Global Nickel Chloride Market Report: Trends, Growth and Forecast (2026-2032)

By Purity Grade (Battery Grade, Industrial Grade), By Application (Battery Materials, Electroplating, Catalysts, Chemicals), By Product Type (Nickel(II) Chloride Hexahydrate, Nickel(II) Chloride Anhydrous, Nickel(II) Chloride Tetrahydrate), By Form (Solid Form, Liquid Form), By Purity Level (Standard Purity, High Purity, Ultra-High Purity), By Region (North America, Latin America, Europe, Middle East & Africa, Asia Pacific)

|

Major Players

|

Global Nickel Chloride Market Statistics and Insights, 2026

- Market Size Statistics

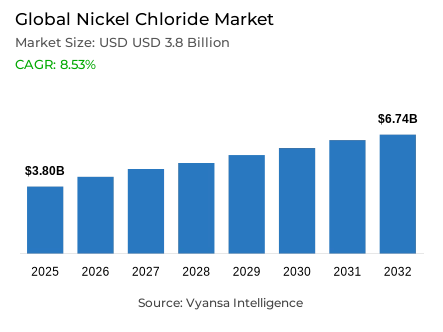

- Global nickel chloride market is estimated at USD 3.8 billion in 2025.

- The market size is expected to grow to USD 6.74 billion by 2032.

- Market to register a CAGR of around 8.53% during 2026-32.

- Purity Grade Shares

- Battery grade grabbed market share of 60%.

- Competition

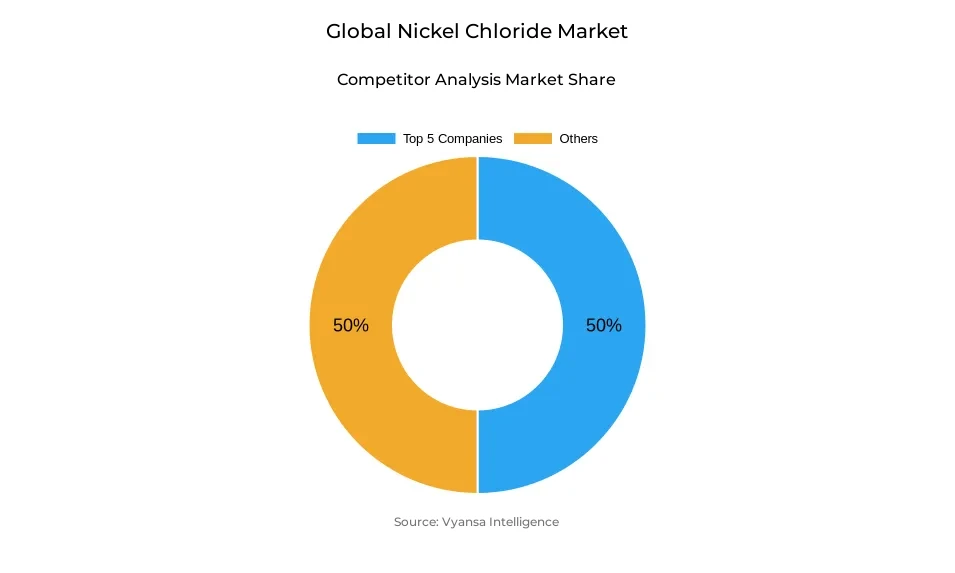

- Global nickel chloride market is currently being catered to by more than 20 companies.

- Top 5 companies acquired around 50% of the market share.

- OxyChem; Olin Corporation; VARTA AG; Glencore; Umicore etc., are few of the top companies.

- Application

- Battery materials grabbed 50% of the market.

- Region

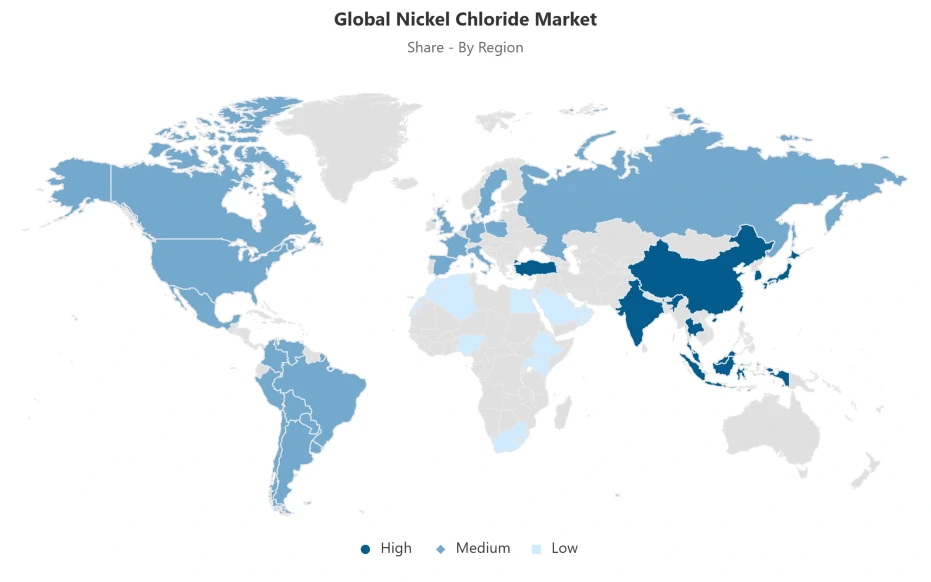

- Asia Pacific leads with a 40% share of the global market.

Global Nickel Chloride Market Outlook

It is expected that the Global nickel chloride market will continue to grow throughout the forecast period of 2026 to 2032 due to the high rate of electric vehicle and energy storage battery manufacturing. The market is estimated to be USD 3.8 billion in 2025 and USD 6.74 billion in 2032 with a compound annual growth rate of about 8.53% within the forecast period. The growing world need of EV batteries, which is almost 950 gigawatt-hours in 2024, keeps supporting the position of nickel-based battery chemistries. Higher nickel content in cathodes like NMC and NCA enhances energy density and decreases cobalt dependence, which directly boosts nickel chloride demand in the battery materials value chain.

Long-term demand visibility is also enhanced by policy-based electrification and massive capacity additions. In 2024, the world battery production capacity was 3.3 terawatt-hours and may reach 6.5 terawatt-hours by 2030, requiring access to battery-grade nickel chemicals. Meanwhile, the supply-side pressures are still high because of the tightening of regulations in Indonesia, which contributes about 56 per cent of the world mined nickel. The decreased mining quotas, limitations of new processing plants, and yearly reviews of the licenses have augmented the volatility of the supply, straining the global balances of nickel and affecting the pricing dynamics of nickel chloride manufacturers.

On the product side, battery-grade nickel chloride is leading the market with a 60% share, which is a result of the high purity standards of high-nickel cathode materials. High purification standards and quality controls make this segment the most strategically valuable and profitable up to 2032. Battery materials, in terms of application, represent about 50% of all demand, far surpassing the growth of electroplating, catalysts, and other industrial applications as EV and energy storage applications gain momentum.

Asia Pacific is the largest shareholder of the Global nickel chloride market with 40% share, supported by its integrated battery manufacturing ecosystem. The production and recycling of battery materials and the closeness to the Indonesian nickel reserves makes China the key center of nickel chloride demand and processing, and the growth is projected to be higher than the global average.

Global Nickel Chloride Market Growth Driver

Electrification-Led Expansion of Battery-Grade Nickel Demand

The Global nickel chloride market is undergoing a robust structural development due to the high rate of electric vehicle battery manufacturing and energy storage systems. By 2024, the worldwide demand of electric-vehicle batteries was about 950 gigawatt-hours, which is most of the almost 1 terawatt-hours of battery demand in mobility and stationary storage. To improve energy density and driving range, battery manufacturers are adding more nickel intensity to cathode chemistries, and at the same time, reducing cobalt dependence. The International Renewable Energy Agency reported that nickel-rich cathodes, including NMC and NCA, constituted over half of worldwide battery chemistries in 2023, further supporting the central role of nickel in advanced lithium-ion systems. This evolution in chemistry directly contributes to the continued growth in demand of nickel intermediates, such as nickel chloride, throughout the battery materials value chain.

Electrification policies supported by the government also enhance the fundamentals of demand of nickel compounds. According to the projections of the International Energy Agency, the global electric-vehicle battery demand will surpass 3 terawatt-hours by 2030 in the case of the specified policy scenarios, which is more than three times higher than the existing ones. The world battery production capacity was 3.3 terawatt-hours in 2024 and may increase to 6.5 terawatt-hours by 2030 provided dedicated projects are fulfilled. This capacity increase necessitates the consistent availability of nickel chemicals of battery grade, which strengthens the long-term consumption growth of nickel chloride among the battery material end users in the global market.

Global Nickel Chloride Market Challenge

Structural Supply Constraints and Regulatory Pressures on Nickel Availability

The Global nickel chloride market is faced with a major limitation of supply-side, especially with the intervention of regulations in the key producing areas. Indonesia, the largest producer of mined nickel, cut its national mining target of 272 million tons in 2024 to 150 million tons in 2025, a 44% drop and a significant shrinkage in world supply capacity. Moreover, Indonesian officials also restricted new high-pressure acid leaching and nickel pig iron processing plants in late 2025, capping downstream capacity growth and adding uncertainty to long-term nickel chemical producers. The move towards multi-year mining permits to annual licensing reviews has also increased the volatility of supply in nickel derivatives.

These regulatory risks are increased by tight global supply-demand balances. The International Nickel Study Group projects a primary nickel production of 3.516 million tons compared to usage of 3.346 million tons in 2024 with only slight surplus anticipated up to 2026. High ore prices and low buffer capacity limit the capacity of producers to absorb disruptions, leading to volatility in prices and limited supply to nickel chloride producers to serve battery and industrial end users.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Nickel Chloride Market Trend

Evolution of Cathode Chemistries Reshaping Nickel Consumption Patterns

The Global nickel chloride market is transforming its demand due to technological change in the lithium-ion battery systems. Higher-nickel cathode formulations are also becoming more popular with battery manufacturers, with NMC111 being replaced by NMC622 and NMC811 chemistries, which offer better energy density and less cobalt intensity. The International Renewable Energy Agency notes that this change is indicative of an industry-wide trend towards performance optimization and supply chain risk reduction. At the same time, lithium-iron-phosphate batteries had taken up about 44% of the worldwide passenger electric-vehicle market in 2023, establishing a bifurcated chemistry environment in which nickel-intensive batteries are used in high-end applications.

The battery application of nickel has grown at a rapid rate, with industry forecasts showing a 567% growth by 2025 relative to 2019 accoding to stockhead. Nickel used in batteries is estimated to be 0.6-0.8 million tons in 2025 and is expected to be 28% of total world nickel consumption by 2030. This long-term growth trend underpins long-term demand of specialized nickel compounds, such as nickel chloride, as manufacturers strike a balance between high-nickel and alternative cathode pathways.

Global Nickel Chloride Market Opportunity

Asia-Pacific Integration and Recycling-Led Supply Diversification

The Asia-Pacific region holds a lot of potential growth in the Global nickel chloride market because of the highly integrated battery production ecosystem. China is a major producer of battery cell materials and components, with about 80% of the world production of these materials and components, forming a dense network of cathode manufacturers, chemical processors, and battery assemblers, which depend on steady supplies of high-purity nickel compounds. This vertical integration facilitates long-term offtake contracts and enhances supplier positioning in regional value chains across China, South Korea, and Japan. The suppliers of nickel chloride who are compatible with these ecosystems enjoy the advantage of being close to the large end users and the ability to see the demand.

Simultaneous expansion of battery recycling facilities increases the sourcing optionality in the future. By 2024, the world battery recycling capacity had reached 450 gigawatt-hours, and is expected to rise to over 1,550 gigawatt-hours by 2030, with China contributing almost three-quarters of the total capacity. With the growth of end-of-life electric-vehicle batteries, recycled nickel will become a complementary supply stream, providing new integration opportunities to nickel chloride manufacturers in circular battery supply chains.

Global Nickel Chloride Market Regional Analysis

By Region

- North America

- Latin America

- Europe

- Middle East & Africa

- Asia Pacific

Asia Pacific holds a dominant position in the Global nickel chloride market, accounting for approximately 40% of global demand throughout the 2026–2032 period. This leadership reflects the region’s concentration of battery manufacturing, cathode synthesis capacity, and nickel refining infrastructure across China, Japan, South Korea, and Southeast Asia. China alone commands around 75% of global battery recycling capacity and produces nearly 80% of battery cell materials, anchoring regional demand for nickel chloride across multiple stages of the value chain. Ongoing gigafactory investments further reinforce this regional concentration.

Proximity to primary nickel resources strengthens Asia-Pacific’s strategic advantage. Indonesia’s 56% share of global nickel mining places the region at the source of upstream supply, while China’s vertically integrated control over refining, chemical processing, and battery production sustains competitive positioning. These structural factors ensure Asia-Pacific remains the central demand and processing hub for nickel chloride, with regional growth expected to exceed global averages as electrification accelerates.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Nickel Chloride Market Segmentation Analysis

By Purity Grade

- Battery Grade

- Industrial Grade

Purity grade segmentation within the Global nickel chloride market is dominated by battery-grade material, which accounts for approximately 60% of total market share. This dominance reflects the stringent chemical specifications required by cathode material manufacturers, where even trace impurities can compromise electrochemical stability and cycle life. Battery-grade nickel chloride must meet strict thresholds for iron, cobalt, and other contaminants, particularly for use in high-nickel NMC and NCA cathode formulations. As battery architectures continue shifting toward higher nickel content, demand for ultra-high-purity feedstocks continues to rise among battery material end users.

The cost structure of battery-grade production reinforces market stratification. Elevated purification requirements, quality assurance protocols, and energy-intensive processing differentiate battery-grade suppliers from commercial-grade producers serving electroplating and catalyst applications. With stable demand, premium pricing, and long-term supply contracts, battery-grade nickel chloride remains the most strategically significant and profitable purity segment through the 2026–2032 period.

By Application

- Battery Materials

- Electroplating

- Catalysts

- Chemicals

Application-based segmentation indicates that battery materials represent the largest end-use segment in the Global nickel chloride market, accounting for approximately 50% of total demand. This leadership is driven by the electrification of transportation and energy storage, where nickel chloride is utilized in precursor synthesis and intermediate processing for cathode materials. The segment benefits from sustained EV production growth, with global battery demand projected to exceed 3 terawatt-hours by 2030, significantly outpacing growth in traditional industrial applications. Battery material manufacturers increasingly require consistent, high-purity chemical inputs, reinforcing long-term procurement of nickel chloride.

Cathode materials account for roughly 40% of total EV battery cell costs, underscoring the strategic importance of raw material reliability. Concentrated purchasing power among large Asia-Pacific-based cathode producers further strengthens this segment’s dominance. While electroplating, catalysts, and specialty chemicals collectively represent the remaining 50% of demand, their growth trajectories remain structurally lower than battery-focused applications.

Market Players in Global Nickel Chloride Market

These market players maintain a significant presence in the Global nickel chloride market sector and contribute to its ongoing evolution.

- OxyChem

- Olin Corporation

- VARTA AG

- Glencore

- Umicore

- Sumitomo Metal Mining

- BASF SE

- Mitsubishi Chemical Holdings

- FDK Corporation

- BYD Company

- Primearth EV Energy

- GP Batteries

- Panasonic Holdings

- Duracell

- Energizer Holdings

Market News & Updates

- Glencore plc, 2025:

Glencore reported Q3 2025 own-sourced nickel production of 24,900 metric tonnes, representing a 1,300-tonne (5%) decline from Q3 2024 primarily attributable to maintenance downtime, with year-to-date 2025 own-sourced nickel production of 52,400 tonnes showing a 4,900-tonne (9%) decrease from the comparable 2024 period reflecting reductions at both Integrated Nickel Operations (INO) and Murrin Murrin facilities. The company narrowed its full-year 2025 nickel production guidance to 70,000-72,000 tonnes from the previous 74,000-80,000 tonnes range, driven partly by a furnace disruption at the INO Sudbury smelter in June 2025 that impacted nickel refining and chloride production capacity. Glencore maintains integrated smelting and refining operations through its Sudbury facility and Nikkelverk refinery in Norway, serving stainless steel, aerospace, and specialty chemical applications with continued nickel chloride production capability despite operational challenges.

- Umicore N.V., 2025:

Umicore's Catalysis Business Group achieved an exceptional H1 2025 adjusted EBITDA of €232 million, representing the second-highest performance level in the division's history, driven by strong contributions from Precious Metals Chemistry and Fuel Cell & Stationary Catalysts operations alongside robust customer demand. The company launched its innovative TMCat Ni product line featuring novel homogeneous nickel catalysts offering unique reactivity patterns complementary to traditional palladium catalysts, enabling advanced applications in fine chemicals, pharmaceutical, and agrochemical synthesis. In May 2025, Umicore announced a significant capital investment to construct a new homogeneous catalyst production facility at its Catoosa site in North America with construction commencing in 2025 and commercial operations targeted for early 2027, positioning the company as a worldwide leader in Grubbs Catalyst® technology production at multi-ton industrial scale across multiple continents.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Nickel Chloride Market Policies, Regulations, and Standards

4. Global Nickel Chloride Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Nickel Chloride Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Purity Grade

5.2.1.1. Battery Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Industrial Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Battery Materials- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Electroplating- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Catalysts- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Chemicals- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Product Type

5.2.3.1. Nickel(II) Chloride Hexahydrate- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Nickel(II) Chloride Anhydrous- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Nickel(II) Chloride Tetrahydrate- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Form

5.2.4.1. Solid Form- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Liquid Form- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Purity Level

5.2.5.1. Standard Purity- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. High Purity- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Ultra-High Purity- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Region

5.2.6.1. North America

5.2.6.2. Latin America

5.2.6.3. Europe

5.2.6.4. Middle East & Africa

5.2.6.5. Asia Pacific

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. North America Nickel Chloride Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Purity Level- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Country

6.2.6.1. US

6.2.6.2. Canada

6.2.6.3. Mexico

6.2.6.4. Rest of North America

6.3. US Nickel Chloride Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Nickel Chloride Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Nickel Chloride Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7. Latin America Nickel Chloride Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Purity Level- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Country

7.2.6.1. Brazil

7.2.6.2. Rest of Latin America

7.3. Brazil Nickel Chloride Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Nickel Chloride Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Purity Level- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Country

8.2.6.1. Germany

8.2.6.2. France

8.2.6.3. UK

8.2.6.4. Italy

8.2.6.5. Spain

8.2.6.6. Netherlands

8.2.6.7. Belgium

8.2.6.8. Russia

8.2.6.9. Poland

8.2.6.10. Turkey

8.2.6.11. Rest of Europe

8.3. Germany Nickel Chloride Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. France Nickel Chloride Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Nickel Chloride Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Nickel Chloride Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Nickel Chloride Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Netherlands Nickel Chloride Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Belgium Nickel Chloride Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in USD Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10. Russia Nickel Chloride Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in USD Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.11. Poland Nickel Chloride Market Statistics, 2022-2032F

8.11.1. Market Size & Growth Outlook

8.11.1.1. By Revenues in USD Million

8.11.2. Market Segmentation & Growth Outlook

8.11.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.12. Turkey Nickel Chloride Market Statistics, 2022-2032F

8.12.1. Market Size & Growth Outlook

8.12.1.1. By Revenues in USD Million

8.12.2. Market Segmentation & Growth Outlook

8.12.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.12.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Nickel Chloride Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Purity Level- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Country

9.2.6.1. UAE

9.2.6.2. Saudi Arabia

9.2.6.3. Rest of Middle East & Africa

9.3. UAE Nickel Chloride Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. Saudi Arabia Nickel Chloride Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Nickel Chloride Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Product Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Purity Level- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Country

10.2.6.1. China

10.2.6.2. Japan

10.2.6.3. South Korea

10.2.6.4. India

10.2.6.5. Australia

10.2.6.6. Thailand

10.2.6.7. Rest of Asia Pacific

10.3. China Nickel Chloride Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.4. Japan Nickel Chloride Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.5. South Korea Nickel Chloride Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.6. India Nickel Chloride Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.7. Australia Nickel Chloride Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.8. Thailand Nickel Chloride Market Statistics, 2022-2032F

10.8.1. Market Size & Growth Outlook

10.8.1.1. By Revenues in USD Million

10.8.2. Market Segmentation & Growth Outlook

10.8.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Glencore

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Umicore

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Sumitomo Metal Mining

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. BASF SE

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Mitsubishi Chemical Holdings

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. OxyChem

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Olin Corporation

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. VARTA AG

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. FDK Corporation

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. BYD Company

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. Primearth EV Energy

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. GP Batteries

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. Panasonic Holdings

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. Duracell

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. Energizer Holdings

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Purity Grade |

|

| By Application |

|

| By Product Type |

|

| By Form |

|

| By Purity Level |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.