Global Manganese Sulfate Market Report: Trends, Growth and Forecast (2026-2032)

By Purity Grade (Battery Grade, Industrial Grade), By Application (Fertilizers, Animal Feed, Battery Materials), By Region (North America, Latin America, Europe, Middle East & Africa, Asia Pacific)

|

Major Players

|

Global Manganese Sulfate Market Statistics and Insights, 2026

- Market Size Statistics

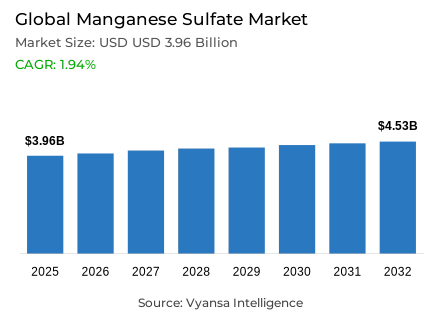

- Global manganese sulfate market is estimated at USD 3.96 billion in 2025.

- The market size is expected to grow to USD 4.53 billion by 2032.

- Market to register a CAGR of around 1.94% during 2026-32.

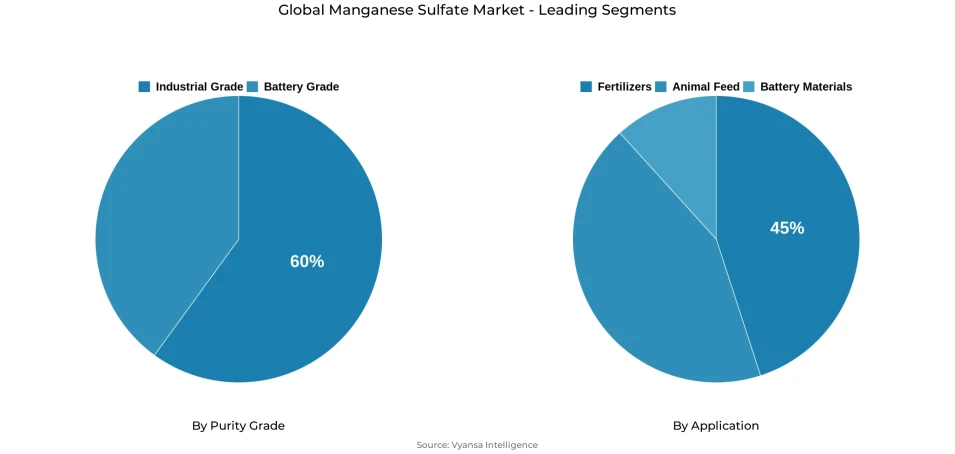

- Purity Grade Shares

- Industrial grade grabbed market share of 60%.

- Competition

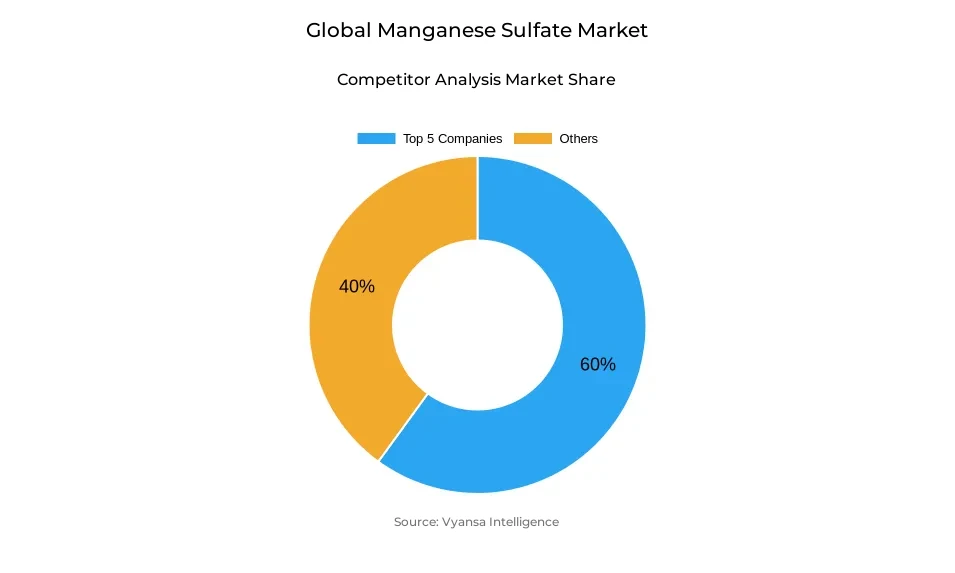

- Global manganese sulfate market is currently being catered to by more than 30 companies.

- Top 5 companies acquired around 60% of the market share.

- Compania Minera Autlan; American Manganese; Element 25; Eramet; South32 etc., are few of the top companies.

- Application

- Fertilizers grabbed 45% of the market.

- Region

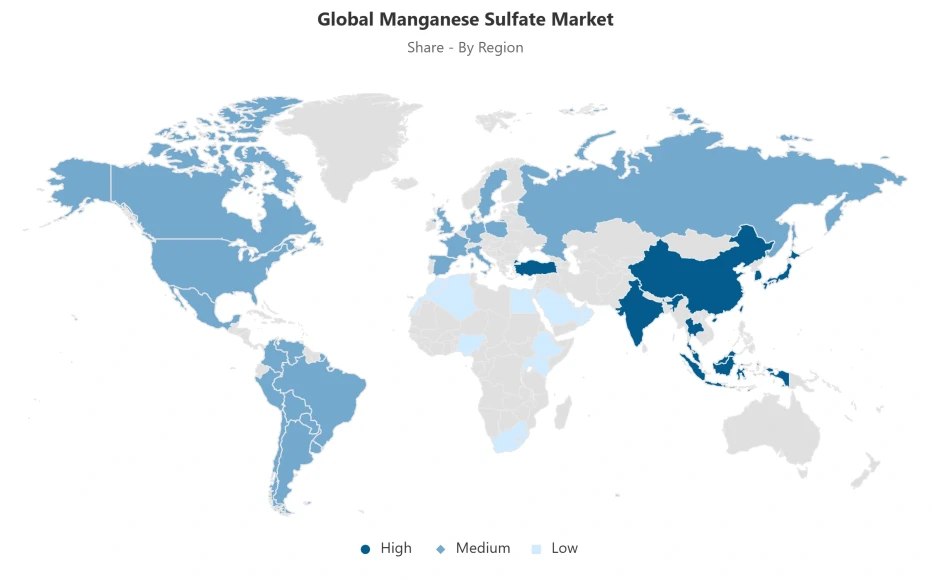

- Asia Pacific leads with a 60% share of the global market.

Global Manganese Sulfate Market Outlook

The Global magnesium sulfate market is expected to grow consistently in the period between 2026-2032 due to its non-replaceable role in steelmaking, agriculture, and the new battery uses. The market is estimated to be USD 3.96 billion in 2025 and USD 4.53 billion in 2032 with a moderate CAGR of approximately 1.94% over the forecast period. The baseline demand is well pegged on the global steel production that stood at 1,882.6 million tonnes in 2024. Manganese remains vital in enhancing the hardness of steel, deoxidation performance, and structural integrity, which maintain uniform upstream usage of manganese-sulfate in metallurgical value chains.

The most consistent demand pillar is agriculture, where fertilizers constitute about 45% of the total market consumption. The ongoing micronutrient deficiencies in key cereal-producing areas still justify the continued use of manganese-sulfate because manganese is essential in photosynthesis and enzymatic functions. The field-level adoption is robust because it is cost effective and yields can be measured, which offers resilience to fluctuations in industrial cycles. This repetitive agricultural need supports long-term stability of the market in terms of volume.

Purity-based segmentation is dominated by industrial-grade manganese-sulfate, which controls almost 60% of the market. Its popularity in the fertilizer production, animal feed, and intermediate chemical processing industries indicates adequate functional performance at reduced cost, which supports the preference of large-volume end users. The more pure grades are confined to niche uses, and industrial-grade specifications are likely to continue leading through 2032.

Asia-Pacific dominates the world market with approximately 60% share, which is backed by the strong steel production, integrated processing capacity, and growing battery production infrastructure. China and India are also major demand hubs, and the closeness to world manganese-ore deposits and well-established trade routes enhances the efficiency of regional supply-chain. This level is likely to maintain the leadership of Asia Pacific over the forecast period.

Global Manganese Sulfate Market Growth Driver

Steel Industry Fundamentals Sustaining Baseline Demand

Manganese is an essential metallurgical feedstock in the world steel production, thus maintaining the basic need of the Global magnesium sulfate market. The major downstream use is steel production, where manganese is necessary to increase hardness, deoxidation efficiency, and overall structural integrity of final steel products. In 2024, the world crude steel production was 1,882.6 million tonnes, highlighting the scale of manganese use that is a part of daily metallurgical processes. The strength of manufacturing in Asia remains decisive, aided by the long-term infrastructure development, automotive manufacturing, and urban construction processes that structurally support steel production throughout economic cycles.

In 2024, global crude steel production was 1,882.6 million tonnes, with Asia-Oceania leading and China at 76.0 million tonnes. This long-term production anchors the demand of manganese-sulfate via upstream alloying and processing chains. The 20,000 thousand metric tons of manganese ore production in 2023 also creates the continuity of supply to steel-related end-users, which strengthens the stability of demand in the manganese-sulfate value chain.

Global Manganese Sulfate Market Challenge

Structural Supply Concentration and Geographic Exposure

The supply chains of manganese-sulfate are very geographically concentrated, thus subjecting the market to systemic regional disruptions. The supply of processed manganese and ore is also closely linked to few producing countries, which limits diversification efforts in the global markets. The United States is a classic example of this weakness by relying solely on imports, as it stopped mining manganese domestically in 1970. In 2023, the United States imported about 500,000 metric tonnes of manganese ore and 300,000 metric tonnes of ferromanganese, thus highlighting its reliance on external sources to supply its industrial and agricultural needs.

The concentration of sourcing of manganese-ore increases the risk, with Gabon providing 62% of U.S. imports, South Africa 24% and Mexico 13% in the 2019-2022 period. South Africa is the sole country that holds an estimated 70% of the world manganese-ore reserves, which concentrates the supply power in one geography. The lack of resilience is limited by limited reserve mobility, long mine development cycles, and the lack of viable metallurgical alternatives, which exposes manganese-sulfate markets to operational shocks, trade barriers, and geopolitical volatility.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Manganese Sulfate Market Trend

Micronutrient Deficiency Correction in Global Agriculture

The consistent micronutrient shortages in agricultural soils support the consistent use of manganese-sulfate in fertilizer systems. Nutrient imbalances in large areas of the world cereal-producing lands directly restrict crop production and food-security performance. The International Fertilizer Association categorizes manganese as a vital micronutrient together with zinc, where a lack of it affects photosynthesis, enzymatic functions, and the general health of the plant. Zinc deficiency is present in about 50% of world cereal soils, and this implies that structural requirements of manganese supplementation are parallel in intensive farming systems.

The economic impact of micronutrient deficiencies is quantifiable, as zinc deficiency impacts 17.3% of the world population and costs the global economy USD 12 billion/year in India alone, as estimated by World Bank. The deficiencies of soil are acute in India, China, Indonesia, Turkey, sub-Saharan Africa, and South America. The application of manganese-sulfate on a field scale has shown a consistent increase in yield, encouraging agricultural end users to consider the use of micronutrient inputs as a cost-effective productivity enhancer in the face of increasing global food demand.

Global Manganese Sulfate Market Opportunity

Energy Transition Infrastructure Expanding Industrial Consumption

The growth of battery energy storage systems and electric-mobility infrastructure creates incremental industrial demand of manganese-sulfate. The production of batteries has become a strategic industrial focus as the economies hasten the integration of renewable energy and grid-stabilization investments. Lithium-ion battery chemistries, particularly nickel-manganese-cobalt formulations, rely on high-purity manganese sulfate for cathode production, positioning manganese as a critical feedstock within energy storage value chains.

Capacity growth has been hastened by policy-based capacity growth. In 2024, the United States battery-manufacturing capacity was over 200 gigawatts, which is twice as much as it was in 2022 after specific industrial incentives. The same trends are being witnessed in Europe and Asia with governments localizing battery supply chains. This structural expansion underpins increased demand of battery-grade manganese-sulfate and expands the end-user base beyond the conventional metallurgical and agricultural markets. The overlap of grid-storage implementation and electric-vehicle manufacturing creates a long-lasting, sustainable consumption layer that is complementary to the existing steel and fertilizer demand curves.

Global Manganese Sulfate Market Regional Analysis

By Region

- North America

- Latin America

- Europe

- Middle East & Africa

- Asia Pacific

Asia Pacific maintains dominant positioning with 60% share across manganese ore mining, processing, and downstream sulfate production, supported by unmatched steel manufacturing capacity. China produced 76.0 million tonnes of crude steel in 2024 with 11.8% year over year growth, while India reached 13.6 million tonnes, expanding at 9.5%. Asia Oceania’s December 2024 crude steel output of 106.3 million tonnes further underscores regional demand intensity for manganese inputs.

The region’s leadership is reinforced by proximity to primary ore reserves, particularly South Africa, which holds approximately 70% of global manganese resources and maintains established trade corridors with Asian processors. Integrated supply chains, competitive production costs, and expanding battery manufacturing infrastructure strengthen Asia Pacific’s role as both the leading producer and consumer region. Ongoing urbanization, infrastructure development, and energy transition investments are expected to sustain regional dominance across metallurgical, agricultural, and battery grade manganese sulfate demand.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Manganese Sulfate Market Segmentation Analysis

By Purity Grade

- Battery Grade

- Industrial Grade

Industrial grade manganese sulfate dominates purity based segmentation, accounting for approximately 60% of total market volume. This grade typically contains 32% to 32.5% manganese content, aligning with technical requirements across fertilizer manufacturing, animal feed supplementation, ceramics, and intermediate chemical processing. For most agricultural and industrial end users, incremental purity improvements do not materially enhance functional performance, reinforcing preference for cost optimized industrial grade formulations.

Agricultural end users consistently favor industrial grade material due to agronomic equivalence with higher purity alternatives, combined with lower procurement costs and broad regulatory acceptance. Industrial grade manganese sulfate complies with established contamination thresholds for agricultural applications, enabling standardized procurement across global fertilizer markets. The breadth of compatible applications, combined with price sensitivity across large volume users, reinforces the structural dominance of this grade. As fertilizer consumption expands in developing regions, industrial grade specifications are expected to retain their leading position within the Global magnesium sulfate market.

By Application

- Fertilizers

- Animal Feed

- Battery Materials

Fertilizer applications represent the largest end use segment, capturing approximately 45% of global manganese sulfate demand. Manganese plays a central biochemical role in photosynthesis, nitrogen metabolism, and enzyme activation, making it indispensable for crop productivity and grain quality. Deficiencies directly reduce yields and reproductive efficiency, prompting widespread adoption of manganese sulfate across cereal crops such as wheat, rice, and corn, alongside soybeans and specialty produce.

Agricultural demand exhibits annual recurrence independent of industrial investment cycles, providing structural stability to the market. Expanding population pressures continue to elevate the importance of yield optimization, particularly in regions with nutrient depleted soils. For farming end users, manganese sulfate offers a capital efficient intervention with measurable productivity returns. The coexistence of agricultural and metallurgical demand diversifies consumption sources, reducing exposure to sector specific volatility and reinforcing manganese sulfate’s role as a foundational input across food security and industrial production systems.

Market Players in Global Manganese Sulfate Market

These market players maintain a significant presence in the Global manganese sulfate market sector and contribute to its ongoing evolution.

- Compania Minera Autlan

- American Manganese

- Element 25

- Eramet

- South32

- OM Holdings

- Transamine Trading

- Gulf Manganese

- Mesa Minerals

- Tshipi é Ntle

- African Rainbow Minerals

- Assmang

- Kudumane Manganese Resources

- Consolidated Minerals

- Jupiter Mines

Market News & Updates

- Element 25, 2025:

Element 25's Louisiana HPMSM facility targets 135,000 tonnes annual capacity for battery-grade manganese sulfate monohydrate. The project secured $166 million DOE grant (September 2024) and locked in 57% of output through offtake agreements: General Motors (32,500 t/y through 2030) and Stellantis (45,000 t across 2026-2030). Permits secured (May 2024); facility under construction with Veolia site development agreement providing 20-year sulfuric acid supply pipeline.

- South32, 2025:

South32's 3.257 million tonnes FY2025 manganese production provides reliable feedstock for global manganese sulfate converters and EV battery material processors. Dual operations (Australia GEMCO + South Africa Mamatwan) ensure geographic supply security. Sustained pricing of $3.68-$3.71/dmtu FOB supports competitive downstream converter economics. FY2026 guidance: 5.2 million tonnes.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Manganese Sulfate Market Policies, Regulations, and Standards

4. Global Manganese Sulfate Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Manganese Sulfate Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Purity Grade

5.2.1.1. Battery Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Industrial Grade- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Fertilizers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Animal Feed- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Battery Materials- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Region

5.2.3.1. North America

5.2.3.2. Latin America

5.2.3.3. Europe

5.2.3.4. Middle East & Africa

5.2.3.5. Asia Pacific

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. North America Manganese Sulfate Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Country

6.2.3.1. US

6.2.3.2. Canada

6.2.3.3. Mexico

6.2.3.4. Rest of North America

6.3. US Manganese Sulfate Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Manganese Sulfate Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Manganese Sulfate Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7. Latin America Manganese Sulfate Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Country

7.2.3.1. Brazil

7.2.3.2. Rest of Latin America

7.3. Brazil Manganese Sulfate Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Manganese Sulfate Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Country

8.2.3.1. Germany

8.2.3.2. France

8.2.3.3. UK

8.2.3.4. Italy

8.2.3.5. Spain

8.2.3.6. Netherlands

8.2.3.7. Belgium

8.2.3.8. Russia

8.2.3.9. Poland

8.2.3.10. Turkey

8.2.3.11. Rest of Europe

8.3. Germany Manganese Sulfate Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. France Manganese Sulfate Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Manganese Sulfate Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Manganese Sulfate Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Manganese Sulfate Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Netherlands Manganese Sulfate Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Belgium Manganese Sulfate Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in USD Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10. Russia Manganese Sulfate Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in USD Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.11. Poland Manganese Sulfate Market Statistics, 2022-2032F

8.11.1. Market Size & Growth Outlook

8.11.1.1. By Revenues in USD Million

8.11.2. Market Segmentation & Growth Outlook

8.11.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.12. Turkey Manganese Sulfate Market Statistics, 2022-2032F

8.12.1. Market Size & Growth Outlook

8.12.1.1. By Revenues in USD Million

8.12.2. Market Segmentation & Growth Outlook

8.12.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

8.12.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Manganese Sulfate Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Country

9.2.3.1. UAE

9.2.3.2. Saudi Arabia

9.2.3.3. Rest of Middle East & Africa

9.3. UAE Manganese Sulfate Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. Saudi Arabia Manganese Sulfate Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Manganese Sulfate Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Country

10.2.3.1. China

10.2.3.2. India

10.2.3.3. Japan

10.2.3.4. South Korea

10.2.3.5. Australia

10.2.3.6. Thailand

10.2.3.7. Rest of Asia Pacific

10.3. China Manganese Sulfate Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.4. India Manganese Sulfate Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.5. Japan Manganese Sulfate Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.6. South Korea Manganese Sulfate Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.7. Australia Manganese Sulfate Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.8. Thailand Manganese Sulfate Market Statistics, 2022-2032F

10.8.1. Market Size & Growth Outlook

10.8.1.1. By Revenues in USD Million

10.8.2. Market Segmentation & Growth Outlook

10.8.2.1. By Purity Grade- Market Insights and Forecast 2022-2032, USD Million

10.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Eramet

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. South32

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. OM Holdings

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Transamine Trading

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Gulf Manganese

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Compania Minera Autlan

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. American Manganese

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Element 25

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Mesa Minerals

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Tshipi é Ntle

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. African Rainbow Minerals

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. Assmang

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. Kudumane Manganese Resources

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. Consolidated Minerals

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. Jupiter Mines

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Purity Grade |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.