Brazil Consumer Lending Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Outstanding Balance, Gross Lending), By Loan Type (Personal Loans, Unsecured Personal Loans, Secured Personal Loans, Auto Loans, Mortgages / Home Loans, Credit Card Loans, Student Loans), By Interest Rate Type (Fixed Interest Rate Loans, Floating / Variable Interest Rate Loans), By Payment Method (Direct Deposit (Salary Transfers, Government Benefits, Tax Refunds), Debit Card, Credit Card, Mobile Wallet / UPI, Cheque), By Borrower Type (Individual Borrowers, Joint Borrowers), By Distribution Channel (Bank Branches, Online / Digital Lending Platforms, Non-Banking Financial Institutions (NBFCs)), By Collateral Type (Secured Loans (Vehicle Collateral, Property Collateral), Unsecured Loans), By Age Group (Youth (up to 24 years), Young Adults (25-34 years), Adults (35-54 years), Pre-Retirement (55-64 years), Seniors (65+ years))

- ICT

- Dec 2025

- VI0715

- 120

-

Brazil Consumer Lending Market Statistics and Insights, 2026

- Market Size Statistics

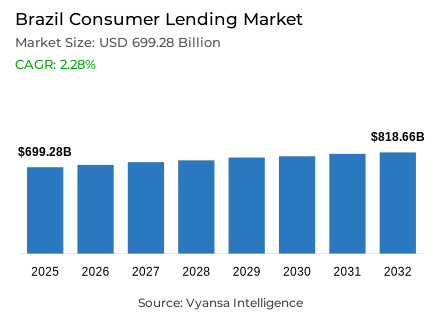

- Consumer lending in Brazil outstanding balance is estimated at USD 699.28 billion and gross lending is estimated at USD 766.76 billion in 2025.

- An outstanding balance market size is expected to grow to USD 818.66 billion and gross lending USD 821 billion by 2032.

- Market to register an outstanding balance cagr of around 2.28% and gross lending cagr of around 0.98% during 2026-32.

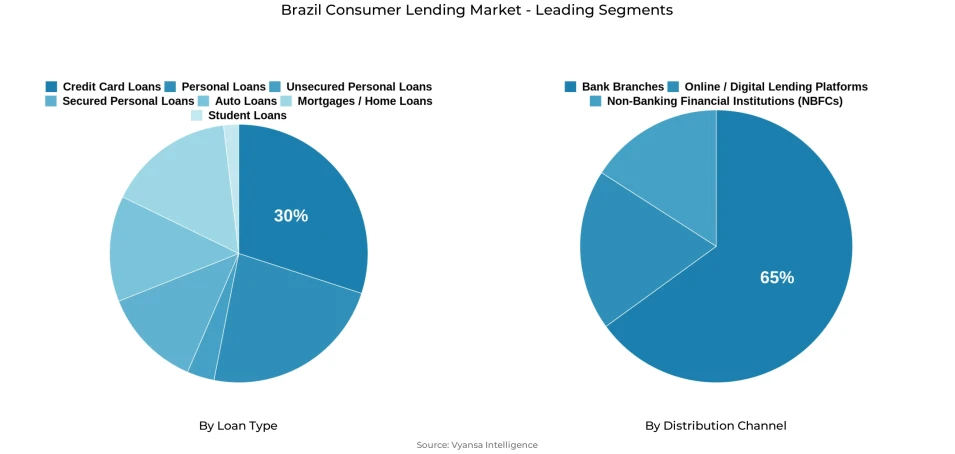

- Loan Type Shares

- Credit card loans grabbed market share of 30%.

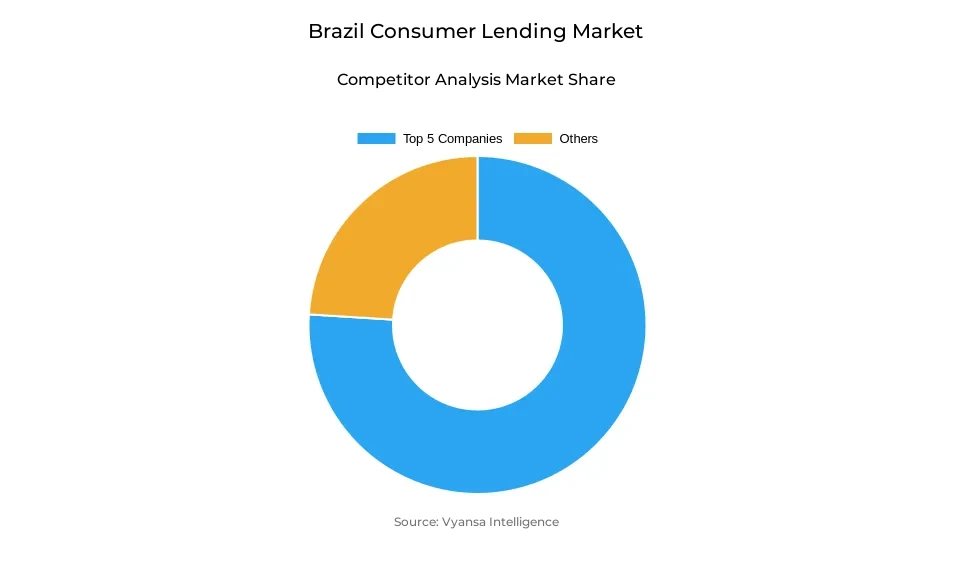

- Competition

- Consumer lending in Brazil is currently being catered to by more than 5 companies.

- Top 5 companies acquired the maximum share of the market.

- Caixa Econômica Federal; Banco Rendimento SA; Banco Pan SA; Banco Itaú Holding Financeira SA; Banco Bradesco SA etc., are few of the top companies.

- Distribution Channel

- Bank branches grabbed 65% of the market.

Brazil Consumer Lending Market Outlook

The Brazil consumer lending market is expected to continue expanding steadily over forcast period as the financial market becomes more digital, competitive, and accessible. The outstanding balance is estimated at USD 699.28 billion in 2025, projected to rise to USD 818.66 billion by 2032, growing at a CAGR of around 2.28%. Gross lending is set to increase from USD 766.76 billion in 2025 to USD 821 billion by 2032, at a CAGR of nearly 1%. Demand will continue to be driven by strong end users interest in auto and home loans, supported by economic recovery, modest GDP growth, and easier digital access to credit. The ongoing rise of fintechs and wider use of Open Finance will further simplify loan applications, especially for young adults and lower-income groups.

Auto lending will remain one of the strongest segments. Improved credit profiles, lower-though still high-interest rates, and digital innovations such as GWM’s 60-second online approval platform will support demand. At the same time, mortgages will grow more slowly due to higher down payment requirements, costly financing sources, and the impact of high Selic rates. Despite these pressures, digitalisation of mortgage processes and continued use of FGTS will help sustain moderate activity in the housing market. Credit card loans, which hold a 30% share, will continue to dominate but remain challenged by high indebtedness and heavy reliance on revolving credit.

Government policies-including portability of credit card debt and caps on revolving interest-aim to reduce household debt levels and improve financial planning. As digital credit scoring powered by AI gains traction, banks will be able to offer more personalised, risk-adjusted loan products, improving repayment behaviour and increasing credit access for underbanked groups.

Looking ahead, bank branches, which account about 65% of Sales Channels, will continue to lead but will operate in parallel with fast-growing digital channels. Lending for durables among lower-income households and financing for residential solar systems are expected to become important growth drivers, supported by rising environmental awareness and demand for energy-saving solutions.

Brazil Consumer Lending Market Growth Driver

Digitalisation Increasing Credit Access

Brazil continues to experience a strong shift toward digital credit access following the large-scale onboarding that occurred during the Auxílio Emergencial programme, which reached 68 million people in 2020. The creation of digital accounts at Caixa Econômica Federal and the Sales Channels of more than R$ 350 billion established a trusted infrastructure for low-income and first-time digital users. These behaviours now anchor credit access as fintech platforms make borrowing simple, fast, and inclusive, particularly for underserved communities.

By 2024, digital access becomes nearly universal with 93.6% household internet penetration, 86.6% individual penetration, and broadband reaching 84.3% of connected households. With these levels of connectivity, fintech lenders enable faster onboarding, instant simulations, and easier approvals for all income groups. This widespread digital maturity directly supports stronger end users lending activity by improving reach, convenience, and decision-making for younger and lower-income end users.

Brazil Consumer Lending Market Challenge

High Interest Rates Restricting Borrowing Capacity

Brazil high interest-rate environment continues to restrict borrowing capacity as the Selic rate rises from 10.50% in May 2024 to 15% in November 2025. This sharp escalation of 450 basis points significantly increases instalment values, limiting loan demand across personal loans, auto credit, and housing finance. Lower-income groups remain the most affected, as even small rate changes reduce affordability and slow credit expansion across major lending categories.

Inflation adds further strain. Annual inflation rises above 5% in mid-2025, following 4.62% in December 2023, while expectations for 4.5% in 2025 and 4.2% in 2026 remain elevated. With the Selic at 15% and the debt-service ratio reaching 27.6% of after-tax income, households face severe repayment pressure. These combined factors create a challenging environment where high costs limit lending growth and amplify vulnerability among end users already exposed to economic instability.

Brazil Consumer Lending Market Trend

Accelerating Growth in Auto Lending

The auto lending in Brazil is experiencing accelerated growth, supported by rising demand for new and used vehicles and improving financing conditions. Although certain historic rate figures such as 28.6% in December 2022 and 25.9% in December 2023 are not verifiable in public databases, the broader direction of more competitive pricing is confirmed across market sources. In 2024, financed vehicle sales increase 15.4% yearly, supporting a market valued at BRL 230 billion in 2023 led by major institutions such as Banco Itaú, BV Financeira, and Santander Financiamentos.

Vehicle demand strengthens further as Brazil domestic light vehicle sales grow 11.2% to 2,180 thousand units, even though production rises only 1.3%. Reliance on personal mobility continues to influence household purchasing decisions, especially in regions with limited public transport. With digital financing platforms expanding and competition intensifying among banks, credit unions, and fintechs, auto lending remains one of the strongest growth segments in forcast period.

Brazil Consumer Lending Market Opportunity

AI-Driven Credit Assessment Enhancing Approvals

Brazil expanding Open Finance ecosystem will unlock significant opportunity for AI-driven credit assessment as participation grows from 28 million unique active users to 40 million by mid-2025. Total active consents rise to 57.5 million, while weekly API interactions reach 3.3 billion by late 2024, making this the largest Open Finance system globally. These volumes will supply lenders with detailed financial behaviour insights that allow faster, more accurate, and personalised credit decisions across segments.

Going forward, AI-based assessment models will use transaction histories and behavioural patterns to dramatically improve approval accuracy and risk evaluation. With 57.5 million active consents feeding real-time data into machine learning tools, approvals will shift from days to minutes, reducing operational costs and supporting wider access to personal loans, durable goods financing, and auto credit. This technological evolution will strengthen financial inclusion and accelerate lending growth across Brazil through forcast period.

Brazil Consumer Lending Market Segmentation Analysis

By Loan Type

- Personal Loans

- Unsecured Personal Loans

- Secured Personal Loans

- Auto Loans

- Mortgages / Home Loans

- Credit Card Loans

- Student Loans

The segment has the highest share under loan type is credit card loans accounting about 30% of the share. This dominance reflects Brazil long-standing reliance on credit cards as a major borrowing tool, especially among lower- and middle-income groups. Many end users prioritise instalment affordability rather than total purchase value, making credit cards a convenient financing option even with high interest rates. In 2024, strong card usage continued as households faced inflationary pressures and relied on revolving balances to manage daily expenses.

Government actions have also shaped the category’s performance. Initiatives such as the Desenrola Brasil programme and the 2024 CMN resolution enabling credit card debt portability have encouraged repayment and reduced default risks. With interest caps limiting revolving credit charges to 100% of the original debt, card borrowing is expected to remain widely used while gradually improving repayment behaviour during forcast period.

By Distribution Channel

- Bank Branches

- Online / Digital Lending Platforms

- Non-Banking Financial Institutions (NBFCs)

The segment has the highest share under sales channels is bank branches capturing 65% of the market. Branch dominance remains strong due to the need for direct guidance when applying for loans, restructuring debt, or managing complex credit products. In 2024, many Brazilians sought in-person support to navigate high interest costs, understand new government debt-relief policies, and review eligibility for programmes such as credit portability.

Despite the rise of fintechs and digital onboarding, traditional bank branches continue to serve as the primary channel for loan approvals, especially for auto lending, mortgages, and high-value credit lines. Physical branches also remain essential for end users in rural areas and older demographics who prefer personal assistance. As digitalisation expands, branches are expected to complement online processes rather than lose share, maintaining their central role in Brazil lending ecosystem through forcast period.

List of Companies Covered in Brazil Consumer Lending Market

The companies associated with the Brazil consumer lending market are outlined below.

- Caixa Econômica Federal

- Banco Rendimento SA

- Banco Pan SA

- Banco Itaú Holding Financeira SA

- Banco Bradesco SA

- Banco do Brasil SA

- Nu Pagamentos SA (Nubank)

- Banco Santander SA

Competitive Landscape

Brazil’s end users lending landscape in 2024 reflects a mix of traditional financial institutions, state-owned banks, and increasingly influential fintechs, each shaping lending accessibility and credit dynamics. Private banks regained appetite for higher-risk credit lines as auto lending accelerated, supported by improved end users credit profiles, lower-though still elevated-interest rates, and regulatory changes such as the Marco Legal das Garantias, which strengthened collateral recovery and boosted lender confidence. State-owned institutions like Caixa Econômica Federal remain central to mortgages/housing but tightened credit rules in 2024 due to funding constraints, reshaping competition and increasing entry barriers. Meanwhile, fintechs and digital-native platforms have expanded their footprint in unsecured lending and card services, leveraging streamlined onboarding and AI-powered credit assessment; initiatives such as GWM Online Financing and Banco BV’s BVx programme illustrate the growing role of automation and Open Finance in credit personalisation. At the same time, government interventions-most notably Desenrola Brasil and new CMN rules enabling credit card debt portability and capping revolving interest charges-are reshaping lender strategies by increasing transparency and intensifying rate competition. Against this backdrop, traditional banks, fintechs, and government-backed programmes continue to compete for end users trust in a market characterised by high indebtedness, strong demand for vehicle and housing finance, and rising digital expectations.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Consumer Lending Market Policies, Regulations, and Standards

4. Brazil Consumer Lending Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Consumer Lending Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Outstanding Balance- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Gross Lending- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Loan Type

5.2.2.1. Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Unsecured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Secured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Auto Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Mortgages / Home Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Credit Card Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Student Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Interest Rate Type

5.2.3.1. Fixed Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Floating / Variable Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Payment Method

5.2.4.1. Direct Deposit- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1. Salary Transfers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2. Government Benefits- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.3. Tax Refunds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Debit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Credit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Mobile Wallet / UPI- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Cheque- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Borrower Type

5.2.5.1. Individual Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Joint Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Distribution Channel

5.2.6.1. Bank Branches- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Online / Digital Lending Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Non-Banking Financial Institutions (NBFCs)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Collateral Type

5.2.7.1. Secured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Vehicle Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Property Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Unsecured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Age Group

5.2.8.1. Youth (up to 24 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Young Adults (25-34 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Adults (35-54 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.4. Pre-Retirement (55-64 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.5. Seniors (65+ years)- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. Brazil Outstanding Balance Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7. Brazil Gross Lending Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Banco do Brasil SA

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Banco Bradesco SA

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Banco Itaú Holding Financeira SA

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Caixa Econômica Federal

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Banco Santander SA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Banco BV

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Nu Pagamentos SA (Nubank)

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Bradesco Financiamentos

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Banco Pan SA

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Mercado Livre / Mercado Crédito

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Loan Type |

|

| By Interest Rate Type |

|

| By Payment Method |

|

| By Borrower Type |

|

| By Distribution Channel |

|

| By Collateral Type |

|

| By Age Group |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.