Global Bio-Ethylene Market Report: Trends, Growth and Forecast (2026-2032)

By Feedstock (Sugarcane, Corn, Others), By Application (Packaging, Automotive, Construction, Consumer Goods), By Region (North America, Latin America, Europe, Middle East & Africa, Asia Pacific)

|

Major Players

|

Global Bio-Ethylene Market Statistics and Insights, 2026

- Market Size Statistics

- Global bio-ethylene market is estimated at USD 610 million in 2025.

- The market size is expected to grow to USD 1.02 billion by 2032.

- Market to register a CAGR of around 7.62% during 2026-32.

- Feedstock Shares

- Sugarcane grabbed market share of 40%.

- Competition

- Global bio-ethylene market is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 65% of the market share.

- SABIC; Enerkem; Oxy Low Carbon Ventures (OCLV); Braskem S.A.; The Dow Chemical Company etc., are few of the top companies.

- Application

- Packaging grabbed 50% of the market.

- Region

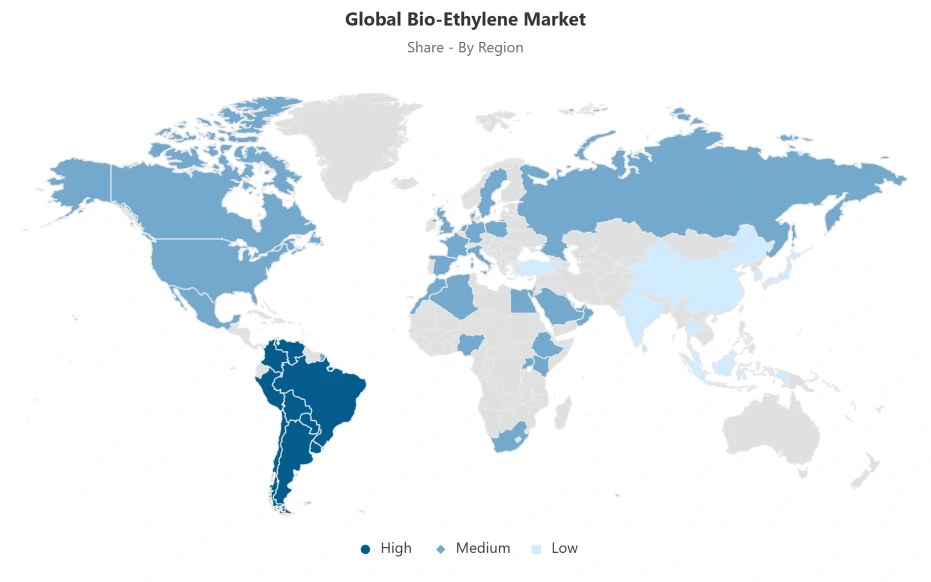

- Latin America leads with a 45% share of the global market.

Global Bio-Ethylene Market Outlook

The Global bio-ethylene market is estimated at worth USD 610 million in 2025 and projected around USD 1.02 billion in 2032 with a CAGR of about 7.62% between the years 2026 and 2032. The supportive policy frameworks that support growth include the Renewable Energy Directive III (RED III) of the European Union that requires renewable-energy quotas and the content of advanced biofuels in transport fuels. Other such efforts in the developing world, such as the RenovaBio programme in Brazil and the early introduction of E20 ethanol blending in India, are increasing regulatory-based demand. Such requirements give predictable consumption patterns to final consumers, such as fuel distributors and polymer producers, and promote investment in bio-ethylene production capacity and competitiveness of renewable feedstocks compared to petroleum-based feedstocks.

Sugar-cane is the most common feedstock with about 40% of the market share because of its high fermentation rate and the established agricultural infrastructure, especially in Brazil and India. Nevertheless, the growth of sugar-cane production in the world and rivalry with food and export markets pose supply-side challenges, which may result in price volatility. Used cooking oils, tallow, and lignocellulosic residues are also becoming more popular as waste-derived feedstocks, due to carbon-intensity policies and circular-economy policies. Incorporation of these alternative inputs will reduce dependence on the major agricultural products and will match production with sustainability objectives.

Packaging has the highest market share of 50% in terms of applications due to the need to use polyethylene-based films and containers in retail and e-commerce supply chains. End users are being forced by regulatory and corporate sustainability requirements to use bio-ethylene derivatives of recyclable and compostable materials. The remaining market share is in industrial applications, such as automotive components, construction, textiles, and chemical intermediates, which are more gradually adopted because of the technical qualification requirements and established supplier networks, but with increasing interest in lifecycle-emission reductions, the market is expanding.

In Latin America, the region has a 45% share of the world market, which is advantaged by structural advantages in sugar-cane production and integrated bio-ethylene supply chains. Brazil is the only country that produces a significant amount of sugar-cane-based ethanol, which serves the local and international markets. North America has a strong presence because of the developed biofuel infrastructure and sustainability-oriented demand, whereas Asia Pacific is the most rapidly growing region, with the help of industrialisation, policy incentives, and investments in bio-based polymer plants. All these indicate a strong future of global bio-ethylene growth by 2032.

Global Bio-Ethylene Market Growth Driver

Policy Mandates Shaping Renewable Fuel Adoption

Such government regulations as the European Union’s Renewable Energy Directive III (RED III), which came into force in November 2023, are thus systemically transforming the Global Bio-ethylene Market by setting targets for renewable energy and advanced biofuel within legal frameworks to ensure the global transition towards sustainable energy. This regulation sets targets for at least 42.5% of the European Union’s energy coming from renewable sources by 2030, aiming for 45%, and at least 5.5% of transport fuel energy from advanced biofuels by 2030. This actively supports market demand for bio-sourced ethanol and bio-ethylene derivatives for transport fuel applications, while sustainable aviation fuel targets from 2% from 2025 to 6% from 2030 further broaden the scope for government-regulated market demands in aviation transports. Emerging markets are setting their agendas for sustainable bio-energy as well: Brazil’s RenovaBio targets rising ethanol blends to 40% by 2034, while E20 ethanol blending had already been introduced successfully in India by 2025, five years ahead of original targets, establishing biofuels firmly within global energy mixes.

The OECD-FAO Agricultural Outlook forecasts that among developing economies, two-thirds of the overall growth demand for biofuels from now until 2034 will come from middle-income countries, driven primarily by energy security concerns, petroleum reduction mandates, and government support policies. Notably, the Agricultural Outlook also underscores that policy mandates are now a transcontinental phenomenon and further implicate them within the bio-ethylene market dynamics represented by structural demand factors that drive the growth of the industry worldwide. It should, however, become apparent that with government support guarantees and improved accessibility through policies mandating the use of renewable fuels within the various transportation sectors and the wider aviation energy sector, particularly, government support policies can mitigate various factors related to competition, development, and implementation within the industry and enhance the overall plannability and predictability associated with demand growth linked to market competitiveness between sustainable alternatives and conventional petroleum-based products accessible through resources derived from fossil oils and gasoline, among others. Generally, policy mandates are pivotal within the overall supportive legal structures particularly associated with the growth and adoption of bio-ethylene.

Global Bio-Ethylene Market Challenge

Agricultural Feedstock Constraints on Market Expansion

The expansion of bio-ethylene production will be limited by moderate growth in basic agricultural feedstock resources, specifically sugarcane, which is a key part of the process of ethanol fermentation. World sugarcane production stood at around 2.0 billion tonnes as of 2023, with annual growth of only 1.2% to end 2034, which naturally limits the future expansion of sugarcane bio-ethylene feedstock resources. The increasingly competing demands for sugarcane based on food, energy, and export requirements naturally further limits the expansion of sugarcane bio-ethylene feedstock resources, since Brazil and India alone already contribute about 60% of total global sugarcane output. This automatically generates inherent bottlenecks for feedstock procurement which can no longer be alleviated by simply going for land expansion due to the conflict for land use.

Data also shows that the share of the total sugarcane production in the world in 2034 will be around 37% from Brazil, while that of the remaining largest production will be 23% from India. The above statistics illustrate the low geographical diversification in the production of the key feedstock for bio-ethylene. Geographically low diversification in the production of the feedstock increases the sensitivity to the change in climate variability, including the shifts in agriculture policies of different countries, leading to the reduction in the accessibility of the feedstock. On the same note, the geographical concentration of the feedstock supply chains will cause complexities in the supply chains to the end-users, including the producers of polymers.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Bio-Ethylene Market Trend

Shifts Toward Circular Feedstock Integration

The use of waste-based feedstocks, such as used cooking oils, tallow, and lignocellulosic agricultural residues, is becoming part of biofuel production systems, as regulatory and sustainability requirements shift. The OECD-FAO Agricultural Outlook indicates that the production of biomass-based diesel using waste-derived feedstocks will rise to between 24 and 28% of total production by 2034 due to the strict lifecycle carbon accounting rules and incentives that favor low-carbon routes. This change is not so much about cost competitiveness but rather about fulfilling the requirements of the circular economy and carbon intensity as required by frameworks like the RED III of the EU, which focus on sustainability requirements. The integration of waste streams into the existing value chains will allow producers to decrease the dependence on primary agricultural products, decrease the burden on food markets, and improve the environmental picture of the bio-ethylene production processes, promoting the systemic sustainability objectives.

The waste-based feedstock integration maturation facilitates the wider industrial shift to decarbonised fuel and polymer production, allowing end users to reconcile their procurement practices with their regulatory and corporate sustainability obligations. This direction allows the creation of novel fermentation pathways that utilize cellulosic biomass and agricultural residues, broadening the range of inputs beyond the conventional sources of sugars or starch. Although the processing costs of such alternative feedstocks are still higher and commercial implementation is still in its early stages, economic differences are being reduced by policy incentives and the changing carbon pricing mechanisms. Finally, the increasing importance of waste-based inputs highlights a new trend in which environmental performance and regulatory compliance of feedstock sources are key determinants of long-term competitiveness in the global bio-ethylene environment.

Global Bio-Ethylene Market Opportunity

Capacity Growth Prospects Driven by Emerging Market Demand

The new markets, especially in Asia, offer a great growth potential of bio-ethylene demand without the influence of the developed market policy drivers, which provides a good opportunity to grow capacity. The OECD-FAO Outlook estimates biofuel use in the middle-income nations to increase at an average of 1.7% per year until 2034 due to government energy security policies, petroleum importation requirements, and limitations on electrification in the transportation industries. Together, the middle-income countries are expected to provide about two-thirds of the world biofuel demand increase in the 2025-2034. India, specifically, will be a key player, as the sugarcane allocation to ethanol production will increase to 22% by 2034, indicating the strong government interest in increasing bio-ethylene production capacity and creating competitive secondary production centres to complement Latin American centres.

To end users in transportation, packaging and industrial sectors in emerging markets, increasing the supply of bio-ethylene will be translated into increased choices in renewable feedstock integration, which can support domestic sustainability agendas and lessen reliance on imported petrochemicals. The accelerated industrialisation and urbanisation also contribute to the increase in the demand of polymers and fuels, which increases the role of bio-ethylene as a part of the overall decarbonisation plans. The emergence signals of long-term capacity expansion are strategic investments in biorefinery infrastructure in Asia Pacific and other growth regions. This structural need context, supported by policy frameworks and economic needs, justifies the opportunities of producers and investors to expand operations and create products and services that are responsive to the emerging dynamic markets end-user requirements.

Global Bio-Ethylene Market Regional Analysis

By Region

- North America

- Latin America

- Europe

- Middle East & Africa

- Asia Pacific

Latin America leads the global bio‑ethylene production and consumption landscape, accounting for approximately 45% of total market share, supported by structural advantages in sugarcane agriculture and vertically integrated production systems. Brazil’s position is especially commanding, producing roughly 39% of global sugarcane output in 2023 and projected to maintain a share near 37% by 2034, while also expected to deliver about 75% of global sugarcane‑based ethanol. These endowments facilitate cost‑competitive production at scale, enabling regional suppliers to serve both domestic and export markets, and reinforce Latin America’s strategic role in global bio‑ethylene supply chains.

North America holds a substantial share in 2025, underpinned by mature biofuel ecosystems, stringent environmental regulations, and significant capital investments in renewable chemical infrastructure. The region benefits from advanced biotechnology capabilities and robust demand from packaging and automotive sectors responding to sustainability mandates. The Asia Pacific region, although currently holding a smaller aggregate market share, is emerging as the fastest‑growing market across the 2025‑2034 period, driven by rapid industrialization, expanding petrochemical industries, and supportive biofuel policies aimed at reducing petroleum import dependence. Large domestic markets and strategic investments in bio‑based polymer facilities signal an expanding regional footprint, setting the stage for accelerated growth in bio‑ethylene production and consumption.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Bio-Ethylene Market Segmentation Analysis

By Feedstock

- Sugarcane

- Corn

- Others

Sugarcane remains the dominant feedstock input for bio‑ethylene production, capturing approximately 60% of global supply due to its high fermentation efficiency and well‑established agricultural infrastructure across Brazil, India, and Southeast Asia. Total global sugarcane production was around 2.0 billion tonnes in 2023 and is projected to grow modestly to approximately 2.1 billion tonnes by 2034, reinforcing sugarcane’s central role in feedstock supply chains. Brazil alone is expected to account for 37% of global sugarcane production by 2034, while India is projected to contribute 23%, solidifying Latin America and Asia as structural centers for feedstock availability. This concentration provides efficiency advantages but also reflects the limited diversification of primary renewable feedstocks for bio‑ethylene.

Alternative feedstock pathways-including corn, wheat, molasses, lignocellulosic biomass, and agricultural residues-offer diversification potential but currently remain secondary due to processing cost and deployment challenges. Corn represents approximately 60% of global ethanol feedstock composition during the base period, while lignocellulosic and waste feedstocks are gaining regulatory‑driven traction. Waste oils and tallow, for example, are projected to grow their share of biomass‑based diesel feedstock inputs from 24% to 28% by 2034, illustrating circular economy influences. For end users seeking to balance sustainability with performance and cost, diversified feedstock strategies are becoming increasingly important, although established sugarcane‑based systems continue to underpin the majority of bio‑ethylene feedstock supply.

By Application

- Packaging

- Automotive

- Construction

- Consumer Goods

Packaging is the largest application category in the Global Bio‑Ethylene Market, capturing approximately 50% of overall market share, driven by sustained demand for polyethylene‑based films and containers in consumer goods distribution and e‑commerce supply chains. The surge in organized retail expansion and stringent sustainability requirements for packaging materials have accelerated uptake of bio‑ethylene derivatives as end users in packaging seek to fulfill corporate and regulatory commitments to recyclable and compostable materials. This dynamic positions bio‑ethylene as a strategic input for brands aiming to align product attributes with environmental, social, and governance (ESG) criteria, bolstering market relevance in one of the most visible polymer end‑use segments.

Industrial applications-including automotive components, construction materials, textiles, and chemical intermediates-collectively represent the remaining 50% of market share, illustrating a secondary yet significant role for bio‑ethylene derivatives outside consumer‑oriented packaging. Adoption in these sectors is more heterogeneous due to performance qualification requirements, entrenched supplier relationships with incumbent petrochemical providers, and comparatively lower sensitivity to commodity pricing. Engineering standards and technical specifications in industrial segments often necessitate extended qualification cycles, tempering rapid uptake despite sustainability incentives. Nonetheless, gradual growth in industrial applications underscores expanding recognition of bio‑ethylene’s utility beyond packaging, particularly among end users prioritizing lifecycle emissions reduction and alignment with evolving regulatory expectations.

Market Players in Global Bio-Ethylene Market

These market players maintain a significant presence in the Global bio-ethylene market sector and contribute to its ongoing evolution.

- SABIC

- Enerkem

- Oxy Low Carbon Ventures (OCLV)

- Braskem S.A.

- The Dow Chemical Company

- Cargill

- Atol

- LyondellBasell Industries

- Linde

- Shell Global

- TotalEnergies

- Axens

- BASF

Market News & Updates

- Braskem S.A., 2025:

At K 2025 in Düsseldorf, Braskem introduced several I’m green bio-based innovations including a new I’m green EVA grade containing 21% vinyl acetate that provides enhanced softness and flexibility targeted at footwear soles and insoles, as well as MDO films based on bio-based polyethylene from sugarcane ethanol designed for mono-material packaging such as flow packs, labels, and stand-up pouches with improved stiffness, optical properties, and recyclability. The same announcement highlighted Medcol, an I’m green bio-based LDPE developed for pharmaceutical blow-fill-seal packaging with a reported carbon footprint of approximately −2.27 kg CO₂e per kilogram, and an I’m green bio-based HDPE for non-wovens in hygiene applications featuring low gel levels, good heat resistance, and stable processing, supported by life-cycle analysis indicating a carbon footprint near −2.01 kg CO₂e per kilogram. Braskem also marked 15 years of I’m green bio-based polyethylene, stating that capacity has been increased by 37% compared with the original plant to reach 275,000 tonnes per year, and through a joint venture with SCG Chemicals in Thailand (Braskem Siam Company Limited) it is developing a bio-ethylene plant based on EtE EverGreen ethanol-to-ethylene technology that will add about 200,000 tonnes per year of bio-based PE capacity focused on Asian markets, nearly doubling the company’s global I’m green bio-PE capacity.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Bio-Ethylene Market Policies, Regulations, and Standards

4. Global Bio-Ethylene Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Bio-Ethylene Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Feedstock

5.2.1.1. Sugarcane- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Corn- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Packaging- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Automotive- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Construction- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Consumer Goods- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Region

5.2.3.1. North America

5.2.3.2. Latin America

5.2.3.3. Europe

5.2.3.4. Middle East & Africa

5.2.3.5. Asia Pacific

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. North America Bio-Ethylene Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Feedstock- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Country

6.2.3.1. US

6.2.3.2. Canada

6.2.3.3. Mexico

6.2.3.4. Rest of North America

6.3. US Bio-Ethylene Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Bio-Ethylene Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Bio-Ethylene Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7. Latin America Bio-Ethylene Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Feedstock- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Country

7.2.3.1. Brazil

7.2.3.2. Rest of Latin America

7.3. Brazil Bio-Ethylene Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Bio-Ethylene Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Feedstock- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Country

8.2.3.1. Germany

8.2.3.2. France

8.2.3.3. UK

8.2.3.4. Italy

8.2.3.5. Spain

8.2.3.6. Netherlands

8.2.3.7. Belgium

8.2.3.8. Russia

8.2.3.9. Poland

8.2.3.10. Turkey

8.2.3.11. Rest of Europe

8.3. Germany Bio-Ethylene Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. France Bio-Ethylene Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Bio-Ethylene Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Bio-Ethylene Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Bio-Ethylene Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Netherlands Bio-Ethylene Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Belgium Bio-Ethylene Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in USD Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10. Russia Bio-Ethylene Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in USD Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.11. Poland Bio-Ethylene Market Statistics, 2022-2032F

8.11.1. Market Size & Growth Outlook

8.11.1.1. By Revenues in USD Million

8.11.2. Market Segmentation & Growth Outlook

8.11.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

8.11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.12. Turkey Bio-Ethylene Market Statistics, 2022-2032F

8.12.1. Market Size & Growth Outlook

8.12.1.1. By Revenues in USD Million

8.12.2. Market Segmentation & Growth Outlook

8.12.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

8.12.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Bio-Ethylene Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Feedstock- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Country

9.2.3.1. Saudi Arabia

9.2.3.2. UAE

9.2.3.3. Rest of Middle East & Africa

9.3. Saudi Arabia Bio-Ethylene Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. UAE Bio-Ethylene Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Bio-Ethylene Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Country

10.2.3.1. China

10.2.3.2. India

10.2.3.3. Japan

10.2.3.4. South Korea

10.2.3.5. Australia

10.2.3.6. Thailand

10.2.3.7. Rest of Asia Pacific

10.3. China Bio-Ethylene Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.4. India Bio-Ethylene Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.5. Japan Bio-Ethylene Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.6. South Korea Bio-Ethylene Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.7. Australia Bio-Ethylene Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.8. Thailand Bio-Ethylene Market Statistics, 2022-2032F

10.8.1. Market Size & Growth Outlook

10.8.1.1. By Revenues in USD Million

10.8.2. Market Segmentation & Growth Outlook

10.8.2.1. By Feedstock- Market Insights and Forecast 2022-2032, USD Million

10.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Braskem S.A.

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. The Dow Chemical Company

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Cargill

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Atol

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. LyondellBasell Industries

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. SABIC

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Enerkem

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Oxy Low Carbon Ventures (OCLV)

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Linde

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Shell Global

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. TotalEnergies

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. Axens

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. BASF

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Feedstock |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.