade, Semiconductor Grade), By Application (Semiconductor Manufacturing, Etching, Cleaning), By Region (North America, Latin America, Europe, Middle East & Africa, Asia Pacific)

|

Major Players

|

Global Nitrogen Trifluoride Market Statistics and Insights, 2026

- Market Size Statistics

- Global nitrogen trifluoride market is estimated at USD 1.54 billion in 2025.

- The market size is expected to grow to USD 2.76 billion by 2032.

- Market to register a CAGR of around 8.69% during 2026-32.

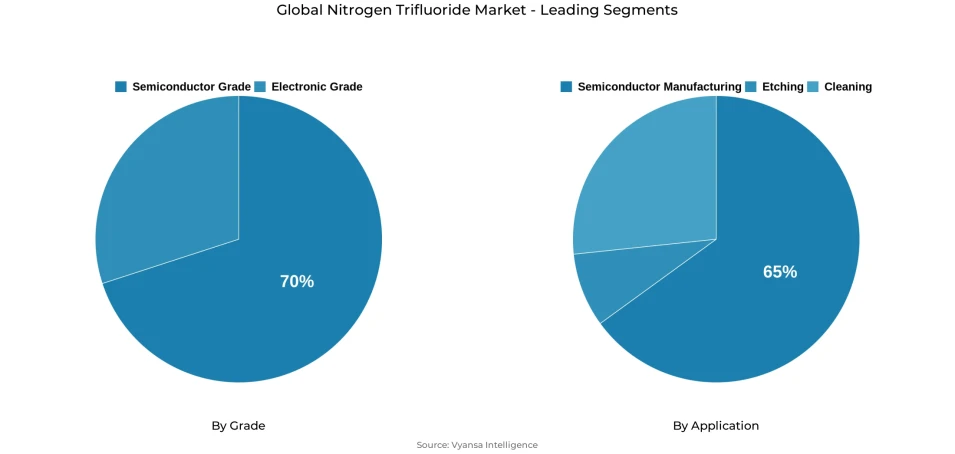

- Grade Shares

- Semiconductor grade grabbed market share of 70%.

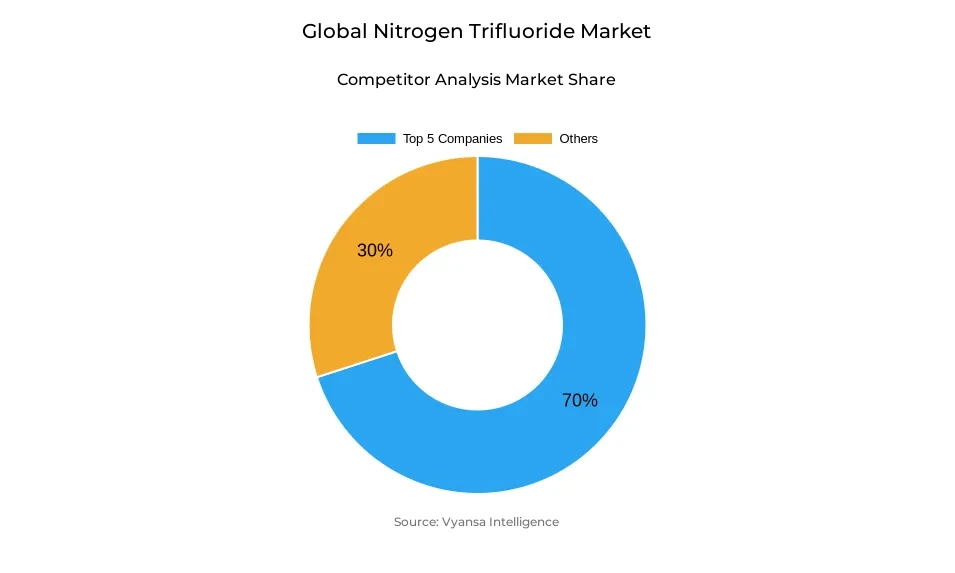

- Competition

- Global nitrogen trifluoride market is currently being catered to by more than 25 companies.

- Top 5 companies acquired around 70% of the market share.

- Air Products & Chemicals; OCI Materials; Anderson Development Company; Mitsui Chemicals; Feiyuan Group etc., are few of the top companies.

- Application

- Semiconductor manufacturing grabbed 65% of the market.

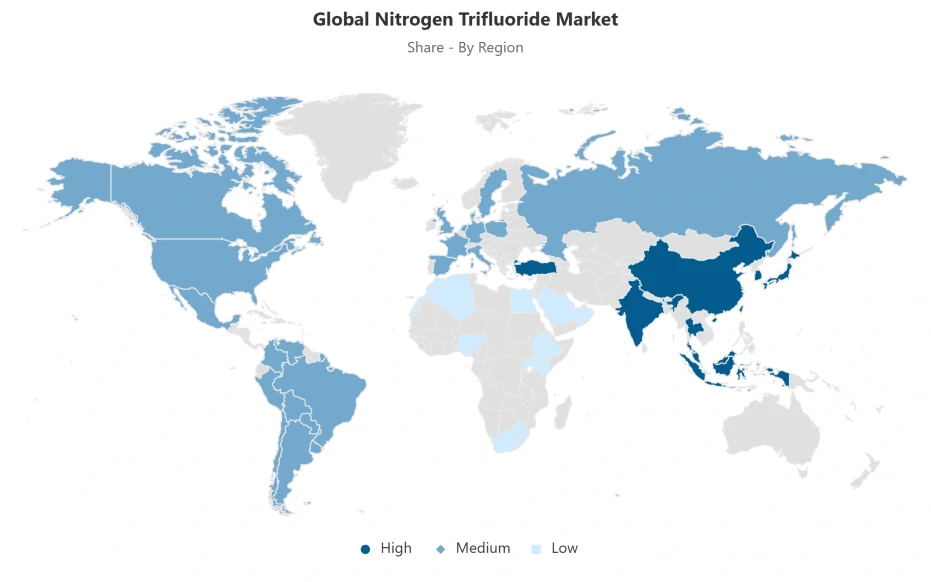

- Region

- Asia Pacific leads with a 75% share of the global market.

Global Nitrogen Trifluoride Market Outlook

The global market of nitrogen trifluoride is estimated at USD 1.54 billion in 2025 and is projected to grow to about USD 2.76 billion by 2032 with a CAGR of about 8.69% in 2026-2032. This expansion perspective is directly associated with the long-term capital investment in semiconductor fabrication, where the world equipment expenditure is estimated to be USD 180 billion in 2024 and is anticipated to increase in 2025. The 5nm and 3nm advanced process nodes demand extremely high capital investments and run at full capacity, thus generating consistent and repeatable demand of high-purity NF3 to facilitate essential etching and chamber cleaning operations.

The semiconductor industry has a solid revenue outlook that supports the fundamental of demand, as the global chip sales are projected to be about USD 630.5 billion in 2024 and are expected to increase in 2025. Since fabrication facilities are running 24 hours a day, 7 days a week to satisfy the growing needs of artificial intelligence and high-performance computing, the consumption of NF3 is directly related to the throughput of the wafer and the growing complexity of the process. NF3 of semiconductor grade is the most prevalent with a 70% market share, due to the high purity levels needed at advanced nodes and the long-term supply relationships that enable steady offtake volumes.

Application-wise, semiconductor manufacturing represents approximately 65% of total NF3 usage. Plasma etching and chamber cleaning are still critical steps in each successive technology node, and the number of process steps per wafer is still increasing. Although energy prices and infrastructure limitations impact operating economics, high fabrication utilization promotes consistent specialty gas demand in line with production output as opposed to short-term market fluctuations.

Asia Pacific dominates the world market in nitrogen trifluoride with an estimated 75% market share, supported by its concentration of semiconductor manufacturing capacity and massive government-supported investments. The increase in fabrication plants in various countries is increasing the regional foundation of demand, and diversification in other areas is contributing to incremental growth, which is supporting a positive global perspective through 2032.

Global Nitrogen Trifluoride Market Growth Driver

Expansion of Global Fabrication Investment Supporting NF₃ Demand

The amount of capital spent on fabrication globally is reaching new heights, supported by the growing need in artificial intelligence (AI), high-performance computing, and supply chain diversification. In 2024, the world semiconductor equipment expenditure was about USD 180 billion annually, growing every year and is expected to grow to about USD 185 billion in 2025 with a projected growth of 7% in manufacturing capacity. The 5nm and 3nm advanced process nodes demand capital outlays of USD 12 billion to USD 20 billion, which is a high barrier to market entry and strengthens the dependence on established market leaders. Such capital investments generate long-term demand of specialty process gases such as nitrogen trifluoride (NF3), since fabs with continuous schedules need to maintain process efficiency and high purity standards to the end users. Constant high utilisation at advanced nodes facilitates constant NF3 consumption relative to wafer throughput and process complexity.

The trend of the semiconductor industry towards almost USD 1 trillion of sales per year by 2030 indicates a continuing need in fabrication infrastructure and related consumables, which supports long-term NF3 demand. In 2024, global semiconductor sales were approximately USD 630.5 billion and are projected to increase to approximately USD 701 billion in 2025, a growth of about 11.2% per annum. The long-term investment in fab capacity and process development is directly proportional to the growth of specialty gas requirements, with more complex etch and chamber-cleaning processes remaining necessary with each new technology node. This capital intensity stimulates long-lasting NF3 demand among the end users worldwide.

Global Nitrogen Trifluoride Market Challenge

Energy Infrastructure Constraints Impacting Manufacturing Economics

State-of-the-art semiconductor manufacturing plants have high energy requirements that have a substantial impact on operating expenses and scalability. One advanced node fab can consume as much as 100 MW of constant power, which is the power needed to serve about 80,000 homes in the U.S., which puts strain on the existing electrical infrastructure. The electricity consumption in the industry, estimated at 100 TWh in 2020, is expected to grow to an estimated 237 TWh by 2030, due to the production of AI chips and high-performance memory. To make this worse, by 2026, data centre electricity consumption will surpass 1 000 TWh because of the concentration of AI workloads, which will increase grid capacity competition and electricity prices in industrial sectors. High energy prices have a direct impact on semiconductor end users, as energy constitutes a large percentage of operational costs in fabrication processes, such as etching chemistry and chamber cleaning.

The volatility of energy costs constrains the capability of fabs to minimize draw without compromising output, which continues to be a consistent limitation on the economics of production and capacity growth plans up to 2032. The rising electricity prices can also encourage more investment in process optimisation and gas abatement systems, which can help to stabilise the trends of NF3 consumption as manufacturers pursue energy efficiencies. The ongoing energy inflation is one of the key threats to fab utilisation rates and rate of capacity deployment that affect the elasticity of demand of specialty gases and strategic planning in the industry.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Nitrogen Trifluoride Market Trend

Workforce Development Efforts Accelerating Production Ramp-Up

The growth of the semiconductor industry is closely linked with the supply of skilled engineering and technical staff to build and run advanced fabrication plants. An estimated global deficit of about 1 million skilled workers by 2030 highlights the urgency of increasing workforce capacity, with Taiwan alone projecting a shortage of about 34 000 engineers by 2030. University programmes and vocational training programs funded by the government are increasing to fill gaps, and almost 77% of semiconductor employers say they have difficulties filling technical jobs, particularly those that demand knowledge of state-of-the-art process technologies. This shortage of talents directly affects the speed at which new fabs can switch to full production, affecting the demand of NF3 associated with active manufacturing.

The coordinated workforce development programmes serve as drivers of transformation of newly constructed capacity into productive output, which strengthens long-term NF3 consumption in etching and chamber cleaning across technology nodes. Countries that invest heavily in semiconductor workforce training are an indication of more serious intentions to run advanced nodes at high utilisation rates, which in turn demand higher volumes of specialty gases per wafer because of more process steps. As a result, human capital investment becomes an important indicator of long-term NF3 demand, regardless of cyclical market changes, because the availability of skilled labour is the foundation of efficient fab operations and technology scaling up to 2032.

Global Nitrogen Trifluoride Market Opportunity

Strategic Trade Policy Reshaping Fabrication Investment Patterns

The recent geopolitical trade policy interventions are playing a major role in the distribution of semiconductor manufacturing capital around the world, establishing new regional centers and changing long-term investment plans. In early 2026, the United States and Taiwan signed a trade agreement that involves at least USD 250 billion of Taiwanese direct investment in U.S. manufacturing operations and equivalent credit guarantees, one of the largest bilateral commitments in the industry. At the same time, the U.S. tariff changes on sophisticated computing semiconductors are intended to balance the development of the domestic supply chain with the international cooperation. These policy tools are directing capital to geographically spread fabrication plants, expanding NF3 demand outside the conventional manufacturing hubs.

Government evaluations of insufficiency of domestic capacity, including the U.S. manufacturing approximately 10% of semiconductors it uses, are fueling reshoring initiatives with heavy government subsidies. Regional investments, such as the JPY 590 billion (USD 3.9 billion) of 2nm development by Japan, KRW 471 trillion of new fabs by South Korea, and USD 40 billion plus of its industry fund by China, all increase the capacity of fabrication globally. These investments are based on trade policy to secure diversified NF3 demand as advanced manufacturing spreads to various regions until 2032.

Global Nitrogen Trifluoride Market Regional Analysis

By Region

- North America

- Latin America

- Europe

- Middle East & Africa

- Asia Pacific

Asia Pacific continues to dominate global nitrogen trifluoride consumption with share of around 75%, driven by the region’s concentration of semiconductor fabrication infrastructure and proactive government policies supporting self-sufficiency. China accounts for over half of the global semiconductor device market, while India emerges as one of the fastest-growing markets with projected near-double-digit growth through 2030, bolstered by attractive incentive programs and foreign direct investment. Taiwan’s foundry leadership and South Korea’s memory fabrication strength further anchor the region’s manufacturing concentration, supported by multibillion-dollar subsidies in Japan, Malaysia, Vietnam, and India that reinforce competitive advantages and infrastructure expansion. These coordinated efforts solidify Asia-Pacific’s dominant NF₃ consumption profile through the 2026–2032 period.

Outside Asia-Pacific, North America is expanding its role through U.S. fab investments incentivized by initiatives like the CHIPS Act and bilateral trade agreements. Europe holds a tertiary position, constrained by higher manufacturing costs and relatively lower investment in advanced fab technology. Nevertheless, broader global policy shifts and investment commitments indicate incremental growth in NF₃ demand across multiple regions, even as Asia-Pacific maintains its leading position.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Nitrogen Trifluoride Market Segmentation Analysis

By Grade

- Electronic Grade

- Semiconductor Grade

In the global nitrogen trifluoride market, semiconductor-grade NF₃ commands the largest segment, accounting for approximately 70% of total NF₃ consumption due to the stringent purity requirements of advanced semiconductor fabrication. This segment encompasses high-purity products meeting or exceeding 99.99% (4N) specifications, with cutting-edge fabs demanding 99.999% (5N) or higher to mitigate contamination risks and maintain process integrity. These elevated purity standards are critical for etch and chamber cleaning operations at advanced nodes, where even minor impurities can compromise device performance. Long-term supply contracts and established vendor relationships with major foundries create significant switching costs, stabilizing demand within this segment and insulating it from short-term price volatility.

The remaining 30% of NF₃ consumption arises from lower-purity grades used in solar photovoltaic cell manufacturing and flat-panel displays. While these applications contribute meaningful volumes, the semiconductor segment’s growth rate outpaces that of non-semiconductor uses, driven by continued device miniaturization and heightened etching intensity per wafer. As capital investments for advanced fabrication expand, the high-purity NF₃ segment will maintain its leadership, reflecting irreplaceable role in supporting sophisticated semiconductor end-user requirements.

By Application

- Semiconductor Manufacturing

- Etching

- Cleaning

The semiconductor manufacturing application segment captures a dominant share-approximately 65%-of global nitrogen trifluoride consumption, reflecting NF₃’s essential role in plasma etching and chamber cleaning at fabrication facilities worldwide. In etching processes, NF₃ decomposes within plasma to generate reactive fluorine species that enable controlled material removal with nanometer precision. In cleaning operations, NF₃ removes polymerized residues and byproducts, sustaining chamber performance and throughput. These two application pathways consume substantial NF₃ volumes, particularly in advanced foundry operations where increased lithography steps and complex layer stacks amplify process gas requirements per wafer. Global semiconductor sales growth drives proportional demand for these consumables as fabs operate 24/7 to meet end-user needs.

Secondary applications, comprising roughly 35% of NF₃ use, include solar photovoltaic manufacturing, flat-panel display production, LED fabrication, and research activities. While these sectors are important, their NF₃ intensity and contract structures do not match the scale or continuity of semiconductor manufacturing. Long-term supply agreements and pricing power held by major fabs further entrench the semiconductor manufacturing segment’s leadership, ensuring its share of NF₃ consumption remains robust through 2032.

Market Players in Global Nitrogen Trifluoride Market

These market players maintain a significant presence in the Global nitrogen trifluoride market sector and contribute to its ongoing evolution.

- Air Products & Chemicals

- OCI Materials

- Anderson Development Company

- Mitsui Chemicals

- Feiyuan Group

- SK Materials

- Linde AG

- American Gas Products

- Shanghai Wechem Chemical Co. Ltd.

- Air Liquide S.A.

- Showa Denko K.K.

- Kanto Denka Kogyo Co. Ltd.

- Foosung Co. Ltd.

- PERIC Special Gases

- Zhejiang Juhua Co. Ltd.

Market News & Updates

- Mitsui Chemicals, 2025:

Mitsui Chemicals announced its decision to exit the nitrogen trifluoride (NF3) business entirely, with production cessation at its wholly-owned subsidiary Shimonoseki Mitsui Chemicals scheduled for March 31, 2026, and sales completion within the same calendar year. The company determined that despite implementing rationalization measures and cost reduction efforts, it could not maintain profitability levels required to sustain this semiconductor and LCD manufacturing equipment-cleaning gas business due to intensified price competition from overseas competitors, rising raw material and utility costs, and increased maintenance expenses. This strategic withdrawal aligns with Mitsui Chemicals' VISION 2030 Long-Term Business Plan, which prioritizes portfolio reform focused on high-growth, high-profitability global specialty chemicals and sustainable green chemicals businesses.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Nitrogen Trifluoride Market Policies, Regulations, and Standards

4. Global Nitrogen Trifluoride Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Nitrogen Trifluoride Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Grade

5.2.1.1. Electronic Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Semiconductor Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Semiconductor Manufacturing- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Etching- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Cleaning- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Region

5.2.3.1. North America

5.2.3.2. Latin America

5.2.3.3. Europe

5.2.3.4. Middle East & Africa

5.2.3.5. Asia Pacific

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. North America Nitrogen Trifluoride Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Country

6.2.3.1. US

6.2.3.2. Canada

6.2.3.3. Mexico

6.2.3.4. Rest of North America

6.3. US Nitrogen Trifluoride Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Nitrogen Trifluoride Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Nitrogen Trifluoride Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7. Latin America Nitrogen Trifluoride Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Country

7.2.3.1. Brazil

7.2.3.2. Rest of Latin America

7.3. Brazil Nitrogen Trifluoride Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Nitrogen Trifluoride Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Country

8.2.3.1. Germany

8.2.3.2. France

8.2.3.3. UK

8.2.3.4. Italy

8.2.3.5. Netherlands

8.2.3.6. Belgium

8.2.3.7. Poland

8.2.3.8. Russia

8.2.3.9. Rest of Europe

8.3. Germany Nitrogen Trifluoride Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. France Nitrogen Trifluoride Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Nitrogen Trifluoride Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Nitrogen Trifluoride Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Netherlands Nitrogen Trifluoride Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Belgium Nitrogen Trifluoride Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Poland Nitrogen Trifluoride Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in USD Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10. Russia Nitrogen Trifluoride Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in USD Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Nitrogen Trifluoride Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Grade- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Country

9.2.3.1. Saudi Arabia

9.2.3.2. Israel

9.2.3.3. Rest of Middle East & Africa

9.3. Saudi Arabia Nitrogen Trifluoride Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. Israel Nitrogen Trifluoride Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Nitrogen Trifluoride Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Country

10.2.3.1. China

10.2.3.2. Japan

10.2.3.3. South Korea

10.2.3.4. India

10.2.3.5. Taiwan

10.2.3.6. Singapore

10.2.3.7. Australia

10.2.3.8. Rest of Asia Pacific

10.3. China Nitrogen Trifluoride Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.4. Japan Nitrogen Trifluoride Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.5. South Korea Nitrogen Trifluoride Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.6. India Nitrogen Trifluoride Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.7. Taiwan Nitrogen Trifluoride Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.8. Singapore Nitrogen Trifluoride Market Statistics, 2022-2032F

10.8.1. Market Size & Growth Outlook

10.8.1.1. By Revenues in USD Million

10.8.2. Market Segmentation & Growth Outlook

10.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.9. Australia Nitrogen Trifluoride Market Statistics, 2022-2032F

10.9.1. Market Size & Growth Outlook

10.9.1.1. By Revenues in USD Million

10.9.2. Market Segmentation & Growth Outlook

10.9.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

10.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Mitsui Chemicals

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Feiyuan Group

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. SK Materials

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Linde AG

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. American Gas Products

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Air Products & Chemicals

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. OCI Materials

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Anderson Development Company

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Shanghai Wechem Chemical Co. Ltd.

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Air Liquide S.A.

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. Showa Denko K.K.

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. Kanto Denka Kogyo Co. Ltd.

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. Foosung Co. Ltd.

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. PERIC Special Gases

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. Zhejiang Juhua Co. Ltd.

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Grade |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.