Mexico Industrial Gases Market Report: Trends, Growth and Forecast (2026-2032)

By Gas Type (Nitrogen Gas, Oxygen Gas, Carbon Dioxide Gas, Argon Gas, Helium Gas, Hydrogen Gas, Other), By Supply Mode (Cylinders, Bulk, On-Site Production, Captive, Other), By Application (Combustion and Process Oxygen, Welding and Metal Fabrication, Inerting Blanketing and Heat Treating, Cryogenics and liquefaction, Chemical Synthesis and Hydrogenation, Purging and Purifications, Analytical and Calibration), By End User Industry (General Manufacturing, Food, Metallurgy, Chemicals, Healthcare, Electronics, Refining & Energy, Glass, Pulp & Paper, Others)

- Energy & Power

- Jan 2026

- VI0829

- 130

-

Mexico Industrial Gases Market Statistics and Insights, 2026

- Market Size Statistics

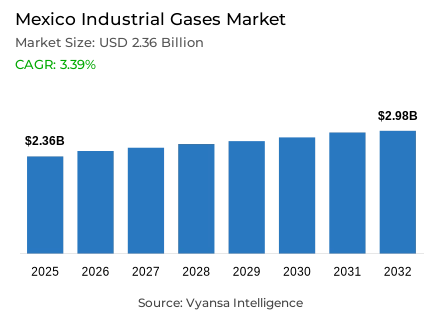

- Industrial gases in Mexico is estimated at USD 2.36 billion in 2025.

- The market size is expected to grow to USD 2.98 billion by 2032.

- Market to register a cagr of around 3.39% during 2026-32.

- Gas Type Shares

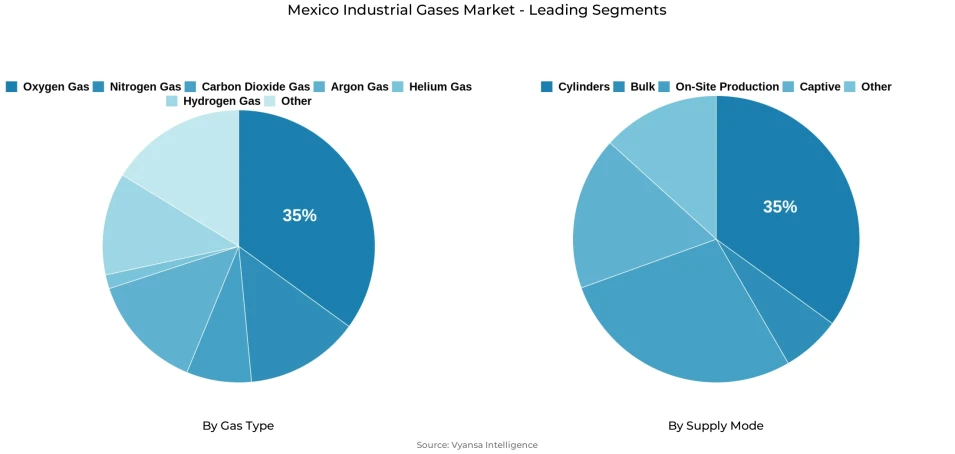

- Oxygen gas grabbed market share of 35%.

- Competition

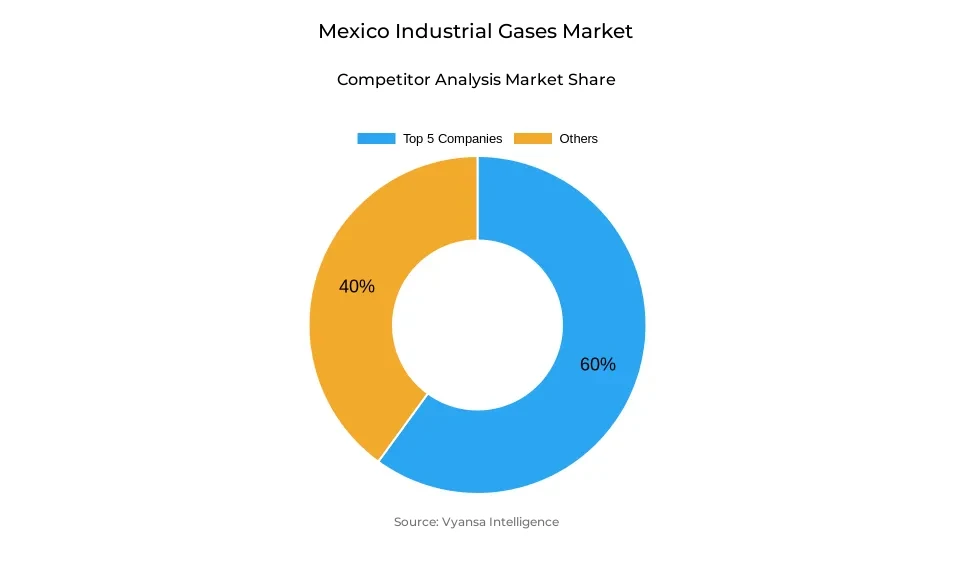

- Industrial gases in Mexico is currently being catered to by more than 5 companies.

- Top 5 companies acquired around 60% of the market share.

- Air Liquide; Grupo Infra (Infra, S.A. de C.V.); Cryoinfra S.A. de C.V.; Linde; Air Products etc., are few of the top companies.

- Supply Mode

- Cylinders grabbed 35% of the market.

Mexico Industrial Gases Market Outlook

The Mexico industrial gases market is set to grow steadily from an estimated USD 2.36 billion in 2025 to USD 2.98 billion by 2032, registering a CAGR of about 3.39% during 2026–2032. This growth is supported by the strong expansion of the automotive and steel industries, with Mexico producing nearly 4 million light vehicles in 2024 and generating 16.2 million metric tons of crude steel in 2023. These sectors rely heavily on oxygen and nitrogen for welding, cutting, heat treatment, and other fabrication processes, strengthening long-term demand.

Manufacturing remains one of the most influential pillars of Mexico’s economy, attracting USD 19.4 billion in FDI through Q3 2024 and accounting for over half of total inflows. As nearshoring accelerates, electronics and automotive production clusters in regions such as Baja California and Monterrey are expanding rapidly, increasing the need for reliable industrial gases. This cluster-based growth also enables suppliers to optimize distribution networks and secure long-term supply contracts.

However, natural gas scarcity continues to restrict production capacity, as Mexico imports nearly 70% of its supply. This limits air separation unit expansion and raises operating costs for hydrogen and oxygen production. Even as demand rises, supply constraints create pressure on producers, particularly in regions with limited infrastructure.

Moreover, renewable energy growth is creating pathways for green hydrogen development. Rising solar capacity and government initiatives such as the Mexican Green Hydrogen Hub support cleaner gas production. Oxygen remains the leading gas type with a 35% market share, while cylinders dominate supply mode at 35%, reflecting strong demand from small and mid-size industrial operations that depend on flexible and accessible delivery formats.

Mexico Industrial Gases Market Growth DriverExpansion of Manufacturing Output Strengthening Industrial Gases Demand

The development of the industrial gases market in Mexico is highly supported by the active development of the automotive and steel manufacturing industries that are still establishing new production standards. In 2024, Mexico produced 3,989,403 light vehicles, surpassing its previous record and representing a 5.6% year‑on‑year increase. General Motors led this growth with 889,072 units, including electric models, a move that indicates a high level of industrial activity and heightens the need of oxygen and nitrogen in welding, cutting, and heat-treatment processes. Simultaneously with the development of the automotive sector, the crude steel production in Mexico amounted to 16.2 million metric tons in 2023, which ranked the country 14th in the world and augmented the oxygen requirements of primary steel production activities.

Manufacturing is one of the most powerful economic pillars in Mexico, with USD 19.4 billion in foreign direct investment (FDI) attracted by the third quarter of 2024, which is over half of the total inflow in the country. The automotive industry is the source of approximately 17.6% of the national manufacturing activity, which directly affects the course of industrial-gases consumption. With the growing capacity of electric-vehicle production, the pressure of metal processing and fabrication increases, which will maintain the strong demand of oxygen and nitrogen up to 2026-2032. As production lines expand and unit volumes rise, industrial gases continue to be essential inputs to a range of fabrication processes, which guarantees steady growth opportunities to suppliers that are consistent with the manufacturing-based industrial ecosystem of Mexico.

Mexico Industrial Gases Market ChallengeStructural Energy Limitations Restricting Production Expansion

The industrial gases market in Mexico is structurally constrained by the lack of natural gas, which restricts the capacity of air-separation and hydrogen-production. According to IEA estimates, domestic natural-gas production has declined by about one-third in the last fifteen years, leaving 70% of domestic demand imported, mainly out of the United States. Even though the total natural-gas consumption grew by a relatively small 2-percent in early 2023, the consumption by the industrial and power sectors increased by 5-percent, putting further strain on the availability of feed-stock. This disequilibrium limits the capacity of manufacturers to increase production facilities, especially air-separation plants that are highly reliant on a consistent supply of natural-gas.

The ongoing supply shortage drives up operating expenses and limits capacity flexibility, forcing suppliers to rely on imported feed-stock and more costly substitutes, limiting scalability of the market in the long term. With the automotive and manufacturing industries increasing demand, these energy constraints increase competition in the distribution channels and reduce the viability of new manufacturing facilities in underserved areas. Without significant growth in domestic natural-gas supply, these limits will keep potential production gains down regardless of the increase in industrial demand. This disconnect between growing end-user demand and limited feed-stock supply is one of the most critical structural issues that hinder growth momentum in the entire industrial-gases sector in Mexico.

Mexico Industrial Gases Market TrendRenewable-Led Hydrogen Development Transforming Supply Dynamics

The growing renewable-energy infrastructure in Mexico is creating significant impetus to develop green hydrogen, which offers long-term substitutes to natural-gas-based industrial gases. In 2023, solar photovoltaic capacity grew by 1,554 MW, bringing distributed generation to 3,892 MW, a 31.6% increase. The IEA estimates the overall solar capacity of up to 19 GW by 2028, almost doubling the figures of 2022 and laying the foundation of hydrogen production through electrolysis. The support of the government, such as the Mexican Green Hydrogen Hub, which is expected to produce 10kt of green hydrogen per year by 2025, and the Delicias Solar project, which is expected to produce 6kt by 2026, is an indication of the increasing interest in renewable-powered gas outputs.

With the increasing focus on low-emission production inputs by industrial end users, green hydrogen becomes a strategic differentiator of suppliers who have implemented sustainability-oriented operating models. Solar-powered electrolysis plants reduce reliance on natural gas, thus overcoming a fundamental limitation in the industrial-gases value chain in Mexico. Commercialization of green hydrogen between 2026 and 2032 will increase the diversity of supply, ease the cleaner production process, and strengthen the incorporation of Mexico into the global low-carbon value chains. This shift makes renewable-powered hydrogen one of the most powerful long-term transformation directions that affect supply resilience and competitive positioning in the Mexican industrial-gases market.

Mexico Industrial Gases Market OpportunityNearshoring-Driven Industrial Clusters Creating Concentrated Demand

The nearshoring investment flows are transforming the market of industrial-gases in Mexico by increasing the concentration of demand in strategic manufacturing clusters in the northern and central states. As of the third quarter of 2024, the total foreign direct investment amounted to USD 35.7 billion, with manufacturing contributing USD 19.4 billion to it, or 51.6% of the total inflow. The output of electronics-manufacturing in Baja California is expected to increase 35% within two years, compared to 30% in Monterrey; both areas need a lot of industrial gases to assemble, fabricate and process components. The growth of manufacturing GDP by 5.06% in the second quarter of 2024 is another indicator of the industrial momentum behind demand.

This type of industrial growth in clusters allows gas suppliers to adopt more efficient distribution models, which involve regional air-separation units and bulk-delivery systems that can serve a number of high-volume end users simultaneously. The concentrated demand lowers distribution expenses, increases the reliability of supply, and reinforces the possibility of long-term contracts with multinational companies that are moving their operations to Mexico. With nearshoring gaining pace in the automotive, electronics, and metalworking industries, suppliers gain a strategic edge by establishing infrastructure in areas where several large-scale manufacturers are located within close proximity. This geographic concentration guarantees strong volume visibility and market fundamentals stability over the forecast period.

Mexico Industrial Gases Market Segmentation Analysis

By Gas Type

- Nitrogen Gas

- Oxygen Gas

- Carbon Dioxide Gas

- Argon Gas

- Helium Gas

- Hydrogen Gas

- Other

Oxygen gas holds the highest market share within the Mexico industrial gases market by gas type, commanding approximately 35% of total share owing to its indispensable role in steel production, metal processing, and fabrication operations. Mexico’s 16.2-million-metric-ton steel output underscores oxygen’s criticality in basic oxygen furnace processes, where it directly influences efficiency and throughput. Beyond steelmaking, oxygen remains integral to automotive component manufacturing, welding operations, and other heavy-industrial applications central to Mexico’s nearshoring-driven expansion. Although medical oxygen contributes supplementary demand, industrial activity remains the core driver of oxygen’s leading market position.

The sustained growth of automotive production, steel capacity additions, and metalworking industries directly reinforces oxygen’s structural dominance over competing gas types, which primarily serve niche or specialized functions. As manufacturing clusters expand across Baja California, Nuevo León, Puebla, and central Mexico, oxygen demand remains closely aligned with rising production volumes and fabrication intensity. Its irreplaceability in metallurgical and thermal processes ensures stable market leadership throughout 2026–2032, with end-user industries relying on oxygen for both throughput efficiency and process consistency across large-scale industrial operations.

By Supply Mode

- Cylinders

- Bulk

- On-Site Production

- Captive

- Other

The cylinder supply mode represents the leading distribution channel in the Mexico industrial gases market, accounting for 35% of total market share due to its flexibility, accessibility, and suitability for small and mid-scale industrial operations. Welding shops, construction firms, small fabrication units, and geographically dispersed industrial facilities across regions such as Estado de México, Nuevo León, Puebla, and Jalisco rely extensively on cylinder-based supply. This mode supports rapid delivery cycles and offers operational convenience for end users lacking the infrastructure or volume requirements needed for bulk or on-site generation systems. The widespread nature of Mexico’s manufacturing footprint reinforces the necessity of portable and easily deployable cylinder networks.

The dominance of cylinder supply mode reflects the economic structure of Mexico’s industrial landscape, where a significant portion of metalworking and fabrication activities are performed by smaller enterprises operating outside major industrial hubs. While bulk and on-site supply modes are expanding within concentrated clusters, cylinders remain essential for decentralized regions and high-mobility applications. Their ability to serve emerging and established end users efficiently ensures continued leadership throughout 2026-2032, particularly as industrial activity extends into new nearshoring-driven manufacturing zones that require flexible gas delivery without substantial capital investment.

List of Companies Covered in Mexico Industrial Gases Market

The companies listed below are highly influential in the Mexico industrial gases market, with a significant market share and a strong impact on industry developments.

- Air Liquide

- Grupo Infra (Infra, S.A. de C.V.)

- Cryoinfra S.A. de C.V.

- Linde

- Air Products

Market News & Updates

- Grupo Infra, 2025:

Launched green hydrogen production facilities advancing Mexico's energy transition with operations in CDMX, León, and Querétaro; commissioned hydrogen refueling infrastructure (Hidrogeneras) in partnership with Air Products featuring 350-700 bar high-pressure composite tanks meeting international safety standards; commenced green hydrogen plant construction in San Luis Potosí with estimated 2025-2026 completion. Company recognized for fifth consecutive year as Socially Responsible Enterprise (ESR) by Mexican Philanthropy Center; operates 200+ distribution centers nationwide with 5,000+ employees across 30+ companies managing medical oxygen homecare services (Inframedica) alongside industrial gases serving petrochemical, automotive, steel, and manufacturing sectors.

- Linde, 2025:

Reported Q1 2025 earnings projections of $3.85-$3.95 adjusted EPS (3-5% growth over prior year) despite unfavorable FX headwinds; maintains extensive Mexico industrial gases operations providing oxygen, nitrogen, carbon dioxide, and specialty gases to healthcare, chemicals, manufacturing, food & beverage, and metallurgical sectors through established distribution network.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Mexico Industrial Gases Market Policies, Regulations, and Standards

4. Mexico Industrial Gases Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Mexico Industrial Gases Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Quantity Sold in Tons

5.2. Market Segmentation & Growth Outlook

5.2.1.By Gas Type

5.2.1.1. Nitrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.2. Oxygen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.3. Carbon Dioxide Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.4. Argon Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.5. Helium Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.6. Hydrogen Gas- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.1.7. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.By Supply Mode

5.2.2.1. Cylinders- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.2. Bulk- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.3. On-Site Production- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.4. Captive- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.By Application

5.2.3.1. Combustion and Process Oxygen- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.2. Welding and Metal Fabrication- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.3. Inerting Blanketing and Heat Treating- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.4. Cryogenics and liquefaction- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.5. Chemical Synthesis and Hydrogenation- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.6. Purging and Purifications- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.3.7. Analytical and Calibration- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.By End User Industry

5.2.4.1. General Manufacturing- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.2. Food- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.3. Metallurgy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.4. Chemicals- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.5. Healthcare- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.6. Electronics- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.7. Refining & Energy- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.8. Glass- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.9. Pulp & Paper- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.4.10. Others- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Mexico Nitrogen Gas Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Quantity Sold in Tons

6.2. Market Segmentation & Growth Outlook

6.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

6.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7. Mexico Oxygen Gas Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Quantity Sold in Tons

7.2. Market Segmentation & Growth Outlook

7.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

7.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8. Mexico Carbon Dioxide Gas Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Quantity Sold in Tons

8.2. Market Segmentation & Growth Outlook

8.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

8.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9. Mexico Argon Gas Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Quantity Sold in Tons

9.2. Market Segmentation & Growth Outlook

9.2.1.By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

9.2.3.By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10. Mexico Helium Gas Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Quantity Sold in Tons

10.2. Market Segmentation & Growth Outlook

10.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

10.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11. Mexico Hydrogen Gas Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.1.2. By Quantity Sold in Tons

11.2. Market Segmentation & Growth Outlook

11.2.1. By Supply Mode- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

11.2.3. By End User Industry- Market Insights and Forecast 2022-2032, USD Million & Quantity in Tons

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Linde

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Air Products

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Air Liquide

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Grupo Infra (Infra, S.A. de C.V.)

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Cryoinfra S.A. de C.V.

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Gas Type |

|

| By Supply Mode |

|

| By Application |

|

| By End User Industry |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.