Germany Compound Feed Market Report: Trends, Growth and Forecast (2026-2032)

By Animal Type (Ruminants, Poultry, Swine, Aquaculture, Others), By Ingredient (Grains & Cereals, Cakes & Meals, Oilseeds & Derivatives, Fish Meal & Fish Oil), By Supplements (Vitamins, Amino Acid, Enzymes, Prebiotics & Probiotics, Acidifiers, Others), By Form (Mash, Pellets, Crumbles), By Sales Channel (Online, Retail, Direct Sales)

- Chemical

- Jan 2026

- VI0554

- 110

-

Germany Compound Feed Market Statistics and Insights, 2026

- Market Size Statistics

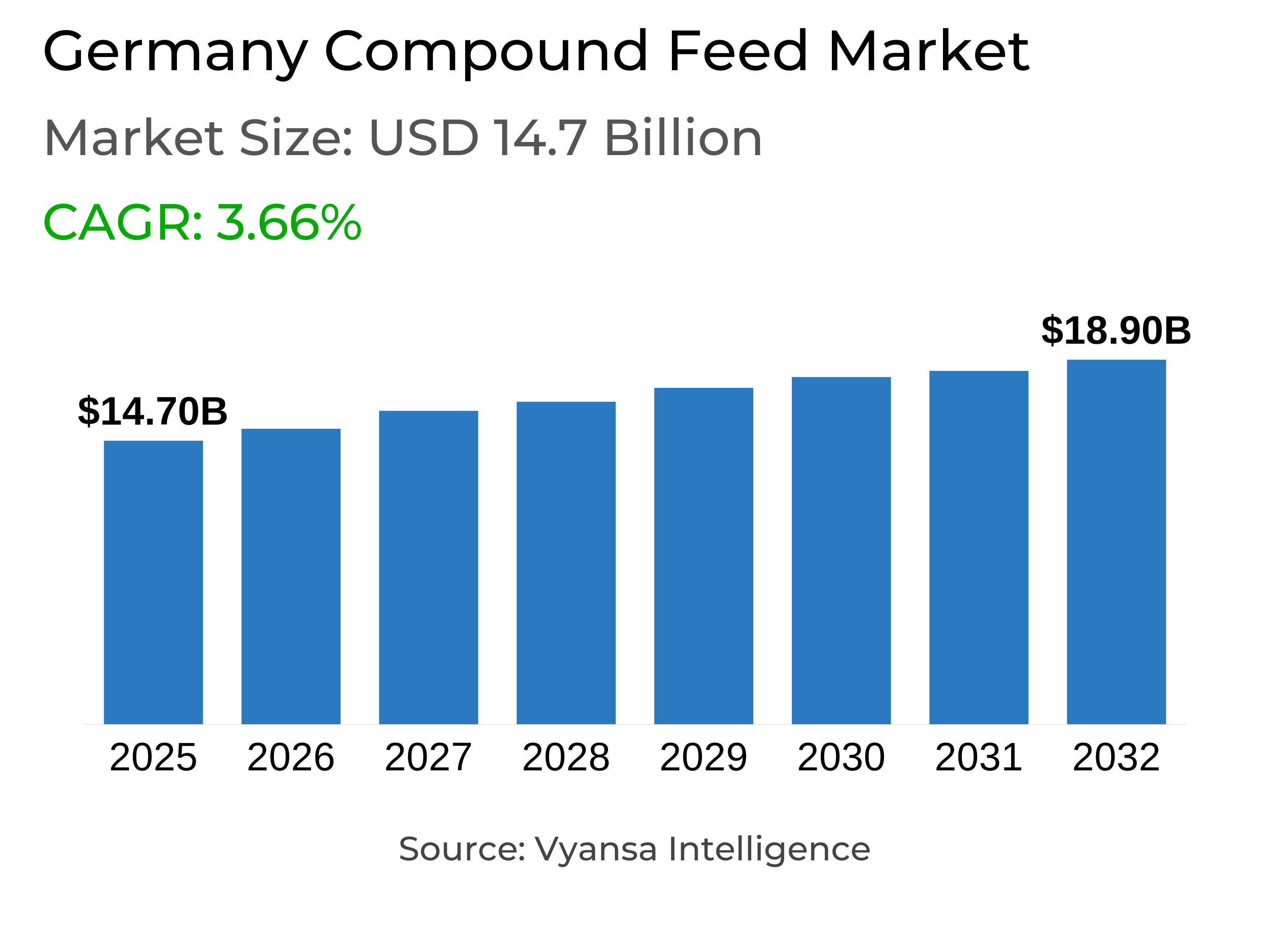

- Compound Feed in Germany is estimated at $ 14.7 Billion.

- The market size is expected to grow to $ 18.9 Billion by 2032.

- Market to register a CAGR of around 3.66% during 2026-32.

- Animal Type Segment

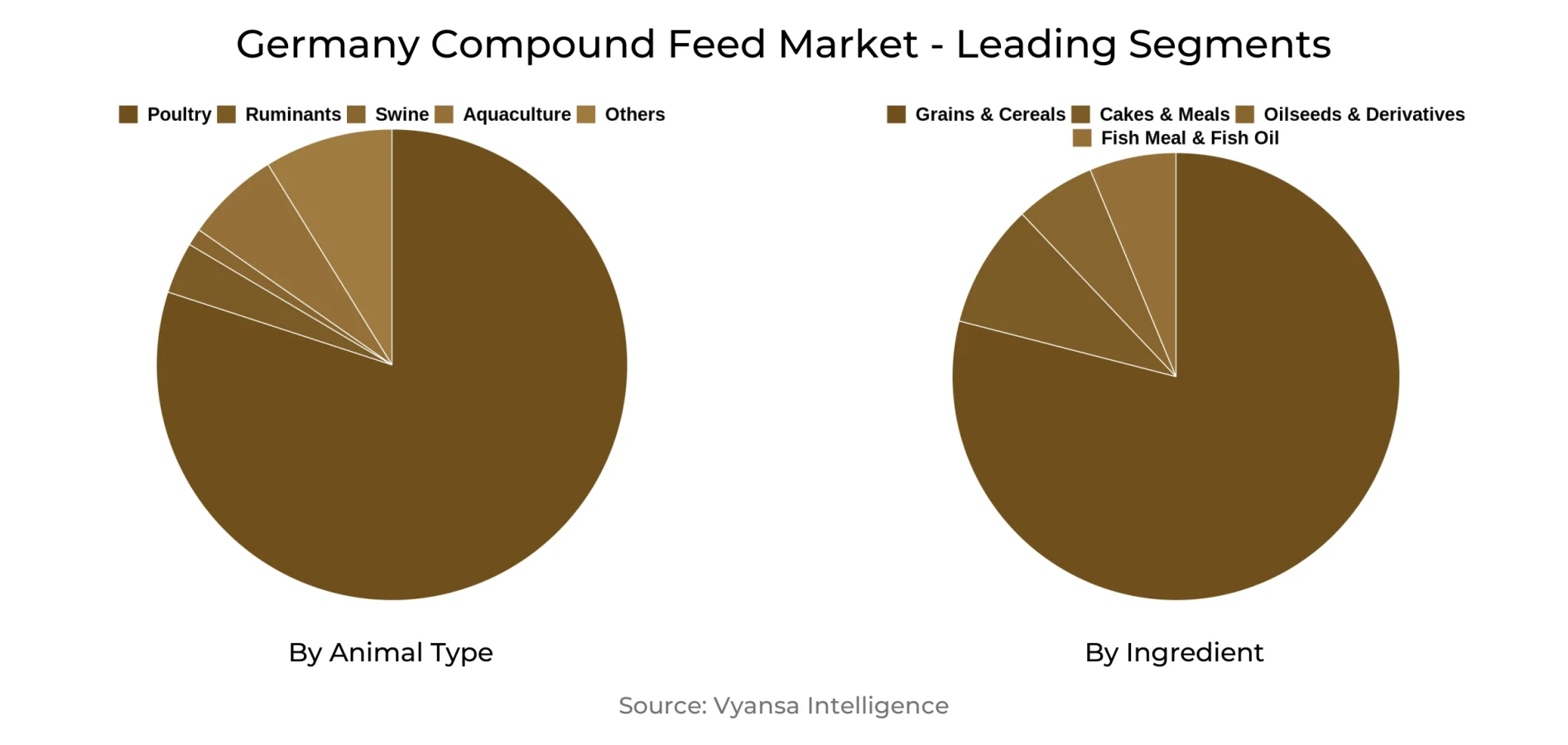

- Poultry continues to dominate the market.

- Competition

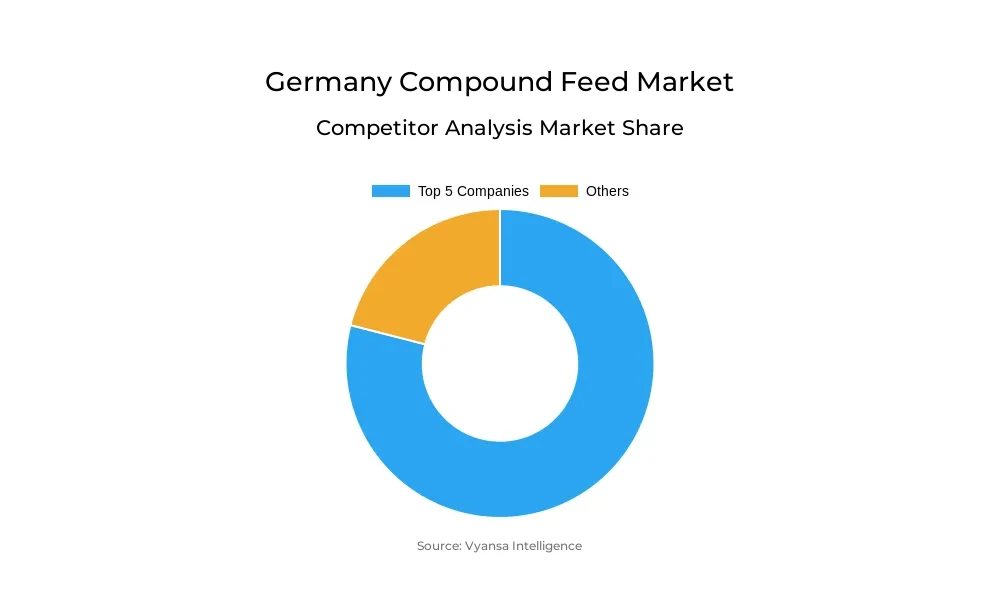

- More than 10 companies are actively engaged in producing Compound Feed in Germany.

- Top 5 companies acquired the maximum share of the market.

- ADM Animal Nutrition, Charoen Pokphand Group, Land O’Lakes Inc., Alltech, Royal Agrifirm Group etc., are few of the top companies.

- Ingredient Type

- Grains & Cereals continues to dominate the market.

Germany Compound Feed Market Outlook

The Germany compound feed market will grow consistently from 2025 to 2030 due to rising demand for high-quality animal nutrition. Livestock producers and farmers are prioritizing more nutrient-rich feeding practices that enhance the health, growth, and productivity of animals. This has caused the consistent growth of the compound feed industry as improved nutritional formulations enable high-quality meat, dairy, and other animal products to be produced. Government programs that support sustainable agriculture also favor the application of compound feed scientifically developed, with the aim of balanced feeding and minimizing environmental impact.

Yet, the sector is pressured by increased production costs. Increased prices of raw materials, energy, and shipping boost manufacturing costs, impacting producers and consumers. Adherence to safety, environmental, and labeling laws also incurs additional costs, particularly weighing down small and medium-sized producers. Cost control and continuous product innovation will become key to sustaining growth and market competitiveness.

Sustainability continues to be at the forefront of the compound feed sector. Manufacturers are embracing green ingredients and cleaner processing to minimize environmental imprints. Application of precision nutrition methods optimizes feed efficiency and reduces waste. Increasing popularity of alternative proteins, such as insect meal and plant-based inputs, and organic ingredients, underscores a trend toward greener solutions that must respond to increasing consumer pressure for sustainable agriculture.

The poultry category is the market leader, boosted by Germany's intensive use of poultry products like chicken meat and eggs. Needs for healthy, protein-enriched feed aimed at poultry well-being and productivity are driving this category further. Other animal species like swine, ruminants, and aquaculture do share in the market, but poultry continues to be the dominant category because of changing consumer trends and research developments in specialty feed formulation.

Germany Compound Feed Market Growth Driver

Increasing Demand for High-Quality Animal Nutrition

Increased concern regarding animal health and nutrition propel demand for Germany compound feed. Livestock farmers and producers focus on feeding strategies that enhance productivity and animal well-being. Improved nutritional solutions assist in enhancing growth rates and immune levels in animals, resulting in improved quality meat, milk, and other produce. Increased attention to optimal nutrition promotes the continued growth of the compound feed industry.

Besides, government policies and schemes for sustainable agriculture favor the application of scientifically formulated compound feed. Such practices stimulate farmers to use feeds that provide balanced diet as well as minimize environmental strain. Consequently, the sector realizes ongoing innovation and higher uptake of compound feed solutions formulated according to particular livestock requirements.

Germany Compound Feed Market Challenge

Managing Rising Production Costs

The industry of compound feed is challenged to curb rising production costs. Increased raw material, energy, and transportation costs raise the cost of manufacturing compound feed. This financial burden grapples both producers and consumers of the feed, whereby it becomes challenging to sustain low-cost feeds while having quality.

Furthermore, compliance with regulations concerning safety, environmental norms, and labeling contributes to the cost of operations. Small and medium-scale manufacturers especially find it difficult to absorb the cost without sacrificing their competitiveness. Managing costs and product innovation simultaneously is a key challenge to maintaining long-term growth in the market.

Germany Compound Feed Market Trend

Emphasis on Sustainable and Eco-Friendly Practices

Sustainability is increasingly becoming a central theme in the feed and agricultural industry, impacting the production and consumption of compound feed. The use of environmentally friendly ingredients and making feed manufacturing processes less polluting is increasingly popular. The movement is responding to consumers' needs for environmentally friendly farming and animal products.

Producers increasingly embrace precision nutrition methods, making use of data and technology to reduce waste and maximize feed efficiency. The growth of alternative protein sources and organic feed ingredients indicates the market's shift to greener options. Such environmentally friendly approaches frame the compound feed formulation of the future in Germany.

Germany Compound Feed Market Opportunity

Expansion in Alternative Protein and Specialty Feed

The future potential is in the production and marketing of innovative alternative protein sources as additives to compound feed. With increasing worries over resources becoming scarce and their environmental impact, novel proteins like insect meal and plant protein ingredients have the potential to become more prominent. This diversification presents new feeding alternatives that are compatible with changing sustainability targets.

Specialty feeds that cater to particular species, health status, or growth phases will gain growing demand. Tailored nutrition solutions will enhance farmers' productivity and animal well-being. Research and technology investments will fuel product differentiation and unlock new earnings streams in the compound feed market.

Germany Compound Feed Market Segmentation Analysis

By Animal Type

- Ruminants

- Poultry

- Swine

- Aquaculture

- Others

The most dominant segment in the Germany compound feed market by animal type is poultry. This is fueled by the huge demand for poultry products like eggs, chicken, and meat in the nation. Poultry feed is a large proportion of the market, driven by the increasing demand for protein-rich, healthy food by consumers. The need for nutritious, well-balanced compound feed of high quality to enhance poultry productivity and health further drives the success of this segment.

Other types of animals sold in the market are ruminants, swine, and aquaculture. Although ruminants command a significant portion due to the large dairy and cattle industry in Germany, the swine sector is challenged by outbreaks of diseases that have limited expansion. Aquaculture is growing but remains smaller compared to the others. The poultry sector as a whole is poised to maintain leadership owing to continuous consumer demand for poultry products as well as improvement in feeds formulation specifically suited for poultry nutrition and performance.

Top Companies in Germany Compound Feed Market

The top companies operating in the market include ADM Animal Nutrition, Charoen Pokphand Group, Land O’Lakes Inc., Alltech, Royal Agrifirm Group, Kent Corporation (Kent Feeds), Cargill, Incorporated, ForFarmers, Nutreco NV, BASF SE, etc., are the top players operating in the Germany Compound Feed Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Compound Feed Market Policies, Regulations, and Standards

4. Germany Compound Feed Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Compound Feed Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Quantity Sold in Thousand Tons

5.2. Market Segmentation & Growth Outlook

5.2.1.By Animal Type

5.2.1.1. Ruminants- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Poultry- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Swine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Aquaculture- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Ingredient

5.2.2.1. Grains & Cereals- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Cakes & Meals- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Oilseeds & Derivatives- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Fish Meal & Fish Oil- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Supplements

5.2.3.1. Vitamins- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Amino Acid- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Enzymes- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Prebiotics & Probiotics- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Acidifiers- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Form

5.2.4.1. Mash- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Pellets- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Crumbles- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Direct Sales- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Germany Ruminants Compound Feed Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Quantity Sold in Thousand Tons

6.2. Market Segmentation & Growth Outlook

6.2.1.By Ingredient- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Supplements- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Germany Poultry Compound Feed Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Quantity Sold in Thousand Tons

7.2. Market Segmentation & Growth Outlook

7.2.1.By Ingredient- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Supplements- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Germany Swine Compound Feed Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.1.2.By Quantity Sold in Thousand Tons

8.2. Market Segmentation & Growth Outlook

8.2.1.By Ingredient- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Supplements- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Germany Aquaculture Compound Feed Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.1.2.By Quantity Sold in Thousand Tons

9.2. Market Segmentation & Growth Outlook

9.2.1.By Ingredient- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Supplements- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Alltech

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Royal Agrifirm Group

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Kent Corporation (Kent Feeds)

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Cargill, Incorporated

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. ForFarmers

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. ADM Animal Nutrition

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Charoen Pokphand Group

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Land O’Lakes Inc.

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Nutreco NV

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. BASF SE

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Animal Type |

|

| By Ingredient |

|

| By Supplements |

|

| By Form |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.