Middle East & Africa Municipal Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By Country (Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Rest of Middle East & Africa)

- Energy & Power

- Feb 2026

- VI0934

- 160

-

Middle East & Africa Municipal Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

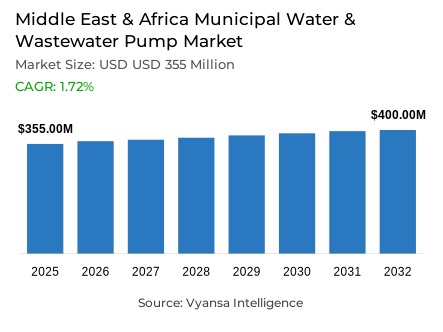

- Middle East & Africa municipal water & wastewater pump market is estimated at USD 355 million in 2025.

- The market size is expected to grow to USD 400 million by 2032.

- Market to register a cagr of around 1.72% during 2026-32.

- Pump Type Shares

- Centrifugal pumps grabbed market share of 80%.

- Competition

- Municipal water & wastewater pump in Middle East & Africa is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 50% of the market share.

- WILO SE; Ebara Corporation; Pentair PLC; Xylem Inc.; Grundfos Holding A/S etc., are few of the top companies.

- Application

- Water grabbed 60% of the market.

- Country

- Saudi Arabia leads with a 20% share of the Middle East & Africa market.

Middle East & Africa Municipal Water & Wastewater Pump Market Outlook

The Middle East and Africa municipal water and wastewater pump market is estimated at USD 355 million in 2025 and is expected to grow to about USD 400 million by 2032 with a small compound annual growth rate of approximately 1.72% in 2026-32. The growth is not high but constant, which indicates the necessity and non-discretionary character of municipal water infrastructure expenditure. The region has an annual population increase of almost 1.9% in urban areas, which keeps increasing the minimum level of demand of potable water and sanitation services, and thus long-term investment is inevitable even in a financially limited setting.

The accelerated urbanisation is increasing the strain on the available treatment, transmission and distribution systems, especially in rapidly expanding cities in the Middle East, North Africa and some sections of Sub-Saharan Africa. Governments and utilities are focusing on the growth and refurbishment of pipelines, reservoirs, lift stations, and treatment plants to deal with old infrastructure and chronic service shortages. Multilateral development banks have been instrumental in maintaining project pipelines, and in 2024, almost USD 19.6 billion was approved to water-related projects, mostly benefiting low- and middle-income economies. These investments are directly converted to steady demand of municipal pumping equipment in the areas of raw water intake, treated water conveyance, and pressure management.

The market is dominated by centrifugal pumps, which represent about 80% of all installations, because of their capability to operate continuously, handle high flows, and have a low cost of life cycle operation. Centrifugal pumps with single stage are popular in municipal networks due to their reliability and easy maintenance, particularly in cases where technical capacity is constrained. Application wise, the largest segment is water supply and distribution which occupies about 60% of total demand due to the magnitude of urban potable water systems and the 24/7 operating needs.

The Saudi market is the largest in the region with an estimated 20% share, which is backed by massive investments in desalination, wastewater treatment, and long-distance water transfer projects. The continued public-private collaboration and multi-stage infrastructure projects will guarantee the repetitive procurement of pumps, making the country the key hub of market demand in the Middle East and Africa by 2032.

Middle East & Africa Municipal Water & Wastewater Pump Market Growth DriverUrban Infrastructure Expansion Supporting Municipal Water Systems

The high rate of urbanisation in the Middle East and Africa is putting strain on the municipal water infrastructure, thus forcing governments to hasten capital investment in treatment, transmission and distribution systems. The 1.9% average annual population increase in the region, coupled with rapid urbanization in weak states, is already becoming a structurally increased minimum demand on potable water and sanitation services. Multilateral development banks have reacted with long-term financing guarantees, such as almost USD 19.6 billion granted in 2024 to water-related projects, mostly to low- and middle-income economies. These investments are indicative of chronic service deficiencies in urban water coverage, old assets, and insufficient treatment capacity, especially in fast-growing metropolitan regions.

In the case of municipal utilities, the growth of conveyance and distribution capacity is inevitable as the population of urban end users grows in number and density. New pipelines, lift stations, reservoirs, and treatment facilities are directly translated into a constant purchase of pumping equipment that is necessary to receive raw water, deliver treated water, and control pressure in service networks. These infrastructure cycles continue to rely on centrifugal pumping systems to sustain long-term equipment demand in growing cities throughout the Gulf, North and Sub-Saharan Africa.

Middle East & Africa Municipal Water & Wastewater Pump Market ChallengeSystem Inefficiencies and Financial Pressures Constraining Utilities

Inefficiency in operations within municipal water systems is a structural limitation that has been persistent in the Middle East and Africa. Leakage, illegal connections, and poor metering Non-revenue water losses are routinely exceeding 30-50% in most cities, which is much higher than the global best-practice standard of about 10%. The losses are especially severe in countries like Jordan, Lebanon, Iraq, and Palestine, which undermine utility revenues and restrict the capacity to self-finance network upgrades. High losses augment the quantity of water that should be abstracted, treated, and pumped without revenue generation, which puts long-term strain on pumping resources and operating budgets.

Wastewater management adds to these challenges in Sub-Saharan Africa. Access to safely managed sanitation services is only available to about a quarter of the population, and a large portion of treatment plants are non-functional or performing poorly. The utilities are thus forced to run pumping systems that cannot provide effective treatment results, hastening equipment wear and adding to maintenance costs and limiting financial viability.

Middle East & Africa Municipal Water & Wastewater Pump Market TrendDigitalisation of Distribution Networks and Pump Operations

Digital tools are becoming more popular in municipal utilities throughout the region to enhance visibility, control, and efficiency in water distribution networks. Massive implementation of smart meters and integrated sensors can provide real-time flow, pressure, and consumption trends, which can help utilities detect leaks more quickly and respond to demand changes more effectively. Gulf country national rollouts and wider adoption in North Africa represent a definite move towards data-driven network management, with government digitalisation agendas and sustainability targets.

This digital revolution is transforming the technical specifications of pumping equipment. The need to integrate with smart meters and supervisory control systems requires pumps that can operate at variable speeds, automatically regulate pressure, and be monitored remotely. The utilities are also becoming more concerned with equipment compatibility with digital platforms to maximise the use of energy and minimise non-revenue water. Consequently, there is an increasing demand to replace the old pumping systems with new systems that are capable of dynamically responding to the real-time network conditions instead of being operated at predetermined design points.

Middle East & Africa Municipal Water & Wastewater Pump Market OpportunityDominance of Centrifugal Technology in Municipal Systems

The long-term water security plans in the Middle East and portions of Africa have placed desalination as a foundation of long-term water security. The area is estimated to contribute about 45% of the total seawater desalination capacity in the world, with a number of Gulf nations deriving the overwhelming proportion of drinking water through the desalination process. Desalination ensures volume, but its energy intensity is high, increasing the cost of operation, and efficiency enhancement is a strategic priority of governments and utilities.

The key to this transition is energy-efficient pumping technologies. Variable-speed drives, high-efficiency motors, and optimised hydraulic designs can save a lot of electricity in desalination intake, high-pressure reverse osmosis, and post-treatment distribution stages. The further integration of renewable energy strengthens the need of flexible pumping systems that can work under different load profiles. These trends provide long-term prospects of high-speed centrifugal pumps and motor systems that can be used to balance reliability, efficiency, and emissions reduction in integrated desalination and municipal networks.

Middle East & Africa Municipal Water & Wastewater Pump Market Country Analysis

By Country

- Saudi Arabia

- UAE

- Egypt

- Nigeria

- South Africa

- Rest of Middle East & Africa

Saudi Arabia holds the largest share of the Middle East and Africa municipal water and wastewater pump market at approximately 20%, reflecting the scale and consistency of its infrastructure investment pipeline. Extensive public-private partnership programs span desalination plants, sewage treatment facilities, transmission pipelines, and strategic reservoirs, translating into substantial and recurring pump procurement. National plans targeting major capacity expansions in desalination, wastewater treatment, and long-distance water transfer underpin sustained equipment demand across multiple project phases.

Beyond Saudi Arabia, several countries contribute significant incremental opportunities. The United Arab Emirates leverages advanced digital integration across extensive treatment assets, while Egypt’s chronic water deficit continues to drive wastewater treatment and irrigation investments. Major national initiatives in Jordan, Morocco, and Kenya further reinforce regional demand, collectively establishing a diverse portfolio of large-scale municipal projects requiring extensive centrifugal pumping systems across water and wastewater applications.

Middle East & Africa Municipal Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- End Suction

- Split Case

- Vertical

- Turbine

- Axial Pump

- Mixed Flow Pump

- Submersible Pump

- Positive Displacement Pumps

- Progressing Cavity

- Diaphragm

- Gear Pump

- Others

Centrifugal pumps form the technological backbone of municipal water and wastewater infrastructure across the Middle East and Africa, accounting for approximately 80% of pump deployments in treatment and distribution applications. Their widespread adoption reflects suitability for continuous operation, high flow rates, and variable hydraulic conditions typical of municipal networks. Single-stage centrifugal pumps alone represent over 60% of centrifugal pump sales, driven by cost efficiency, simplified maintenance requirements, and dependable performance in medium-pressure distribution systems.

Municipal utilities favour centrifugal designs due to lower lifecycle costs compared with alternative pump technologies, particularly in environments characterised by constrained budgets and limited maintenance capacity. Proven reliability across diverse water qualities and operating conditions further reinforces their dominance. As infrastructure expansion and rehabilitation programs continue, centrifugal pumps are expected to remain the preferred technology for new installations and replacements, supporting their sustained leadership within the regional municipal pump landscape.

By Application

- Water

- Wastewater

Water supply and distribution applications represent the largest demand segment within the Middle East and Africa municipal pump market, accounting for roughly 60% of total municipal pumping requirements. This dominance reflects the scale of investments directed toward potable water transmission, pressure boosting, and network expansion to serve growing urban end users. Continuous operation requirements and extensive pipeline networks generate steady demand for pumps across intake, treatment, storage, and distribution stages.

Wastewater collection, conveyance, and treatment systems comprise the remaining 40% of demand, underpinned by rising regulatory pressure to expand treatment coverage and reduce environmental discharge. Ageing sewer networks, new treatment plants, and rehabilitation of underperforming facilities all require robust pumping solutions capable of handling variable solids loads and fluctuating flows. Together, water and wastewater applications sustain broad-based pump demand, with centrifugal systems preferred across both segments for operational flexibility and reliability.

Various Market Players in Middle East & Africa Municipal Water & Wastewater Pump Market

The companies mentioned below are highly active in the Middle East & Africa municipal water & wastewater pump market, occupying a considerable portion of the market and shaping industry progress.

- WILO SE

- Ebara Corporation

- Pentair PLC

- Xylem Inc.

- Grundfos Holding A/S

- KSB SE & Co. KGaA

- Flowserve Corporation

- Sulzer Ltd

- ITT Inc. Goulds Pumps

- LEO PUMP

- Nanfang Pump Industry Co.Ltd.

- SHIMGE PUMP

Market News & Updates

- Xylem Inc., 2025:

Xylem raised its full-year 2025 revenue guidance to $8.90–9.00 billion, reflecting strong demand across water infrastructure and applied water segments supporting municipal and industrial applications. The Water Infrastructure division achieved Q2 2025 sales of $650 million, exceeding analyst expectations of $627 million, driven substantially by municipal water and wastewater pump sales and water treatment solutions across the Middle East and Africa region. This performance demonstrates accelerating regional demand for advanced water management infrastructure and treatment technologies supporting municipal expansion and industrial water security across MENA.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Middle East & Africa Municipal Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Middle East & Africa Municipal Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Middle East & Africa Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Million Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Country

5.2.3.1. Saudi Arabia

5.2.3.2. UAE

5.2.3.3. Egypt

5.2.3.4. Nigeria

5.2.3.5. South Africa

5.2.3.6. Rest of Middle East & Africa

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Saudi Arabia Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Million Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

7. UAE Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Million Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

8. Egypt Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold in Million Units

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

9. Nigeria Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Units Sold in Million Units

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

10. South Africa Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Units Sold in Million Units

10.2. Market Segmentation & Growth Outlook

10.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Xylem Inc.

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Grundfos Holding A/S

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. KSB SE & Co. KGaA

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Flowserve Corporation

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Sulzer Ltd

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. WILO SE

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Ebara Corporation

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Pentair PLC

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. ITT Inc. Goulds Pumps

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. LEO PUMP

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. Nanfang Pump Industry Co.Ltd.

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. SHIMGE PUMP

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.