Global Nickel Oxide Market Report: Trends, Growth and Forecast (2026-2032)

By Purity Grade (Battery Grade, Industrial Grade), By Application (Battery Cathodes, Catalysts, Ceramics, Electronics), By Region (North America, Latin America, Europe, Middle East & Africa, Asia Pacific)

|

Major Players

|

Global Nickel Oxide Market Statistics and Insights, 2026

- Market Size Statistics

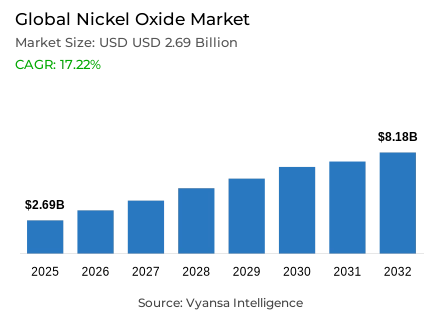

- Global nickel oxide market is estimated at USD 2.69 billion in 2025.

- The market size is expected to grow to USD 8.18 billion by 2032.

- Market to register a CAGR of around 17.22% during 2026-32.

- Purity Grade Shares

- Battery grade grabbed market share of 60%.

- Competition

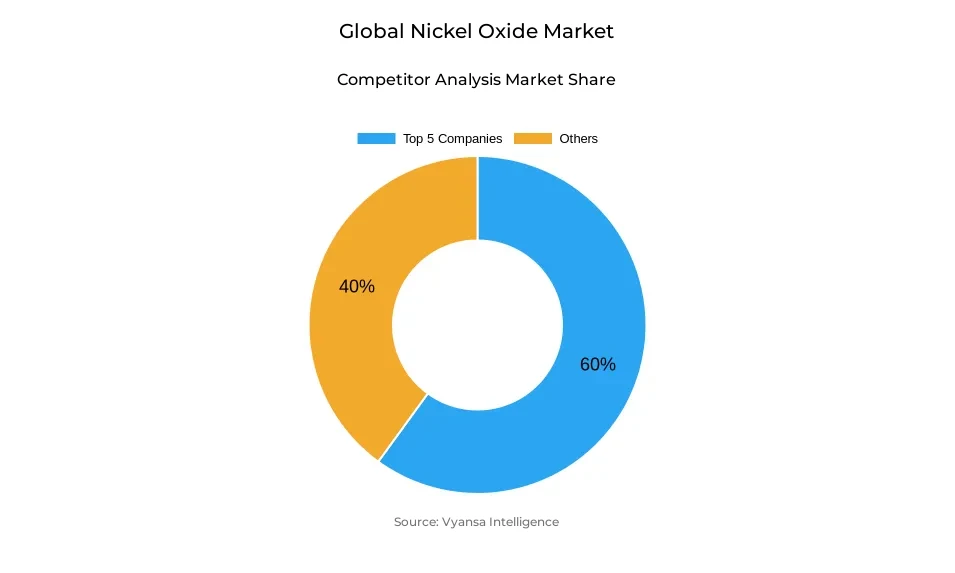

- Global nickel oxide market is currently being catered to by more than 30 companies.

- Top 5 companies acquired around 60% of the market share.

- Tanaka Chemical; Resonac Holdings; L&F Co.; Umicore; Todini Chemicals etc., are few of the top companies.

- Application

- Battery cathodes grabbed 55% of the market.

- Region

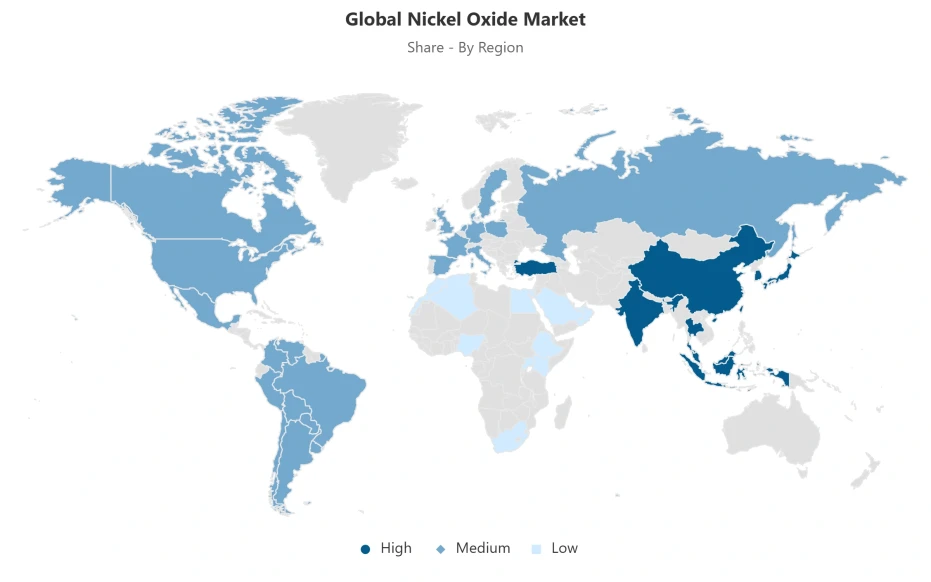

- Asia Pacific leads with a 50% share of the global market.

Global Nickel Oxide Market Outlook

The global nickel oxide market is estimated to be USD 2.69 billion in 2025 and is expected to be USD 8.18 billion in 2032, which is a strong CAGR of about 17.22% between the years 2026 and 2032. The main factors behind this rapid growth are the increasing electrification of the transportation industry and the proliferation of stationary energy storage systems. Nickel oxide is a very important component in lithium-ion battery cathodes, which improves energy density, cycle life, and thermal stability. With the growth in the production of electric vehicles and the growth of grid-scale renewable energy storage, battery manufacturers are entering into long-term procurement contracts, which in turn offers them a clear view of demand that will allow them to grow the market in the long term.

In contrast to the traditionally prevailing demand of nickel in the manufacturing of stainless steel, the consumption based on battery uses is directly correlated with the national decarbonisation goals and infrastructure development policies. This structural change minimizes short-term commodity cycles and enables multi-year capacity planning by battery manufacturers and automotive OEMs. As a result, the market is becoming more inclined towards high-purity materials and long-term supply contracts, which strengthens the investment in refining capacity and quality control. The battery-grade nickel oxide dominates the purity-based segmentation, with a market share of 60%, which is a result of the high standards demanded in high-end battery applications.

Application wise, battery cathodes represent approximately 55% of the total market demand, and hence the biggest and fastest growing segment. This preeminence highlights that energy storage is fueling incremental demand growth instead of conventional industrial applications, which still offer stable but slower-growing consumption. The existence of long-term offtake contracts across the battery value chain also strengthens the baseline demand and capacity utilisation.

The Asia-Pacific region has almost 50% of the global market share regionally. This leadership is supported by the concentrated nickel resources, high-capacity refining, and highly integrated battery manufacturing ecosystems. The presence of Indonesia as a large producer of nickel, downstream processing operations, and battery manufacturing in East and Southeast Asia, keeps the region dominant up to 2032.

Global Nickel Oxide Market Growth Driver

Electrification Led Expansion of Advanced Battery Materials Demand

The sustained growth in the global nickel oxide market is based on rapid electrification of transportation and stationary energy storage systems. Nickel oxide is still a key component of lithium-ion battery cathode formulations, allowing increased energy density, extended cycle life, and thermal stability needed in electric vehicles and grid-scale storage. The International Energy Agency assessments validate batteries as the most rapidly expanding end use of nickel, which is a structural change in the global energy consumption. Rapid electric vehicle manufacturing and massive integration of renewable energy have resulted in long-term procurement contracts with battery producers, which have helped in long-term demand visibility of high-purity nickel oxide.

This is a materially different demand profile than the historical patterns of nickel consumption that were dominated by stainless steel. The demand driven by batteries is associated with national decarbonisation goals and infrastructure investment as opposed to short-term commodity cycles. With the spread of electrification in both developed and developing economies, the demand of nickel oxide is advantaged by the multi-year capacity planning of cell manufacturers and automotive OEMs. This realignment of structure creates a sustainable growth base, which strengthens investment in refining capacity, quality control, and long-term supply contracts throughout the battery materials ecosystem.

Global Nickel Oxide Market Challenge

Structural Supply Concentration and Geopolitical Exposure Risks

Nickel oxide supply chains are highly geographically and ownership concentrated globally, posing systemic risk to end users. In 2024, Indonesia contributed about 59% of the world primary nickel production, and much of the downstream refining capacity is owned by Chinese companies. This two-fold focus on mining and processing phases restricts diversification opportunities and increases vulnerability to policy changes, export restrictions, and bilateral trade actions. Such concentration is found in analyses by the International Energy Agency as a material constraint to meeting global electrification and decarbonisation goals at scale.

The geopolitical processes have already been translated into the real supply disruption and price fluctuations. In 2025, trade restrictions by large importing economies limited the flow of nickel to North-American battery supply chains, and low prices made much of the global production capacity uneconomic and offline. These dynamics indicate that the supply risks are structural but not cyclical. To battery producers and industrial end-users, the management of nickel oxide supply is becoming a matter of strategic sourcing, regional diversification and alignment with policy-compliant suppliers as opposed to spot-market sourcing.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Nickel Oxide Market Trend

Shifting Battery Chemistries and Material Substitution Momentum

The development of battery technology is transforming the trends in material demand, as the use of chemistries that do not heavily depend on high-nickel cathodes is increasingly adopted. Lithium iron phosphate batteries registered significantly greater growth compared to nickel-rich formulations in 2025 due to cost competitiveness, enhanced safety, and easier supply chains. According to industry analyses, LFP chemistries may constitute the biggest portion of worldwide battery volumes prior to 2030, especially in mass-market electric vehicles and stationary storage where ultra-high energy density is not as important.

This transition is supported by regulatory and policy frameworks. The European Union Battery Regulation requires high recovery rates of nickel and other metals by 2027, which will increase the availability of secondary supply more quickly and decrease reliance on primary nickel oxide. Alternative cathode materials are becoming a priority in publicly funded research programmes to reduce environmental and geopolitical risks. Although absolute battery production is still increasing, these trends are gradually reducing the share of applications that demand large amounts of nickel oxide inputs, which creates a structural moderating effect on the long-term growth of demand in battery end applications.

Global Nickel Oxide Market Opportunity

Expansion of Catalytic Roles in the Hydrogen Economy

Nickel oxide is becoming strategically important as an active catalyst in hydrogen generation and industrial decarbonisation routes. Hydrogen outlooks by the International Energy Agency emphasize the role of hydrogen in lowering emissions in steelmaking, ammonia production, and high-temperature industrial processes. Nickel-oxide-based catalysts are highly active in electrolysis and reforming processes and have cost and scalability benefits compared to precious-metal catalysts. The effectiveness of nickel-oxide nanostructures in the production of green hydrogen is confirmed by peer-reviewed studies published after 2020.

This new application generates demand streams that are not dependent on the dynamics of the battery market. The hydrogen targets supported by the government, such as large-scale renewable hydrogen production commitments in Europe, are being converted into pilot projects and initial commercial deployments. In contrast to battery applications where chemistry substitution pressures exist, catalytic applications take advantage of inherent chemical properties of nickel oxide that have few direct substitutes. Catalytic demand is a structurally significant opportunity that diversifies end-use exposure and enables incremental volume growth at a low current base as hydrogen infrastructure scales to the late 2020s.

Global Nickel Oxide Market Regional Analysis

By Region

- North America

- Latin America

- Europe

- Middle East & Africa

- Asia Pacific

Asia Pacific holds approximately 50% share of the Global nickel oxide market, underpinned by concentrated resource availability, refining capacity, and integrated battery manufacturing ecosystems. Indonesia’s position as the largest nickel producer globally anchors regional supply, while extensive downstream investments link mining output to cathode and cell production across East and Southeast Asia. Coordinated industrial policies and infrastructure development support end to end integration, enabling efficient scaling of nickel oxide production to serve both regional and export markets.

Within the region, emerging economies are contributing incremental demand growth alongside established manufacturing centers. India’s expanding renewable energy deployment and electric mobility initiatives are increasing regional consumption of battery materials, reinforcing Asia Pacific’s leadership position. Despite diversification efforts in North America and Europe, the depth of resource endowment and processing capacity in Asia Pacific supports sustained regional dominance through 2032. This regional structure shapes global trade flows, investment decisions, and strategic sourcing strategies for nickel oxide end users worldwide.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Nickel Oxide Market Segmentation Analysis

By Purity Grade

- Battery Grade

- Industrial Grade

Battery grade nickel oxide dominates purity based segmentation, accounting for approximately 60% of the market share. This leadership reflects stringent material specifications required for lithium ion battery cathodes, where purity above 99.5% is essential to ensure electrochemical stability, consistent cycle life, and thermal safety. Tight limits on trace contaminants such as sulfur and iron necessitate advanced refining processes, quality assurance systems, and higher production costs, supporting premium pricing for battery grade material.

Industrial grade nickel oxide represents the remaining 40% of the share, serving applications such as ceramics, pigments, and metallurgical processes. These uses tolerate lower purity levels typically between 95 and 98%, enabling simpler and more cost efficient production routes. The segmentation highlights a structural shift toward premium specification demand driven by electrification. As battery manufacturing capacity expands globally, growth is increasingly concentrated within battery grade supply streams, reinforcing investment focus on high purity refining and process control capabilities.

By Application

- Battery Cathodes

- Catalysts

- Ceramics

- Electronics

Battery cathodes represent the largest application segment within the Global nickel oxide market, accounting for roughly 55% of total demand. This dominance reflects the central role of nickel oxide in lithium ion battery production for electric vehicles and stationary energy storage. Long term supply agreements between material producers and battery manufacturers create stable baseline demand, supporting predictable offtake volumes and capacity utilization across the value chain. The segment also exhibits the fastest growth trajectory, aligned with global electrification targets.

The remaining 45% of demand originates from traditional industrial applications that provide steady but slower growing consumption. Distinct specification requirements separate battery cathode supply from industrial uses, resulting in differentiated pricing and sourcing strategies. Application level segmentation underscores that incremental market expansion is increasingly driven by advanced energy storage rather than legacy industrial sectors. For producers, aligning production portfolios toward battery cathode requirements is central to capturing the most attractive demand growth and margin opportunities.

Market Players in Global Nickel Oxide Market

These market players maintain a significant presence in the Global nickel oxide market sector and contribute to its ongoing evolution.

- Tanaka Chemical

- Resonac Holdings

- L&F Co.

- Umicore

- Todini Chemicals

- Mitsubishi Chemical Holdings

- BASF SE

- Sumitomo Metal Mining

- JFE Chemical

- 3M

- Honeywell

- BAE Systems

- Royal Ten Cate

- Koninklijke DSM

- Dow Chemical

Market News & Updates

- Umicore, 2025:

Umicore launched Sustainable Procurement Frameworks for Nickel in November 2025, establishing comprehensive supply chain visibility, traceability, and risk assessment protocols aligned with OECD Due Diligence Guidance. The framework requires suppliers to complete self-assessment questionnaires covering business activities, environmental and social governance (ESG) policies, and due diligence practices, with planned regular site visits and audits to verify responsible sourcing. The company targets third-party certification completion by end-2025 latest, extending its responsible sourcing governance previously established for cobalt into nickel supply chains to address deforestation, biodiversity loss, and other environmental risks linked to mining operations, particularly in Indonesia and other key sourcing regions.

- BASF SE, 2025:

BASF delivered first batches of mass-produced ultra-high nickel NCM (Nickel-Cobalt-Manganese) cathode active materials featuring a unique composite coating layer to Beijing WELION New Energy Technology in August 2025. The company achieved transition from concept development to mass production within approximately one year, marking a significant commercialization milestone in advanced battery materials technology. The supplied materials enhance energy density and improve cycling performance for semi-solid-state battery applications through interface optimization between the cathode active material and solid electrolyte, addressing critical degradation mechanisms.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Nickel Oxide Market Policies, Regulations, and Standards

4. Global Nickel Oxide Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Nickel Oxide Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Purity Grade

5.2.1.1. Battery Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Industrial Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Battery Cathodes- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Catalysts- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Ceramics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Electronics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Region

5.2.3.1. North America

5.2.3.2. Latin America

5.2.3.3. Europe

5.2.3.4. Middle East & Africa

5.2.3.5. Asia Pacific

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. North America Nickel Oxide Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Country

6.2.3.1. US

6.2.3.2. Canada

6.2.3.3. Mexico

6.2.3.4. Rest of North America

6.3. US Nickel Oxide Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Nickel Oxide Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Nickel Oxide Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7. Latin America Nickel Oxide Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Country

7.2.3.1. Brazil

7.2.3.2. Rest of Latin America

7.3. Brazil Nickel Oxide Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Nickel Oxide Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Country

8.2.3.1. Germany

8.2.3.2. France

8.2.3.3. UK

8.2.3.4. Italy

8.2.3.5. Spain

8.2.3.6. Netherlands

8.2.3.7. Belgium

8.2.3.8. Poland

8.2.3.9. Russia

8.2.3.10. Turkey

8.2.3.11. Rest of Europe

8.3. Germany Nickel Oxide Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. France Nickel Oxide Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Nickel Oxide Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Nickel Oxide Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Nickel Oxide Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Netherlands Nickel Oxide Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Belgium Nickel Oxide Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in USD Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10. Poland Nickel Oxide Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in USD Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.11. Russia Nickel Oxide Market Statistics, 2022-2032F

8.11.1. Market Size & Growth Outlook

8.11.1.1. By Revenues in USD Million

8.11.2. Market Segmentation & Growth Outlook

8.11.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.12. Turkey Nickel Oxide Market Statistics, 2022-2032F

8.12.1. Market Size & Growth Outlook

8.12.1.1. By Revenues in USD Million

8.12.2. Market Segmentation & Growth Outlook

8.12.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.12.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Nickel Oxide Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Country

9.2.3.1. Saudi Arabia

9.2.3.2. UAE

9.2.3.3. Rest of Middle East & Africa

9.3. Saudi Arabia Nickel Oxide Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. UAE Nickel Oxide Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Nickel Oxide Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Country

10.2.3.1. China

10.2.3.2. Japan

10.2.3.3. South Korea

10.2.3.4. India

10.2.3.5. Australia

10.2.3.6. Thailand

10.2.3.7. Rest of Asia Pacific

10.3. China Nickel Oxide Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.4. Japan Nickel Oxide Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.5. South Korea Nickel Oxide Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.6. India Nickel Oxide Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.7. Australia Nickel Oxide Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.8. Thailand Nickel Oxide Market Statistics, 2022-2032F

10.8.1. Market Size & Growth Outlook

10.8.1.1. By Revenues in USD Million

10.8.2. Market Segmentation & Growth Outlook

10.8.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Umicore

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Todini Chemicals

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Mitsubishi Chemical Holdings

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. BASF SE

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Sumitomo Metal Mining

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Tanaka Chemical

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Resonac Holdings

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. L&F Co.

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. JFE Chemical

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. 3M

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. Honeywell

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. BAE Systems

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. Royal Ten Cate

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. Koninklijke DSM

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. Dow Chemical

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Purity Grade |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.