China Consumer Lending Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Outstanding Balance, Gross Lending), By Loan Type (Personal Loans, Unsecured Personal Loans, Secured Personal Loans, Auto Loans, Mortgages / Home Loans, Credit Card Loans, Student Loans), By Interest Rate Type (Fixed Interest Rate Loans, Floating / Variable Interest Rate Loans), By Payment Method (Direct Deposit (Salary Transfers, Government Benefits, Tax Refunds), Debit Card, Credit Card, Mobile Wallet / UPI, Cheque), By Borrower Type (Individual Borrowers, Joint Borrowers), By Distribution Channel (Bank Branches, Online / Digital Lending Platforms, Non-Banking Financial Institutions (NBFCs)), By Collateral Type (Secured Loans (Vehicle Collateral, Property Collateral), Unsecured Loans), By Age Group (Youth (up to 24 years), Young Adults (25-34 years), Adults (35-54 years), Pre-Retirement (55-64 years), Seniors (65+ years))

- ICT

- Jan 2026

- VI0732

- 120

-

China Consumer Lending Market Statistics and Insights, 2026

- Market Size Statistics

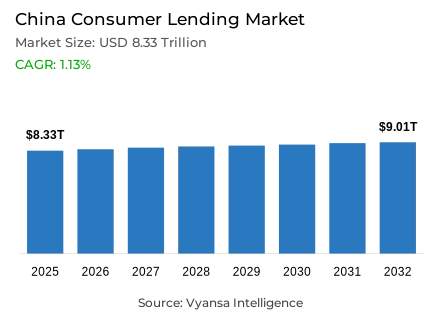

- Consumer lending in China outstanding balance is estimated at USD 8.33 trillion and gross lending is estimated at USD 6.76 trillion in 2025.

- An outstanding balance market size is expected to grow to USD 9.01 trillion and gross lending USD 7.26 trillion by 2032.

- Market to register an outstanding balance cagr of around 1.13% and gross lending cagr of around 1.01% during 2026-32.

- Loan Type Shares

- Mortgages / home loans grabbed market share of 55%.

- Competition

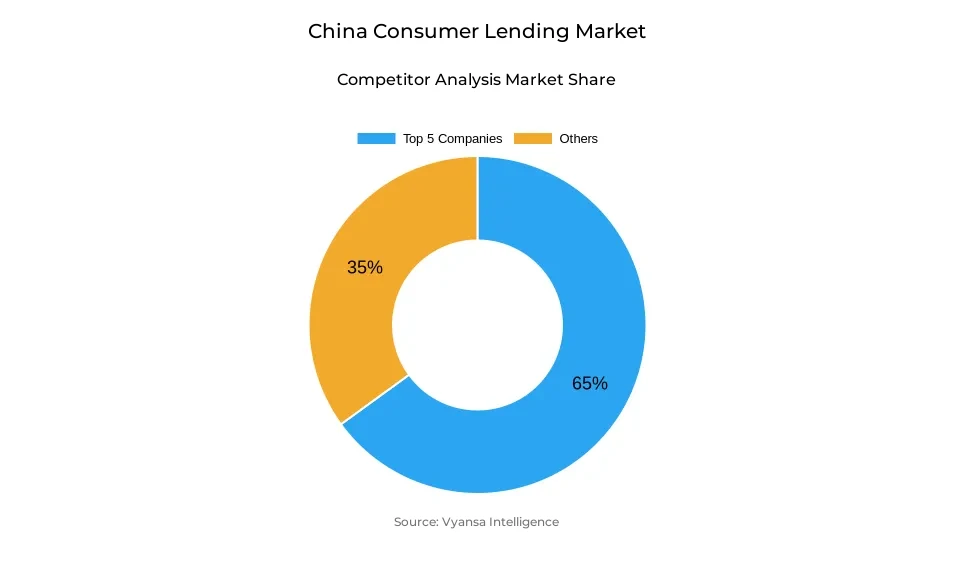

- Consumer lending in China is currently being catered to by more than 15 companies.

- Top 5 companies acquired around 65% of the market share.

- China Merchants Bank Co Ltd; Bank of Communications Co Ltd; China CITIC Bank Corp Ltd; China Construction Bank Corp; Industrial & Commercial Bank of China Ltd etc., are few of the top companies.

- Distribution Channel

- Bank branches grabbed 70% of the market.

China Consumer Lending Market Outlook

The China consumer lending market is set to witness steady but moderate growth through forcast period, with easing interest rates, supportive government measures, and a slow recovery in the main lending categories. In 2025, the outstanding balance is estimated at USD 8.33 trillion, while gross lending stands at USD 6.76 trillion. By 2032, these figures are forecast to reach USD 9.01 trillion and USD 7.26 trillion, registering CAGRs of around 1.12% for the outstanding balance and 1.01% for gross lending. Growth remains modest as economic uncertainty and weak end users confidence continue to influence borrowing behavior.

Mortgages/housing will continue to provide the backbone of the market, retaining 55% share and continuing to grow even as the real estate market slowly bounces back from earlier declines. Following declines in 2023, the category returned to growth in 2024, supported by lower five-year Loan Prime Rate (LPR) rates, gradual improvement in housing sentiment, and efforts by local governments to ease purchase restrictions. Complementing card lending are non-card lending categories-auto lending in particular-which will benefit from growing EV sales and aggressive financing options offered by both local automakers and global brands.

Card lending, however, will continue to shrink as credit card circulation declines, spending reduces, and an increasingly greater shift to alternative digital financial platforms such as Ant Credit Pay occurs. Lower borrowing costs, underpinned by cuts in 2024 Loan Prime Rate (LPR) and retail banks offering personal loan rates below 3%, will promote demand for select categories of loans, particularly home and durable goods loans, which are supported by government-backed trade-in subsidy programs.

Bank branches are very likely to maintain the leading position in sales channels, with a share of 70%, driven by trust, strong networks, and regulatory alignment. All in all, the market outlook indicates slight but stable growth, with China continuing monetary easing, supporting household borrowing, and working to stabilize the broader economic environment.

China Consumer Lending Market Growth DriverFalling Lending Rates Supporting Credit Demand

The China consumer lending environment benefits from deep cuts in rates through 2024, and the People's Bank of China lowers the 1-year loan prime rate (LPR) to 3.1% and the 5-year Loan Prime Rate (LPR) to 3.6% by December 2024. These levels are below what had been indicated in previous reports previously, in February 2024, the 5-year Loan Prime Rate (LPR) was already cut to 3.95%. The easing cycle reduces mortgage and personal loan rates, hence directly supporting the refinancing rate and stimulating demand across household credit segments. This offers a boost to short-term confidence among end users dependent on lower rates in order to gain access to more affordable credit.

However, this support abruptly reverses in 2025. Since April 2025, major retail banks have imposed at least a 3% floor on end users loan rates, ending the availability of sub-3% loan products. Banks cite higher default risks and expanding bad debt pressures across their end users portfolios. As rate easing is withdrawn, the incentive to borrow becomes significantly weaker as refinancing is limited, credit appetite is suppressed, and it becomes very challenging to achieve an expansion in lending.

China Consumer Lending Market ChallengeWeak Real Estate Undermines Household Balance Sheets

The most significant structural challenge weighing on lending to end users persists, concerning the downturn in real estate. The unsold inventory stands at 648 million square meters as of August 2024, according to official NBS data, while broader excess stock-including unfinished and speculative units-reaches 7 to 10 billion, according to former NBS deputy director. Prices continue to decline across key cities like Beijing, Shanghai, and Shenzhen. This erosion of household wealth impairs repayment capacity. Strong property value had been a mainstay for confidence in borrowing and collateral strength.

About 69% of total end users lending is made up of mortgages, which creates high concentration risk as property values stagnate or fall. Moreover, household repayment capacity further deteriorates under higher employment uncertainty related to real estate-linked markets and flat disposable income. This continued pressure contributes to narrower new credit intake, narrower refinancing opportunities, and narrower use of households taking property as collateral. Real estate weaknesses, due to unresolved oversupply and persistent deflation risks, remain the strongest headwind to China's end users lending outlook.

China Consumer Lending Market TrendRapid Growth in EV-Driven Auto Lending

China EV boom becomes the most powerful trend shaping end users lending, actual penetration far exceeding earlier estimates. Total EV sales reached 12.52 million units in 2024, comprising 6.701 million BEVs and 5.821 million PHEVs, which corresponds to 49% of total vehicle sales standing at 25.58 million units. In October 2025, EV penetration increases to 51.4%, for the first time ever electric vehicles take more than half of all new vehicle sales. This fast tempo of adoption puts auto lending in the spotlight of end users credit growth.

Aggressive manufacturer incentives continue to drive financing momentum. Tesla introduces zero-interest loans, while BYD, NIO, and others offer 0% down-payment and sub-3% financing-converting younger and urban buyers at scale. China reinforces global dominance with production of 12 million of the world's 17 million EVs in 2024. As EV financing now represents nearly half of vehicle loans, auto lending accelerates faster than mortgages and personal loans and becomes the leading growth engine in China's end-users credit market.

China Consumer Lending Market OpportunityGovernment-Backed Trade-In Subsidies Boosting Home & Durable Lending

Government trade-in incentives will provide significant impetus for lending expansion as China reinforces the national consumption upgrade program. In 2024, sales revenue harnessed under the scheme topped 1 trillion yuan, confirming strong household adoption across appliances, furniture, NEVs, and home durables. The programme stimulates demand for short- and medium-tenor credit linked to home renovation, appliance upgrades, and durable goods financing, creating strong activity across non-mortgage end users lending categories.

The opportunity will also expand rapidly in the next few years, as the central government doubles programme funding in 2025 by issuing 300 billion yuan in special bonds. Of this, 162 billion yuan is divided in the first half of 2025, while 138 billion yuan has been granted for the second half. This policy support will expedite the financing of home improvement, appliance replacement, and durable goods purchases through 2025–2026. Other segments have limited growth due to real estate weakness and rate reversals, so trade-in driven lending will emerge as one of the fastest-growing non-card credit categories in China.

China Consumer Lending Market Segmentation Analysis

By Loan Type

- Personal Loans

- Unsecured Personal Loans

- Secured Personal Loans

- Auto Loans

- Mortgages / Home Loans

- Credit Card Loans

- Student Loans

The segment with highest market share under loan type is Mortgages/Home Loans, accounting around 55% of the China end users lending market. This strong dominance depicts the big role of housing finance in household borrowing, supported by relatively lower loan prime rates and other government measures aimed at stabilizing the real estate market. With the five-year Loan Prime Rate (LPR) recently reduced to 3.85%, borrowing for home purchases has become more affordable, encouraging end userss to reconsider long-term housing commitments.

Going forward, mortgages will continue to make up the highest share of outstanding balances, especially with the easing of local government's rules on down payments, and also with the introduction of incentives for first and second-time home buyers. Despite the continued stress in the property market, the gradual policy easing coupled with improved affordability should keep mortgage lending at the center of China end-users lending structure.

By Distribution Channel

- Bank Branches

- Online / Digital Lending Platforms

- Non-Banking Financial Institutions (NBFCs)

The segment with highest market share under sales channels Channel is Bank Branches, with around 70% os the share. Large ticket loans like mortgages and auto loans are still favored by end users to be dealt with through physical touch banking channels, wherein face-to-face consultation, verification of documents, and credit assessment remain paramount. Conventional banks also continue to have a strong end users trust and a long-standing relationship, especially for secured lending.

It is expected that bank branches will remain strong during forcast period, with regulatory requirements for large loans continuing to be favourable for in-person processing. While digital finance is on the rise, branch-based lending continues to be key regarding complex products that involve detailed assessment and review of risk. The PBOC's supportive policies regarding a probable cut in the RRR and Loan Prime Rate (LPR) have been and will continue to prop loan activity through formal banking channels during the forecast period.

List of Companies Covered in China Consumer Lending Market

The companies associated with the China consumer lending market are outlined below.

- China Merchants Bank Co Ltd

- Bank of Communications Co Ltd

- China CITIC Bank Corp Ltd

- China Construction Bank Corp

- Industrial & Commercial Bank of China Ltd

- Bank of China Ltd

- Postal Savings Bank of China

- Agricultural Bank of China Ltd

- Ping An Bank Co Ltd

- Shanghai Pudong Development Bank Co Ltd

Competitive Landscape

Competitive Landscape Shifting demand patterns, monetary easing, and increasing competition among financial institutions remain powerful drivers in China's end users lending landscape in 2024. Retail banks remain key players, responding to the July 2024 rate cuts by the PBOC with the introduction of an increasingly competitive personal loan products that offer annualized rates below 3% to reach consumers in a generally more depressed economy. Mortgage/housing continues to be the most dominant share of household debt portfolios today, a growth which returns in 2024 after its downturn the previous year, whereas auto lenders including banks and electric vehicle makers like Tesla and NIO position stronger through aggressive financing incentives to drive electric vehicle purchases. Meanwhile, the share of traditional credit card lenders could shrink as declining card circulation and higher appetite for alternative digital financing platforms--such as Ant Credit Pay--undermine their share. As the regulatory easing proceeds along with the loosening by local governments of home-buying rules, competition will continue to shift toward low-cost lending, digital credit solutions, and targeted financing linked with housing, EVs, and appliance trade-in programs.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. China Consumer Lending Market Policies, Regulations, and Standards

4. China Consumer Lending Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. China Consumer Lending Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Outstanding Balance- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Gross Lending- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Loan Type

5.2.2.1. Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Unsecured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Secured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Auto Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Mortgages / Home Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Credit Card Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Student Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Interest Rate Type

5.2.3.1. Fixed Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Floating / Variable Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Payment Method

5.2.4.1. Direct Deposit- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1. Salary Transfers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2. Government Benefits- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.3. Tax Refunds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Debit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Credit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Mobile Wallet / UPI- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Cheque- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Borrower Type

5.2.5.1. Individual Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Joint Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Distribution Channel

5.2.6.1. Bank Branches- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Online / Digital Lending Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Non-Banking Financial Institutions (NBFCs)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Collateral Type

5.2.7.1. Secured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Vehicle Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Property Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Unsecured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Age Group

5.2.8.1. Youth (up to 24 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Young Adults (25-34 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Adults (35-54 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.4. Pre-Retirement (55-64 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.5. Seniors (65+ years)- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. China Outstanding Balance Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7. China Gross Lending Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Industrial & Commercial Bank of China (ICBC)

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.China Construction Bank

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Bank of China

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Agricultural Bank of China

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.China Merchants Bank

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Postal Savings Bank of China

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Ping An Bank

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Shanghai Pudong Development Bank

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Ant Credit Pay (Ant Group)

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. China CITIC Bank

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Loan Type |

|

| By Interest Rate Type |

|

| By Payment Method |

|

| By Borrower Type |

|

| By Distribution Channel |

|

| By Collateral Type |

|

| By Age Group |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.