Global Lithium Hexafluorophosphate (LiPF₆) Market Report: Trends, Growth and Forecast (2026-2032)

By Type (Battery-grade (≥ 99.9%), Electronic-grade (≥ 99.99%), Industrial-grade (< 99.9%)), By Form (Crystal Variant, Liquid Variant), By Application (EV Batteries, Renewable Energy Storage, Consumer Electronics), By Region (North America, Latin America, Europe, Asia Pacific, Middle East & Africa)

|

Major Players

|

Global Lithium Hexafluorophosphate (LiPF₆) Market Statistics and Insights, 2026

- Market Size Statistics

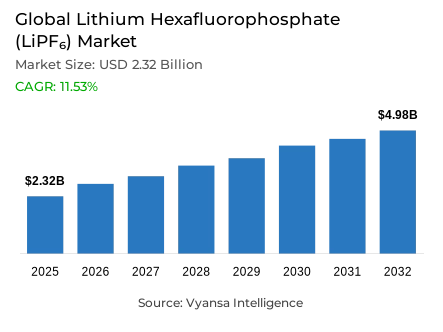

- Global lithium hexafluorophosphate (lipf₆) market is estimated at USD 2.32 billion in 2025.

- The market size is expected to grow to USD 4.98 billion by 2032.

- Market to register a CAGR of around 11.53% during 2026-32.

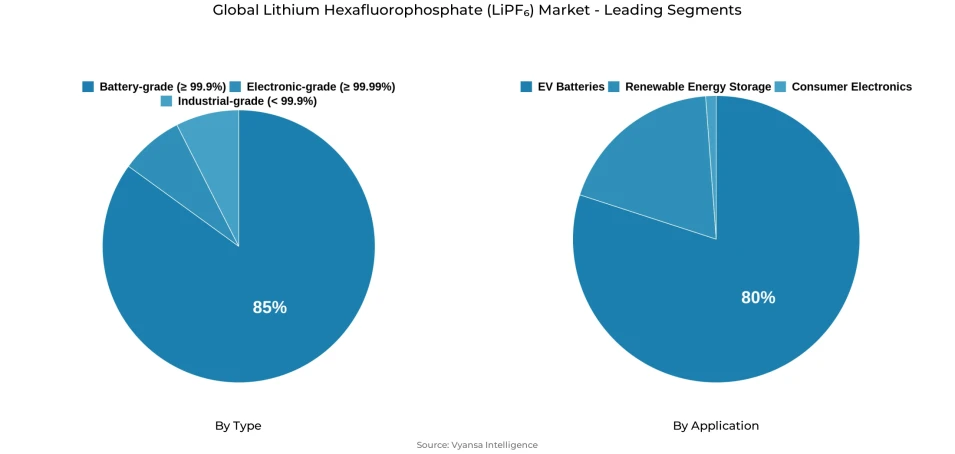

- Type Shares

- Battery-grade (≥ 99.9%) grabbed market share of 85%.

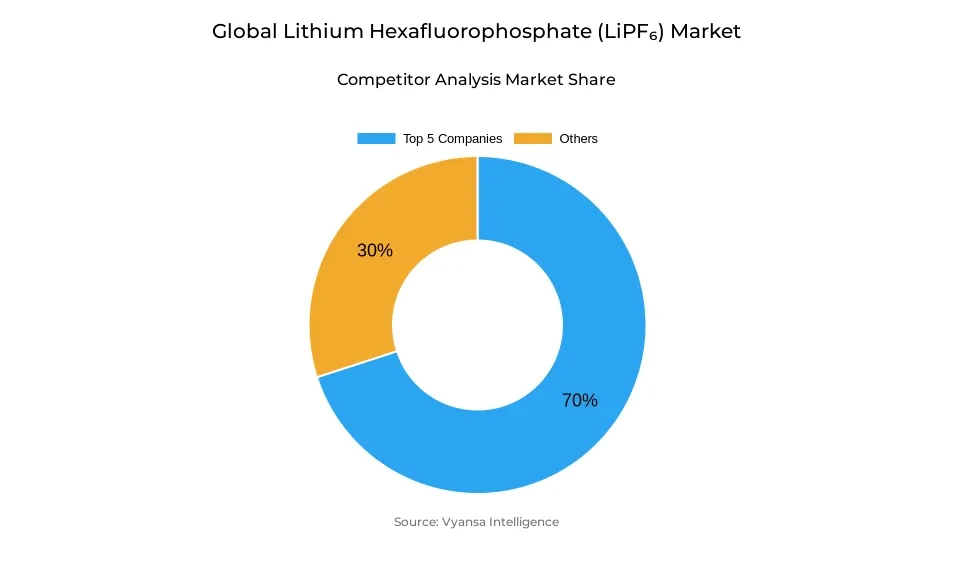

- Competition

- More than 30 companies are actively engaged in producing lithium hexafluorophosphate (lipf₆).

- Top 5 companies acquired around 70% of the market share.

- Do-Fluoride Chemicals; Tonze Group; Hexa Fluor Chem; Morita Chemical; Stella Chemifa etc., are few of the top companies.

- Application

- Ev batteries grabbed 80% of the market.

- Region

- Asia Pacific leads with a 75% share of the global market.

Global Lithium Hexafluorophosphate (LiPF₆) Market Outlook

The global LiPF6 market (also known as lithium hexafluorophosphate) was worth $2.32 billion in 2025 and is expected to reach $4.98 billion by 2032, with a projected CAGR of approximately 11.53% from 2026 to 2032. A significant factor driving this growth is the rapid transition to electric mobility worldwide. In 2024, it is estimated that sales of EVs exceeded 17 million units (or about 20% of worldwide passenger car sales), and this number is expected to increase to over 40% of the global passenger car sales by 2030. With approximately 90% of lithium supplies being used for electric vehicles and with battery capacities per vehicle expected to increase from 40 kWh to more than 60 kWh, the continued demand for LiPF6 based on anticipated lithium usage is expected to continue to grow.

This battery-grade product is manufactured to a minimum purity of 99.9%, and as such, represents about 85% of the LiPF6 sales in the marketplace. Because of very strict manufacturing quality standards for lithium-ion batteries, only this battery-grade materials can be used to manufacture lithium-ion batteries. Higher purity levels associated with battery-grade LiPF6 lead to improved performance, extended life cycles, and enhanced safety of lithium-ion batteries manufactured from it. About 15% of LiPF6 sales are composed of industrial-grade materials, with little or no consumption for any of the niche, non-battery applications. The continuing trend of manufacturers to produce advanced, high-performance batteries to support automotive and energy storage contributes to the continuing dominance of battery-grade materials in the marketplace.

LiPF6 is primarily consumed in the manufacturing of batteries for electric vehicles and is estimated to make up about 80% of the global LiPF6 consumption. The upcoming development of energy storage systems on a grid-scale basis, which will likely exceed 500 GWh globally by 2034, will create an even greater demand for LiPF6 in the coming years. These two markets will result in an exceptionally stable, strong LiPF6 market during the forecasted period.

Geographic location: Asia-Pacific accounts for 75% of the total global LiPF6 market, with factories in China, South Korea, and Japan providing a large volume of LiPF6, amounting to more than 60,000 tons per year of manufactured product in China. While North America and Europe are in the process of developing their domestic sources, it is likely that the Asia-Pacific region will still be able to maintain its position as the dominant producer of LiPF6 through 2032 due to its long-established manufacturing facilities, lower production costs, and high levels of supply chain integration.

Global Lithium Hexafluorophosphate (LiPF₆) Market Growth Driver

Expanding Electric Mobility Driving Electrolyte Demand

The ongoing shift to electric transportation globally is leading to substantial increases in the demand for Lithium Hexafluorophosphate (LiPF₆), a key electrolyte salt for lithium-ion batteries. According to the IEA, electric vehicles accounted for more than 20% of the global passenger cars sold in 2024 and their volume of sales exceeded 17 million units. The IEA expects the share of car sales that are electric vehicles to exceed 40% in 2030. Currently, nearly 90% of lithium demand comes from electric vehicles, and therefore as battery packs increase in size from 40 KWh up over 60 KWh there will be a continued increase in the demand for LiPF₆. The increase in the number of EVs being adopted and their larger energy storage potential will create an ongoing and strong demand across the major global manufacturing economies of Asia, Europe, and the emerging markets.

The growth of grid scale energy storage will further support demand for LiPF₆. According to the IEA, the total installed capacity of stationary energy storage systems globally reached 57 GWh in 2024, and is projected to reach more than 500 GWh by 2034. In order to achieve these targets these systems will require electrolytes that are long cycle life, highly thermally stable and compatible with repeated charge / discharge cycles. The combined effect of the growth of electric vehicles, continued growth of stationary energy storage systems, and improvements in battery chemistry will provide strong indications of demand from 2026 through 2032.

Global Lithium Hexafluorophosphate (LiPF₆) Market Challenge

Geographic Concentration Creating Supply Vulnerabilities

Over 70% of global LiPF₆ production capacity is concentrated in the Asia Pacific region, predominately China. The majority of LiPF₆ production facilities are located in Jiangsu and Hunan provinces of China, with minimal production additions occurring in South Korea and Japan.The disparity in global supplies of LiPF6 and local users' attempts to become self-sufficient with respect to automated production remains an obstacle for North America and Europe. The impact of fluctuating raw material prices and the difficulty associated with establishing new LiPF6 production facilities outside of Asia further limit diversification activities globally.

To produce LiPF6 requires extensive technical knowledge, precise control of moisture levels, and compliance with specific quality specifications since very small quantities of moisture introduced into a LiPF6 production process can create an environment conducive to the generation of CaF2 (calcium fluoride), which can form corrosive hydrofluoric acid and decrease battery safety. Due to the intricacies associated with the conditions required to produce LiPF6, combined with the concentration of manufacturers at one location, there are geographical limitations on the ability to manufacture LiPF6 that potentially could limit market growth if regional diversification and establishment of new plants do not occur prior to 2032.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Lithium Hexafluorophosphate (LiPF₆) Market Trend

Technological Evolution Shaping Future Demand Patterns

The transition to new technologies and materials, mainly using solid-state and newer generations of batteries, is impacting how and where LiPF₆ is expected to be in demand. Today, the majority of the world's market for LiPF₆ is associated with the liquid electrolyte application of LiPF₆, with some companies starting to explore using solid-state electrolytes. As solid-state battery technology continues to evolve into a commercially available product between 2027 and 2030, we can expect rapid growth for solid-state battery chemistries over the next several years. There are a few large companies like Toyota, QuantumScape, and Samsung that are investing heavily into this type of technology due to its benefits, including increased safety and enhanced compatibility with lithium-metal anodes. However, given the well-established manufacturing infrastructure surrounding liquid LiPF₆ electrolytes and the demonstrated reliability of performance, we anticipate that liquid LiPF₆ electrolytes will continue to dominate the industry up until approximately 2032.

In addition to the rapid growth in solid-state battery technology in areas such as Europe, there is an increasing demand for lithium iron phosphate (LFP) batteries in China (which contain significantly lower quantities of cobalt and nickel while offering a similar level of lithium intensity) that also continues to support the use of LiPF₆ as a battery electrolyte. Thus, despite an increased diversity of battery chemistries being developed by battery manufacturers, LiPF₆ remains an important component of the evolving energy storage ecosystem due to the challenges that exist within the balancing of battery performance and cost efficiencies.

Global Lithium Hexafluorophosphate (LiPF₆) Market Opportunity

Regulatory Shifts Encouraging Supply Chain Localization

Investment into local production of LiPF₆ (lithium hexafluorophosphate) is growing based on current regulatory changes in many economies that are a response to the continued dependency on Asia-Pacific supplychains. The European Union Battery Regulation 2023/1542 requires that all batteries must have a recovery rate of 50% lithium by Dec 31, 2027 with minimum levels of recycled content by 2028. At the same time, the U.S. Department of Energy has allocated approximately $3B to support the extraction, processing and recycling of the critical minerals, in accordance with domestic manufacturing goals of the Inflation Reduction Act.

These factors and supportive government policies will lead to increased number of new LiPF₆ facilities being established in North America and Europe which will support compliance with the carbon footprint reduction, recycling efficiency and responsible sourcing requirements. Suppliers that supply LiPF₆ into these regions will have increased opportunities to procure this material during the years 2026 to 2032 as a result of the combination of these factors.

Global Lithium Hexafluorophosphate (LiPF₆) Market Regional Analysis

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Asia-Pacific is by far the largest producer and consumer of LiPF6 in the world, with approximately 75% of the total market share. China is responsible for more than 60,000 metric tons of annual LiPF6 production, while South Korea and Japan are also significant players. In South Korea, production of LiPF6 increased from 8,000 to 13,000 tons between 2022 and 2024 as a result of the expansion of the capacity required to supply LG and SK Innovation with sufficient batteries for their production.Over 70% of the global supply chain of lithium-ion cells is located in Asia-Pacific, making it one of the largest areas of production capacity on the planet. As a result, the Asia-Pacific region will have significant advantages in developing its own lithium-ion cell manufacturing capacity as part of a larger initiative to be a critical component of the global battery material supply chain.

North America and Europe continue to rapidly increase their domestic LiPF6 supply, while at the same time, the Asia-Pacific region has many more advantages, including large-scale lithium production, high production efficiency levels, cost advantages, and integrated supply chains. Due to China's technological advancements and economies of scale, China is expected to remain the world's largest producer of LiPF6 until at least 2032; however, increased efforts to create a diversified source of the material and improve supply chain resiliency in North America and Europe will eventually contribute to the increased demand for localized electrolyte supplies, as a result of the increased utilization of electric vehicles (EVs) over the next several years.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Global Lithium Hexafluorophosphate (LiPF₆) Market Segmentation Analysis

By Type

- Battery-grade (≥ 99.9%)

- Electronic-grade (≥ 99.99%)

- Industrial-grade (< 99.9%)

Battery-grade LiPF₆, defined by purity levels of 99.9% or higher(≥ 99.9%), commands approximately 85% of the total market share due to stringent quality demands in lithium-ion battery manufacturing. End users rely on ultra-high-purity electrolytes to maintain electrochemical stability, ensure long cycle life, and prevent degradation under varying operational conditions. The prevalence of this grade underscores the direct correlation between electrolyte purity and battery performance, as impurities can significantly impair energy density and safety.

Industrial-grade LiPF₆, with lower purity levels, accounts for the remaining 15% and serves niche applications outside the battery sector. However, as global standards for battery efficiency and safety continue to tighten, battery-grade LiPF₆ will maintain its leadership position. The segment’s dominance is reinforced by the accelerating shift toward high-performance battery technologies requiring exceptional electrolyte consistency and regulatory compliance.

By Application

- EV Batteries

- Renewable Energy Storage

- Consumer Electronics

Electric vehicle batteries represent the dominant application for LiPF₆, accounting for approximately 80% of global demand. The automotive industry’s electrification trend drives substantial electrolyte consumption, as each EV battery pack requires large volumes of LiPF₆ to ensure optimal ion conductivity and charge stability. Rising EV sales, which exceeded 17 million units in 2024, and the consistent expansion of battery capacity per vehicle further entrench this segment’s dominance through 2032.

Beyond the automotive segment, energy storage systems, consumer electronics, and industrial equipment collectively contribute the remaining 20% of demand. Among these, grid-scale energy storage is expanding most rapidly as renewable energy integration intensifies worldwide. Nevertheless, electric vehicles will continue to anchor LiPF₆ consumption, reflecting their central role in global decarbonization and battery innovation initiatives.

Market Players in Global Lithium Hexafluorophosphate (LiPF₆) Market

These market players maintain a significant presence in the Global lithium hexafluorophosphate (lipf₆) market sector and contribute to its ongoing evolution.

- Do-Fluoride Chemicals

- Tonze Group

- Hexa Fluor Chem

- Morita Chemical

- Stella Chemifa

- Kanto Denka Kogyo

- Central Glass

- Tinci Materials (Guangzhou Tinci)

- Mitsubishi Chemical Holdings

- Merck KGaA

- Formosa Plastics

- Thermo Fisher

- American Elements

- Jiangsu Xintai Material Technology

- Shanshan

Market News & Updates

- Kanto Denka, 2025:

Kanto Denka’s LiPF₆ production capacity is expanding from ~5,400 t/yr toward ~8,000 t/yr as part of meeting increasing battery demand. The company claims approximately 70 % market share in automotive battery applications (in Japan), 40% in the US, and 10% in Europe.

- Tinci Materials, 2025:

Tinci Materials’ subsidiary signed a long-term supply agreement with Cornex New Energy to deliver at least 550,000 t of electrolyte-related products through 2030, signaling robust long-term demand for LiPF₆ and associated electrolyte chemicals in battery supply chains.

Tinci Materials and its U.S. subsidiary Tinci Delaware LLC, signed two Equity Purchase Agreements with Honeywell International Inc. and its subsidiary Advanced Energy Materials LLC (AEM), to set up strategic joint ventures focused on the production, operation, and sales of liquid lithium hexafluorophosphate (LiPF₆) and electrolytes for lithium-ion batteries.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Lithium Hexafluorophosphate (LiPF₆) Market Policies, Regulations, and Standards

4. Global Lithium Hexafluorophosphate (LiPF₆) Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type

5.2.1.1. Battery-grade (≥ 99.9%)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Electronic-grade (≥ 99.99%)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Industrial-grade (< 99.9%)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Crystal Variant- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Liquid Variant- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. EV Batteries- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Renewable Energy Storage- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Consumer Electronics- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Region

5.2.4.1. North America

5.2.4.2. Latin America

5.2.4.3. Europe

5.2.4.4. Asia Pacific

5.2.4.5. Middle East & Africa

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. North America Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Country

6.2.4.1. US

6.2.4.2. Canada

6.2.4.3. Rest of North America

6.3. US Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7. Latin America Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Country

7.2.4.1. Brazil

7.2.4.2. Mexico

7.2.4.3. Rest of Latin America

7.3. Brazil Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

7.4. Mexico Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

7.4.1.Market Size & Growth Outlook

7.4.1.1. By Revenues in USD Million

7.4.2.Market Segmentation & Growth Outlook

7.4.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

7.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Europe Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Country

8.2.4.1. Germany

8.2.4.2. France

8.2.4.3. UK

8.2.4.4. Spain

8.2.4.5. Italy

8.2.4.6. Netherlands

8.2.4.7. Belgium

8.2.4.8. Poland

8.2.4.9. Rest of Europe

8.3. Germany Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.4. France Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.5. UK Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.6. Spain Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.7. Italy Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.8. Netherlands Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

8.8.1.Market Size & Growth Outlook

8.8.1.1. By Revenues in USD Million

8.8.2.Market Segmentation & Growth Outlook

8.8.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.9. Belgium Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

8.9.1.Market Size & Growth Outlook

8.9.1.1. By Revenues in USD Million

8.9.2.Market Segmentation & Growth Outlook

8.9.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.9.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

8.10. Poland Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

8.10.1. Market Size & Growth Outlook

8.10.1.1. By Revenues in USD Million

8.10.2. Market Segmentation & Growth Outlook

8.10.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

8.10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Asia Pacific Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Country

9.2.4.1. China

9.2.4.2. Japan

9.2.4.3. South Korea

9.2.4.4. India

9.2.4.5. Australia

9.2.4.6. Thailand

9.2.4.7. Rest of Asia Pacific

9.3. China Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.4. Japan Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.5. South Korea Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

9.5.1.Market Size & Growth Outlook

9.5.1.1. By Revenues in USD Million

9.5.2.Market Segmentation & Growth Outlook

9.5.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

9.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.6. India Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

9.6.1.Market Size & Growth Outlook

9.6.1.1. By Revenues in USD Million

9.6.2.Market Segmentation & Growth Outlook

9.6.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

9.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.7. Australia Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

9.7.1.Market Size & Growth Outlook

9.7.1.1. By Revenues in USD Million

9.7.2.Market Segmentation & Growth Outlook

9.7.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

9.7.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

9.8. Thailand Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

9.8.1.Market Size & Growth Outlook

9.8.1.1. By Revenues in USD Million

9.8.2.Market Segmentation & Growth Outlook

9.8.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

9.8.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Middle East & Africa Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Country

10.2.4.1. UAE

10.2.4.2. Saudi Arabia

10.2.4.3. Turkey

10.2.4.4. Russia

10.2.4.5. Rest of Middle East & Africa

10.3. UAE Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.4. Saudi Arabia Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.5. Turkey Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.6. Russia Lithium Hexafluorophosphate (LiPF₆) Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Type- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Morita Chemical

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Stella Chemifa

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Kanto Denka Kogyo

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Central Glass

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Tinci Materials (Guangzhou Tinci)

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Do-Fluoride Chemicals

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Tonze Group

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Hexa Fluor Chem

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Mitsubishi Chemical Holdings

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Merck KGaA

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. Formosa Plastics

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. Thermo Fisher

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. American Elements

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. Jiangsu Xintai Material Technology

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. Zhejiang Do-Fluoride

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type |

|

| By Form |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.