Mexico Ice Cream Market Report: Trends, Growth and Forecast (2025-2030)

By Category (Frozen Yoghurt, Impulse Ice Cream, Plant-based Ice Cream, Take-Home Ice Cream), By Leading Flavours (Chocolate, Vanilla, Strawberry, Cookies & Cream, Caramel, Mango, Pralines & Cream, Kulfi), By Format (Cup, Stick, Cone, Brick), By Sales Channel (Retail Offline, Retail E-Commerce)

- Food & Beverage

- Dec 2025

- VI0004

- 116

-

Mexico Ice Cream Market Statistics and Insights, 2025

- Market Size Statistics

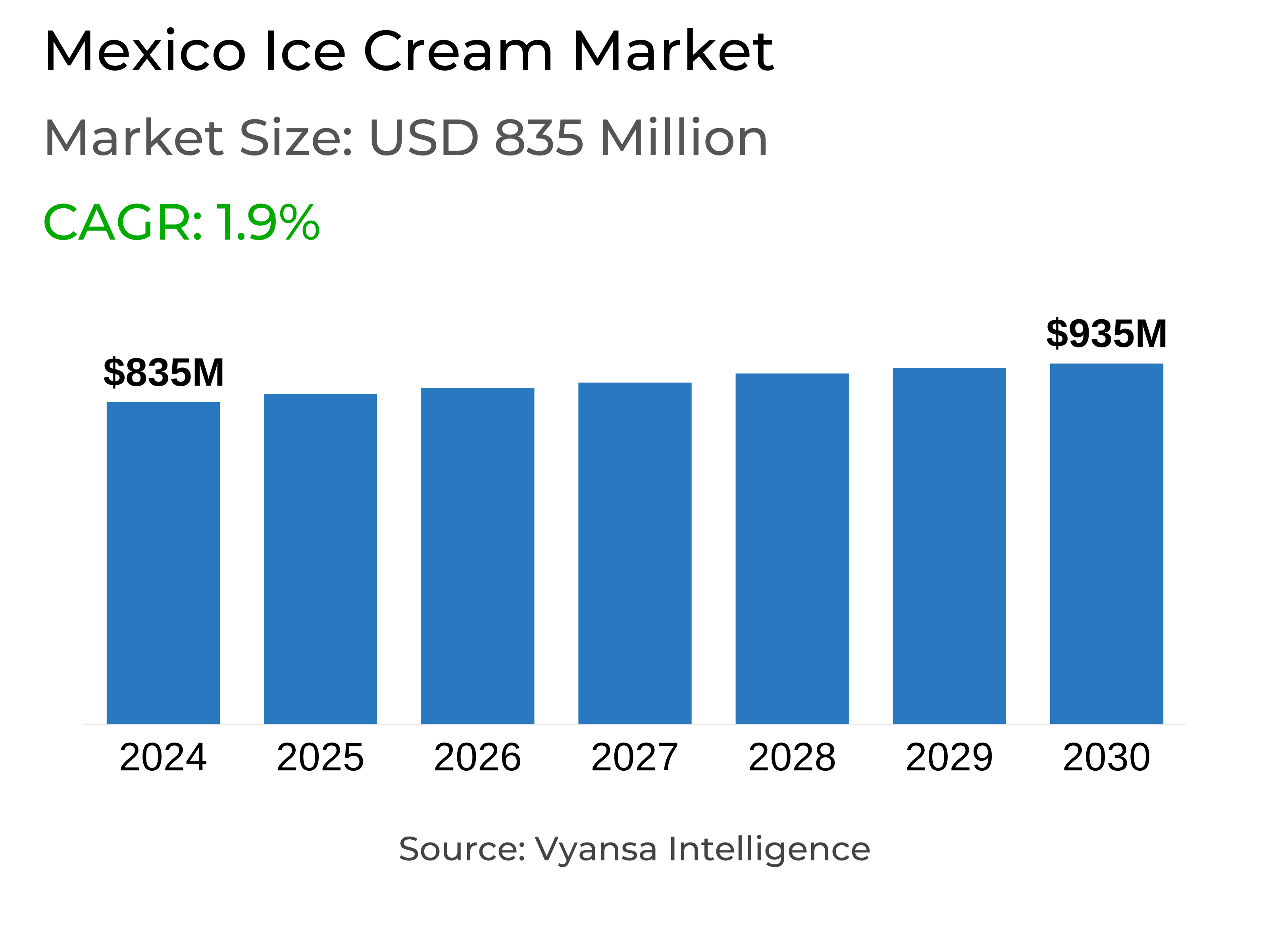

- Ice Cream in Mexico is estimated at $ 835 Million.

- The market size is expected to grow to $ 935 Million by 2030.

- Market to register a CAGR of around 1.9% during 2025-30.

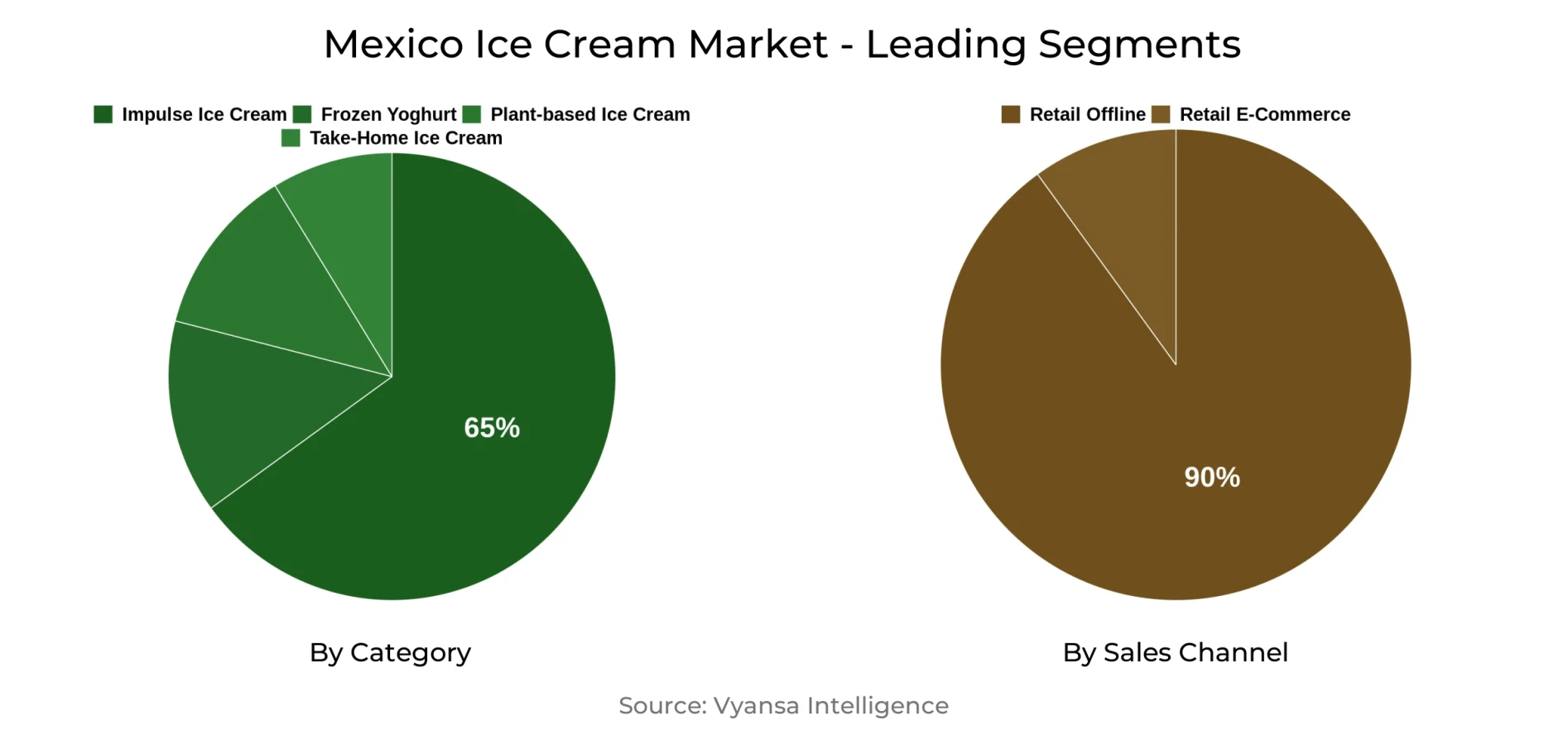

- Product Shares Shares

- Impulse Ice Cream grabbed market share of 65%.

- Impulse Ice Cream to witness a volume CAGR of around 1.34%.

- Competition

- More than 10 companies are actively engaged in producing Ice Cream in Mexico.

- Top 5 companies acquired 80% of the market share.

- Supermercados Internacionales HEB SA de CV, Santa Clara Mercantil de Pachuca S de RL de CV, Globo SA de CV, El, Unilever de México S de RL de CV, Herdez SAB de CV, Grupo etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 90% of the market.

Mexico Ice Cream Market Outlook

The Mexico ice cream market is set for retail current value sales growth in 2025, supported by good profit margins in the midst of an inflationary setting. Although retail volume sales will experience only slight growth, steady consumer demand suggests resilience, coupled with cost-of-living pressures. Consumers are purchasing less often but staying true to their preferred brands, leading companies to invest in product innovation and line extensions. High-profile instances include Unilever de México's Cornetto Spotify and Mars Wrigley's launching of its Turín brand in ice cream.

Market segmentation is becoming a dominant strategy to maintain consumption. Unilever's Cornetto Spotify marketed to centennials with an experience led by music, and NotCo launched NotIcecream, a plant-based ice cream for lactose-intolerant consumers. These targeted products mark an increasing focus on connecting product innovation with lifestyle and nutritional choices.

Retail infrastructure upgrades, especially in refrigeration space throughout supermarkets, hypermarkets, and convenience stores, have facilitated product portfolio expansion. This has enabled increased market access for newer brands like Not Ice Cream, Gelartier, Halo Top, and Lulo, injecting color and competition into the category.

While there are continuing issues with cold chain logistics, improved storage and distribution facilities are facilitating increased product availability and innovation. As indulgence continues to be an underlying purchase driver, particularly for dairy-based ice creams, new products such as Unilever's Magnum Sunlight and Moonlight will continue to sustain consumer interest in the future. In the future, the market will be positively impacted by these innovations and infrastructure advantages, with Unilever poised to retain leadership.

Mexico Ice Cream Market Challenge

In spite of having a positive growth prospect in terms of both retail value and volume (constant 2025 prices), persistent economic pressures are most likely to prove to be a dampener to the market growth. Sustained inflation, with increasing energy, fuel and raw material prices like milk, sugar, packaging etc. Combining to push the production cost of the ice cream. It is swelling retail prices, which is dampening end users' demand, primarily among the price sensitive end users. Consequently, end users might switch to lower-priced snack substitutes like sweet biscuits, bakery products and chocolate or sugar confectionery. The increasing competition is forcing ice cream companies to expand the width of product offerings in price points and formats which will contribute to rising operating and R&D expenses.

Mexico Ice Cream Market Trend

The indigenous start-ups and confectionery firms continue to enter the market. Motivated by previous experience in the salty snack and wafer market. The new entrants emphasize artisanal production and the use of iconic indigenous ingredients. For example, the end users have access to chile en nogada (chili in walnut sauce) flavoured ice cream in artisan outlets. More focus by the end user on the history of consuming the product, where the human touch becomes central to how the products are produced. In addition, established confectionery players like Ferrero de México are banking on the indulgent product lines, including its Ferrero and Rafaello coconut-flavored ice lollies. The total market is also fueled by hectic lifestyles and warmer weather which drives the need for indulgence and refreshment, the expansion of confectionery brands into ice cream will increase even more to meet the end users need for comfort and pleasure.

Mexico Ice Cream Market Opportunity

The increasing emphasis on the sustainability, the retailers and manufacturers continue to emphasize the growth of cold chain logistics in order to reach more ice cream to more geographies. With growing demand particularly with increasing temperatures, strategic capital investments in advanced cold storage and refrigerated transport are likely to define a leaner and lower-cost cold chain infrastructure throughout the forecast period. Also, the road security is a problem that is hindering the growth. For example, The Mexico Association of Carrier Organizations (AMOTAC) recorded a 10% increase in cargo robbery in 2023 over 2022, which was a point of concern for organized crime. Overall, the security concerns have resulted in road obstruction and higher operational expenditures, which have discouraged some players from investing in refrigerated fleets. In spite of all the challenges, organizations focusing on innovation and coping in cold chain development are most likely to achieve a competitive advantage in the changing market and hence the market share will expand over the forecast period.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 835 Million |

| USD Value 2030 | $ 935 Million |

| CAGR 2025-2030 | 1.9% |

| Largest Category | Impulse Ice Cream segment leads with 65% market share |

| Top Challenges | Impact of Economic Pressures on Consumer Demand and Operational Costs |

| Top Trends | Rise of Artisanal Offerings and Confectionery Brand Expansion Driven by Indulgence and Innovation |

| Top Opportunities | Advancements in Cold Chain Infrastructure Amid Rising Demand |

| Key Players | Supermercados Internacionales HEB SA de CV, Santa Clara Mercantil de Pachuca S de RL de CV, Globo SA de CV, El, Unilever de México S de RL de CV, Herdez SAB de CV, Grupo, General Mills de México SA de CV, Qualamex SA de CV, Organización Soriana SAB de CV, Blue Bell Manhattan, Yogurt Boutique SA de CV and Others. |

Mexico Ice Cream Market Segmentation Analysis

Single-serve dairy impulse ice cream is the top segment under the Category segment with market share of approximately 65%. The market is led by the market leadership of single-serve dairy impulse ice cream. It is largely because of the comparatively cheap price tag. Further, dairy based impulse ice cream with the share continues to attract the end customers based on the perceived indulgence underpinned by ongoing innovations, where different players are availing themselves of the rising popularity of new forms of ice creams in the current ice cream which are able to sustain consumption growth. For example, in 2023, Unilever de México introduced Cornetto Spotify, a limited launch targeting centennials who view music as the central source of entertainment. It was flavored with chocolate hazelnut and caramel sauce and incorporated a QR code that directed the end users to listen to the already prepared playlist. End Users had the ability to connect via Spotify for mood-match music and a chance to win tickets to concerts.

Top Companies in Mexico Ice Cream Market

The top companies operating in the market include Supermercados Internacionales HEB SA de CV, Santa Clara Mercantil de Pachuca S de RL de CV, Globo SA de CV, El, Unilever de México S de RL de CV, Herdez SAB de CV, Grupo, General Mills de México SA de CV, Qualamex SA de CV, Organización Soriana SAB de CV, Blue Bell Manhattan, Yogurt Boutique SA de CV, etc., are the top players operating in the Mexico Ice Cream Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Mexico Ice Cream Market Policies, Regulations, and Standards

4. Mexico Ice Cream Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Mexico Ice Cream Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Volume in Million Litres

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Frozen Yoghurt- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2. Impulse Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2.1. Single Portion Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.2.2. Single Portion Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.3. Plant-based Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4. Take-Home Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1. Take-Home Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1.1. Bulk Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.1.2. Multi-Pack Dairy Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2. Take-Home Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2.1. Bulk Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.1.4.2.2. Multi-Pack Water Ice Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.By Leading Flavours

5.2.2.1. Chocolate- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.2. Vanilla- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.3. Strawberry- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.4. Cookies & Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.5. Caramel- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.6. Mango- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.7. Pralines & Cream- Market Insights and Forecast, 2020-2030, USD Million

5.2.2.8. Kulfi- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.By Format

5.2.3.1. Cup- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.2. Stick- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.3. Cone- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.4. Brick- Market Insights and Forecast, 2020-2030, USD Million

5.2.3.5. Others (Sandwich, Tub, etc.)- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1. Grocery Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1. Convenience Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1.1. Convenience Stores- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.1.2. Forecourt Retailers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.2. Supermarkets- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.3. Hypermarkets- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.4. Food & Drink Specialists- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.1.1.5. Small Local Grocers- Market Insights and Forecast, 2020-2030, USD Million

5.2.4.2. Retail E-Commerce- Market Insights and Forecast, 2020-2030, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Mexico Frozen Yoghurt Ice Cream Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Volume in Million Litres

6.2. Market Segmentation & Growth Outlook

6.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

6.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

7. Mexico Impulse Ice Cream Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Volume in Million Litres

7.2. Market Segmentation & Growth Outlook

7.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

7.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

8. Mexico Plant-based Ice Cream Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.1.2.By Volume in Million Litres

8.2. Market Segmentation & Growth Outlook

8.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

8.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

9. Mexico Take-Home Ice Cream Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.1.2.By Volume in Million Litres

9.2. Market Segmentation & Growth Outlook

9.2.1.By Leading Flavours- Market Insights and Forecast, 2020-2030, USD Million

9.2.2.By Format- Market Insights and Forecast, 2020-2030, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast, 2020-2030, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Supermercados Internacionales HEB SA de CV

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Santa Clara Mercantil de Pachuca S de RL de CV

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Globo SA de CV

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. El Unilever de México S de RL de CV

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Herdez SAB de CV Grupo

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. General Mills de México SA de CV

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Qualamex SA de CV

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Organización Soriana SAB de CV

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Blue Bell Manhattan

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Yogurt Boutique SA de CV

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Leading Flavours |

|

| By Format |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.