Mexico Consumer Lending Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Outstanding Balance, Gross Lending), By Loan Type (Personal Loans, Unsecured Personal Loans, Secured Personal Loans, Auto Loans, Mortgages / Home Loans, Credit Card Loans, Student Loans), By Interest Rate Type (Fixed Interest Rate Loans, Floating / Variable Interest Rate Loans), By Payment Method (Direct Deposit (Salary Transfers, Government Benefits, Tax Refunds), Debit Card, Credit Card, Mobile Wallet / UPI, Cheque), By Borrower Type (Individual Borrowers, Joint Borrowers), By Distribution Channel (Bank Branches, Online / Digital Lending Platforms, Non-Banking Financial Institutions (NBFCs)), By Collateral Type (Secured Loans (Vehicle Collateral, Property Collateral), Unsecured Loans), By Age Group (Youth (up to 24 years), Young Adults (25-34 years), Adults (35-54 years), Pre-Retirement (55-64 years), Seniors (65+ years))

- ICT

- Jan 2026

- VI0761

- 120

-

Mexico Consumer Lending Market Statistics and Insights, 2026

- Market Size Statistics

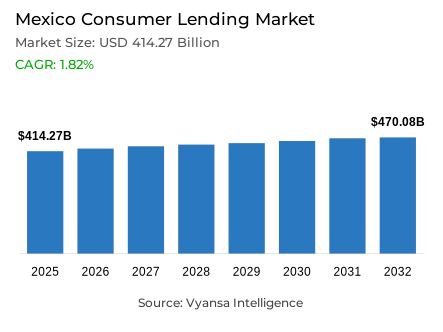

- Consumer lending in Mexico outstanding balance is estimated at USD 414.27 billion and gross lending is estimated at USD 209.08 billion in 2025.

- An outstanding balance market size is expected to grow to USD 470.08 billion and gross lending USD 239.22 billion by 2032.

- Market to register an outstanding balance cagr of around 1.82% and gross lending cagr of around 1.94% during 2026-32.

- Loan Type Shares

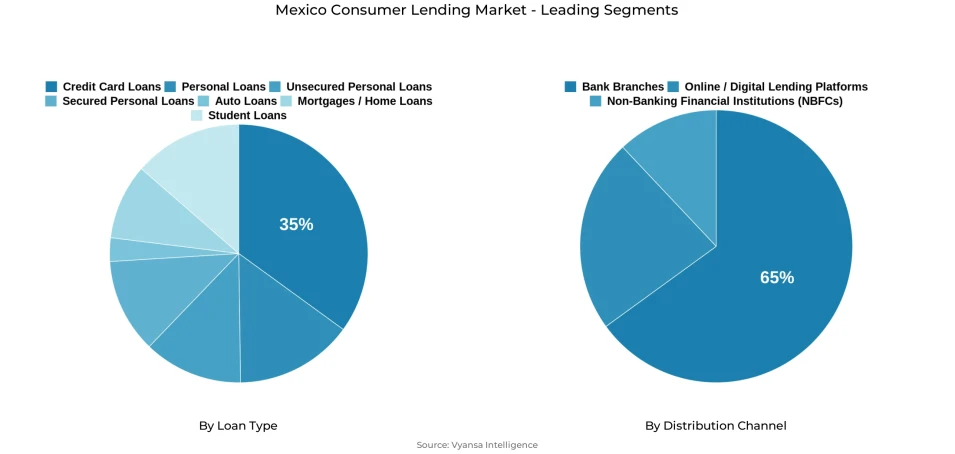

- Credit card loans grabbed market share of 35%.

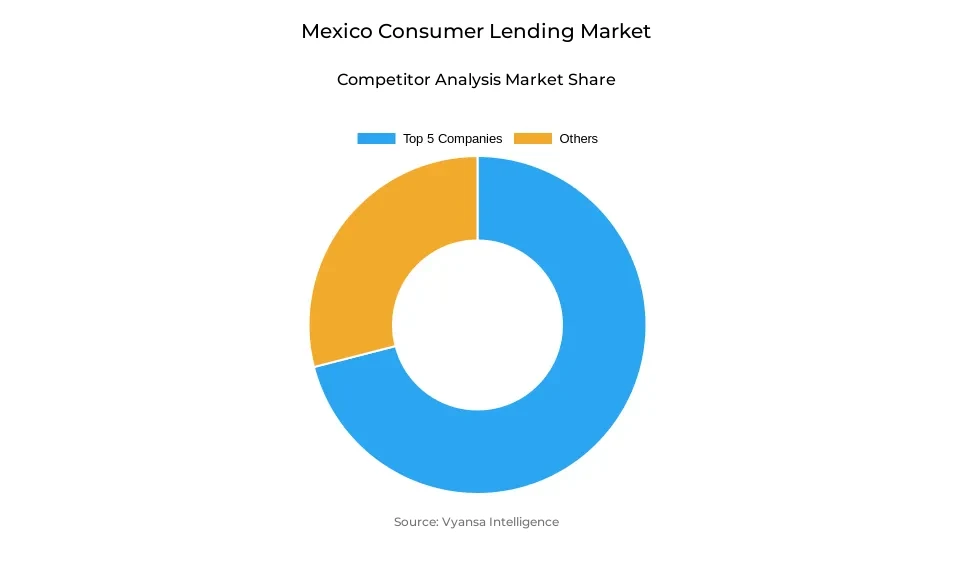

- Competition

- Consumer lending in Mexico is currently being catered to by more than 15 companies.

- Top 5 companies acquired the maximum share of the market.

- Grupo Financiero Inbursa SAB de CV; The Bank of Nova Scotia (Scotiabank México); Klar; Banco Bilbao Vizcaya Argentaria SA (BBVA México); Bancoppel SA etc., are few of the top companies.

- Distribution Channel

- Bank branches grabbed 65% of the market.

Mexico Consumer Lending Market Outlook

The Mexico consumer lending market is set to grow at a steady pace through to 2032. The market outstanding balance is valued around $414.27 billion, while its gross lending reaches around $209.08 billion in 2025, and is set to reach $470.08 billion and $239.22 billion by 2032. This is a moderate outstanding balance growth rate of 1.82% and gross lending of 1.94% for the forcastperiod, showing a steadystate growth despite a challenging economic environment due to changes in the government and effects of nearshoring.

Credit card loans are leaders in terms of lending, with a 35% market share due to a low penetration rate of only 10% among credit cards, offering immense growth opportunities. Established banking organizations enjoy robust distribution power with a massive 65% of the market share held by bank branches, with a substantial focus on developing online services to compete with upcoming fintech companies. Leading banks like Santander are developing purely online banking channels like Openbank, blending long-established banking networks with advanced digitized ease of use to lure technology-conscious end user.

The fintech marrket has been growing at a very rapid pace, and Mexico has emerged as the second-biggest financial technology market in Latin America for 2024. Major companies such as Klar have developed from credit-oriented startups into fully licensed financial entities providing savings and investment solutions, while mobility firm DiDi forayed into the financial services business after acquiring sofipo JP Sofiexpress. Buy Now, Pay Later services have been adopted at a very rapid pace, with companies such as Aplazo securing a credit acceptance rate of above 80% and securing investment from venture capitalist firm QED Investors, who funds them for innovative AI-based product developments and financial inclusion.

The mortgage loans market continues experiencing growth due to the effects of nearshoring, low unemployment rates, and above inflation levels of increasing minimum wage. Though growth is below the levels experienced before the pandemic due to the effects of high interest rates and public cautions against property fraud in tourist sites, the market is expected to have its offering expansions through financial service platforms like Mercado Pago’s applying for digital banking licenses continue through 2032. The market is challenged by signs of the economy slowing down and limited public repayment capacity due to prices of essentials increasing.

Mexico Consumer Lending Market Growth DriverStable Economic Conditions Enhancing Financial Inclusion

Exceptionally low unemployment levels, recorded at 2.7% in Q1 2024 according to INEGI, reflect one of the most favorable labour market conditions observed over the past decade. Banco de México revealed that inflation fell to around 4.2% by May 2024, an aspect that improved the ability of households to generate value through their spending on essential commodities. This positive economic environment, along with the growing use of fintech, contributed to the increased use of the various online services.

The fintech market in mexico has maintained strong growth momentum in 2024, propelling it to become one of the biggest fintech markets in Latin America in terms of market size, as digital platforms have widened accessibility of credits as well as savings. Klar, for instance, has grown quickly, which has contributed significantly to improvements in financial inclusion. The improvement in economic fundamentals, in addition to rapid digital growth, has remained core for consumer lending growth.

Mexico Consumer Lending Market ChallengeElevated Interest Rates Constraining Credit Growth

A prolonged period of elevated monetary policy has prevailed in Mexico, with the central bank maintaining benchmark interest rates at approximately 11.25% for most of 2024. However, the slight reductions towards 10.25% were noticed towards the end of 2024. This high-interest rate environment had therefore suppressed the debt growth of the population, especially the residential market. Middle-class end users continued being discouraged because of the high installment payments on long-term borrowing.

In Mexico, real estate fraud intensified, especially in tourist regions, registering more than 3,800 cases in 2024, significantly weakening borrower confidence. Furthermore, despite better labor market conditions, average cost of living challenges restricted repayment ability. In aggregate, these conditions restricted more aggressive credit growth paths, as well as sustained borrower conservatism in housing and high-purchase loans.

Mexico Consumer Lending Market TrendTraditional Banks Accelerating Digital Banking Expansion

Digital banking services showed considerable growth during the year 2024, with conventional banking institutions channeling considerable investment into digital banking to effectively compete with fintech based institutions for faster transaction services. Rapid growth showed itself at Santander Mexico's Openbank platform, which recorded more than 17 million digital end user by the year 2023 with increased adoption rates during 2024. These digital banking services act as hybrid digital credit access channels for the end user.

Preferences concerning digital onboarding processes started to grow rapidly in 2024, with waitlist systems based on apps and streamlined approval processes resulting in significantly faster credit application procedures. This has contributed to a more challenging and competitivemarket, with lower-interest rates and increased service quality, and digital banking transformation, thus,at the forefront of what has become a distinct feature of the Mexico consumer lending market.

Mexico Consumer Lending Market OpportunityBNPL Expansion Capitalizing on Credit Card Penetration Gap

Buy Now, Pay Later services are growing at a very fast pace in the Mexican market, owing chiefly to the low penetration of credit cards, as only 13.8% of the population had access to credit cards as of 2024, compared to 10.5% in 2021, as reported by World Bank’s Global Findex 2024. Companies such as Aplazo seized these opportunities by investing heavily in capital and the resultant AI technology that could offer loans above 80% approval, targeting those who do not have access to traditional loans.

With an expanding use of digital payments and e-commerce in Mexico, flexibleInstallment Payment Schemes in Buy Now, Pay Later (BNPL) solutions are becoming increasingly popular in managing personal finances in a fluctuating economy. With low entry barriers, the BNPL market is recognized as one of Mexico’s most rapidly expanding financial markets, which will continue to demonstrate intense interest of investors in innovating products, hence rapidly penetrating the market during 2024 and beyond.

Mexico Consumer Lending Market Segmentation Analysis

By Loan Type

- Personal Loans

- Unsecured Personal Loans

- Secured Personal Loans

- Auto Loans

- Mortgages / Home Loans

- Credit Card Loans

- Student Loans

The segment with highest market share under loan types, is Credit Card Loans, which leads by 35% in the Mexican consumer loans market. However, this market poses immense growth opportunities, as merely 10% of the Mexicans have credit cards. Banks and fintech firms are competing vigorously to increase credit card penetration with novel products. New companies like DiDi are offering fee-free credit cards with contactless payments, while existing firms are enhancing approval times and attractiveness of credit card interest rates.

When consumers become increasingly confident with AI-powered personal credit services and as digital payments become more widespread, credit card lending is poised to claim a bigger piece of the Mexican consumer loan market.

By Distribution Channel

- Bank Branches

- Online / Digital Lending Platforms

- Non-Banking Financial Institutions (NBFCs)

The segment with highest market share under distribution channel is Bank Branches has captured around 65% of the total market share despite the growing use of electronic alternatives. The conventional bank branches remain the dominant channels through which people acquire loans given the need to physically touch the financial touchpoints while applying for a mortgage and making bigger loans.

However, the market environment is undergoing changes as conventional banking institutions invest extensively in technology-based services to preserve their market share. Openbank, initiated by Santander, offers combined offline and fully online facilities, while technology-based companies such as Mercado Pago, aiming to obtain digital banking licenses, are increasingly providing combined financial services like credit cards, personal loans, and insurance through simple-to-use mobile apps. This technology-driven shift in market trends is consequently impacting distribution channel preferences, and bank branches shall preserve their leading position in the forecast period due to the infrastructure developed in the Mexico consumer lending market.

List of Companies Covered in Mexico Consumer Lending Market

The companies associated with the Mexico consumer lending market are outlined below.

- Grupo Financiero Inbursa SAB de CV

- The Bank of Nova Scotia (Scotiabank México)

- Klar

- Banco Bilbao Vizcaya Argentaria SA (BBVA México)

- Bancoppel SA

- Grupo Financiero Santander SAB de CV

- Grupo Financiero Banamex SA de CV (Citibanamex)

- Grupo Financiero Banorte SAB de CV

- Openbank (Santander Group)

- DiDi México (DiDi Préstamos)

Competitive Landscape

Mexico’s consumer lending landscape in 2024 is becoming increasingly competitive and diversified, shaped by the convergence of fintechs, traditional banks, and non-financial digital players. Established banks are accelerating digital transformation through proprietary fintech-style platforms and digital-only banks such as Openbank (Santander Group), leveraging strong brand trust, branch-backed credibility, and large-scale marketing to defend share. At the same time, fintech leaders like Klar are moving beyond pure credit into savings and investment products, strengthening their position through regulatory licences and acquisitions of sofipos. Non-traditional players are also reshaping competition: DiDi has expanded into financial services by acquiring JP Sofiexpress, while BNPL specialists such as Aplazo are emerging as high-growth challengers supported by international venture capital and AI-driven credit models. Meanwhile, ecosystem-based players like Mercado Pago are blurring category boundaries by offering integrated credit, payments, insurance, and remittance services, intensifying competition around convenience, financial inclusion, and multi-product platforms rather than standalone lending alone.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Mexico Consumer Lending Market Policies, Regulations, and Standards

4. Mexico Consumer Lending Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Mexico Consumer Lending Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Outstanding Balance- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Gross Lending- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Loan Type

5.2.2.1. Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Unsecured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Secured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Auto Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Mortgages / Home Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Credit Card Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Student Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Interest Rate Type

5.2.3.1. Fixed Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Floating / Variable Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Payment Method

5.2.4.1. Direct Deposit- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1. Salary Transfers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2. Government Benefits- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.3. Tax Refunds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Debit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Credit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Mobile Wallet / UPI- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Cheque- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Borrower Type

5.2.5.1. Individual Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Joint Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Distribution Channel

5.2.6.1. Bank Branches- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Online / Digital Lending Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Non-Banking Financial Institutions (NBFCs)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Collateral Type

5.2.7.1. Secured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Vehicle Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Property Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Unsecured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Age Group

5.2.8.1. Youth (up to 24 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Young Adults (25-34 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Adults (35-54 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.4. Pre-Retirement (55-64 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.5. Seniors (65+ years)- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. Mexico Outstanding Balance Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7. Mexico Gross Lending Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Grupo Financiero Banorte SAB de CV

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Grupo Financiero Santander (Mexico)

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Grupo Financiero BBVA (BBVA Mexico)

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Grupo Financiero Banamex (Citibanamex)

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Grupo Financiero Inbursa

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Banco Bilbao Vizcaya Argentaria SA (BBVA)

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Bancoppel SA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Santander Mexico

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Klar

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Mercado Pago / Mercado Libre

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Loan Type |

|

| By Interest Rate Type |

|

| By Payment Method |

|

| By Borrower Type |

|

| By Distribution Channel |

|

| By Collateral Type |

|

| By Age Group |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.