Malaysia Consumer Lending Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Outstanding Balance, Gross Lending), By Loan Type (Personal Loans, Unsecured Personal Loans, Secured Personal Loans, Auto Loans, Mortgages / Home Loans, Credit Card Loans, Student Loans), By Interest Rate Type (Fixed Interest Rate Loans, Floating / Variable Interest Rate Loans), By Payment Method (Direct Deposit (Salary Transfers, Government Benefits, Tax Refunds), Debit Card, Credit Card, Mobile Wallet / UPI, Cheque), By Borrower Type (Individual Borrowers, Joint Borrowers), By Distribution Channel (Bank Branches, Online / Digital Lending Platforms, Non-Banking Financial Institutions (NBFCs)), By Collateral Type (Secured Loans (Vehicle Collateral, Property Collateral), Unsecured Loans), By Age Group (Youth (up to 24 years), Young Adults (25-34 years), Adults (35-54 years), Pre-Retirement (55-64 years), Seniors (65+ years))

- ICT

- Jan 2026

- VI0745

- 110

-

Malaysia Consumer Lending Market Statistics and Insights, 2026

- Market Size Statistics

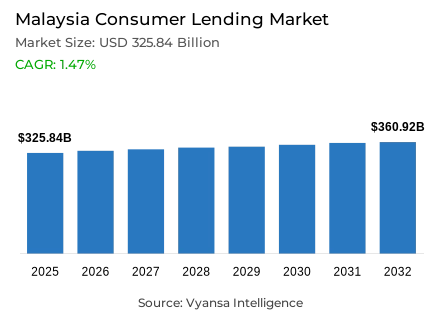

- Consumer lending in Malaysia outstanding balance is estimated at USD 325.84 billion and gross lending is estimated at USD 145.57 billion in 2025.

- An outstanding balance market size is expected to grow to USD 360.92 billion and gross lending USD 176.92 billion by 2032.

- Market to register an outstanding balance cagr of around 1.47% and gross lending cagr of around 2.83% during 2026-32.

- Loan Type Shares

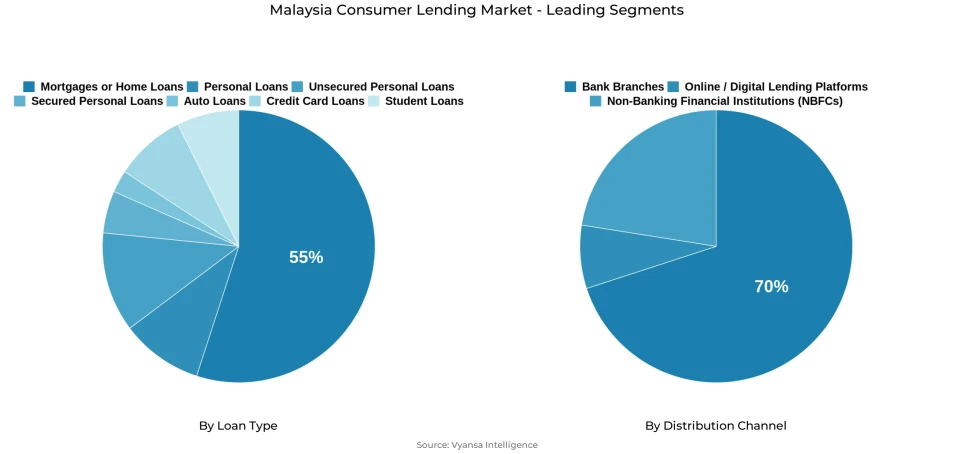

- Mortgages / home loans grabbed market share of 55%.

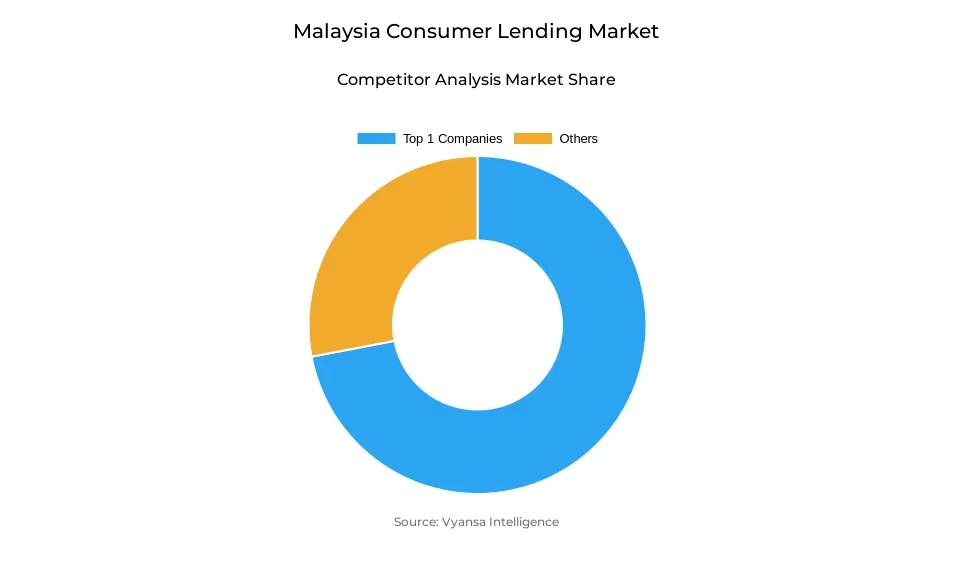

- Competition

- Consumer lending in Malaysia is currently being catered to by more than 15 companies.

- Top 10 companies acquired the maximum share of the market.

- Hong Leong Bank; AmBank; RHB Bank; Maybank; HSBC etc., are few of the top companies.

- Distribution Channel

- Bank branches grabbed 70% of the market.

Malaysia Consumer Lending Market Outlook

The Malaysia consumer lending market is set to grow steadily up to 2032, fueled by changes in end user behavior and digitalization. The outstanding business balance around $325.84 billion with a gross lending around $145.57 billion in 2025, and is projected to grow around $360.92 billion and $176.92 billion, respectively, by 2032. This records a moderate outstanding balance CAGR and a gross lending CAGR of 1.47% and 2.83%, respectively, over the forcats period, thus indicating a mature yet stable lending sector.

Mortgages/home loans remain the leading category with an impressive 55%, thanks to government initiatives such as Housing Credit Guarantee Scheme (HCGS) and MyHome Scheme. This category also focuses on serving the underserved sectors of society, such as gig workers and first-home buyers. Despite government initiatives, the increasing prices in the market, coupled with slowing loan expansion from 7.3% in 2023 to 6.9% in December 2024, indicate maturation in this category.

There are challenges in the market posed by the defaults in education loans, registering 2.7 million unpaid loans amounting to MYR 32 billion as of November 2024. As a result of the rising cost of living, particularly fueled by the cutbacks in diesel fuel and the tentative cutback in petrol subsidies in Budget 2025, end user turn to credit cards, personal loans, and the likes because of the convenience and accessibility associated with such products.

Digital disruption is transforming the vertical with a rapid adoption of Buy Now Pay Later options supported with a high penetration of 94% for e-wallets in Q4 of 2024. There are currently three digital banks: GXBank, Aeon Bank, and Boost Bank, with a penetration of 93% for end user awareness and 50% for usage penetration. Meanwhile, bricks-and-mortar bank branches lead with a 70% penetration of distribution channels, but digital platforms are set to support growing demand for a personal loan via mobile-based solutions aimed at Y and-middle-income demographics.

Malaysia Consumer Lending Market Growth DriverGovernment Housing Schemes Supporting Mortgage Growth

Government-linked housing programs are still very crucial in promoting malaysia mortgage loan market. The Housing Credit Guarantee Scheme (HCGS) offers a guarantee coverage of 100% and beyond for up to RM500,000, especially targeting gig economy workers, farmers, petty traders, and irregular income earners who are considered to be served inadequately by conventional banking institutions, according to the Malaysian Ministry of Finance.

Although there was strong growth of 15.2% yearly for housing loans sanctioned during April 2024, the rate of growth for outstanding housing loans eased to 6.9% yearly as of December 2024, from 7.3% during 2023, as stated in the Financial Stability Report 2024 released by Bank Negara Malaysia. Although there have been favorable tax incentives, the growth rate trend for housing credit appears to be maturing rather than accelerating.

Malaysia Consumer Lending Market ChallengeElevated PTPTN Student Loan Default Rates

The Malaysia consumer lending market is challenged by a high number of defaulted students loans. As of November 2024, official data from the Ministry of Higher Education showed that there were 2.7 million unpaid loans amounting to MYR 32 billion, Of the total unpaid loans, the defaulting loans consist of 2.8 million or 72% from Bumiputeran students and 1.1 million or 28% from the rest of the students.

Borrowers in lower-income households are found to be having a harder time repaying loans on a monthly basis, and an ever-expanding pool of long-term defaulters is registered. Programs initiated by the government, which aim to examine the use of legal means of enforcing and examining the possibility of an income-contingent loan repayment scheme, reveal an urgency in ensuring reform. The rising cost of living will limit loan repayment, thus increasing defaults. Without proper loan structures, repaying PTPTN will remain suboptimal, which will also affect Malaysia fiscal framework.

Malaysia Consumer Lending Market Trend Accelerating Buy Now Pay Later (BNPL) Adoption

BNPL services are quickly integrating into Malaysia's consumer lending market. Internet penetration was recorded at 97.4% in January 2024, courtesy of data from the Department of Statistics in Malaysia, through World Bank statistics. Mobile payment technology accessed through e-wallets recorded impressive growth, with 88% of Malaysians adopting it in 2024 compared with 63% in 2023, with 94% in Q4 2024, which recorded the highest penetration.

This rapid online payment infrastructure is a direct catalyst for the growth of BNPL in the reatil online, fashion, and lifestyle sectors. Smaller transaction amounts have been the major force within the usage of BNPL services. Banks and fintech companies are scaling the usage of BNPL services together with the significant increase in the usage of e-wallets in the market with 94% in Q4 2024, ultimately paving the way for BNPL as an integral mainstream payment alternative in the market for the forcast period.

Malaysia Consumer Lending Market OpportunityDigital-First Platform Expansion in Personal Lending

Digital financial platforms are enormous growth areas in the consumer lending market in Malaysia. According to Bank Negara Malaysia, digital financial service use surpassed 88%, indicating massive public adoption of mobile-enhanced platforms. Three fully-licensed digital banks—GXBank, Aeon Bank, and Boost Bank—launched operations in 2023-2024 years following licensing in April 2022.

Awareness of digital banks among Malaysian end users achieved the penetration of 93% by the end of Q4 2024, with a penetration rate of actual users at 50%. GXBank has the leading digital bank market share, especially among the young generation and the higher-income class.The percentage of non-users who are interested in future digital bank application intentions reaches 70%. As the regulatory environment changes, supporting responsible digital lending, digital initiatives are poised to tap into rising personal loan volumes from the end of 2024 to 2025, thanks to the National Cashless Boleh 4.0 campaign.

Malaysia Consumer Lending Market Segmentation Analysis

By Loan Type

- Personal Loans

- Unsecured Personal Loans

- Secured Personal Loans

- Auto Loans

- Mortgages / Home Loans

- Credit Card Loans

- Student Loans

The segment with highest market share under Loan Type is Mortgages/Home Loans, acquiring around 55% market share. Such leadership is made possible by the well-structured homeownership support system offered in Malaysia, through its Housing Credit Guarantee Scheme (HCGS) and the MyHome schemes, which aim at targeting lower and irregular income-earners by easing the costs and offering financing guarantees. As such, these programs have managed to make mortgages the backbone of people finance plans.

For the forcast period, it can be stated that mortgages would maintain their market dominance due to increased opportunities facilitated through state-supported programs that have relaxed requirements for acquiring an affordable home. Though high living expenses could pose demands in the short term, state-backed programs would ensure that mortgage loans continue to retain their market standing in terms of core business. Increased ease of processing, facilitated through banking institutions, would further cement this large market share.

By Distribution Channel

- Bank Branches

- Online / Digital Lending Platforms

- Non-Banking Financial Institutions (NBFCs)

The segment with highest market share under distribution channel is Bank Branches, which hold around 70% of the market share. The branches are still considered a preferred channel for high loan value products such as mortgages, automobile, and personal structured loans, which are propelled by necessary documentation for face to face identity verification and comprehensive assessment for loan checkouts. The end user confidence in formal banking institutions sustains this position in Malaysia lending market.

The forecast period will see continuous dominance of the branches since the regulatory structures that regulate lending of high-value amounts continue to support the process of lending through a branch application. The growth of the digital platform has been complemented by end user need for the advisors offered by the branches when analyzing financial commitments of a long-term nature. Banks continue to align branches with digital technology such as pre-approvals and faster processing of lending through the branches.

List of Companies Covered in Malaysia Consumer Lending Market

The companies associated with the Malaysia consumer lending market are outlined below.

- Hong Leong Bank

- AmBank

- RHB Bank

- Maybank

- HSBC

- Public Bank

- CIMB

- Standard Chartered

- BSN

- Alliance Bank

Competitive Landscape

Malaysia consumer lending landscape in 2024 features active competition between major banks, alternative lenders, and digital-first platforms, each responding to rising living costs and shifting credit demand. Traditional banks such as AmBank, HSBC Bank, and CIMB Bank expanded their presence by entering the Buy Now Pay Later (BNPL) space through partnerships with platforms like Shopee and GrabPay, strengthening their appeal among short-term borrowers. Meanwhile, government-backed institutions such as PTPTN remained central to the education lending segment, though they faced mounting challenges due to widespread loan defaults. The market also saw rapid growth of digital lenders including BigPay and Touch ‘n Go Digital, which attracted borrowers with fast approvals and simplified access to personal loans. As competitive offerings broadened across conventional banks, non-financial entities, and fintech platforms, Malaysian consumers in 2024 benefited from more flexible, digitally accessible lending options tailored to rising financial pressures

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Malaysia Consumer Lending Market Policies, Regulations, and Standards

4. Malaysia Consumer Lending Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Malaysia Consumer Lending Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Outstanding Balance- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Gross Lending- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Loan Type

5.2.2.1. Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Unsecured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Secured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Auto Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Mortgages / Home Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Credit Card Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Student Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Interest Rate Type

5.2.3.1. Fixed Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Floating / Variable Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Payment Method

5.2.4.1. Direct Deposit- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1. Salary Transfers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2. Government Benefits- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.3. Tax Refunds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Debit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Credit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Mobile Wallet / UPI- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Cheque- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Borrower Type

5.2.5.1. Individual Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Joint Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Distribution Channel

5.2.6.1. Bank Branches- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Online / Digital Lending Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Non-Banking Financial Institutions (NBFCs)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Collateral Type

5.2.7.1. Secured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Vehicle Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Property Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Unsecured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Age Group

5.2.8.1. Youth (up to 24 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Young Adults (25-34 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Adults (35-54 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.4. Pre-Retirement (55-64 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.5. Seniors (65+ years)- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. Malaysia Outstanding Balance Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7. Malaysia Gross Lending Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Maybank (Malayan Banking Bhd)

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.CIMB Bank Bhd

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Public Bank Bhd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.RHB Bank Bhd

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.AmBank Group

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.HSBC Bank Malaysia

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.UOB Malaysia

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Hong Leong Bank Bhd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Bank Islam Malaysia Bhd

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. AEON Credit Service (M) Bhd

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Loan Type |

|

| By Interest Rate Type |

|

| By Payment Method |

|

| By Borrower Type |

|

| By Distribution Channel |

|

| By Collateral Type |

|

| By Age Group |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.