Global Nickel Sulfate Market Report: Trends, Growth and Forecast (2026-2032)

By Type/Grade (Crystalline (Hexahydrate), Liquid, Plating-Grade, Battery Grade, High-Purity Grade), By Application (Battery Manufacturing, Electroplating, Catalysts, Chemicals, Ceramics, Textile Dyes), By Sales Channel (Direct Sales, Online, Distributors, Retailers), By Region (North America, Latin America, Europe, Asia-Pacific)

- Chemicals

- Oct 2025

- VI0425

- 200

-

Global Nickel Sulfate Market Statistics and Insights, 2026

- Market Size Statistics

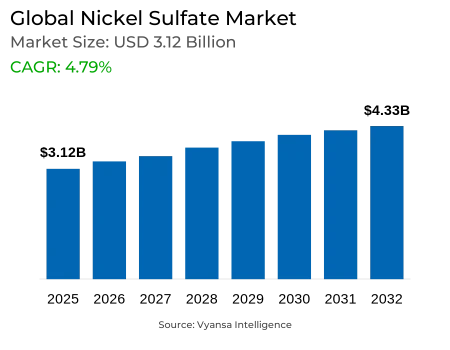

- Global Nickel Sulfate Market is estimated at $ 3.12 Billion.

- The market size is expected to grow to $ 4.33 Billion by 2032.

- Market to register a CAGR of around 4.79% during 2026-32.

- Type/Grade Shares

- Crystalline (Hexahydrate) grabbed market share of 85%.

- Competition

- More than 20 companies are actively engaged in producing Nickel Sulfate.

- Top 5 companies acquired 70% of the market share.

- Jinco Nonferrous, Seido Chemical Industry, Indian Platinum Pvt. Ltd., Norilsk Nickel, Umicore etc., are few of the top companies.

- Application

- Battery Manufacturing grabbed 70% of the market.

- Region

- Asia-Pacific leads with a 55% share of the Global Market.

Global Nickel Sulfate Market Outlook

The Global market for nickel sulfate is expected to grow significantly between 2026 and 2032, led mainly by the swift growth of electric vehicle (EV) manufacturing and grid-scale energy storage initiatives. Nickel sulfate is an important chemical in battery cathodes, and in 2022, EVs represented around 45% of the demand in the world, underscoring its crucial position in clean transportation. The rising trend of decarbonization and the adoption of renewable energy keeps propelling demand for high-purity nickel sulfate, with end users depending on its quality consistency for automotive as well as stationary battery use. In 2025, the market is approximated at $3.12 billion and is expected to be $4.33 billion by 2032.

Supply limitations continue to be a prime concern for the market. Indonesia and the Philippines, which account for more than 60% of mined nickel, have strengthened export regulations and environmental policies, curbing ore availability and raising feedstock costs. Further, refining capacity to process nickel matte into high-purity nickel sulfate is scarce, lengthening lead times for new projects. These supply issues generate price volatility, with London Metal Exchange contract prices increasing 35% during January to September 2023. Consequently, end users are increasingly using long-term supply contracts and hedging mechanisms in order to get stable procurement and control costs.

Battery production leads the application segment with 70% global nickel sulfate usage. The material is essential for NMC and NCA cathode chemistries to provide high-energy-density performance and durability. Secondary uses, including electroplating and pigment manufacture, occupy a lesser proportion of the market. The dominance of crystalline hexahydrate nickel sulfate with an 85% share in Type/Grade segmentation also promotes stability in battery production through better purity, solubility, and uniform chemical properties.

Regionally, Asia-Pacific dominates consumption, with 55% of global demand coming from China, Japan, and South Korea. China alone manufactured more than 6 million EVs in 2022, highlighting the region's pivotal position in nickel sulfate adoption. Situational advantage near nickel ore deposits, strong refining networks, and favorable policies in favor of electrification and integration of renewable energy support solid demand. As EV adoption and energy storage deployment expand, Asia-Pacific is expected to remain a key hub for both market growth and strategic supply chain management during 2026–2032

Global Nickel Sulfate Market Growth Driver

The surge in electric vehicle (EV) production continues to underpin the growth of the global nickel sulfate market. EV batteries require high-purity nickel sulfate for cathode manufacturing, making it a critical component in clean transportation initiatives. In 2022, electric vehicles accounted for approximately 45% of global nickel sulfate demand, highlighting the chemical’s essential role in supporting decarbonization across automotive supply chains. Increasing commitments towards sustainable mobility further reinforce nickel sulfate's importance in energy-efficient transport solutions. Outside the automotive sector, the growth of grid-scale energy storage projects heightens aggregate battery manufacturing needs. Renewable energy installations increased by 27% during 2023, increasing demand for utility-scale storage technologies. Nickel sulfate usage in long-duration energy storage systems further solidifies its importance as an anchor chemical during the shift toward renewable energy. End users increasingly use nickel sulfate for guaranteeing the consistency and reliability of performance in both stationary battery and EV applications, underlining its position at the center of the world's energy system.

Global Nickel Sulfate Market Challenge

World nickel mining is also confronted by geopolitical and environmental challenges curtailing the availability of nickel sulfate. Indonesia and the Philippines, which supply more than 60% of nickel mined, have tightened export policies and environmental regulations. These actions restrict ore flow, increase feedstock prices, and pose challenges to downstream nickel sulfate production. Moreover the End users are facing problems such as supply risk that requires strategic planning to ensure constant procurement for the manufacture of batteries. Processing capacity for the conversion of nickel matte into high-purity nickel sulfate continues to be constrained and new plants take a long time to start production, which delays supply. Restrictive refinery throughput puts pressure on manufacturers to obtain long-term offtake contracts in unstable market conditions. These restrictions increase price volatility and force end users to implement proactive procurement strategies, reinforcing the imperative need for supply chain resilience to address the increasing demand from automobile and stationary energy storage industries

Global Nickel Sulfate Market Trend

Nickel sulfate prices have had sharp upward momentum as a result of tightening supply and exploding battery demand. Contract values on the London Metal Exchange rose 35% during January through September 2023, causing cost burdens for producers of cathode material. The trend highlights the value premium of nickel sulfate in high energy density battery applications and encourages study of substitute chemistries to reduce reliance on primary supply. Volatility in the spot market has induced end users to implement hedging arrangements, such as multi-year supply contracts, to stabilize procurement costs. These strategies mirror the chemical's strategic value in battery value chains and nickel sulfate market maturity. End users come to rely on both cost predictability and secure access to sustain uninterrupted production in EV and grid-scale energy storage applications, cementing nickel sulfate as a high-value industrial chemical.

Global Nickel Sulfate Market Opportunity

The recycling of used lithium-ion batteries is still in its nascent stage, and world nickel sulfate recovery rates are less than 5% owing to technical and economic constraints. This low rate of recovery presents a large opportunity for chemical recyclers to establish effective extraction techniques and circular supply models, minimizing the need to draw from primary mining sources. The increase in recycling capacity can also improve sustainability credentials for end consumers looking to fulfill ESG requirements. Investment in hydrometallurgical and closed-loop recycle technologies offers the prospect to leverage underexploited feedstocks. Recycled nickel sulfate tends to be priced at a premium over virgin input, with associated economic and environmental benefits. Improved recycling capacity can reduce battery production's carbon footprint and ensure supply security, providing a sustainable growth path for nickel sulfate interest holders and supporting international energy transition objectives.

Global Nickel Sulfate Market Regional Analysis

By Region

- North America

- Latin America

- Europe

- Asia-Pacific

Asia-Pacific leads the global nickel sulfate consumption at 55%, with China, Japan, and South Korea contributing most of regional demand. China alone manufactured more than 6 million EVs in 2022, driving high nickel sulfate adoption. The area is favored by proximity to nickel ore deposits, established refining capacity, and favorable government policies encouraging electrification and integration of renewable energy. Main applications are production of cathode material for batteries and electroplating in electronics production. Established EV and energy storage industries in the area create steady end-user demand for high-purity nickel sulfate. Anomic regulatory systems and infrastructure benefits affirm Asia-Pacific's dominant role in the global market to make it the focal point of consumption and strategic supply management in the value chain of nickel sulfate.

Global Nickel Sulfate Market Segmentation Analysis

By Type/Grade

- Crystalline (Hexahydrate)

- Liquid

- Plating-Grade

- Battery Grade

- High-Purity Grade

Crystalline (Hexahydrate) nickel sulfate has an 85% market share in Type/Grade segmentation on account of its high purity and solubility, which offers consistent quality of the cathode precursor. Manufacturers prefer it for stable battery performance and minimal impurities, and it is thus the go-to in battery-grade nickel sulfate manufacturing. Its stable crystal form also lends itself to streamlined manufacturing procedures in industries. Aside from battery uses, crystalline nickel sulfate has extensive applications in electroplating and catalyst preparation. Its consistency in physical and chemical properties facilitates consistent metal deposition and reliable process results. This widespread applicability bolsters the prevalence of the crystalline hexahydrate grade, supporting the ability of producers to stick to standardized practices while serving high-demand industrial markets and optimizing supply for essential end users.

By Application

- Battery Manufacturing

- Electroplating

- Catalysts

- Chemicals

- Ceramics

- Textile Dyes

Battery production has the highest market share in Application segmentation with 70% of total nickel sulfate consumption. This is a result of the surge in EV manufacturing and grid-scale energy storage initiatives. Nickel sulfate plays a key role as a constituent in NMC and NCA cathode chemistries that support performance and durability for high-energy-density battery systems. End users value consistent purity and quality to satisfy stringent performance standards in both automotive and stationary uses. Secondary uses, including pigment production and electroplating, form a smaller percentage of the market. Expansion in these markets remains limited, with battery production the major driver for nickel sulfate demand. The focusing of consumption in battery use highlights the necessity for production capacity increases to be engineered specifically to meet end users' needs in an accelerating electrification energy environment.

Top Companies in Global Nickel Sulfate Market

The top companies operating in the market include Jinco Nonferrous, Seido Chemical Industry, Indian Platinum Pvt. Ltd., Norilsk Nickel, Umicore, Sumitomo Metal Mining, Coremax, Palm Commodities International, Univertical, Zenith, Anron Chemicals, Green Eco-Manufacturer, Vizag Chemical, Axiom Materials, Vale, etc., are the top players operating in the Global Nickel Sulfate Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Nickel Sulfate Market Policies, Regulations, and Standards

4. Global Nickel Sulfate Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Nickel Sulfate Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type/Grade

5.2.1.1. Crystalline (Hexahydrate)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Liquid- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Plating-Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Battery Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. High-Purity Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Battery Manufacturing- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Electroplating- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Catalysts- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Chemicals- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Ceramics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Textile Dyes- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Direct Sales- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Distributors- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Retailers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Region

5.2.4.1. North America

5.2.4.2. Latin America

5.2.4.3. Europe

5.2.4.4. Asia-Pacific

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. North America Nickel Sulfate Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Country

6.2.4.1. USA

6.2.4.2. Canada

6.2.4.3. Mexico

6.2.4.4. Rest of North America

6.3. USA Nickel Sulfate Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in US$ Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Nickel Sulfate Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in US$ Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Nickel Sulfate Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in US$ Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7. Latin America Nickel Sulfate Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Country

7.2.4.1. Brazil

7.2.4.2. Mexico

7.2.4.3. Rest of Latin America

7.3. Brazil Nickel Sulfate Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in US$ Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7.4. Mexico Nickel Sulfate Market Statistics, 2022-2032F

7.4.1.Market Size & Growth Outlook

7.4.1.1. By Revenues in US$ Million

7.4.2.Market Segmentation & Growth Outlook

7.4.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

7.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Nickel Sulfate Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Country

8.2.4.1. Germany

8.2.4.2. Russia

8.2.4.3. France

8.2.4.4. UK

8.2.4.5. Spain

8.2.4.6. Italy

8.2.4.7. Netherlands

8.2.4.8. Belgium

8.2.4.9. Poland

8.2.4.10. Turkey

8.2.4.11. Rest of Europe

8.3. Germany Nickel Sulfate Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in US$ Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. Russia Nickel Sulfate Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in US$ Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. France Nickel Sulfate Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in US$ Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. UK Nickel Sulfate Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in US$ Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Nickel Sulfate Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in US$ Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Italy Nickel Sulfate Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in US$ Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Netherlands Nickel Sulfate Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in US$ Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10. Belgium Nickel Sulfate Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in US$ Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.11. Poland Nickel Sulfate Market Statistics, 2022-2032F

8.11.1. Market Size & Growth Outlook

8.11.1.1. By Revenues in US$ Million

8.11.2. Market Segmentation & Growth Outlook

8.11.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

8.11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.12. Turkey Nickel Sulfate Market Statistics, 2022-2032F

8.12.1. Market Size & Growth Outlook

8.12.1.1. By Revenues in US$ Million

8.12.2. Market Segmentation & Growth Outlook

8.12.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

8.12.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Asia-Pacific Nickel Sulfate Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Country

9.2.4.1. China

9.2.4.2. South Korea

9.2.4.3. Japan

9.2.4.4. India

9.2.4.5. Australia

9.2.4.6. Thailand

9.2.4.7. Rest of Asia-Pacific

9.3. China Nickel Sulfate Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in US$ Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. South Korea Nickel Sulfate Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in US$ Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.5. Japan Nickel Sulfate Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in US$ Million

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.6. India Nickel Sulfate Market Statistics, 2022-2032F

9.6.1.Market Size & Growth Outlook

9.6.1.1. By Revenues in US$ Million

9.6.2.Market Segmentation & Growth Outlook

9.6.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

9.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.7. Australia Nickel Sulfate Market Statistics, 2022-2032F

9.7.1.Market Size & Growth Outlook

9.7.1.1. By Revenues in US$ Million

9.7.2.Market Segmentation & Growth Outlook

9.7.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

9.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.8. Thailand Nickel Sulfate Market Statistics, 2022-2032F

9.8.1.Market Size & Growth Outlook

9.8.1.1. By Revenues in US$ Million

9.8.2.Market Segmentation & Growth Outlook

9.8.2.1. By Type/Grade- Market Insights and Forecast 2022-2032, USD Million

9.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Norilsk Nickel

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Umicore

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Sumitomo Metal Mining

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Coremax

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Palm Commodities International

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Jinco Nonferrous

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Seido Chemical Industry

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Indian Platinum Pvt. Ltd.

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Univertical

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Zenith

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

10.1.11. Anron Chemicals

10.1.11.1.Business Description

10.1.11.2.Product Portfolio

10.1.11.3.Collaborations & Alliances

10.1.11.4.Recent Developments

10.1.11.5.Financial Details

10.1.11.6.Others

10.1.12. Green Eco-Manufacturer

10.1.12.1.Business Description

10.1.12.2.Product Portfolio

10.1.12.3.Collaborations & Alliances

10.1.12.4.Recent Developments

10.1.12.5.Financial Details

10.1.12.6.Others

10.1.13. Vizag Chemical

10.1.13.1.Business Description

10.1.13.2.Product Portfolio

10.1.13.3.Collaborations & Alliances

10.1.13.4.Recent Developments

10.1.13.5.Financial Details

10.1.13.6.Others

10.1.14. Axiom Materials

10.1.14.1.Business Description

10.1.14.2.Product Portfolio

10.1.14.3.Collaborations & Alliances

10.1.14.4.Recent Developments

10.1.14.5.Financial Details

10.1.14.6.Others

10.1.15. Vale

10.1.15.1.Business Description

10.1.15.2.Product Portfolio

10.1.15.3.Collaborations & Alliances

10.1.15.4.Recent Developments

10.1.15.5.Financial Details

10.1.15.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type/Grade |

|

| By Application |

|

| By Sales Channel |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.