Global Lithium Carbonate Market Report: Trends, Growth and Forecast (2026-2032)

By Grade (Battery Grade, Technical Grade, Industrial Grade), By Application (EV batteries, Pharmaceuticals, Glass & Ceramics, Grid Storage, Others), By Region (North America, Latin America, Europe, Asia-Pacific)

- Chemical

- Nov 2025

- VI0423

- 205

-

Global Lithium Carbonate Market Statistics and Insights, 2026

- Market Size Statistics

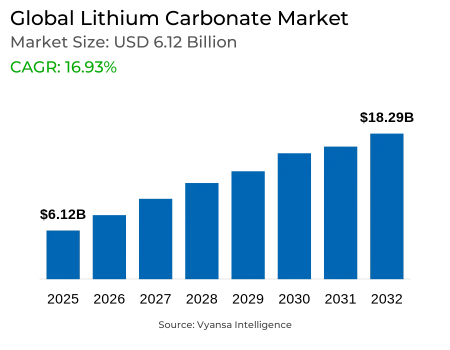

- Global Lithium Carbonate Market is estimated at $ 6.12 Billion.

- The market size is expected to grow to $ 18.29 Billion by 2032.

- Market to register a CAGR of around 16.93% during 2026-32.

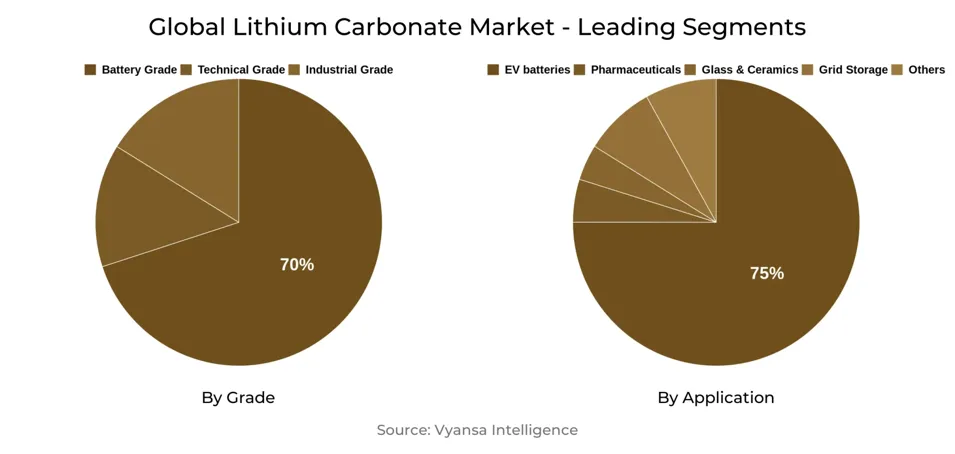

- Grade Shares

- Battery Grade grabbed market share of 70%.

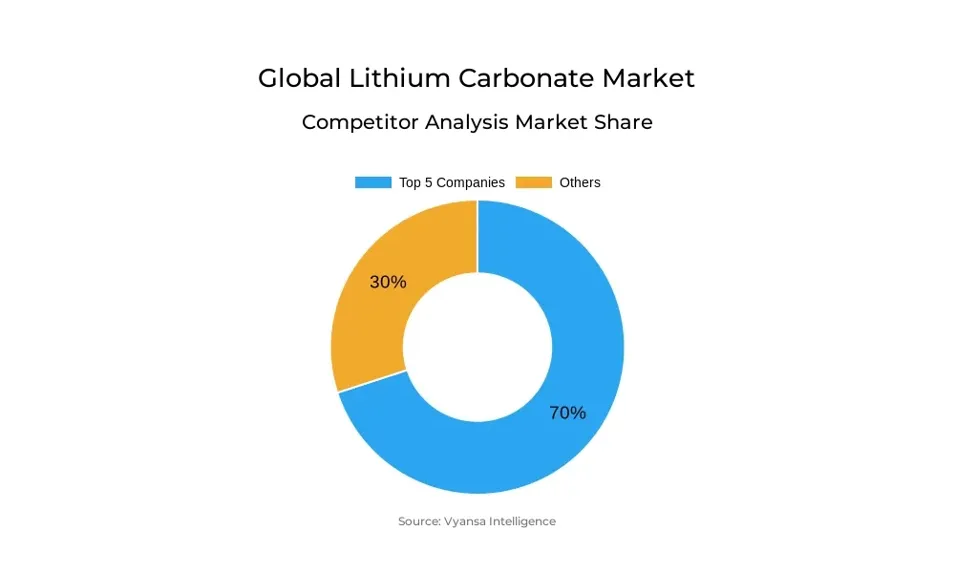

- Competition

- More than 25 companies are actively engaged in producing Lithium Carbonate.

- Top 5 companies acquired 70% of the market share.

- Lithium Americas, Orocobre / Allkem, Pilbara Minerals, Albemarle Corporation, Ganfeng Lithium etc., are few of the top companies.

- Application

- EV batteries grabbed 75% of the market.

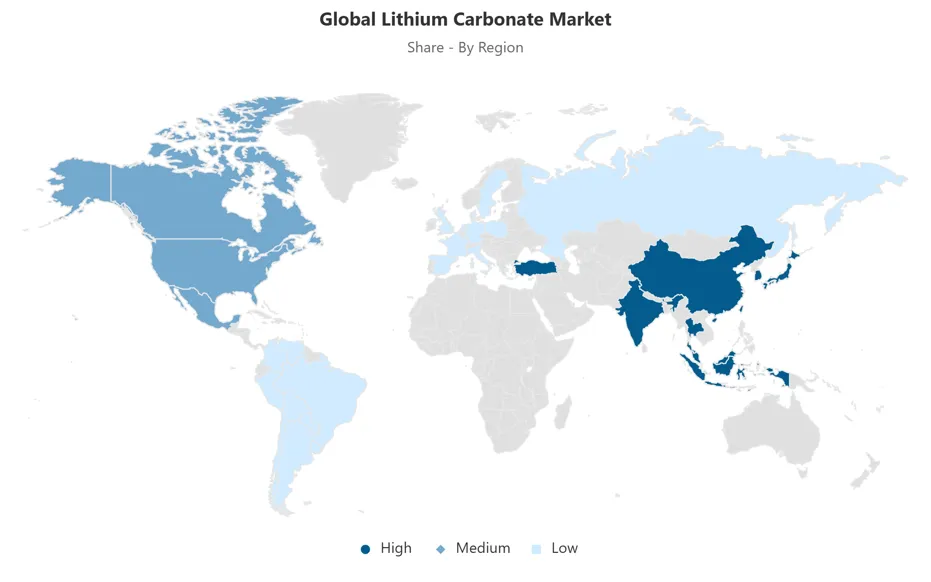

- Region

- Asia-Pacific leads with a 60% share of the Global Market.

Global Lithium Carbonate Market Outlook

The Global Lithium Carbonate Market is experiencing strong growth, driven primarily by the rapid adoption of electric vehicles (EVs). In 2024, global EV sales reached 10 million units, a 40% increase compared to the previous year, creating significant demand for high-purity lithium carbonate to ensure battery safety and performance. Government subsidies and tighter emissions rules are further driving the trend, aligning lithium carbonate as a key material for clean mobility. Outside of transportation, big-scale renewable energy storage initiatives are also boosting the market, as lithium carbonate's high energy density provides it with a perfect fit to balance intermittent solar and wind generation.

Ensuring a secure lithium supply is one of the main challenges. Australia and Chile supply almost two-thirds of world lithium production, focusing supply in areas exposed to geopolitical threats and environmental concerns. Water-intensive brine extraction processes have invited regulatory and local criticism, especially in water-scarce locations. These considerations highlight the role of sustainable extraction processes to ensure longer-term market stability.

Recycling is becoming a key approach to bridging supply. Lithium from recycling grew by 50% in 2024, but remained under 5% of all feedstock. Joint ventures between car manufacturers and recyclers are enabling circular supply chains to be built, minimizing dependence on virgin lithium, decreasing environmental footprint, and securing price stability for customers.

Market-dominant battery-grade lithium carbonate accounts for 70% of total share, with 75% of uses coming from EV batteries. Industrial and technical grades of carbonates cater to smaller market segments like glass, ceramics, and lubricants. Asia-Pacific has the largest global consumption at 60% based on huge-scale EV and battery production, strong domestic demand, and aggressive government policies. The global Lithium Carbonate Market, worth $6.12 billion in 2025, is expected to be worth $18.29 billion by 2032, indicating consistent growth fueled by both automotive and energy storage markets.

Global Lithium Carbonate Market Growth Driver

The lithium carbonate demand is being fueled by an unprecedented boom in electric vehicle adoption, making it a keystone of clean transportation. In 2024, EV sales crossed 10 million units globally, up 40% year on year, forcing battery makers to focus on high-purity lithium carbonate for higher safety and performance. Government-incentivized policies and tighter emissions requirements amplify the trend, propelling widespread adoption and establishing long-term growth prospects for the Global Lithium Carbonate Market.

Aside from mobility, renewable energy storage initiatives globally are increasing demand. Grid-scale battery installations in large quantities grew 35% in 2024, creating new non-automotive markets for lithium carbonate. While grid operators struggle with balancing intermittent solar and wind generation, the higher energy density of lithium carbonate makes it the material of choice for long-duration, flexible energy storage, expanding its uses on global energy infrastructure even further.

Global Lithium Carbonate Market Challenge

The Global Lithium Carbonate Market continues to face a key challenge of having a secure and stable lithium supply. Australia and Chile supplied almost two-thirds of global lithium output in 2023, and this has concentrated supply chains within geographically and environmentally sensitive areas. Such concentration subject end users to increased geopolitical threats and logistic bottlenecks, especially when export policy or labor strikes hamper production.

Environmental sustainability also aggravates these risks. Evaporative extraction of lithium brine uses as much as 2 million liters of water per tonne of lithium carbonate, raising opposition from local communities and regulatory action in major mining areas. Increasing water shortages amplifies these tensions, tending to postpone project approvals and jeopardize social license to operate. Accordingly, accessing sustainable extraction methods is becoming crucial to guaranteeing long-term availability and stability in international supply.

Global Lithium Carbonate Market Trend

Battery recycling is transforming from an emerging practice to a vital aspect of the Global Lithium Carbonate Market. Recycling facilities, in 2024, were recovering 50% more lithium than in the previous year, but still representing less than 5% of the feedstock, indicating the difference between increasing demand and recycling capabilities. The increasing focus on circular practices is supporting supply stabilization, lowering environmental pressures tied to mining, and delivering price stability for consumers.

Joint ventures between automotive manufacturers and recyclers are taking hold, with end-of-life battery take-back solutions included directly within supply chains. These closed-loop models lengthen resource lives, reduce virgin lithium reliance, and shrink carbon footprints. As the aging of EV and storage batteries is picked up pace, recycling has become a strategic imperative, transforming manufacturing and sourcing practices companywide.

Global Lithium Carbonate Market Opportunity

Increased demand for lithium carbonate of high purity provides a huge opportunity for industry players. Battery-grade material with 99.5% purity has premium prices, realizing up to 30% better margins compared to industrial-grade alternatives. This enables manufacturers to ride the increasing EV uptake while satisfying the rigid performance specifications of the grid storage systems.

Producers that have sophisticated refining capabilities can use this capability to continue delivering high-grade lithium to energy storage customers, meeting both short-term spikes in demand as well as long-term industry expansion. By targeting the premium-grade battery applications, market participants can increase profitability, secure their position in the value chain, and reduce risks stemming from volatility in broader industrial or commodity-grade lithium demand.

Global Lithium Carbonate Market Regional Analysis

By Region

- North America

- Latin America

- Europe

- Asia-Pacific

Asia-Pacific dominates the Global Lithium Carbonate Market, with a predicted 60% share of global consumption. China, Japan, and South Korea control this market through their status as prime locations for EV and battery manufacturing. The high concentration of gigafactories, paired with strong domestic demand, reinforces the region's dominance in consumption and production capacity, providing reliable access to purified lithium carbonate.

Government incentives further enhance Asia-Pacific's lead, with subsidies, resource alliances, and pro-active policies fueling fast scale-up of energy storage schemes. Domestic refining capacity and strategic investment in resource procurement enhance resistance to global supply chain shocks. With a close-knit ecosystem of battery production, end-consumers, and policy-friendly regimes, Asia-Pacific remains setting the market growth pace globally.

Global Lithium Carbonate Market Segmentation Analysis

By Grade

- Battery Grade

- Technical Grade

- Industrial Grade

Battery-grade lithium carbonate occupies the largest proportion under the grade segment, with 70% of the Global Lithium Carbonate Market. Its ultra-pure form explains its dominance, as it complies with high-performance EV battery and stationary energy storage stringent demands. The growth of the segment is further supported by increased gigafactory production and long-term supply agreement commitments, highlighting its status as the industry benchmark.

Conversely, industrial-grade lithium carbonate facilitates glass and ceramic applications where purity demands are not as stringent and growth is modest. Technical-grade carbonate, applied to greases and lubricants, represents a smaller portion of demand. Although the two niches are useful ones, their reduced purity levels and lack of scalability hold them back from keeping pace with the growth in the battery-grade segment.

By Application

- EV batteries

- Pharmaceuticals

- Glass & Ceramics

- Grid Storage

- Others

EV batteries control the Global Lithium Carbonate Market with 75% of the demand under the application segment. This dominance is driven by fast-paced growth in electric vehicle manufacturing, aided by gigafactories around the world securing long-term lithium supply agreements to protect against shortages. The magnitude of automotive uptake positions EV batteries among leading global consumption, setting the tone for market forces as a whole.

Other uses, such as pharmaceuticals, glass, and ceramics, trail in market share but show relatively modest growth. While these markets provide stable demand, their volumes are dwarfed by the size of the battery industry. Non-automotive end users continue in a supporting capacity, but the long-term path of lithium carbonate use will continue to be closely linked to technological progress in EV and stationary battery technologies.

Top Companies in Global Lithium Carbonate Market

The top companies operating in the market include Lithium Americas, Orocobre / Allkem, Pilbara Minerals, Albemarle Corporation, Ganfeng Lithium, SQM S.A., Tianqi Lithium, Livent, FMC Corporation, Neometals, Jiangxi Ganfeng, Sichuan Yahua, American Elements, Vishnu Priya Chemicals, LevertonHELM, etc., are the top players operating in the Global Lithium Carbonate Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Lithium Carbonate Market Policies, Regulations, and Standards

4. Global Lithium Carbonate Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Lithium Carbonate Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Grade

5.2.1.1. Battery Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Technical Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Industrial Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Application

5.2.2.1. EV batteries- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Pharmaceuticals- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Glass & Ceramics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Grid Storage- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Region

5.2.3.1. North America

5.2.3.2. Latin America

5.2.3.3. Europe

5.2.3.4. Asia-Pacific

5.2.4. By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. North America Lithium Carbonate Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Country

6.2.3.1. USA

6.2.3.2. Canada

6.2.3.3. Mexico

6.2.3.4. Rest of North America

6.3. USA Lithium Carbonate Market Statistics, 2022-2032F

6.3.1. Market Size & Growth Outlook

6.3.1.1. By Revenues in US$ Million

6.3.2. Market Segmentation & Growth Outlook

6.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Lithium Carbonate Market Statistics, 2022-2032F

6.4.1. Market Size & Growth Outlook

6.4.1.1. By Revenues in US$ Million

6.4.2. Market Segmentation & Growth Outlook

6.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Lithium Carbonate Market Statistics, 2022-2032F

6.5.1. Market Size & Growth Outlook

6.5.1.1. By Revenues in US$ Million

6.5.2. Market Segmentation & Growth Outlook

6.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7. Latin America Lithium Carbonate Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Country

7.2.3.1. Brazil

7.2.3.2. Mexico

7.2.3.3. Rest of Latin America

7.3. Brazil Lithium Carbonate Market Statistics, 2022-2032F

7.3.1. Market Size & Growth Outlook

7.3.1.1. By Revenues in US$ Million

7.3.2. Market Segmentation & Growth Outlook

7.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7.4. Mexico Lithium Carbonate Market Statistics, 2022-2032F

7.4.1. Market Size & Growth Outlook

7.4.1.1. By Revenues in US$ Million

7.4.2. Market Segmentation & Growth Outlook

7.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

7.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Lithium Carbonate Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Country

8.2.3.1. Germany

8.2.3.2. France

8.2.3.3. UK

8.2.3.4. Spain

8.2.3.5. Italy

8.2.3.6. Russia

8.2.3.7. Netherlands

8.2.3.8. Belgium

8.2.3.9. Poland

8.2.3.10. Turkey

8.2.3.11. Rest of Europe

8.3. Germany Lithium Carbonate Market Statistics, 2022-2032F

8.3.1. Market Size & Growth Outlook

8.3.1.1. By Revenues in US$ Million

8.3.2. Market Segmentation & Growth Outlook

8.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. France Lithium Carbonate Market Statistics, 2022-2032F

8.4.1. Market Size & Growth Outlook

8.4.1.1. By Revenues in US$ Million

8.4.2. Market Segmentation & Growth Outlook

8.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Lithium Carbonate Market Statistics, 2022-2032F

8.5.1. Market Size & Growth Outlook

8.5.1.1. By Revenues in US$ Million

8.5.2. Market Segmentation & Growth Outlook

8.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Spain Lithium Carbonate Market Statistics, 2022-2032F

8.6.1. Market Size & Growth Outlook

8.6.1.1. By Revenues in US$ Million

8.6.2. Market Segmentation & Growth Outlook

8.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Italy Lithium Carbonate Market Statistics, 2022-2032F

8.7.1. Market Size & Growth Outlook

8.7.1.1. By Revenues in US$ Million

8.7.2. Market Segmentation & Growth Outlook

8.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Russia Lithium Carbonate Market Statistics, 2022-2032F

8.8.1. Market Size & Growth Outlook

8.8.1.1. By Revenues in US$ Million

8.8.2. Market Segmentation & Growth Outlook

8.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Netherlands Lithium Carbonate Market Statistics, 2022-2032F

8.9.1. Market Size & Growth Outlook

8.9.1.1. By Revenues in US$ Million

8.9.2. Market Segmentation & Growth Outlook

8.9.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10.Belgium Lithium Carbonate Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in US$ Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.11.Poland Lithium Carbonate Market Statistics, 2022-2032F

8.11.1. Market Size & Growth Outlook

8.11.1.1. By Revenues in US$ Million

8.11.2. Market Segmentation & Growth Outlook

8.11.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.12.Turkey Lithium Carbonate Market Statistics, 2022-2032F

8.12.1. Market Size & Growth Outlook

8.12.1.1. By Revenues in US$ Million

8.12.2. Market Segmentation & Growth Outlook

8.12.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

8.12.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Asia-Pacific Lithium Carbonate Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Country

9.2.3.1. China

9.2.3.2. Japan

9.2.3.3. South Korea

9.2.3.4. India

9.2.3.5. Australia

9.2.3.6. Thailand

9.2.3.7. Rest of Asia-Pacific

9.3. China Lithium Carbonate Market Statistics, 2022-2032F

9.3.1. Market Size & Growth Outlook

9.3.1.1. By Revenues in US$ Million

9.3.2. Market Segmentation & Growth Outlook

9.3.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. Japan Lithium Carbonate Market Statistics, 2022-2032F

9.4.1. Market Size & Growth Outlook

9.4.1.1. By Revenues in US$ Million

9.4.2. Market Segmentation & Growth Outlook

9.4.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.5. South Korea Lithium Carbonate Market Statistics, 2022-2032F

9.5.1. Market Size & Growth Outlook

9.5.1.1. By Revenues in US$ Million

9.5.2. Market Segmentation & Growth Outlook

9.5.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.6. India Lithium Carbonate Market Statistics, 2022-2032F

9.6.1. Market Size & Growth Outlook

9.6.1.1. By Revenues in US$ Million

9.6.2. Market Segmentation & Growth Outlook

9.6.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.7. Australia Lithium Carbonate Market Statistics, 2022-2032F

9.7.1. Market Size & Growth Outlook

9.7.1.1. By Revenues in US$ Million

9.7.2. Market Segmentation & Growth Outlook

9.7.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.8. Thailand Lithium Carbonate Market Statistics, 2022-2032F

9.8.1. Market Size & Growth Outlook

9.8.1.1. By Revenues in US$ Million

9.8.2. Market Segmentation & Growth Outlook

9.8.2.1. By Grade- Market Insights and Forecast 2022-2032, USD Million

9.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1.Company Profiles

10.1.1. Albemarle Corporation

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Ganfeng Lithium

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. SQM S.A.

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Tianqi Lithium

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Livent

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Lithium Americas

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Orocobre / Allkem

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Pilbara Minerals

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. FMC Corporation

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Neometals

10.1.10.1. Business Description

10.1.10.2. Product Portfolio

10.1.10.3. Collaborations & Alliances

10.1.10.4. Recent Developments

10.1.10.5. Financial Details

10.1.10.6. Others

10.1.11. Jiangxi Ganfeng

10.1.11.1. Business Description

10.1.11.2. Product Portfolio

10.1.11.3. Collaborations & Alliances

10.1.11.4. Recent Developments

10.1.11.5. Financial Details

10.1.11.6. Others

10.1.12. Sichuan Yahua

10.1.12.1. Business Description

10.1.12.2. Product Portfolio

10.1.12.3. Collaborations & Alliances

10.1.12.4. Recent Developments

10.1.12.5. Financial Details

10.1.12.6. Others

10.1.13. American Elements

10.1.13.1. Business Description

10.1.13.2. Product Portfolio

10.1.13.3. Collaborations & Alliances

10.1.13.4. Recent Developments

10.1.13.5. Financial Details

10.1.13.6. Others

10.1.14. Vishnu Priya Chemicals

10.1.14.1. Business Description

10.1.14.2. Product Portfolio

10.1.14.3. Collaborations & Alliances

10.1.14.4. Recent Developments

10.1.14.5. Financial Details

10.1.14.6. Others

10.1.15. LevertonHELM

10.1.15.1. Business Description

10.1.15.2. Product Portfolio

10.1.15.3. Collaborations & Alliances

10.1.15.4. Recent Developments

10.1.15.5. Financial Details

10.1.15.6. Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Grade |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.