Nigeria Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Jan 2026

- VI0830

- 130

-

Nigeria Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

- Colour cosmetics in Nigeria is estimated at USD 60 million in 2025.

- The market size is expected to grow to USD 85 million by 2032.

- Market to register a cagr of around 5.1% during 2026-32.

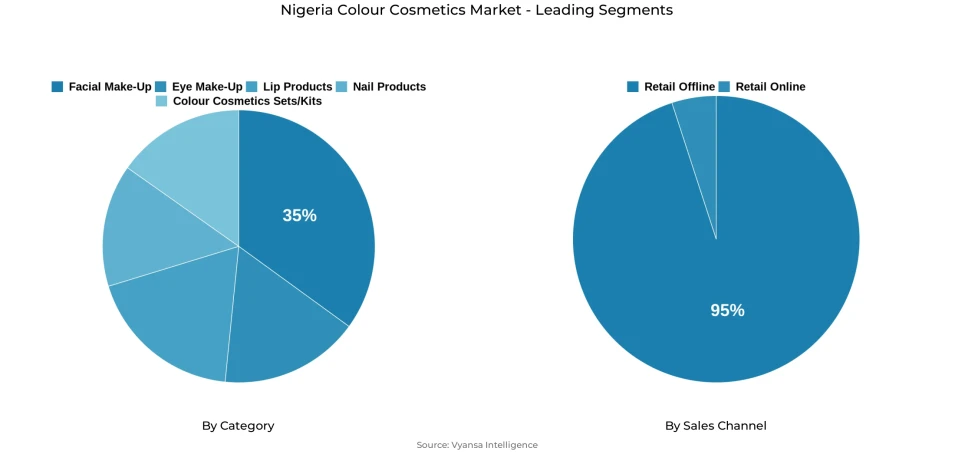

- Category Shares

- Facial make-up grabbed market share of 35%.

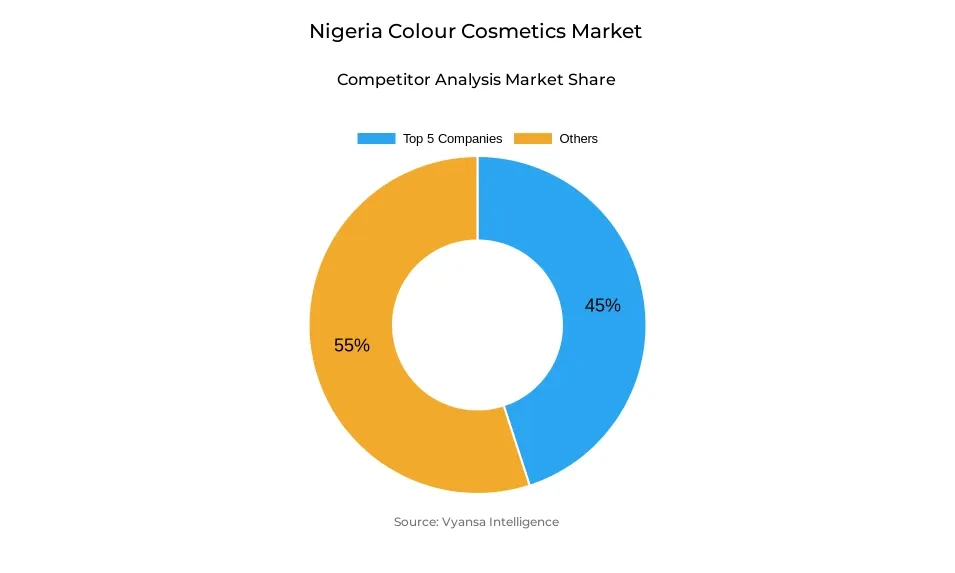

- Competition

- More than 20 companies are actively engaged in producing colour cosmetics in Nigeria.

- Top 5 companies acquired around 45% of the market share.

- Iman Cosmetics Inc; Zaron International Ltd; Sleek Nigeria; Kuddy Cosmetics International Ltd; Milani Cosmetics Nigeria etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 95% of the market.

Nigeria Colour Cosmetics Market Outlook

The Nigeria colour cosmetics market is also anticipated to show a positive growth trend during the period 2026–2032. For the year 2025, the market is estimated at USD 60 million. However, it is anticipated to show a marked growth and achieve a value of USD 85 million by the year 2032. This would result in a compound annual growth rate of around 5.1% for the period 2026–2032. The market future growth would be aided by an increasing level of dispensable income among Nigeria end users. Additionally, more females are being shown to join the formal workforce. Furthermore, there would be a revival of “social occasions”, which are major drivers for colour cosmetics products. The major application area for these products is facial make-up. This is mainly due to the fact that facial make-up products have skin-toning properties. The major market share for the “Colour Cosmetics – Nigeria” market is held by the “Facial Make-Up” market. This market currently holds around 35 % market share.

The market remains influenced by local brands that more closely serve Nigerian skin types, while there is also a continued role for premium brands, particularly among mid-income end-users who value brands looking for higher-end alternatives in terms of quality. The offline retailing channel continues to dominate in terms of retailing, and Retail Offline accounts for about 95 % of total sales. Beauty shops, make-up parlors, and pharmacies continue to be important purchasing locations for end-users who require consultations and tests on products prior to actual purchases.

Despite the intense competition from unregulated and counterfeit products in times of economic stress, traditional brands enhance their reach on the internet through social media websites and retail online websites.

With technological advancements in skin-friendly products, foundation products combined with skin care benefits, and hydrating products, the demand in the future forecast period will continue to fuel the market. As the economic conditions continue to become better, the future of the Nigerian colour cosmetics market holds immense growth by 2032.

Nigeria Colour Cosmetics Market Growth DriverRising Urbanisation and Working-Age Population

Urbanization as well as the growing employment-age section of the population is majorly contributing to the demand for colored cosmetic products in Nigeria. As shown in the data presented by World Bank, over 55% of the population in Nigeria is currently living in urban areas, thus indicating increasing urbanization, which is set to boost the demand for personal care as well as beauty products.

Urban final end user, especially in major cities, are more likely to be exposed to beauty trends. In addition, more than 55% of the population aged 15 to 64 years is a major demographic with purchasing power. Also, with more women participating in and employed within the workforce, usage of colour cosmetics for such purposes as work and media-related beauty trends is forecast to increase

Nigeria Colour Cosmetics Market ChallengeHigh Inflation and Cost Pressures on End Users

Constant inflation and cost challenges continue to impact end-user demand within non-essential product categories, such as color cosmetics, in Nigeria. It can be observed that, according to Nigerian economic statistics, a high level of inflation of over 30% has been recorded in 2024. This highlights large rises in the cost of living, primarily in food, transportation, and general home items.

High inflation rates directly contribute to a depreciation of income, especially for lower and middle-income households, causing many final end user to reduce spending on beauty and luxury items, indicating a lean towards cheaper, unregulated options. This makes the consumption capacity of packaged colour cosmetics brands a constraint, with price elasticity of demand a significant factor for manufacturers as well as retailers, especially until such a time that inflation is no longer a relevant factor.

Nigeria Colour Cosmetics Market TrendDigital and Social Commerce Influences Purchase Behaviour

The Nigeria colour cosmetics market is witnessing a rising influence of digital commerce on purchasing decisions, particularly among younger end users. Though the offline distribution format is the major one, the growing role of online purchase options such as the integration of social commerce on platforms such as Instagram, TikTok, and the online marketplace of professional cosmetic retailers is becoming significant. Local brands have been using social media influencers to show end user the looks.

This is a reflection of overall online adoption trends in the country of Nigeria, which sees the use of online platforms for purchasing products, including the beauty and personal care segment, on the rise. While exact statistics for the online penetration of retail in the country are unavailable for the cosmetic segment at the national level, the overall growth in internet usage serves as a precursor for the enhanced role of retail online platforms in influencing the buying of cosmetics in the coming decade.

Nigeria Colour Cosmetics Market OpportunityGrowing Female Workforce and Spending Power

The expansion of Nigeria's female workforce presents a significant opportunity for the colour cosmetics sector over 2026 to 2032. As more women enter formal employment, including banking, real estate, and service sectors, disposable incomes rise, strengthening purchasing power for beauty and personal care products. This socioeconomic shift aligns with global findings that increased female labour participation correlates with higher spending on personal care categories.

While Nigeria's official unemployment estimates may understate labour market challenges, broader demographic and employment trends suggest a rising base of working end users with greater financial autonomy and sharper focus on professional and social presentation. As the economy recovers and urban employment opportunities expand, the intersection of income growth and aesthetic aspirational behaviour is expected to support sustained growth in demand for both affordable and premium colour cosmetics.

Nigeria Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

The segment with highest market share under category is facial make Up with around 35 % share. The key contributors in this category include foundation/concealer and powder cosmetics, considered key elements of make-up for correcting skin imperfections and for engaging in skinimal trends in modern beautification practices among end-use individuals.

Foundation and powder are also helped by technological developments such as hydrating and skin-friendly textures, and are driven by health-conscious end user, thus filling the gap between cosmetics and skin care. In a growing market for high-quality facial makeup products, this category maintains its premium position within the overall market for color cosmetics.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales channels is retail offline with around 95% of share. Conventional retail channels such as specialized beauty shops, make-up salons, or pharmacies serve as the prime platforms for the purchase of color cosmetics in Nigeria.

The influence of beauty professionals and beauty salons cannot be overestimated, as they provide make-up services and personalized recommendations to induce product usage. Although there are increasing retail sales happening both online and through social-commerce, the retail infrastructure still plays a crucial role in the color cosmetic sector in the Nigerian market. Claude may err in the responses he gives. Please verify.

List of Companies Covered in Nigeria Colour Cosmetics Market

The companies listed below are highly influential in the Nigeria colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Iman Cosmetics Inc

- Zaron International Ltd

- Sleek Nigeria

- Kuddy Cosmetics International Ltd

- Milani Cosmetics Nigeria

- Mary Kay Inc

- House of Tara International

- Zikel Solutions Investment Ltd

- Revlon Inc

- Glam's Cosmetics SRL

Competitive Landscape

Nigeria’s Colour Cosmetics Market in 2025 was shaped by the strong presence of locally rooted players with extensive distribution networks and affordable yet trusted product portfolios. Kuddy Cosmetics International Ltd led the market through its Black Up brand, supported by widespread wholesale, retail, and e-commerce operations and strong relevance for African skin tones. Milani Cosmetics Nigeria, along with brands such as Zaron International Ltd, Note Cosmetics, Glam’s Cosmetics, and Zikel Solutions, strengthened competitiveness through accessible pricing, broad shade ranges, and active social media engagement. Premium brands including MAC and Maybelline retained niche demand among higher-income users, while beauty specialists, pharmacies, and expanding e-commerce platforms reinforced visibility and consumer access across the market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Nigeria Colour Cosmetics Market Policies, Regulations, and Standards

4. Nigeria Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Nigeria Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Nigeria Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Nigeria Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Nigeria Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Nigeria Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Nigeria Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Kuddy Cosmetics International Ltd

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Milani Cosmetics Nigeria

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Mary Kay Inc

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. House of Tara International

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Zikel Solutions Investment Ltd

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Iman Cosmetics Inc

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Zaron International Ltd

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Sleek Nigeria

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Revlon Inc

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Glam’s Cosmetics SRL

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.